Ethereum short-term gains wiped out: Can bulls prevent further plunge

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- ETH’s weak fundamentals might delay instant value reversal.

- Brief-term Ethereum holders’ income could possibly be reduce to measurement.

Ethereum [ETH] dropped beneath its $1,600 mark after Bitcoin [BTC] misplaced the $23k zone. BTC sharply declined on 24 January, shifting beneath $22.5k and flattening ETH to $1,518.

At press time, ETH struggled to interrupt above $1,560 as BTC hovered beneath the $22,800 stage. Due to this fact, BTC’s lack of traction and velocity might drive ETH right into a short-term vary earlier than bulls tried to focus on the inexperienced zone.

Learn Ethereum’s [ETH] Worth Prediction 2023-24

ETH is caught within the $1,540 – $1,560 vary: Is a break above seemingly?

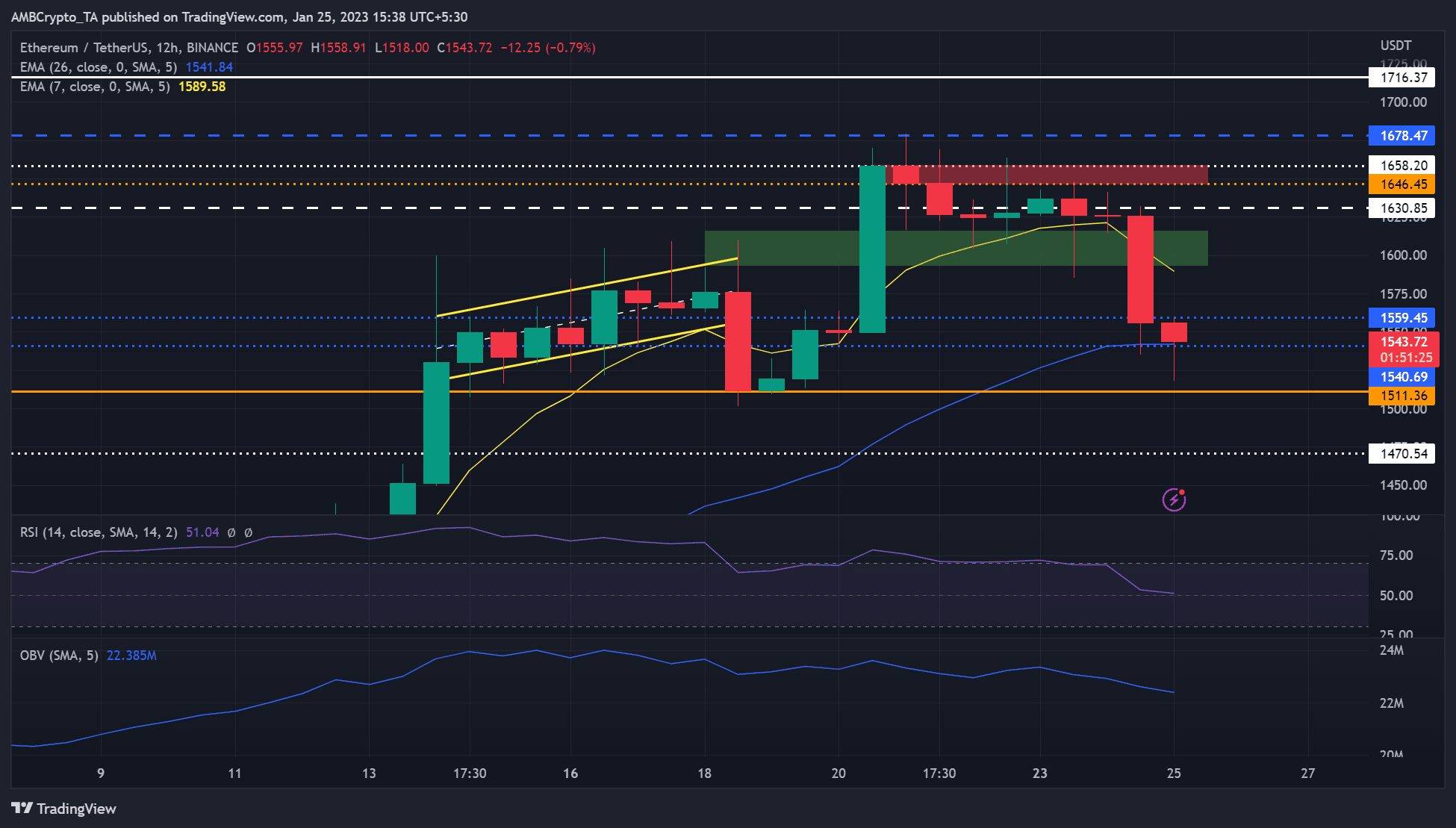

Supply: ETH/USDT on TradingView

ETH fronted an additional rally round 14 January, regardless of indicators of slowing momentum. The value motion carved a rising channel (yellow) in the identical interval.

The altcoin broke beneath the channel however discovered regular assist at $1,511. The following restoration confronted rejection at $1,678, adopted by a slight consolidation earlier than a significant drop on Tuesday to the $1,500 area.

On the 12-hour chart, ETH’s Relative Energy Index (RSI) declined and was 52, displaying a gentle bullish momentum that was near a impartial market construction. Equally, the On-Stability Quantity (OBV) declined, undermining a powerful uptrend momentum for the King of the altcoin market.

Due to this fact, ETH might fluctuate within the $1,540 – $1,560 vary within the quick time period earlier than making an attempt a retest of the $1,600 zone within the subsequent couple of days/weeks. As well as, a transfer to the $1,700 zone could possibly be potential if BTC strikes past $23K, particularly if subsequent week’s FOMC announcement triggers the markets positively.

Nevertheless, a drop beneath $1,511 would invalidate the above bias. Such a plunge might see ETH settle at $1,471.

ETH noticed a short-term accumulation, whereas positive factors declined by over 10%

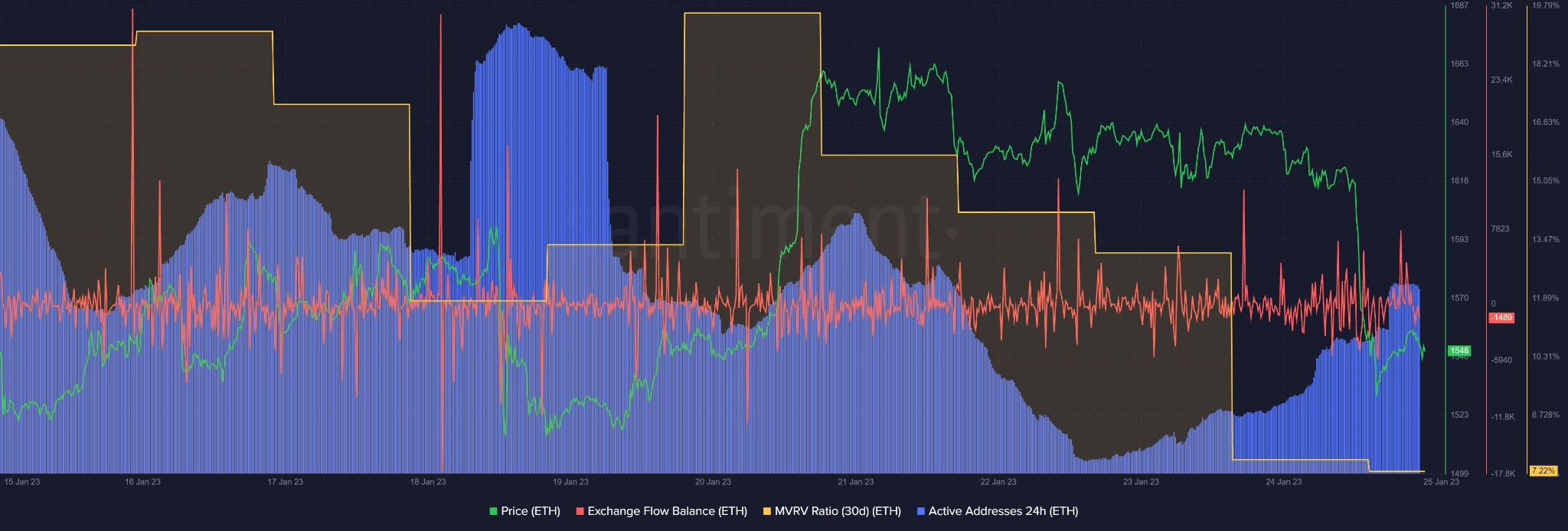

Supply: Santiment

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

In line with Santiment, ETH’s Alternate Move Stability was unfavorable at press time. It reveals extra ETH flowed out than into the exchanges, indicating {that a} short-term accumulation occurred on the time of publication.

Nevertheless, the stagnant lively addresses previously 24 hours present that buying and selling quantity remained unchanged, undermining a powerful value reversal. Due to this fact, short-term accumulation and stagnant buying and selling quantity might drive ETH right into a value consolidation throughout the $1,540 – $1,560 vary within the subsequent few hours.