Ethereum [ETH] stuck at $1,700 as bulls need to overcome this Fib level

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- ETH has been rejected at $1,743 and faces OB at a 78.6% Fib stage.

- Fluctuating open curiosity (OI) might hold the above problem going.

After the discharge of US CPI, traders’ risk-on strategy has seen Ethereum [ETH] publish a 17% hike up to now 4 days. It reached a brand new excessive of $1,743 after Bitcoin [BTC] hit the $25k mark.

Nevertheless, a pointy correction occurred after BTC misplaced the psychological $25,000 mark. Though the bulls of ETH discovered regular assist on the 61.8% Fib stage, the impediment remained on the 78.6% Fib stage.

Learn Ethereum [ETH] Worth Prediction 2023-24

The hurdle of the 78.6% Fib stage: Are additional features unlikely?

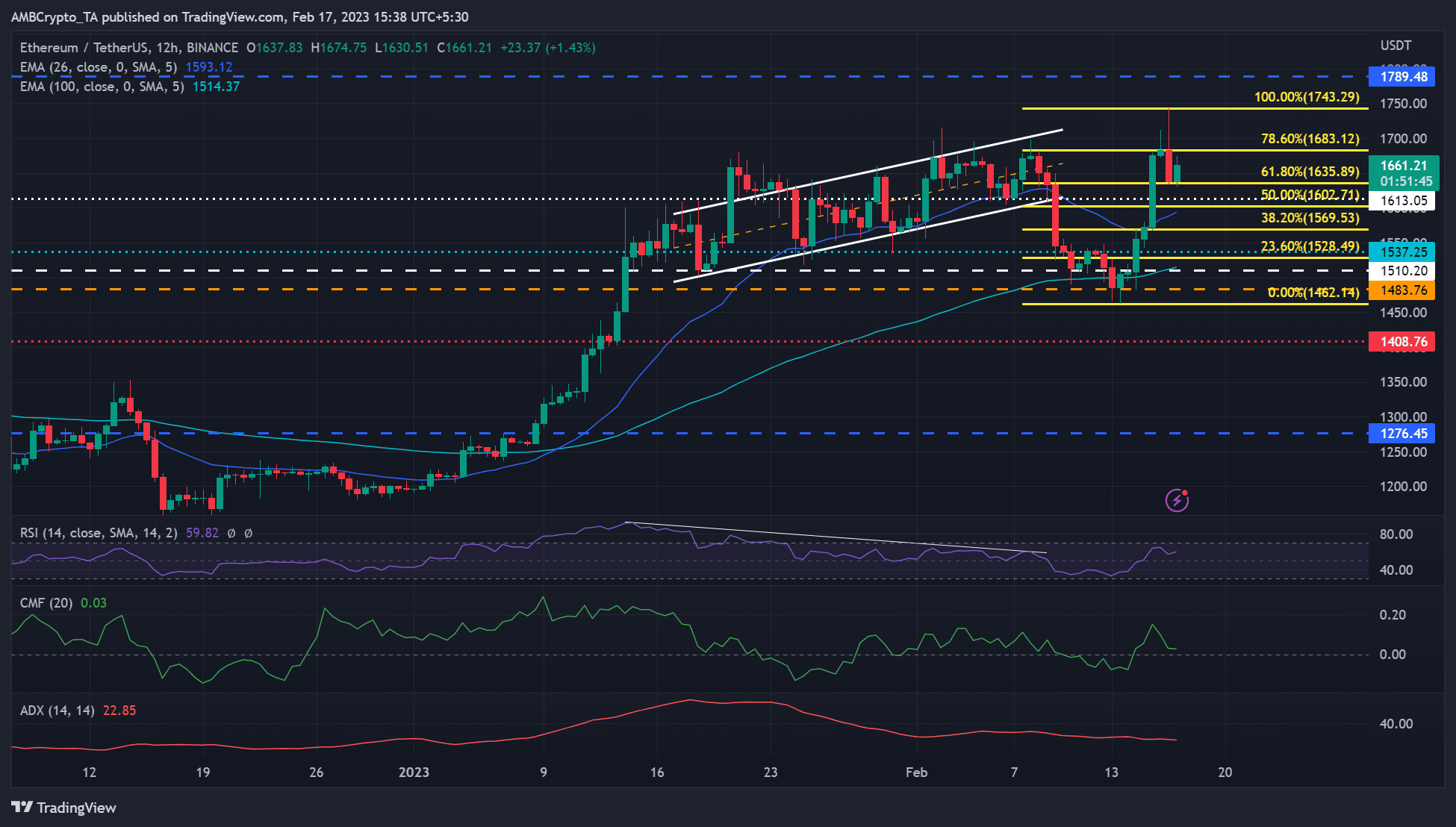

Supply: ETH/USDT on TradingView

Regardless of an prolonged rally after 10 January, the upward momentum of ETH has weakened on the 12-hour chart. That is highlighted by the bearish RSI divergence and the falling Common Directional Motion Index (ADX).

The sharp decline from the ascending channel (white) turned the market into bearish, however the zone between $1,483 and $1,510 stored the drop in test, permitting the bulls to publish a 17% acquire. ETH might goal the overhead resistance of $1,743 if BTC holds the $23.5k assist and continues to rise.

Nevertheless, the bulls want to beat the bearish order block (OB) on the 78.6% Fib stage of $1,683 – close to $1,700. This stage has blocked the additional uptrend of ETH since mid-January. One other crucial resistance stage to be careful for if ETH clears this hurdle is the September excessive of $1,790.

A break beneath the swing low of $1,483 would invalidate the bullish thesis above. This might lead the bears to devalue ETH in the direction of $1,400 or $1,276.

ETH noticed a short-term accumulation, however OI fluctuations might complicate issues

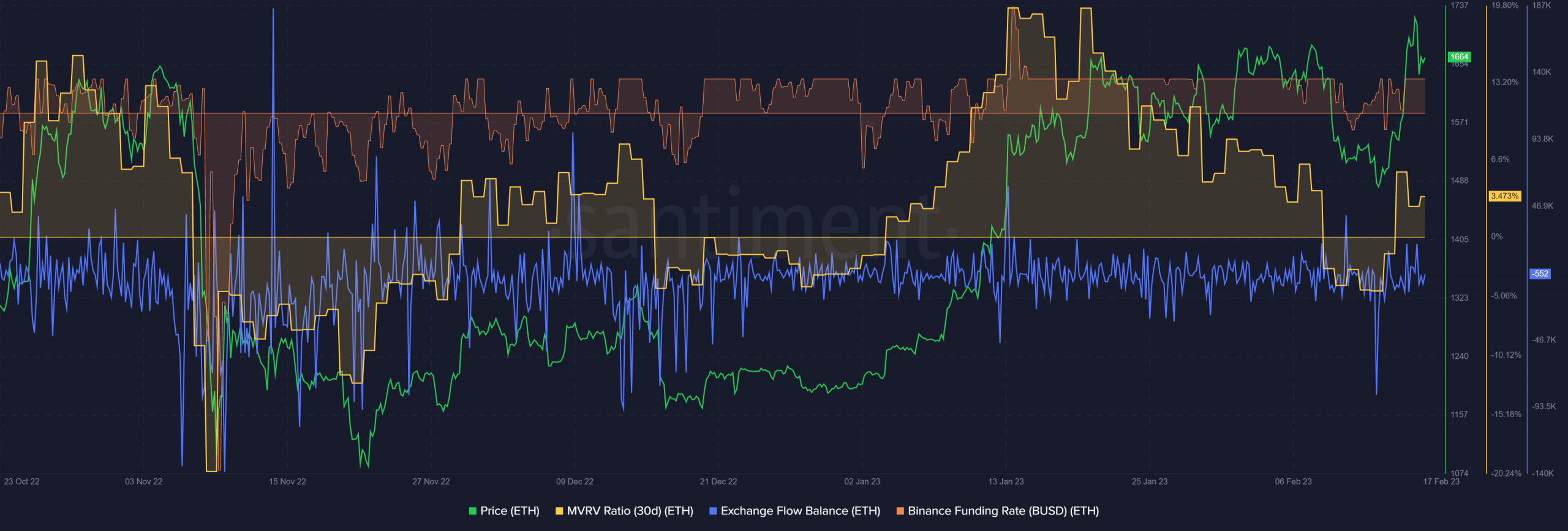

Supply: Santiment

At press time, extra ETH was out of the exchanges than in, as proven by the unfavorable trade circulate stability. This means that there was much less ETH on the market on the exchanges, so there was short-term accumulation.

As well as, the current Ethereum upswing has decreased holder losses because the 30-day MVRV turned from constructive to unfavorable. The demand described above can also be bolstered by a constructive Funding Fee, indicating bullish sentiment within the derivatives market.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

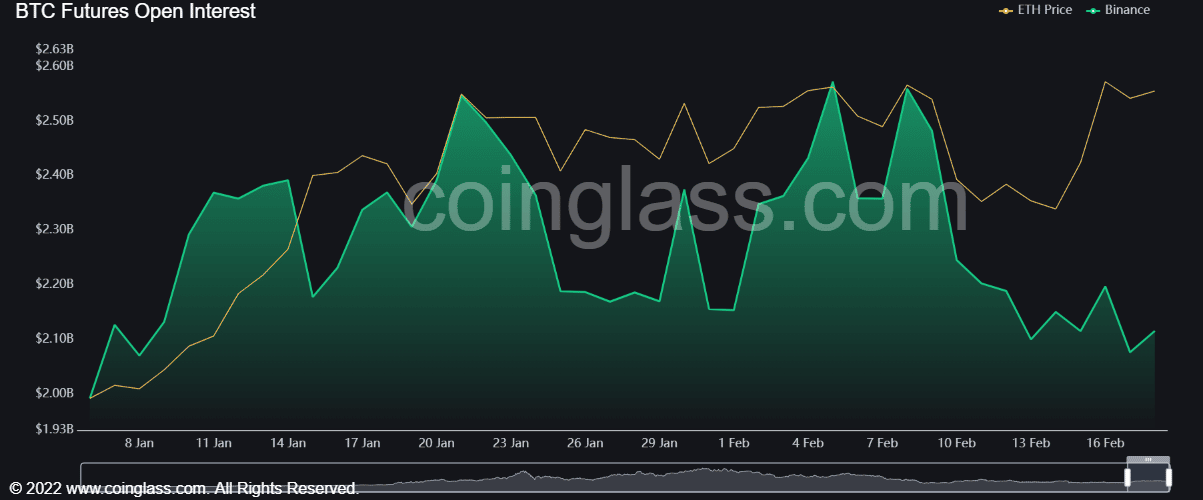

Nevertheless, the open curiosity (OI) fluctuations highlighted by Coinglass might complicate the bulls’ efforts. In distinction to the January rally, which was accompanied by a gentle rise in OI, the current upswing has been characterised by fluctuations.

A gentle rise in OI and a break above the 78.6% Fib stage might sign robust upside momentum able to retesting the $1,743 and different resistance ranges.

Supply: Coinglass