Ethereum: Deflationary? Yes, but there is more than meets the eye

- In January, ETH’s provide decreased by 10,145.72 models.

- February is perhaps marked by a value decline.

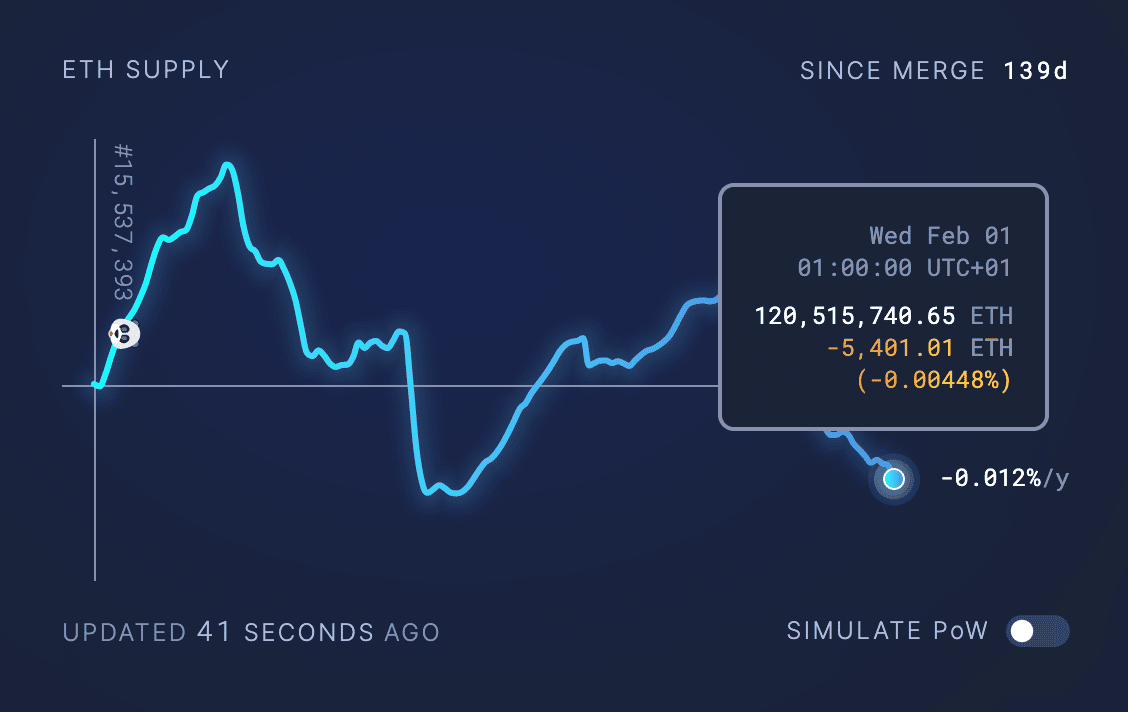

In line with information from Ultrasound Money, in January, Ethereum’s [ETH] provide decreased by 10,145.72 models, leading to a internet deflationary worth of roughly $16 million. As of this writing, the present whole provide of ETH stood at 120,515,752, with an annual development price of -0.012%.

Supply: Ultrasound Cash

Learn Ethereum’s [ETH] Worth Prediction 2023-24

Ethereum: Deflation is the popular possibility

The lower within the provide of ETH has a number of implications for the cryptocurrency market. A lower in provide results in a rise in demand, as much less of the asset is accessible for buy. This will drive up the value of ETH, making it extra precious. Thus, the rise in demand may additionally entice extra buyers to the market, which may additional increase the value of ETH.

Additionally, the online deflationary worth of ETH may positively influence the foreign money’s stability. Notably, deflationary currencies keep their worth over time, because the lower in provide creates a shortage of the asset. This reduces the danger of inflation and may make the foreign money extra enticing to buyers, as it’s much less more likely to depreciate.

Outlook is gloomy within the interim

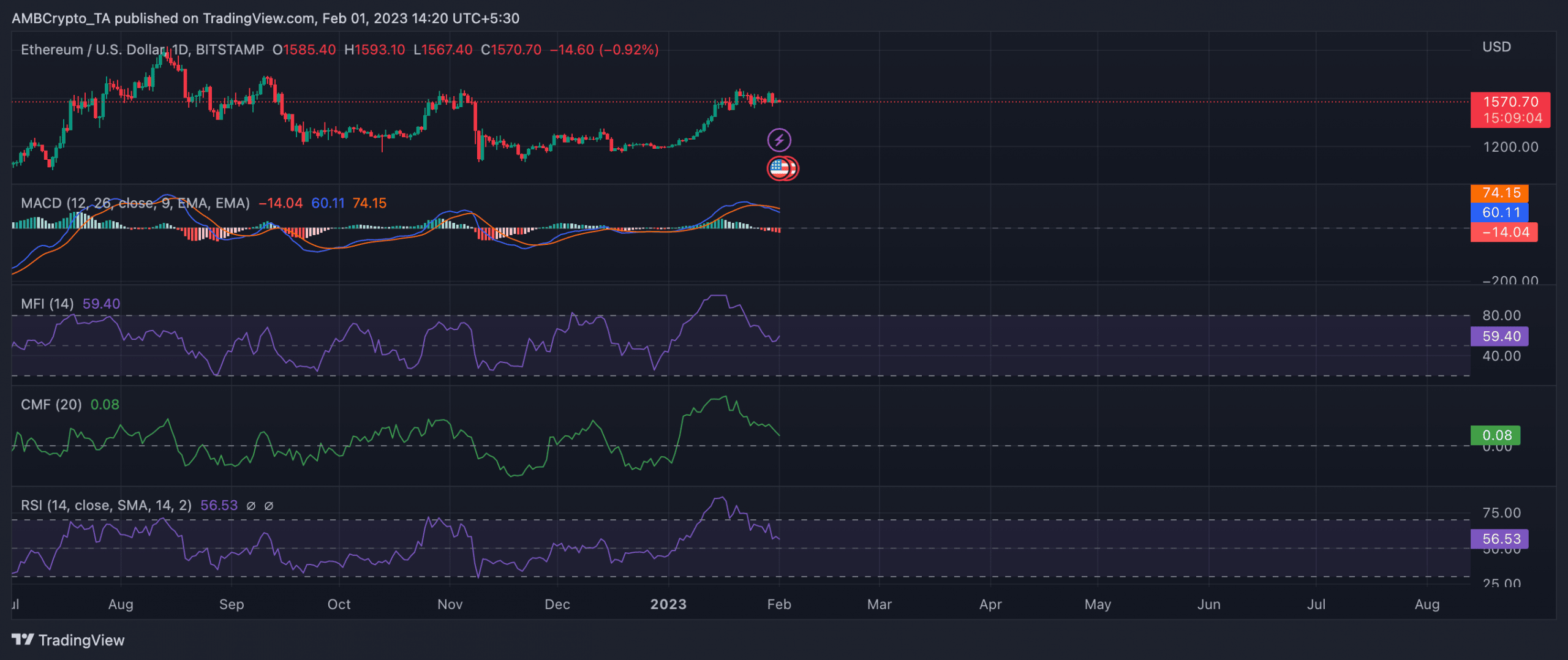

Whereas ETH’s internet deflationary worth may guarantee value stability in the long run, an evaluation of value actions on a day by day chart revealed that an imminent value reversal was on the horizon.

At press time, ETH traded at $1,569.93. In January, the altcoin’s worth rose by 32%. Nonetheless, as many buyers rallied to take income, shopping for stress seems to have declined considerably.

A take a look at ETH’s shifting common convergence/divergence (MACD) confirmed the graduation of a brand new bear cycle on 27 January. Since then, the indicator has returned solely pink histogram bars, and ETH’s value has fallen by 2%.

At press time, key momentum indicators aimed for his or her respective impartial zones. ETH’s Relative Energy Index (RSI) and Cash Movement Index (MFI) have declined persistently within the final week and remained in downtrends at 56.33 and 59.40, respectively, on the time of writing. A drop in ETH accumulation marked the previous week, and lots of took to promoting their holdings.

Likewise, the dynamic line (inexperienced) of the coin’s Chaikin Cash Movement (CMF) aimed to cross into the unfavorable zone. Many buyers shied away from shopping for extra ETH.

Supply: ETH/USDT on TradingView

What number of ETHs can you purchase for $1?

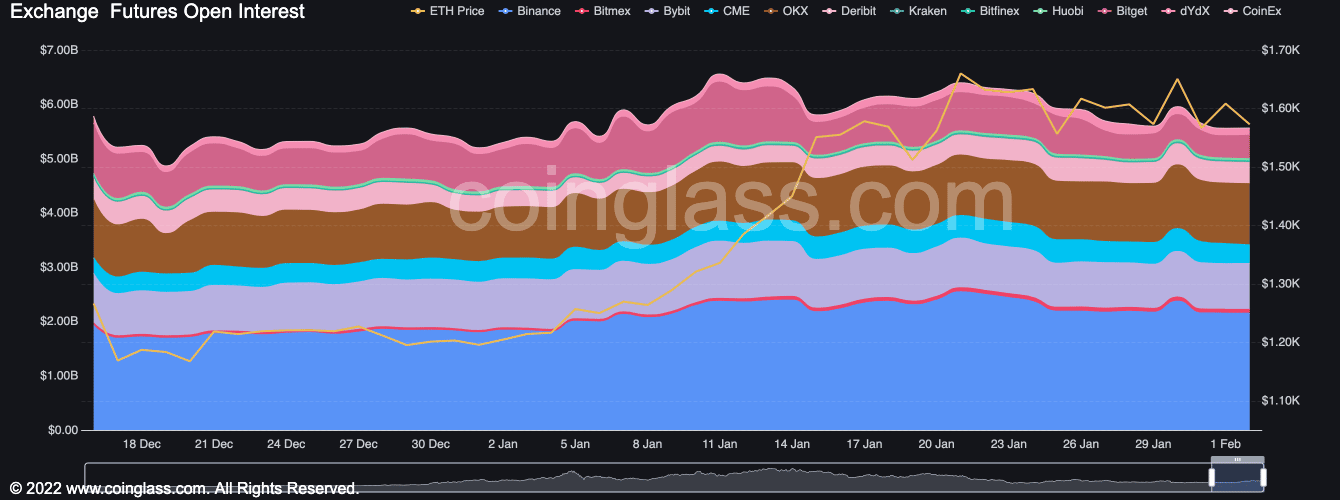

The dearth of recent demand for ETH was depicted by a constant decline in its Open Curiosity up to now ten days, information from Coinglass revealed. Inside that interval, ETH’s Open Curiosity fell by 16%.

Usually, a decline in an asset’s Open Curiosity implies that merchants are closing out their positions and there’s a decline in new contracts being created. This implies that they’re turning into much less assured sooner or later value actions of the asset and are decreasing their publicity.

Supply: Coinglass