Ethereum [ETH]: Bears gear up to draw curtains on recent price rally

- ETH noticed its highest revenue transaction ratio since October 2021.

- On-chain knowledge urged {that a} native high has been reached.

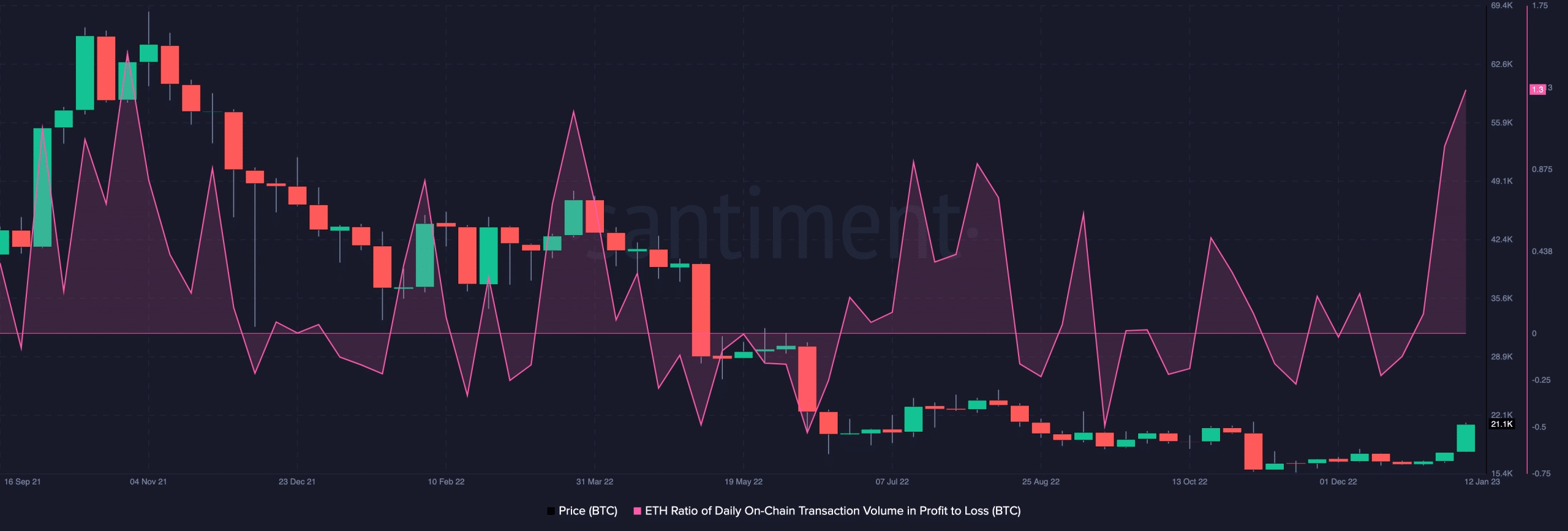

At the moment buying and selling at its pre-FTX degree, main altcoin Ethereum [ETH] logged its highest revenue transaction ratio since October 2021 on 16 January, knowledge from Santiment revealed.

💸 Are #crypto markets seeing a high? Merchants are behaving like they consider so, taking this chance to revenue take whereas given the possibility. #Bitcoin is seeing its highest revenue tx ratio since Feb, 2021. For #Ethereum, it is the best since Oct, 2021. https://t.co/GFrtZtFIYP pic.twitter.com/yqDc2uDPuR

— Santiment (@santimentfeed) January 16, 2023

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

As reported by the on-chain analytics instrument, earlier than the most recent excessive, the best revenue transaction ratio for ETH within the final two years had been 1.50 on 28 October, 2021. Throughout that point, the worth per ETH oscillated between $3500 and $4500 to register an all-time excessive.

Since then, ETH’s worth declined by over 60%, knowledge from CoinMarketCap confirmed.

Supply: Santiment

Is the “high” in?

Usually, when the ratio of day by day on-chain transaction quantity in revenue is larger than that in loss, it’s typically interpreted as an indication {that a} native high has been reached, and that traders have been taking income earlier than the potential begin of a worth reversal.

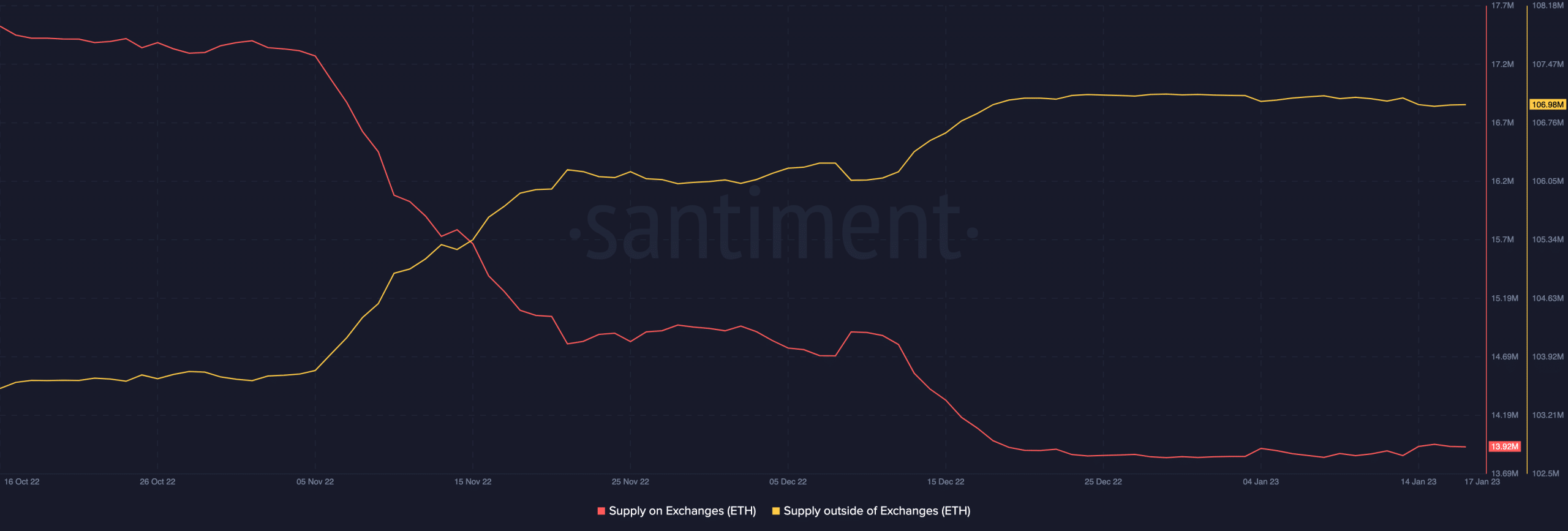

ETH’s trade exercise previously three days confirmed the alt’s holders’ profit-taking actions. In keeping with knowledge from Santiment, since 13 January, the provision of ETH on exchanges grew by 1%.

Conversely, its provide outdoors of exchanges additionally fell by 1% inside the identical interval. Per CryptoQuant, the uptick in ETH’s provide on exchanges previously 4 days brought about the full variety of cash held on exchanges to be pegged at 18.30 million ETH at press time.

Supply: Santiment

When a crypto’s provide on exchanges exceeds the quantity held off exchanges, it signifies that many asset holders have been keen to promote their holdings on the open market at press time. This was usually an indication of weakening demand, as holders selected to liquidate their positions relatively than maintain on to them.

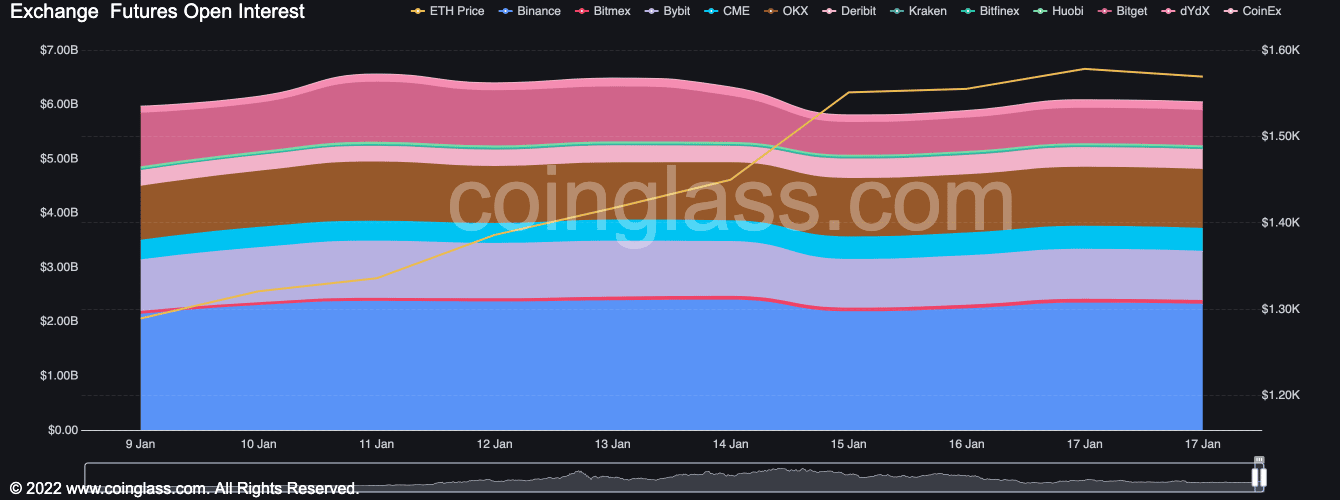

Additional, the waning demand for ETH previously few days offered a decline within the alt’s Open Curiosity. In keeping with Coinglass, at $6.04 billion as of this writing, ETH’s Open Curiosity fell by 8% within the final week.

Supply: Coinglass

Has Ethereum reached its peak?

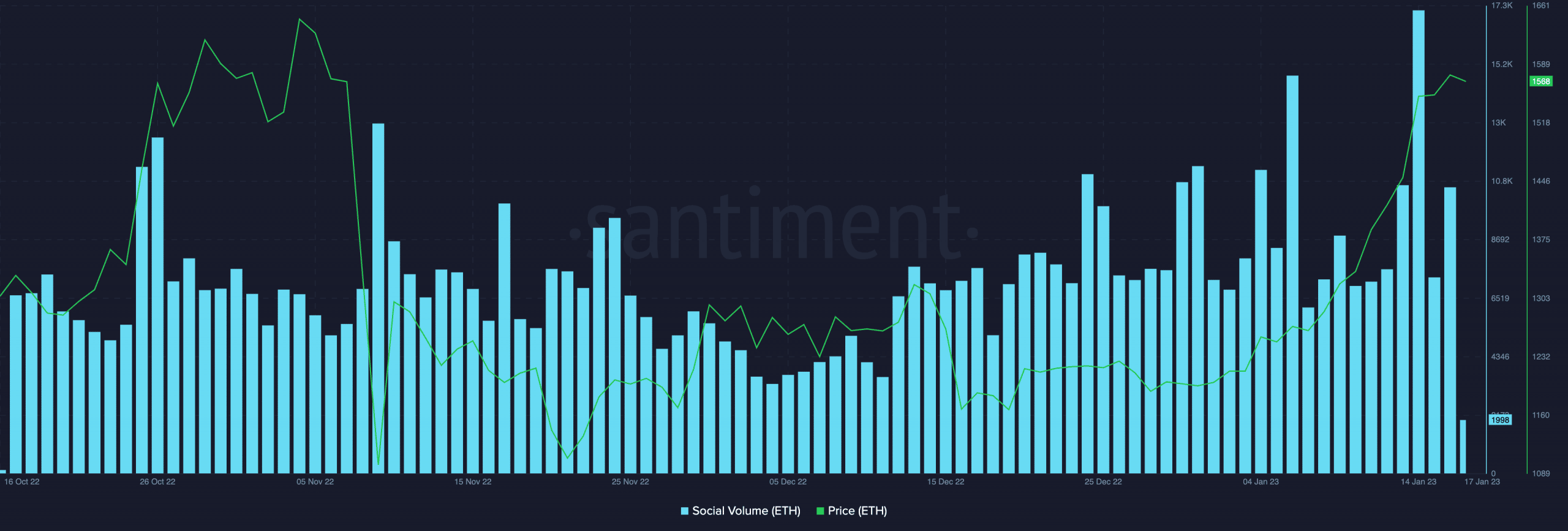

On 14 January, ETH noticed a extreme spike in social mentions, which was its highest worth previously 90 days.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Excessive ranges of social mentions, notably throughout a worth rally, can point out that the hype surrounding a coin has reached its peak. This may be as a result of giant variety of traders turning into overly optimistic concerning the coin’s market efficiency and shopping for into it based mostly on worry of lacking out (FOMO).

Most instances, these spikes in social mentions coincided with native worth highs and are sometimes adopted by a interval of worth stabilization or decline.

Supply: Santiment