Ethereum stares down a cliff as median gas price soars to monthly high

- Ethereum’s community demand and bullish value motion underpin the surge in gasoline price costs.

- ETH internet trade outflows assist bullish dominance regardless of the market slowdown.

The Ethereum community has been criticized previously for the costly nature of charges. That is usually the case particularly when there may be lots of community utilization and when ETH’s value soars.

ETH’s newest value means that this can proceed to be the case in 2023 if the market is on the highway to restoration.

Life like or not, right here’s Ethereum’s market cap in BTC’s phrases

One of many newest Glassnode alerts revealed that ETH’s median gasoline value is now at a brand new month-to-month excessive. That is unsurprising contemplating that we’ve got seen a powerful restoration within the quantity of on-chain exercise for the reason that begin of the yr. It confirms that community demand improved considerably.

📈 #Ethereum $ETH Median Fuel Worth (7d MA) simply reached a 1-month excessive of 23.128 GWEI

Earlier 1-month excessive of 23.097 GWEI was noticed on 19 January 2023

View metric:https://t.co/6QGDfZoULY pic.twitter.com/s7TzVcGIEF

— glassnode alerts (@glassnodealerts) February 4, 2023

Why are gasoline price costs growing?

There is likely to be multiple issue affecting the gasoline price costs as has been the case traditionally. Certainly one of them is that larger community demand causes congestion and better demand for ETH and tokens used to pay the gasoline value.

The opposite purpose is that it is a widespread incidence throughout a bull market. The identical precept applies, the place demand for the underlying cryptocurrency or token pushes up the worth.

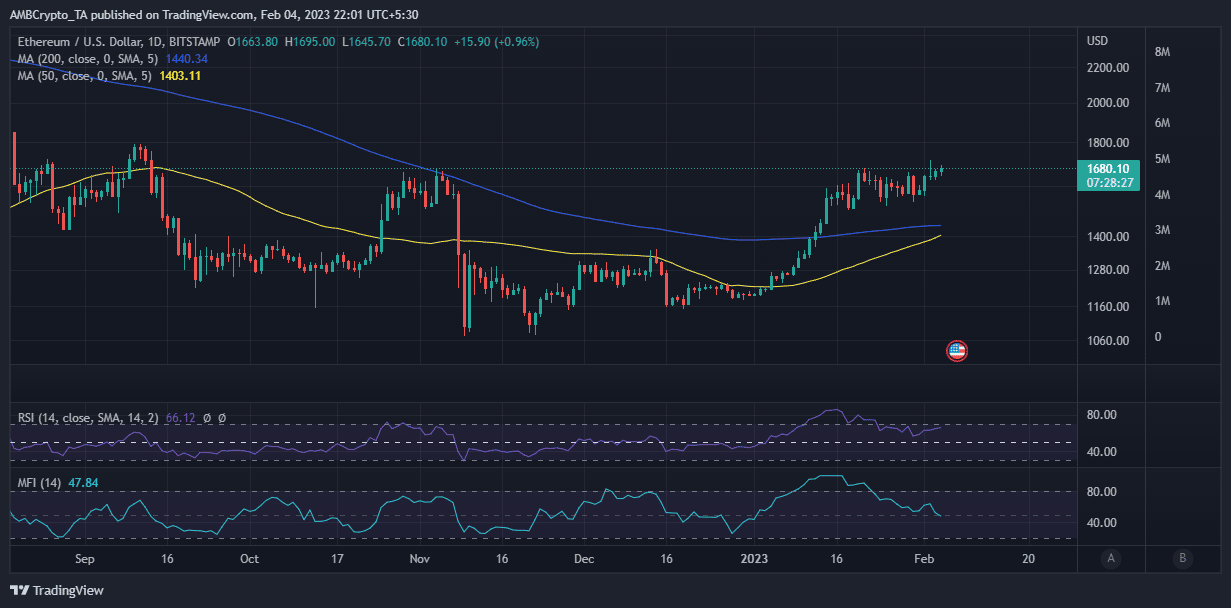

The second purpose probably has the largest affect on costs. Each components have been at play for the final 4 weeks throughout which ETH managed to tug off a 40% upside. Effectively, on the time of writing, ETH traded at $1680.

Supply: TradingView

ETH’s present value is one to observe as a result of it’s inside a resistance zone that it has struggled to beat in the previous couple of days. Whether or not it would breakout, keep throughout the present vary, or retrace continues to be a toss-up.

A have a look at a few of its metrics might provide insights into the place it’s at the moment leaning in direction of.

Is your portfolio inexperienced? Try the Ehereum Revenue Calculator

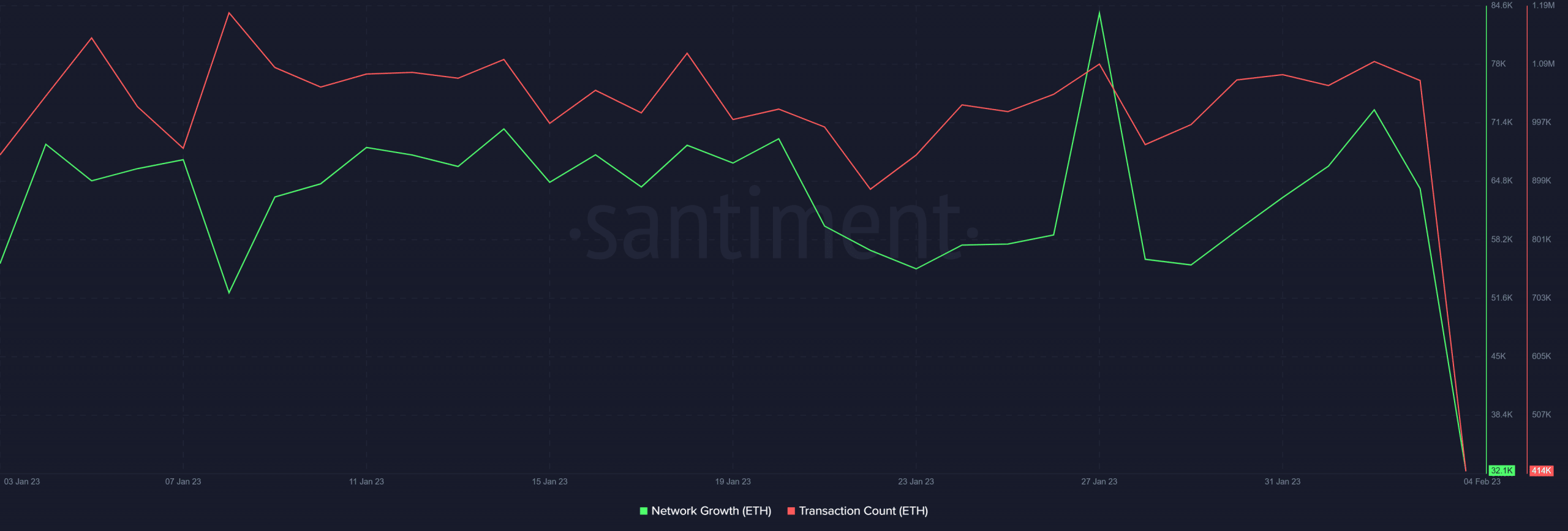

Each community progress and transaction depend maintained noteworthy ranges within the final 4 weeks. Nevertheless, the identical metrics crashed to their lowest month-to-month ranges within the final 24 hours. This may occasionally point out a drop in natural demand throughout the Ethereum community.

Supply: Santiment

Whereas there isn’t any clear clarification for this statement, a speculative purpose is likely to be the FUD that endured over financial information and FOMC in the course of the week.

Nonetheless, this doesn’t clarify why ETH’s value remained within the inexperienced for the reason that begin of February. ETH trade flows provide a clearer perspective of the present scenario.

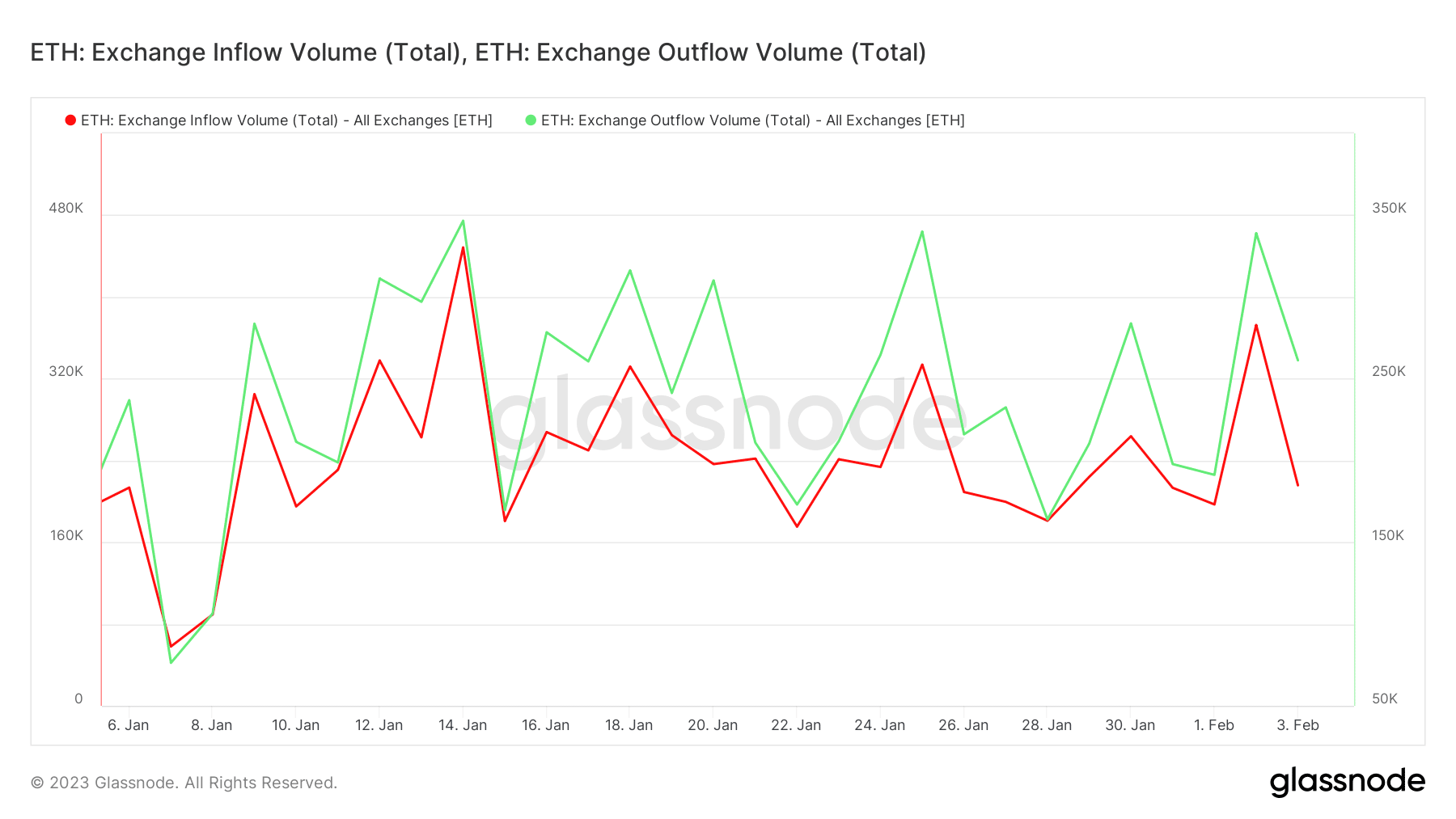

Supply: Glassnode

Change flows did pivot within the final 48 hours, adopting a downward trajectory. That is affirmation of a requirement slowdown as famous earlier.

Nonetheless, the quantity of trade outflows stays larger than the inflows. For this reason the bulls have retained management, albeit barely.