Ethereum: While “sell orders” dominate market, positive sentiment lingers

- Most ETH merchants have taken to distributing their holdings.

- The constructive conviction nonetheless lingers as many anticipate the Shanghai Improve.

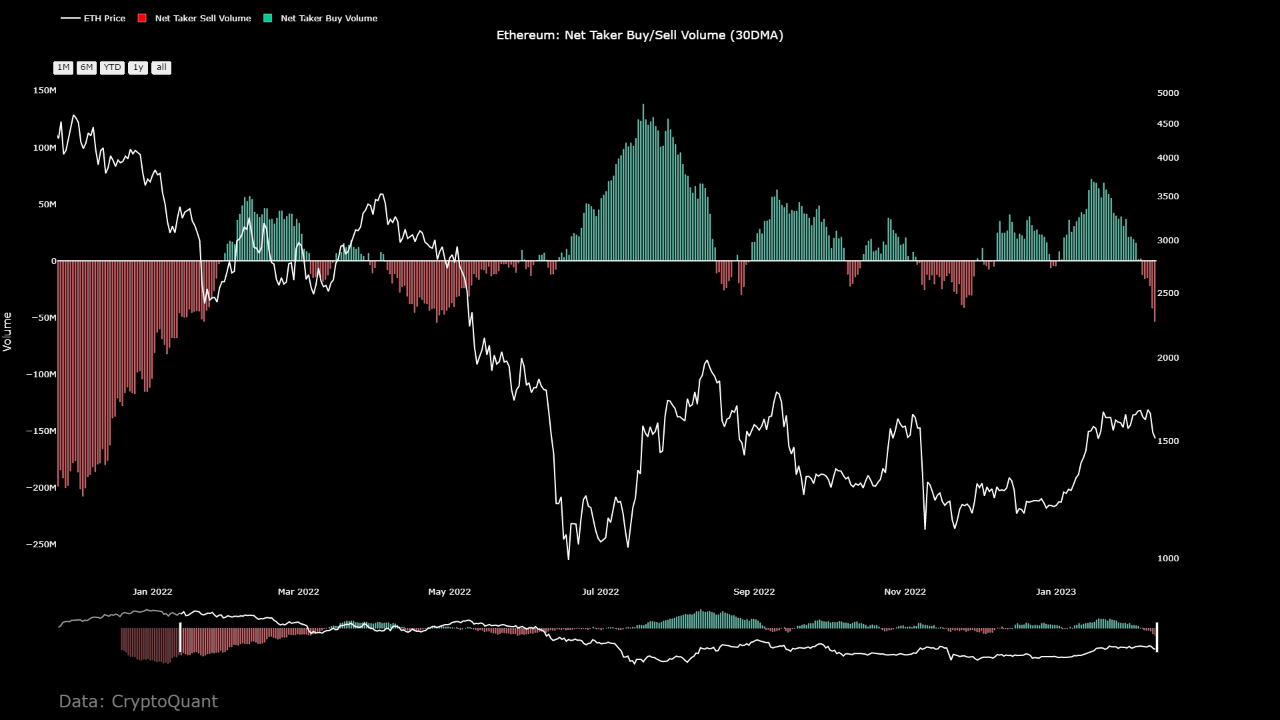

On-chain evaluation of the Internet Taker Quantity metric has revealed that following the latest rally within the value of Ethereum [ETH], merchants have been exiting the market in giant numbers, with the very best quantity of exits seen for the reason that collapse of Terra-Luna.

Learn Value Prediction for Ethereum [ETH] 2023-24

In accordance with CryptoQuant analyst Maartunn, the Internet Taker Quantity metric tracks the aggressiveness of market sellers and consumers for a specified crypto asset.

The metric calculates the distinction between the ‘Taker Purchase Quantity’ and ‘Taker Promote Quantity’ and supplies insights into the habits of market members who use market orders.

Market members who use market orders are prepared to purchase or promote at any value, whatever the price or charges concerned. Nevertheless, their primary precedence is to exit their place, based on Maartunn.

With ETH’s Internet Taker Quantity at its deepest destructive worth since Might 2022, “merchants on Ethereum are escaping the market by means of market orders, which is pushing the worth down,” Maartuun famous.

Supply: CryptoQuant

On methods to hedge in opposition to the upcoming value drawdown, Martuun suggested:

“The strongest sign of the indicator is when costs are nonetheless comparatively excessive, however Internet Taker Quantity is deeply crimson. And that’s the place Ethereum is at the moment. This doesn’t imply that Ethereum can’t bounce within the quick time period, however so long as Internet Taker Quantity exhibits destructive values, it’s higher to promote the dip aside from purchase the dip.”

Shopping for has weakened, however Shanghai Improve may work wonders

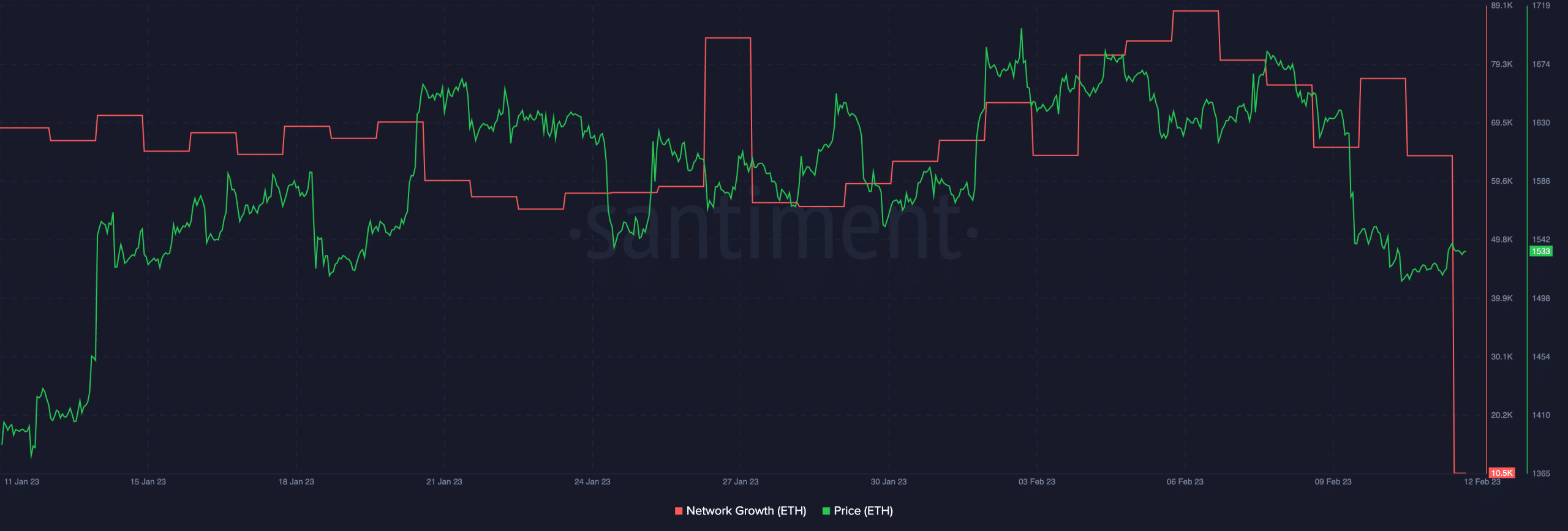

In accordance with knowledge from Santiment, after ETH crossed the $1600 value mark, new demand for the alt weakened. The rely of latest addresses created on the community every day since has since fallen by a whopping 88%.

Supply: Santiment

With the consumers available in the market exhausted and unable to provoke any additional value rallies, the market has additionally been with out the mandatory infusion of latest liquidity. Therefore, a 6% decline in value within the final week.

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

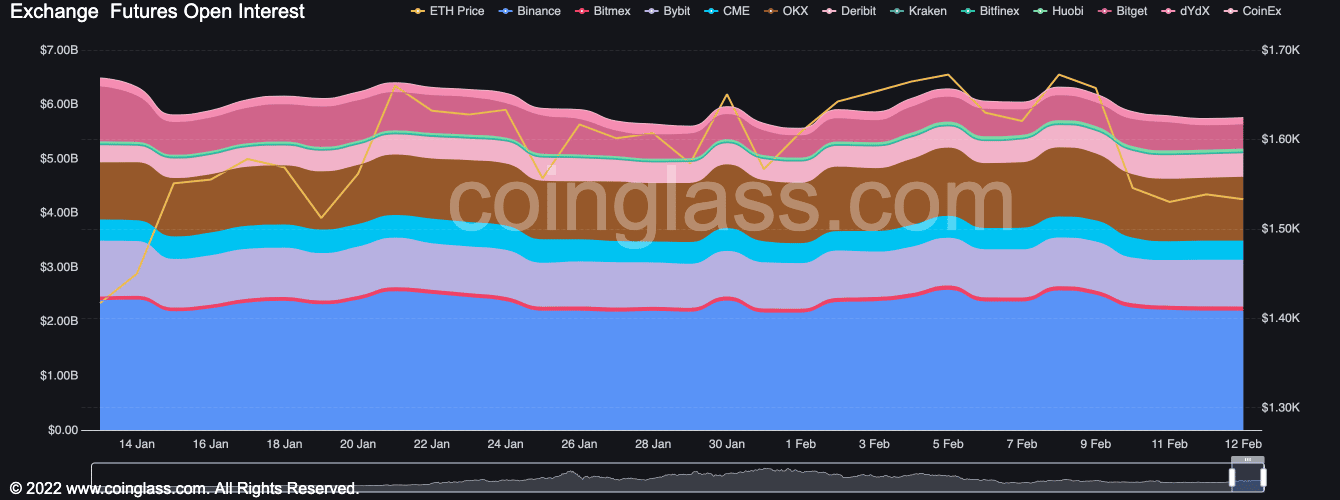

Additional, per knowledge from Coinglass, throughout that interval, ETH’s Open Curiosity fell by 5%. It’s trite {that a} lower in an asset’s Open Curiosity usually suggests a scarcity of market demand or investor attraction to the asset, probably leading to a drop in value.

Supply: Coinglass

Regardless of this, many buyers preserve a constructive outlook as a consequence of the potential for unlocking long-staked ETH cash with the upcoming Shanghai Improve in March.

In accordance with CryptoQuant, ETH’s funding charges remained constructive and have so been within the final month, suggesting that buyers proceed to put bets in favor of the altcoin.

Supply: CryptoQuant