Ethereum Classic: Short traders could benefit if this support fails to hold

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- ETC value correction might break under $18.28 and settle at $17.60.

- A breakout above the bearish order block at $19.18 would invalidate the bias.

- ETC noticed a slight decline in demand within the futures market.

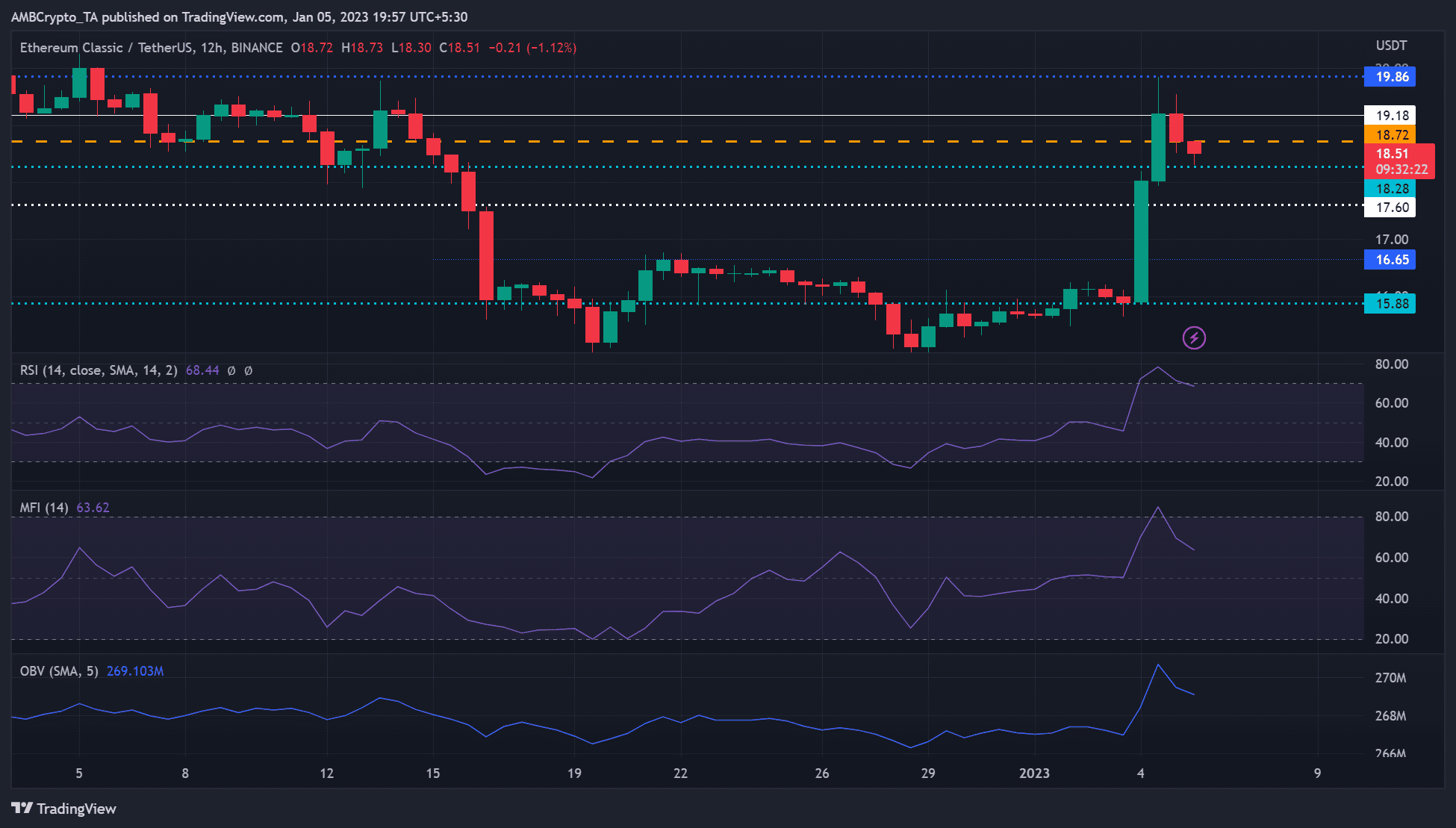

Ethereum Basic [ETC)] rallied on 4 January, following Bitcoin’s [BTC] rally on the identical day. ETC rose from $15.88 to $19.86, however a bearish order block at $19.86 undermined the additional rally and compelled a value correction.

The correction adopted BTC’s pullback from the $16.95K excessive reached on 4 January. At press time, ETC was buying and selling at $18.51 after retesting earlier help at $18.28.

Though ETC was extraordinarily bullish on the 12-hour chart, it had reached the overbought zone and will see additional value reversal (downtrend). Such a transfer might present merchants with extra alternatives to promote at these ranges.

Learn Ethereum Basic’s [ETC] Value Prediction 2023-24

Help at $18.28: Can the bears break under it?

Supply: ETC/USDT on TradingView

All three technical indicators (RSI, MFI, and OBV) level to an extra downtrend. The Relative Energy Index (RSI) pulled again from overbought territory, an indication of easing shopping for strain.

Equally, the Cash Move Index (MFI) had reached the overbought space and was shifting down. This exhibits that accumulation peaked and distribution was underway. As well as, the on-balance quantity (OBV) has fallen sharply, so shopping for strain could also be restricted.

These modifications would give bears extra room to push ETC costs down. Due to this fact, ETC might break under $18.28 and settle at $17.60. Quick merchants can promote excessive and purchase again if ETC reaches $17.60.

Nevertheless, a bullish BTC might push ETC to interrupt the bearish order block at $19.18. Such a transfer would invalidate the bearish bias above.

ETC noticed a decline in open curiosity and buying and selling quantity

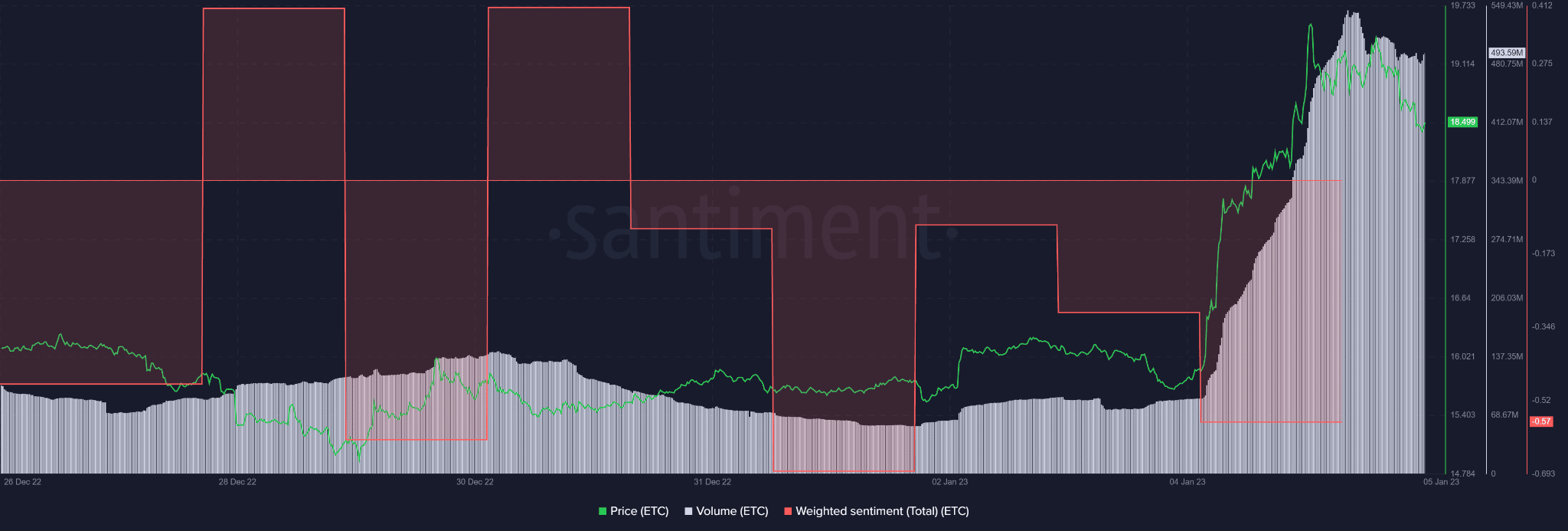

ETC skilled a divergence between open curiosity (OI) and value on 3 January, which was adopted by an upswing in value on 4 January.

Nevertheless, at press time, open curiosity (OI) fell as ETC costs fell, indicating a decline in open buying and selling positions within the derivatives market. This bearish outlook within the derivatives market might put downward strain on the worth of ETC if it continues.

As well as, elevated unfavourable sentiment and a slight decline in buying and selling volumes, as indicated by Santiment, might undermine additional shopping for strain and provides extra leverage to sellers.

Are your holdings flashing pink or inexperienced? Examine the ETC Revenue Calculator

Nonetheless, a bullish BTC will enhance ETC to beat the bearish order block, therefore value monitoring.

Supply: Santiment