Ethereum (ETH) Bottom Finally In? Fidelity’s Macro Analyst Says Price of Bitcoin (BTC) Offers a Clue

Constancy’s director of world macro is evaluating the place Bitcoin (BTC) and Ethereum (ETH) stand after months of worth capitulation.

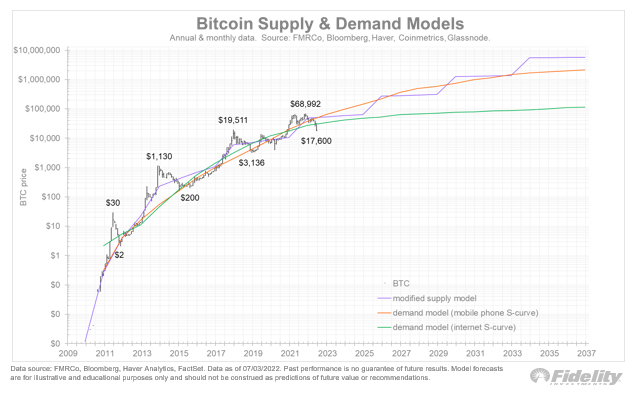

Jurrien Timmer tells his 131,200 Twitter followers that Bitcoin is probably going undervalued at present costs based mostly on his S-curve mannequin.

The mannequin makes an attempt to gauge the worth of BTC by predicting the longer term progress of its community based mostly on the speed at which customers adopted the web.

“Bitcoin and crypto basically haven’t been spared from the widespread drawdowns this 12 months, and that’s an understatement.

At its current low of $17,600, Bitcoin is now beneath even my extra conservative S-curve mannequin, which is predicated on the web adoption curve.”

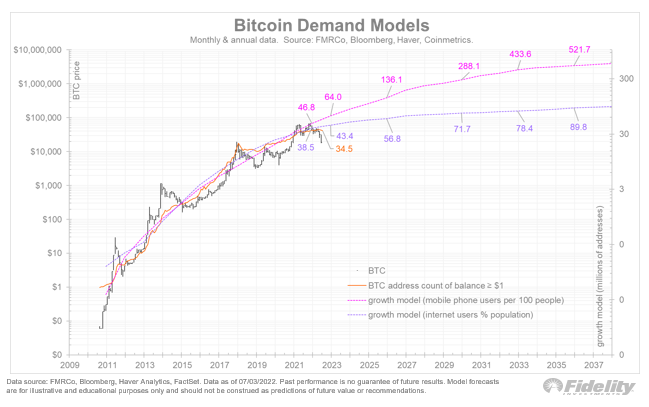

Timmer subsequent shares his perception that the tempo of Bitcoin adoption extra intently resembles that of the early web than cellphones, referencing Metcalfe’s Legislation, which states {that a} community grows in worth because the variety of customers on the community will get greater.

“Taking a look at Bitcoin’s community progress, it’s clear that the adoption curve is monitoring the extra asymptotic web adoption curve, slightly than the extra exponential cell phone curve.

Per Metcalfe’s regulation, slower community progress suggests a extra modest worth appreciation.”

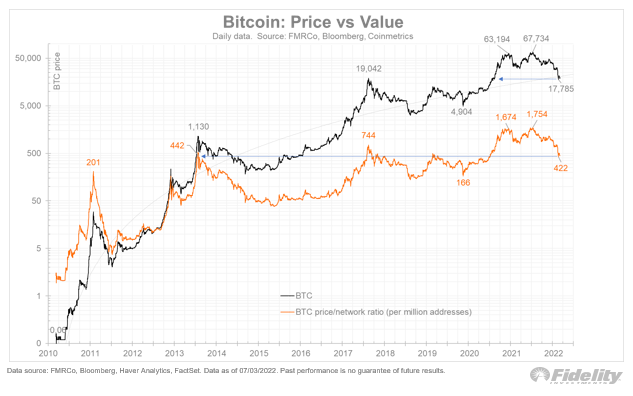

Timmer adds that he’s additionally wanting on the variety of non-zero Bitcoin addresses as a technique of calculating BTC’s true value, saying that it’s nonetheless deeply undervalued regardless of being in a bear market.

“I take advantage of the value per thousands and thousands of non-zero addresses as an estimate for Bitcoin’s valuation, and the chart beneath reveals that valuation is all the best way again to 2013 ranges, regardless that worth is barely again to 2020 ranges.

In different phrases, Bitcoin is reasonable.”

At time of writing, Bitcoin is up 1.28% during the last 24 hours, buying and selling for $21,806.

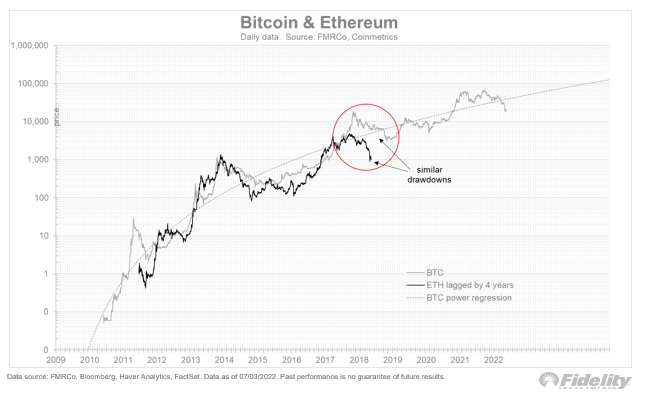

The analyst wraps up his thread by asking whether or not Ethereum might be thought-about comparatively cheaper than Bitcoin. Timmer compares ETH’s present worth drawdown with Bitcoin’s 2018 bear market, assuming that Ethereum’s worth motion is simply behind Bitcoin’s market cycle by 4 years.

“If Bitcoin is reasonable, then maybe Ethereum is cheaper.

If ETH is the place BTC was 4 years in the past, then the analog beneath means that Ethereum might be near a backside.”

Ethereum is buying and selling sideways on the day with an asking worth of $1,231.

Test Worth Motion

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Featured Picture: Shutterstock/EvojaPics/VECTORY_NT