Ethereum burn hits 2-month high thanks to these sources

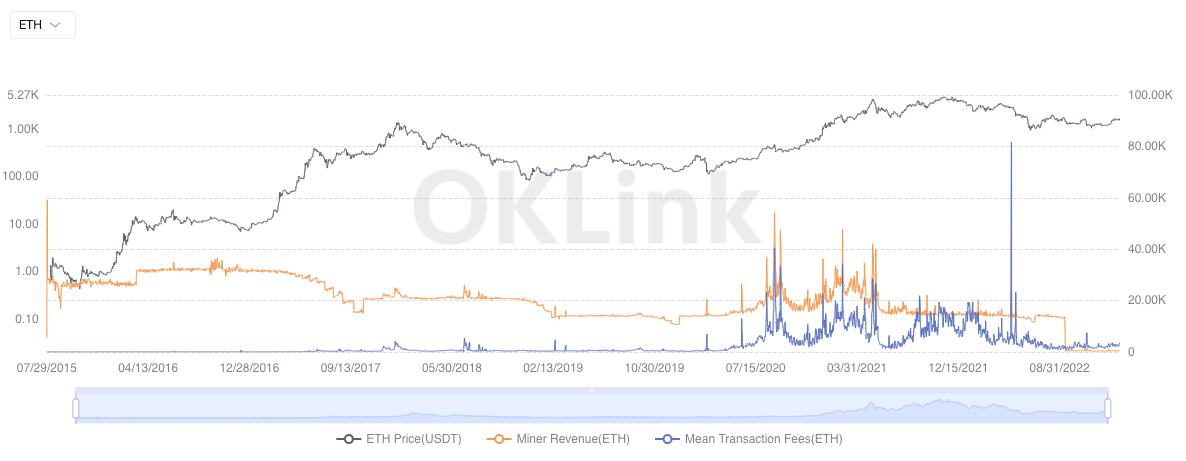

- There was a notable enhance within the variety of ETH burned, however miner income declined.

- Ethereum’s growth exercise prevailed in highs as Shanghai improve attracts close to.

The EIP-1559 proposal was permitted as an answer to congestion of the Ethereum [ETH] community. Reportedly, the proposal may even assist the blockchain with token deflation. The exercise considerably addresses the excessive fuel charges with ideas from transactions going to the miners.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Fireplace on the mine

Nonetheless, Ethereum has had the behavior of switching between inflationary and deflationary standing‘ over the past two months. However as of two February, the quantity of ETH burned hit its highest worth since 10 November 2022.

The burning quantity of Ethereum reached 3040 on February 2, reaching a brand new excessive since November 10 final yr. The principle burning sources are Uniswap and OpenSea. The cryptocurrency greed index has remained round 60 for a number of days. https://t.co/fT66f684lJ pic.twitter.com/uToCDwOYZt

— Wu Blockchain (@WuBlockchain) February 3, 2023

At press time, the whole quantity of ETH burned was 3040.83, according to OKLink. Curiously, Uniswap [UNI] and NFT market OpenSea contributed a lot of the ETH burned, as said by the tweet above.

This might not be a shock, particularly as there was a rise in Ethereum NFT quantity. Additionally, Uniswap has additionally boasted of a constant transaction enhance in the previous couple of weeks.

Following the rise, ETH block rewards improved for miners. Nonetheless, it was not an all-round enhance within the Ethereum ecosystem. Regardless of the burn hike, miner income remained flatlined — near the area it was throughout the brutal 2022 market situation.

Supply: OKLink

Often, the impression on the rise can be for miners to obtain block rewards. However miners’ income will not be essentially impacted. Typically, earnings might lower due to the destruction of fundamental prices.

Nonetheless, worth motion could also be affected as a result of ETH deflation may partially enhance its worth.

Fuel down however ETH shoots

Regarding Ethereum’s fuel charges, they have been additionally at a low level. This was anticipated to be the case since a rise in EIP-1559 exercise would result in a discount in fuel costs.

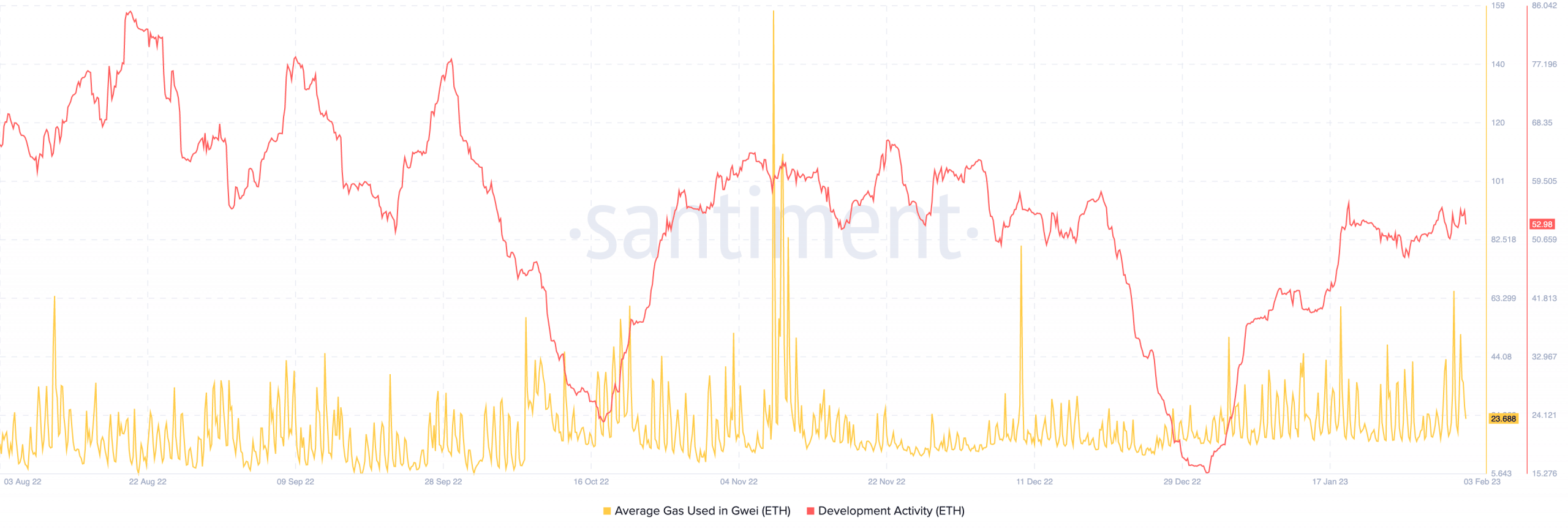

Based on Santiment, the common fuel used, measured in Gwei, was 23.688. In comparison with the spike of 1 February, this was a colossal drop.

Per its growth exercise, the on-chain data supplier confirmed that Ethereum was on the pinnacle of management. On the time of writing, growth exercise had elevated to 52.45. The event exercise describes a mission’s dedication to sprucing its community.

Supply: Santiment

What number of are 1,10,100 ETHs value right this moment?

Nonetheless, this metric was predictable, because the second-ranked crypt mission has been main upgrades because the September 2022 Merge. The forthcoming Shanghai improve additionally mirrored how devoted the Ethereum crew remained to its enterprise.

In conclusion, the woes managed in some areas have been balanced by development in different elements. Based on Extremely Sound Cash, Ethereum was sustainable even supposing the bull market will not be totally blown but.

Respect this graph? You are early!

→ Ethereum day by day burn is uncapped 🔥

→ Ethereum day by day issuance is capped 💧

→ Ethereum is sustainable in a bear

→ Ethereum is extremely worthwhile in a bull🦇🔊🚧 is the extremely sound barrier pic.twitter.com/uvnrxbZhK1

— extremely sound cash 🦇🔊 (@ultrasoundmoney) February 3, 2023