Ethereum (ETH) Price Prediction 2025-2030: When will ETH reach $10,000?

Disclaimer: The datasets shared within the following article have been compiled from a set of on-line sources and don’t replicate AMBCrypto’s personal analysis on the topic

The second-largest cryptocurrency on the earth, Ethereum (ETH), has had a big rebound after experiencing intense promoting strain over the earlier weekend.

In keeping with on-chain information, the variety of energetic Ethereum addresses on 2 December rose to its highest degree in six weeks. The worth of ETH skyrocketed by 30% in simply six weeks from the earlier time this occurred.

Learn Value Prediction for Ethereum [ETH] 2023-24

The worth of Ethereum (ETH) has recently undergone a big correction, but the whales have been buying at each decline. The fifth-largest accumulation day in a yr was recorded final week as ETH whale exercise reached a brand new degree. Because the FTX drawback developed over this month of November, Ethereum whales have been build up. According to the Santiment report,

“Ethereum’s giant key addresses have been rising in quantity because the #FTX debacle in early November. Pictured are the important thing moments the place shark & whale addresses have gathered & dumped. The variety of 100 to 100k $ETH addresses is at a 20-month excessive.”

It virtually reached the lows through the FTX collapse-driven meltdown of the cryptocurrency market, nevertheless it quickly bounced again and was capable of preserve above these ranges as nicely. This strengthens the argument since Ethereum has sometimes outperformed Bitcoin.

Given the whole lot, shopping for Ethereum have to be a sound funding in the long run, proper? Most consultants have optimistic predictions for ETH. Moreover, the majority of long-term Ethereum worth projections are upbeat.

Why are projections necessary?

Since Ethereum has seen phenomenal development in recent times, it isn’t stunning that buyers are putting important bets on this cryptocurrency. Ethereum gained traction after the value of Bitcoin dropped in 2020, following a protracted interval of stagnation in 2018 and 2019.

Apparently, a lot of the altcoin market remained idle even after the halving. One of many few that picked up the momentum shortly is Ethereum. Ethereum had elevated by 200% from its 2017 highs by the top of 2021.

Ethereum might expertise such a spike due to a number of essential components. One in all these is an improve to the Ethereum community, particularly a transfer to Ethereum 2.0. Another excuse is the Ethereum tokenomics debate. With the change to Ethereum 2.0, ether tokenomics will turn into much more deflationary. Consequently, there gained’t be as many tokens available on the market to fulfill rising demand. The result would possibly enhance Ethereum’s rising momentum sooner or later.

On this article, we’ll take a fast have a look at the cryptocurrency market’s current efficiency, paying specific consideration to market cap and quantity. Essentially the most well-known analysts’ and platforms’ predictions will likely be summarized on the finish, together with a have a look at the Worry & Greed Index to gauge market sentiment.

Ethereum’s worth, quantity, and the whole lot in between

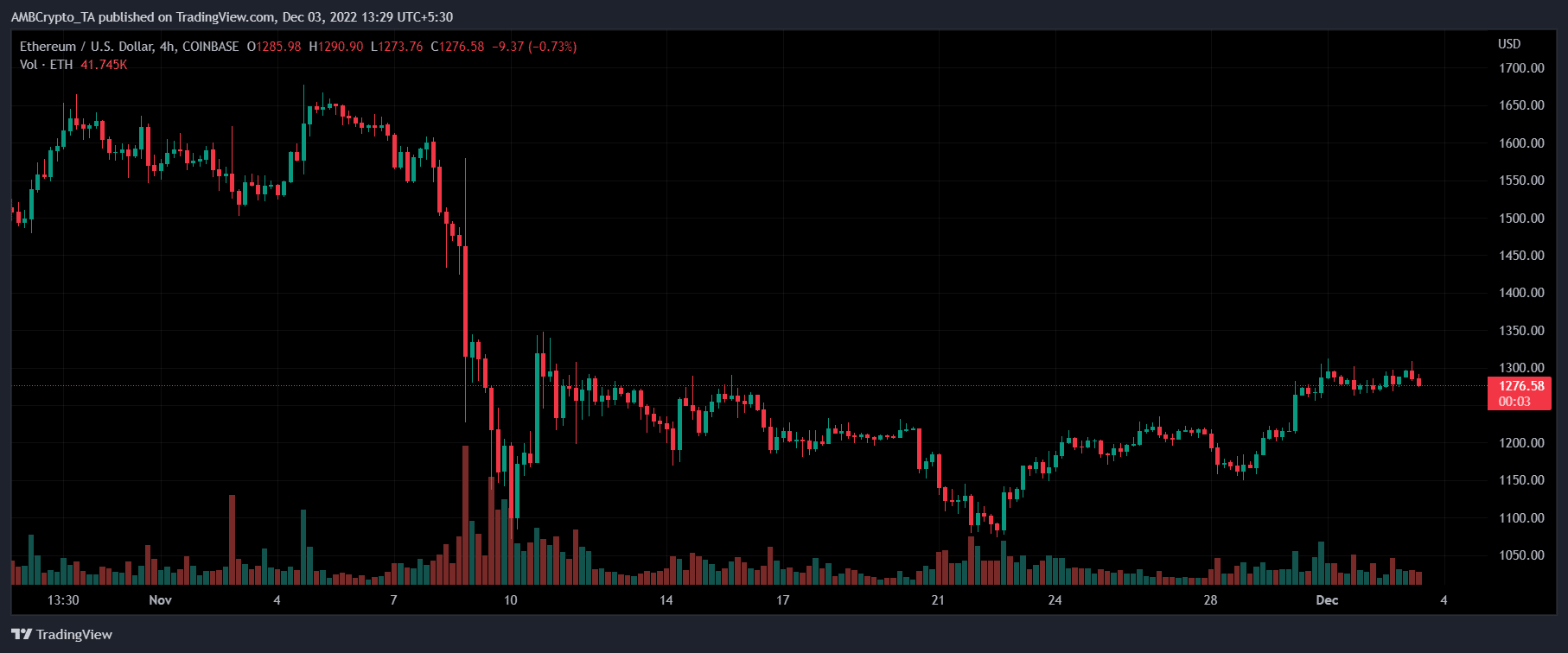

Ethereum, at press time, was buying and selling at $1,276, exhibiting resistance for the previous few weeks following the FTX debacle. Early buyers have, nonetheless, tripled their investments yearly, due to its excessive ROI.

Supply: TradingView

Ether spot market exercise has additionally elevated, with the cryptocurrency surpassing Bitcoin as probably the most traded coin on Coinbase some time again.

Although it may be tough to forecast the value of a risky cryptocurrency, most consultants concur that ETH might as soon as once more cross the $4,000 barrier in 2022. And, in line with a current forecast by Bloomberg intelligence analyst Mike McGlone, the value of Ethereum will conclude the yr between $4,000 and $4,500.

Moreover, according to a report by Kaiko on 1 August, ETH’s market share of buying and selling quantity will attain 50% parity with Bitcoin’s for the primary time in 2022.

In keeping with Kaiko, ETH outpaced Bitcoin in July on account of important inflows into the spot and by-product markets. Most exchanges have seen this surge, which will be a sign of returning buyers. Moreover, an increase in common commerce measurement is the precise reverse of what has been seen to date in 2022’s downturn.

On 2 August, Open Curiosity (OI) of Deribit Ether Choices priced at $5.6 billion exceeded the OI of Bitcoin valued at $4.6 billion by 32%. This was the primary time in historical past that ETH surpassed BTC within the Choices market.

Supply: Glassnode

Actually, a majority of cryptocurrency influencers are bullish on Ethereum and anticipate it to achieve unbelievable highs.

Given the anticipation across the merge, Ethereum has turn into the speak of the city. The second-largest crypto has crushed the king of crypto to turn into probably the most in-demand crypto. A fast division of quantity by market capitalization of each cryptos will reveal Ethereum’s relative quantity is in truth higher than that of Bitcoin.

Whereas the broader Ethereum neighborhood is wanting ahead to the environment-friendly PoS replace, a faction has emerged in favor of a fork that can retain the energy-intensive PoW mannequin.

The faction is generally made up of miners who threat dropping their funding in costly mining gear because the replace would render their enterprise mannequin ineffective. Distinguished Chinese language miner Chandler Guo said on Twitter final month that an ETHPoW is “coming quickly”.

Binance has clarified that within the occasion of a fork which creates a brand new token, the ETH ticker will likely be reserved for the Ethereum PoS chain, including that “withdrawals for the forked token will likely be supported”. Stablecoin tasks Tether and Circle have each reiterated their unique assist for the Ethereum PoS chain after the merge.

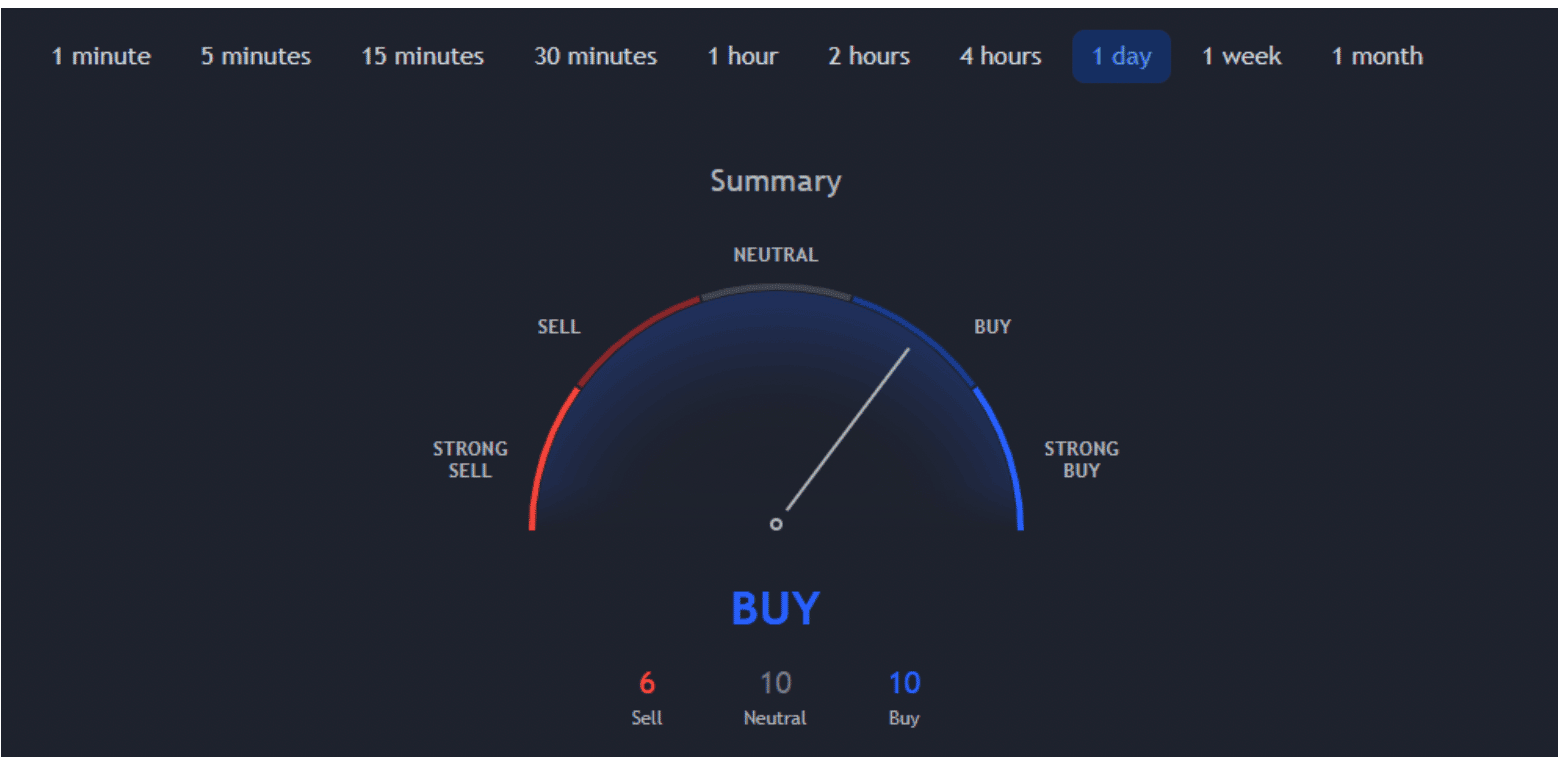

TradingView expressed the identical opinion on the time this text was written, and their technical evaluation of the Ethereum worth indicated that it was a “Purchase” sign for ETH.

Supply: Tradingview

Actually, PwC’s Crypto-head Henri Arslanian claimed in an edition of First Mover that “Ethereum is the one present on the town.” Nevertheless, buyers might want to witness elevated demand and functioning for Ether’s worth to maintain climbing.

In keeping with Mudrex’s Edul Patel,

“The Merge will full Ethereum’s transition to PoS, making it extraordinarily power environment friendly and handy to make funds. That can solely assist Ethereum’s huge use instances, in the end driving demand greater for the ETH token.”

Kenneth Worthington, analyst at JPMorgan Chase, has expressed his confidence within the Merge’s means to profit stakeholders like Coinbase. Worthington believes that Coinbase has positioned itself to capitalize on the Merge by “maximizing the worth of Eth staking for its purchasers”

Distinguished enterprise capitalist Fred Wilson revealed a weblog on 15 August outlining the approaching adjustments that can comply with the Merge. Wilson defined that together with a diminished carbon footprint which is able to make Ethereum extra surroundings pleasant, the Merge will alter the availability and demand stability of ether. This transformation was demonstrated by Bankless of their blogpost the place they projected a structural influx of $0.3 million per day, in distinction to the present structural outflow of $18 million per day.

In keeping with investor and creator of the cryptocurrency analysis and media group Token Metrics Ian Balina, “I believe Ethereum can go to $8,000.”

ETH Whale Exercise

Information from blockchain analytics agency Santiment reveals ETH provide held by the highest addresses on crypto exchanges has been on the rise since early June. Then again, ETH provide held by the highest non-exchange addresses i.e. ETH held in {hardware} wallets, digital wallets and so forth. has been declining since early June. However why June? As a result of it was round that point {that a} tentative timeline for the Merge was disclosed to the neighborhood.

Santiment had tweeted final week that over the previous 3 months, whales had beefed up their change holdings by 78%

So what does this imply? It signifies that Ethereum whales are transferring their ETH onto exchanges. High ETH hodlers are taking their provide out of chilly storage and transferring it to exchanges, most definitely to facilitate a fast transaction if wanted.

Within the run as much as the merge, plenty of exchanges like Coinbase and Binance introduced that they are going to be suspending all ETH and ERC-20 token deposits and withdrawals, as a way to guarantee a seamless transition.

It’s doable that the whales moved their holdings onto exchanges to both preemptively dump their holdings in anticipation of a worth hunch after the Merge. The opposite chance is them ready until nicely after the Merge to behave on ETH’s worth motion.

Let’s now have a look at what well-known platforms and analysts should say about the place they imagine Ethereum will likely be in 2025 and 2030.

Ethereum Value Prediction 2025

In keeping with Changelly, the least anticipated worth of ETH in 2025 is $7,336.62, whereas the utmost doable worth is $8,984.84. The buying and selling expense will likely be round $7,606.30.

CoinDCX additionally predicts ETH may have a comparatively profitable yr in 2025 as a result of there might not be a lot of an antagonistic influence on the asset. There may be little doubt that the bulls could possibly be well-positioned and retain a big upturn all year long. The asset is anticipated to achieve $11,317 by the top of the primary half of 2025, however doable transient pullbacks.

Nevertheless, you need to keep in mind that the yr is 2025, and quite a lot of these projections are based mostly on Ethereum 2.0 launching and performing efficiently. And by that, it means Ethereum has to resolve its high-cost gasoline charges points as nicely. Additionally, world regulatory and legislative frameworks haven’t but constantly backed cryptocurrencies.

Nevertheless, though newer and extra environmentally pleasant applied sciences have been developed, analysts incessantly declare that Ethereum’s “first mover benefit” has positioned it for long-term success, regardless of new competitors. The worth predictions appear conceivable as a result of, along with its projected replace, Ethereum is anticipated for use extra incessantly than ever earlier than within the growth of DApps.

Ethereum Value Prediction 2030

Changelly additionally argued that the value of ETH in 2030 has been estimated by cryptocurrency specialists after years of worth monitoring. It will likely be traded for at least $48,357.62 and a most of $57,877.63. So, on common, you’ll be able to anticipate that in 2030, the value of ETH will likely be roughly $49,740.33.

Lengthy-term Ethereum worth estimates could be a useful gizmo for analyzing the market and studying how key platforms anticipate that future developments just like the Ethereum 2.0 improve will have an effect on pricing.

Crypto-Rating, for example, predicts that by 2030, Ethereum’s worth will seemingly exceed $100,000.

Each Pantera Capital CEO Dan Morehead and deVEre Group founder Nigel Inexperienced additionally predict that through the subsequent ten years, the value of ETH will hit $100,000.

Appears like an excessive amount of? Nicely, the purposeful capabilities of the community, similar to interoperability, safety, and transaction pace, will seriously change on account of Ethereum 2.0. Ought to these and different associated reforms be efficiently carried out, opinion on ETH will change from being barely favorable to strongly bullish. This may present Ethereum the possibility to thoroughly rewrite the principles of the cryptocurrency recreation.

Conclusion

Whereas a few of these buyers have began investing in rival tokens as a way to revenue, others are doing it out of precaution as a way to hedge their portfolios. This has been corroborated by the volatility witnessed in metrics like each day energetic customers and worth motion of so-called Ethereum killers like Avalanche, Solana, Cardano and so forth. within the run as much as the merge occasion which is lower than a month away.

The vast majority of buyers anticipated that Ethereum would backside out at $3500 early this yr, however the foreign money moved decrease to point out them incorrect. Actually, ETH briefly fell beneath the terrifying $1000 threshold.

Nevertheless, the coin has all the time rebounded when it appeared that it was poised to strike the goal as soon as extra, restoring confidence in its future. This consists of the incident in November 2022 when an FTX hacker allegedly dumped over 30,000 ETH. Hope is obtainable by the token’s persistence within the wake of the FTX chapter and the protracted crypto chilly.

Solely yesterday, the Federal Reserve launched the minutes of the Federal Open Market Committee (FOMC) assembly. It instructed that the central financial institution might make smaller rate of interest will increase going ahead. Following this information, ETH’s worth ticked up and reached $1,181.51 as we speak.

Ethereum might start a brand new hunch whether it is unable to rise over the $1,300 resistance. Close to $1,225 is the primary level of assist on the draw back.

There may be broad hope that the primary sensible contract blockchain will survive this era of trials, regardless of Ethereum’s rivalries and different components contributing to its steady instability.

So far as the Merge is worried, it’s being hailed as a significant success story by the Ethereum neighborhood. Buterin cited a analysis examine by an Ethereum researcher, Justin Drake, that means that the “merge will cut back worldwide electrical energy consumption by 0.2%.”

“The merge will cut back worldwide electrical energy consumption by 0.2%” – @drakefjustin

— vitalik.eth (@VitalikButerin) September 15, 2022

It additionally reduces the time to mine one block of ETH from 13 seconds to 12 seconds. The Merge marks 55% completion of Ethereum’s journey towards higher scalability and sustainability.

The probability that Ether will expertise a worth surge of fifty% sooner or later is elevated by its superior interim fundamentals to these of Bitcoin. To start with, Ether’s annual provide charge plummeted in October, partially due to a fee-burning mechanism often called EIP-1559 that takes a specific amount of ETH out of perpetual circulation anytime an on-chain transaction takes place.

Issues about censorship on the Ethereum ecosystem have additionally emerged put up the Merge. Round half of the Ethereum blocks are Workplace of International Belongings Management (OFAC)-compliant as MEV-Enhance received carried out. As Ethereum has upgraded to a PoS consensus, MEV-Enhance has been enabled to a extra consultant distribution of block proposers, moderately than a small group of miners underneath PoW. This growth raises a priority about censorship underneath the power of OFAC.

It’s attention-grabbing to notice that whereas many eagerly waited for Ethereum’s Merge and beefed up their holdings in anticipation of a worth surge, there was a bunch of buyers who weren’t assured within the Merge’s profitable rollout. These buyers had been betting on a glitch within the rollout course of, hoping that the replace runs into bother. Whereas a few of these buyers have began investing in rival tokens as a way to revenue, others are doing it out of precaution as a way to hedge their portfolios. This was corroborated by the volatility witnessed in metrics like each day energetic customers and worth motion of so-called Ethereum killers like Avalanche, Solana, Cardano and so forth. within the run as much as the Merge.

The vast majority of Ethereum worth forecasts point out that ETH can anticipate great development over the following years.

As per Santiment, Ethereum’s energetic addresses have sunk to 4-month lows with weak arms persevering with to drop post-Merge, and disinterest at a excessive as costs have stagnated. 17 October was the primary day that there have been lower than 400,000 addresses on the community since 26 June.

😲 #Ethereum‘s energetic addresses have sunk to 4-month lows with weak arms persevering with to drop post-#merge, and disinterest at a excessive as costs have stagnated. Monday was the primary day that there have been lower than 400k addresses on the community since June twenty sixth. https://t.co/FKXHhg6Z5g pic.twitter.com/1Ekj3bpT0A

— Santiment (@santimentfeed) October 20, 2022

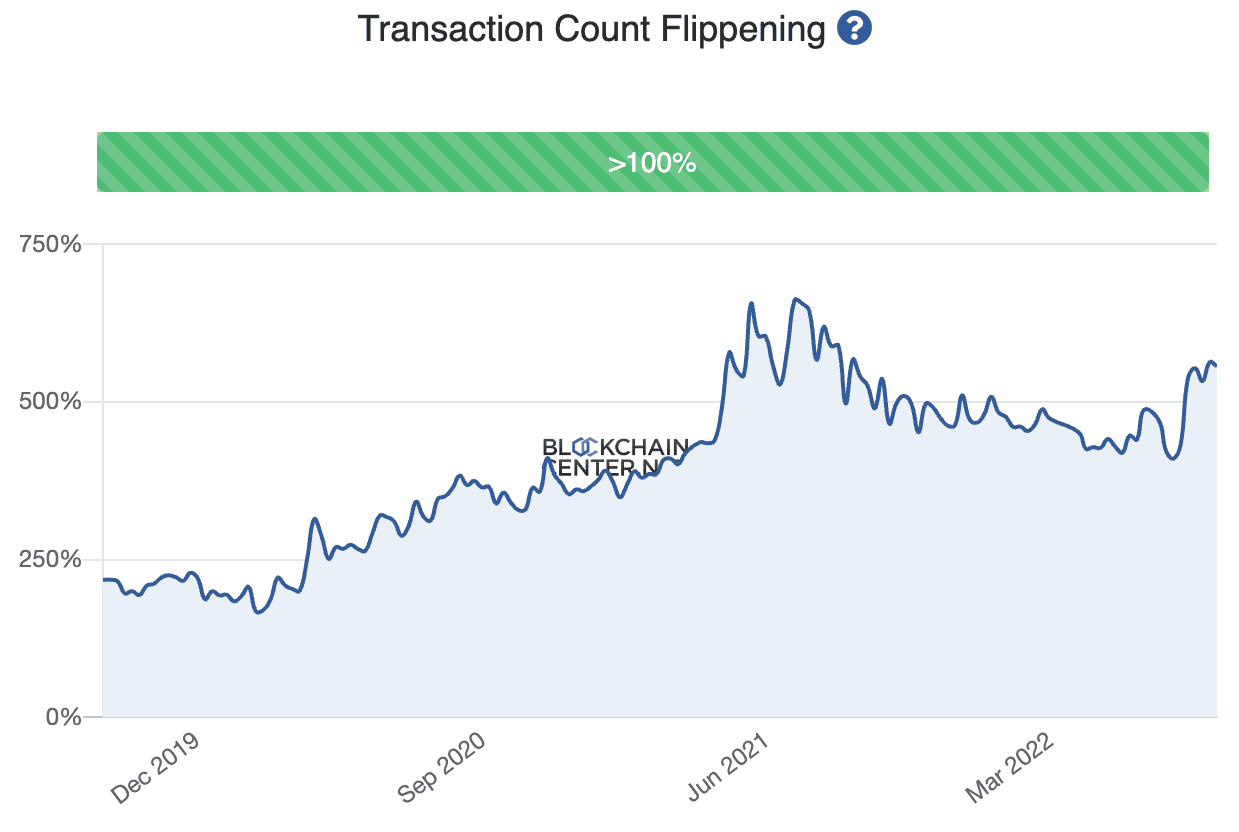

What in regards to the flippening then? Is it doable that the altcoin would possibly cross Bitcoin on the charts sooner or later? Nicely, that’s doable. Actually, in line with BlockchainCenter, ETH has already surpassed BTC on a number of key metrics.

Take into account Transaction Counts and Whole Transaction Charges, for example. On each counts, ETH is forward of BTC.

Supply: BlockchainCenter

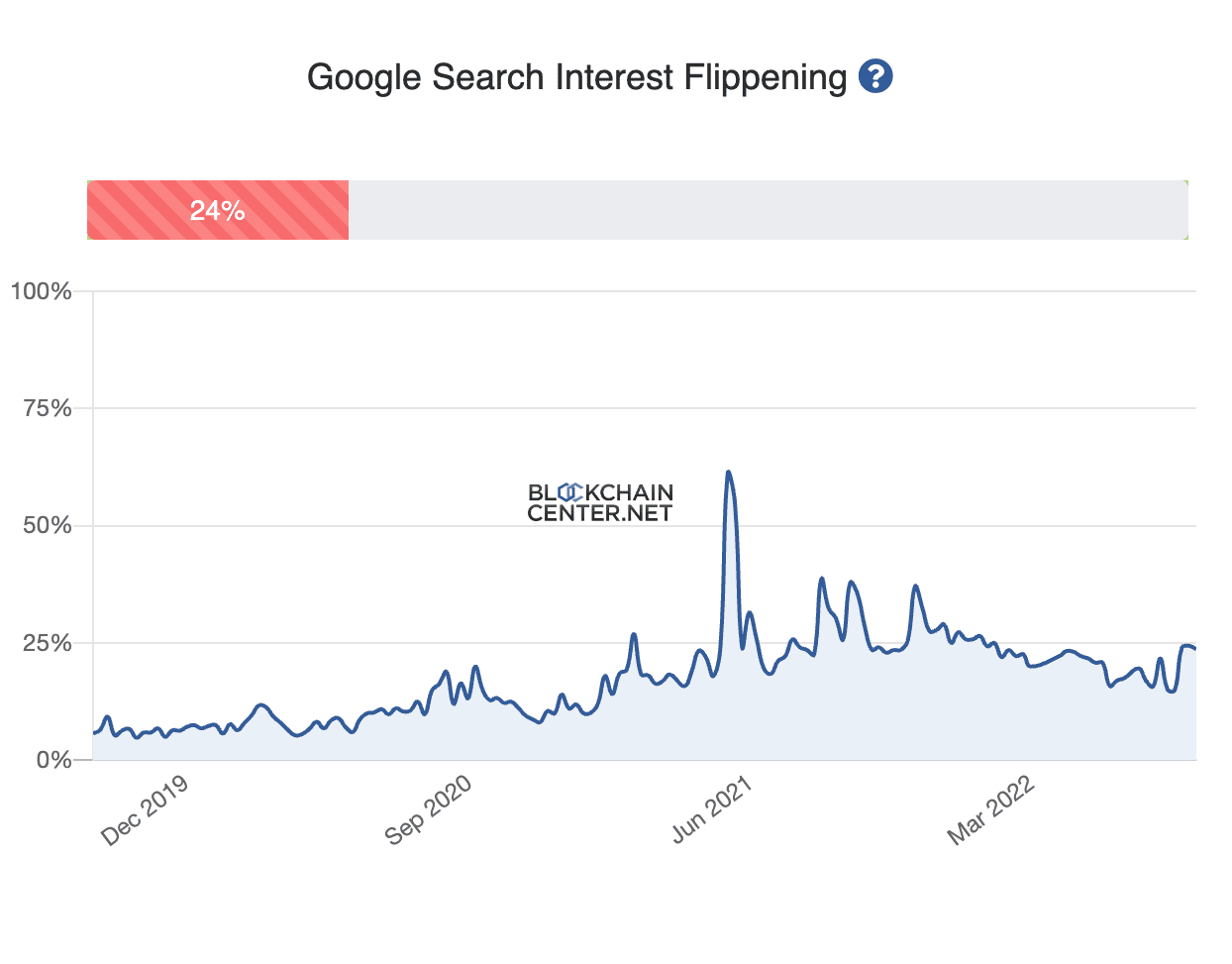

Quite the opposite, the normal definition of a ‘flippening’ pertains to the market cap of cryptos flipping. So far as the identical is worried, ETH is 48.2% off BTC’s market cap.

Equally, Google Search Curiosity for ETH was over 76% off the figures for BTC’s personal figures.

Supply: BlockchainCenter

Nevertheless, keep in mind that quite a bit can change over these years, particularly in a extremely risky market like cryptocurrency. Main analysts’ projections range tremendously, however even probably the most conservative ones would possibly lead to respectable earnings for anybody selecting to put money into Ethereum.