Ethereum short traders could witness gains only if ETH drops to “this” level

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- ETH traders loved at the least 30% beneficial properties within the final two weeks

- ETH short-term merchants might have some leverage given ETH’s newest upside

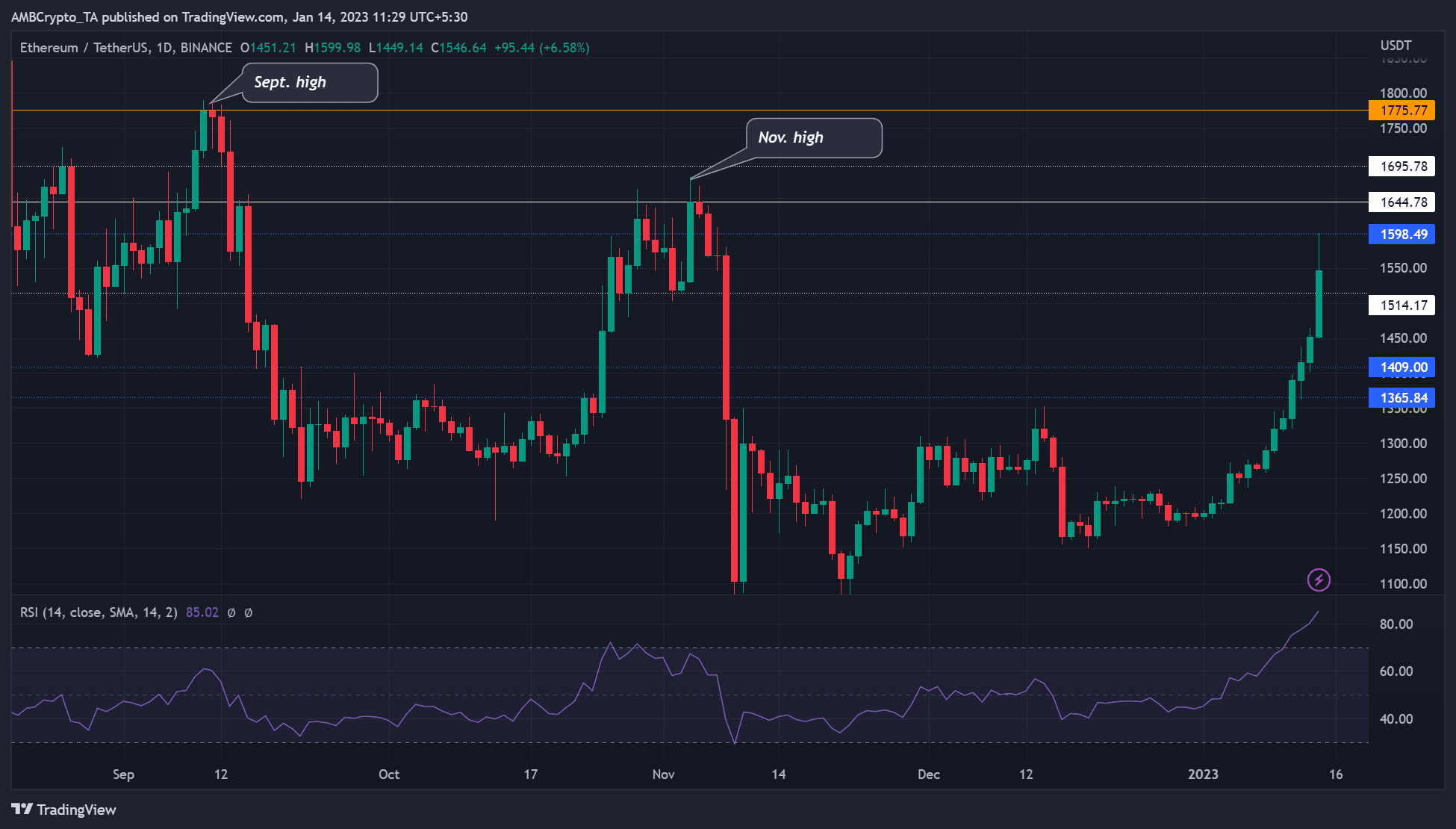

Ethereum [ETH] provided traders over 30% beneficial properties prior to now two weeks. It rallied from $1,190 to a excessive of $1,598. The rally put ETH an inch away from its November excessive of $1,680.

With a bullish BTC following eased US inflation charges, ETH might goal at $1,644 or go above it. At press time, ETH was buying and selling at $1,550, whereas BTC was buying and selling beneath a short-term bearish order block at $20,956.

If BTC closes above $21K, ETH bulls might be incentivized to reclaim its November excessive.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

The November excessive of $1,680

Supply: ETH/USDT on TradingView

ETH peaked at $1,680 earlier than FTX implosion pressured a wide-market crash, dropping it to a low of $1,100, a 35% plunge. Nonetheless, a month and a half later, ETH appears on a path to recovering all of the losses made after the November crash.

ETH was extremely bullish on the each day chart and will retest or break above November’s bearish order block at $1,644.78 within the subsequent few hours/days. Such a transfer will permit ETH holders to recuperate all of the losses incurred after the November market crash.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Nonetheless, if bears achieve extra affect out there, ETH might drop to $1,514.17, invalidating the bullish bias described above. Due to this fact, quick merchants ought to solely guess in opposition to ETH’s uptrend if it drops beneath $1,514 to attenuate danger.

Brief-term ETH holders made earnings as buying and selling volumes elevated

Supply: Santiment

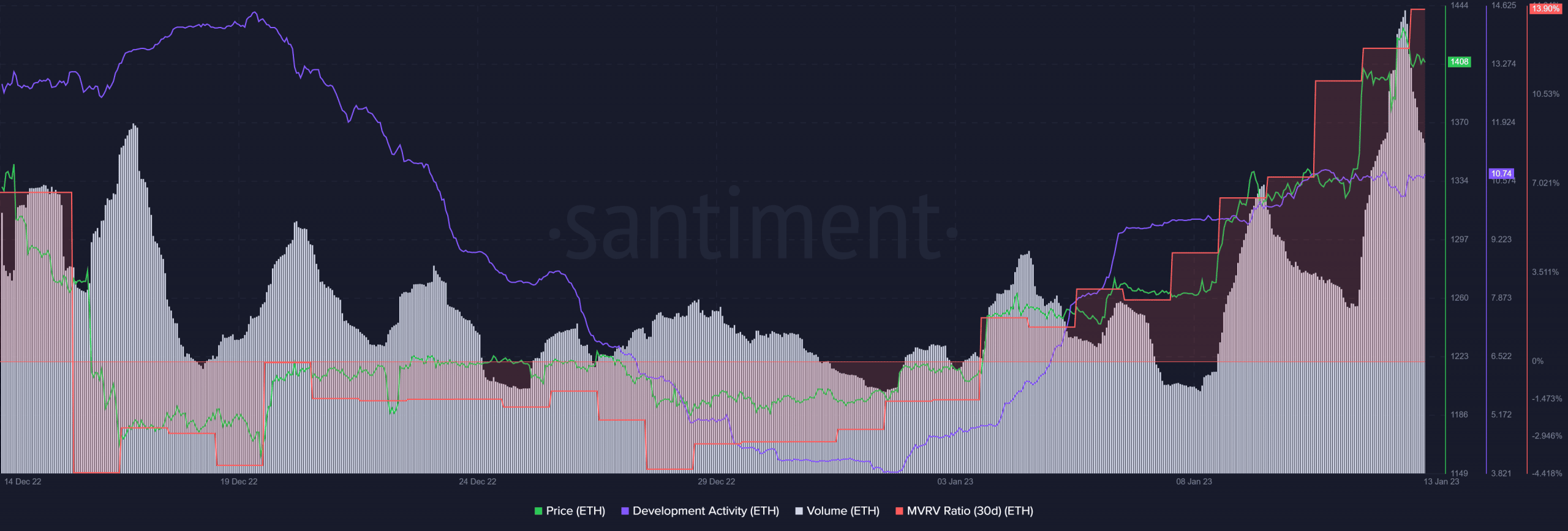

In accordance with Santiment, the 30-day market worth to realized worth (MVRV) ratio has been optimistic since 4 January and climbed even larger. This indicated that short-term merchants noticed incremental beneficial properties from January 4. Nonetheless, long-term holders (365-day MVRV) had been but to cross above the impartial line; therefore they had been but to publish any beneficial properties.

ETH’s growth exercise additionally recorded a gradual enhance prior to now two weeks. This indicated that builders saved constructing the community in the identical interval. This might increase traders’ confidence and additional prop up ETH’s worth in the long term.

As well as, ETH’s buying and selling quantity elevated in the identical interval however dropped sharply at press time. Though the drop might undermine uptrend momentum within the quick run, ETH volumes might enhance if BTC is bullish.

Due to this fact, traders ought to monitor BTC, particularly if it strikes above $21K. Such a transfer would set ETC to reclaim its November excessive.