Ethereum infrastructure: A look at SSV Network and how it is evolving

- Ethereum’s SSV community unveils a brand new fund that helps additional decentralization.

- SSV bulls could also be headed for a cliff after the sturdy efficiency within the final two months.

Ethereum is pretty standard within the blockchain enviornment, with a lot of the consideration it will get going towards mainnet and layer 2 networks.

Its decentralization infrastructure has comparatively flown underneath the radar; there’s one explicit section that doesn’t obtain sufficient consideration and that’s decentralization infrastructure.

Ethereum’s shift to Proof of Stake opened the doorways to a wholly new construction of incentivized community participation. SSV Community, an open-source, decentralized Ethereum stake protocol goes the additional mile to help decentralization.

Its DAO, dubbed the SSV community lately unveiled a $50 million fund geared toward supporting the creation of extra purposes utilizing Distributed Validator Know-how (DVT).

The pursuit of extra decentralization

Latest studies counsel that the fund represents a path by means of which to facilitate extra decentralization and right here’s how- SSV Community goals to push for DVT as the primary Ethereum infrastructure.

This is identical expertise championed by Vitalik Buterin as the perfect path for guaranteeing decentralization.

If profitable, its footprints shall be evident within the type of extra help for decentralized staking options. It may also help a extra strong progress path for the SSV community and its native SSV token.

Extra worth for SSV?

SSV already boasts a number of use instances which embody governance, voting, and operator funds. A broader influence on the general Ethereum ecosystem could increase SSV’s demand.

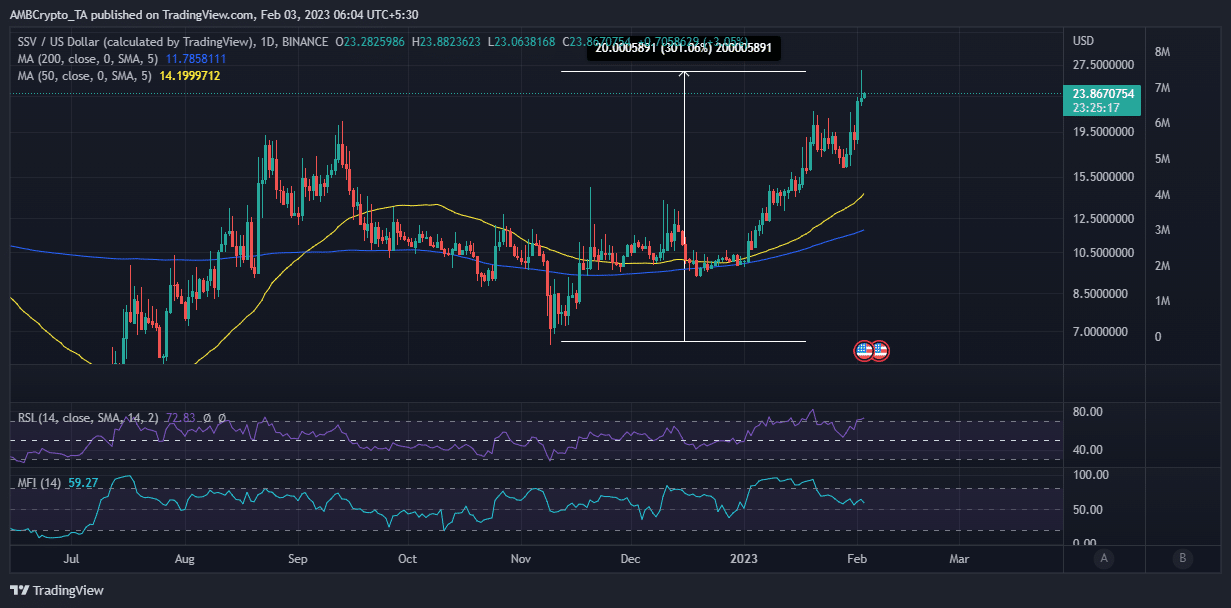

The latter has far pushed SSV into the checklist of the best-performing tokens. For perspective, it’s up by over 300% from its November lows. Additionally, it lately managed to tug off a brand new 12-month excessive because of sturdy demand.

Supply: TradingView

Can SSV preserve the rally? Nicely, its MFI means that there have been a large quantity of outflows in the previous few days. As well as, the RSI is forming a price-RSI divergent sample which suggests {that a} retracement is within the works.

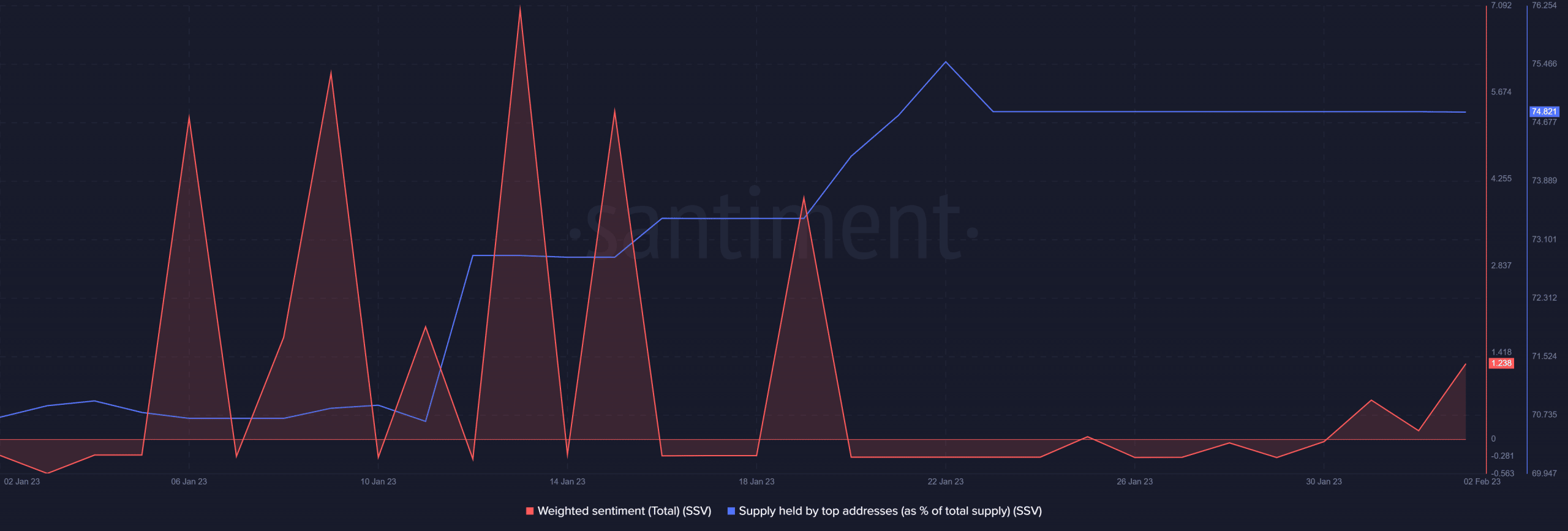

SSV’s on-chain metrics are additionally flashing attention-grabbing indicators. That will not essentially align with the bearish expectations. For instance, the provision of SSV held by prime addresses has remained unchanged for nearly two weeks, which means whales are usually not contributing to promoting stress.

Supply: Santiment

What number of are 1,10,100 SSVs price right this moment?

Moreover, the weighted sentiment has barely improved in favor of the bulls for the reason that finish of January.

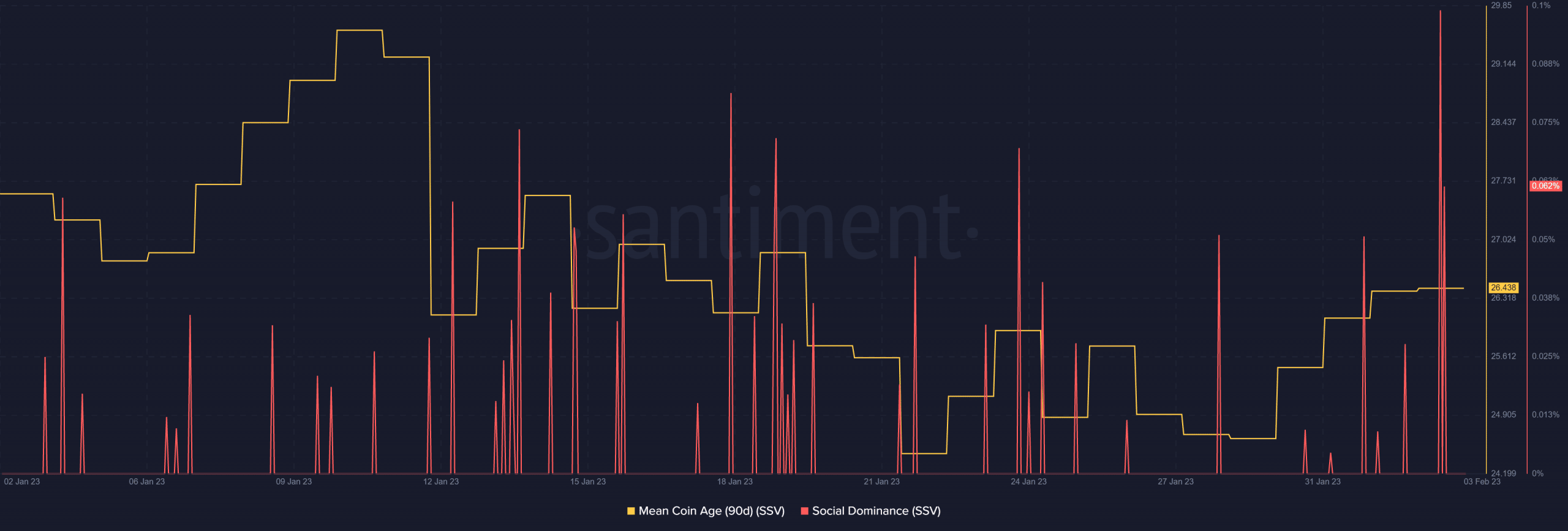

This can be a affirmation that buyers’ sentiment is enhancing. The 90-day imply coin age metric did register some upside confirming a rise within the stage of patrons bearing the present highs.

This was backed by a latest surge in social dominance to a brand new month-to-month excessive.

Supply; Santiment

If something, these indicators are bullish, however that is opposite to the worth sample that means the next chance of a reversal.