Ethereum miner revenue reaches monthly high, but here’s the issue

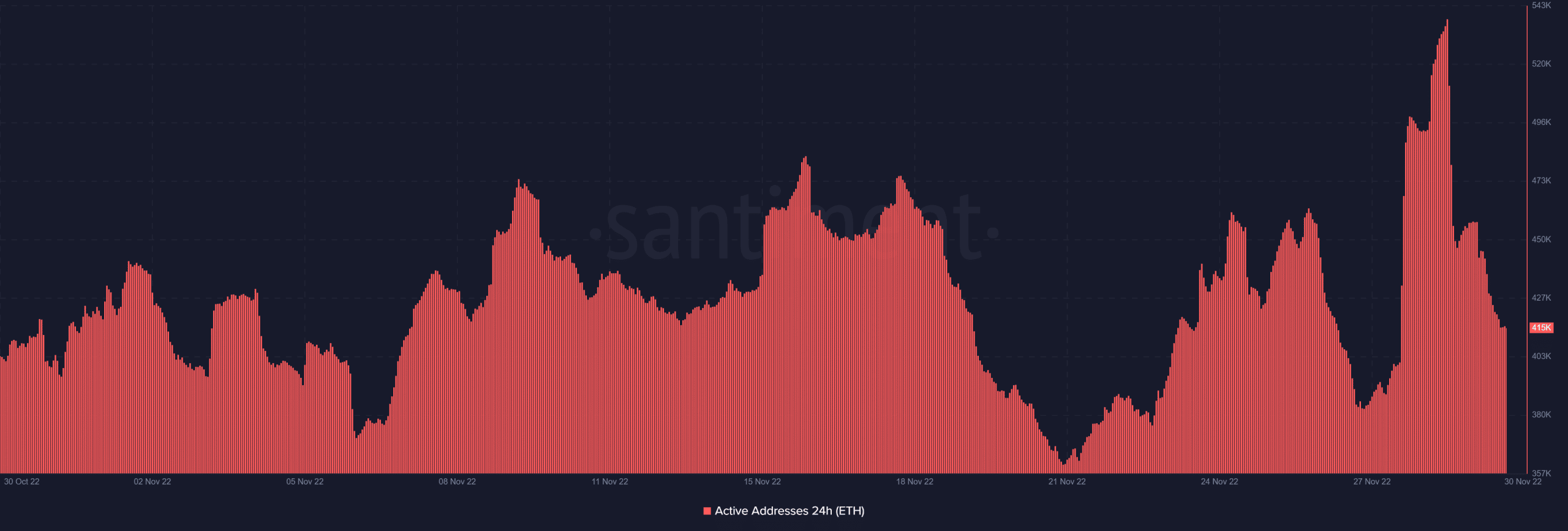

- ETH’s variety of each day energetic addresses surged to a month-to-month excessive within the final three days.

- The transaction quantity was comparatively low which advised the dearth of a robust whale presence.

Ethereum community exercise has seen important restoration this week as market situations enhance. This was highlighted within the newest Glassnode report which reveals that miner income has achieved a brand new month-to-month excessive.

Learn Ethereum’s (ETH) Value Prediction 2022-2023

Ethereum miner income is a helpful metric not only for assessing mining profitability. It may be used to evaluate the community’s degree of utility. Particularly if the market is coming from a interval of low quantity and low demand.

This sort of state of affairs has been the case out there, therefore the noticed improve in miner income is sweet information for buyers.

📈 #Ethereum $ETH % Miner Income from Charges (7d MA) simply reached a 1-month excessive of 0.595%

View metric:https://t.co/VqDTBhRlCb pic.twitter.com/y0xoJBvQJr

— glassnode alerts (@glassnodealerts) November 30, 2022

So far as Ethereum’s community exercise is anxious, the variety of each day energetic addresses surged to a month-to-month excessive within the final three days. This implies the variety of ETH transactions soared throughout the identical time and would clarify why miner income additionally went up.

Supply: Santiment

The noticed improve in transaction quantity could point out accumulation and thus a return of bullish demand. Consequently, ETH value motion has continued to rally step by step.

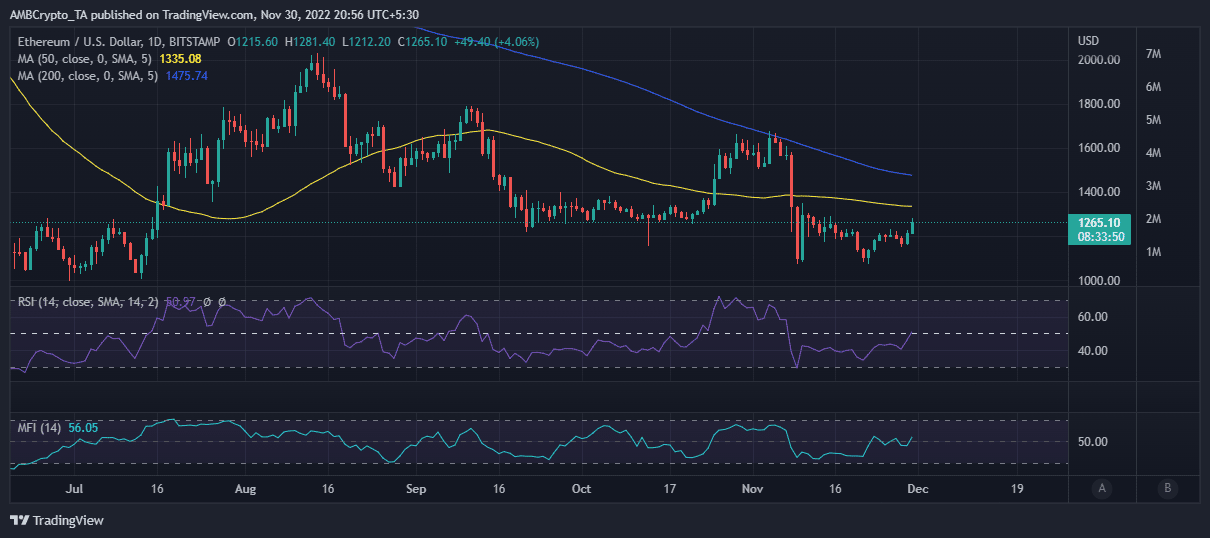

It managed to tug off a 9.3% upside within the final two days, confirming that the current spike in energetic addresses was largely shopping for quantity. ETH traded at $1265, on the time of writing.

Supply: TradingView

Will Ethereum preserve the upper community utility?

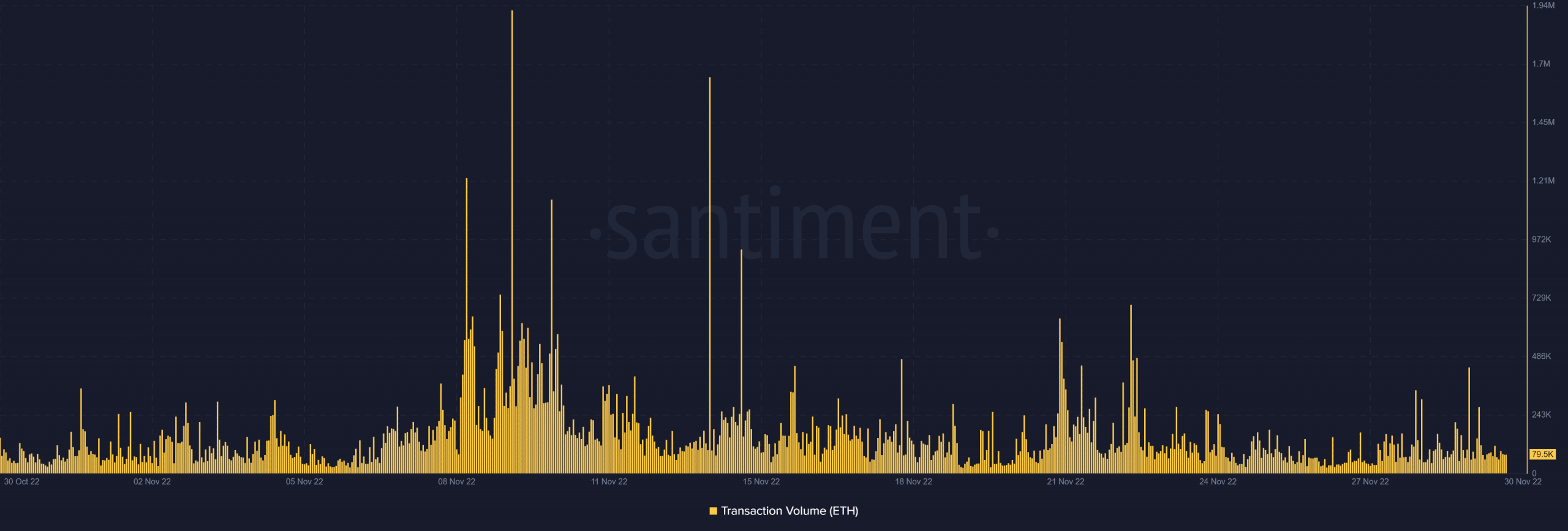

The bullish stress answerable for ETH’s present upside was mirrored in a slight improve in transaction quantity up to now this week. Nevertheless, it was comparatively low in comparison with its highest each day transaction quantity figures earlier in November.

Supply: Santiment

The truth that the transaction quantity was comparatively low suggests the dearth of a robust whale presence. This may occasionally even be confirmed that the noticed spike in energetic addresses displays elevated retail exercise.

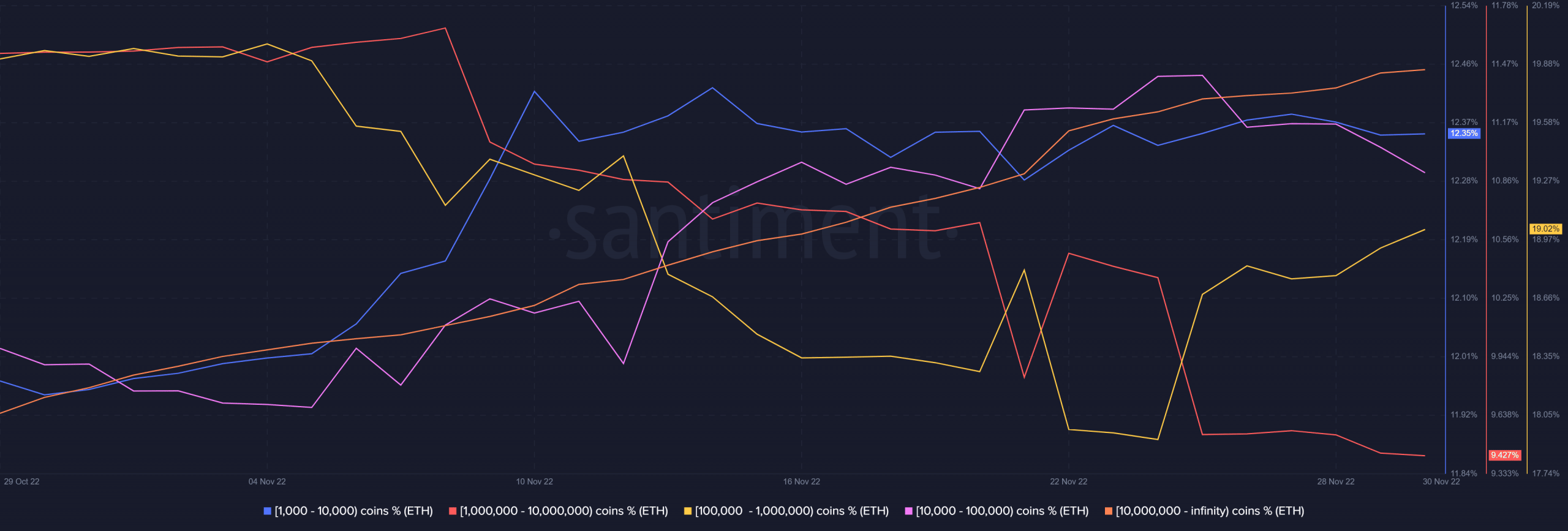

The retail market normally has much less of an influence on the value than the whales. Talking of whales, inbound promote stress was noticed from addresses holding between 1,000 and 100,000 ETH.

Supply: Santiment

Furthermore, addresses holding between a million and 10 million cash have additionally been trimming their balances. The promoting stress confirms that there was some profit-taking within the final three days.

Sufficient promote stress could finally set off a bearish retracement. Nonetheless, there was additionally some shopping for stress from some whales, particularly these within the 100,000 to 1 million cash class.

Conclusion

The above observations affirm the return of ETH’s bullish demand. Nevertheless, the most recent upside has additionally attracted some profit-taking and the market participation remains to be low. In different phrases, buyers’ confidence is enhancing however not sufficient for FOMO ranges of shopping for stress.