Ethereum holders shorting ETH in bull market should read this first

- Ethereum addresses with a non-zero steadiness rise to succeed in an all-time excessive.

- The king alt’s % provide in revenue additionally crossed over the 60 mark.

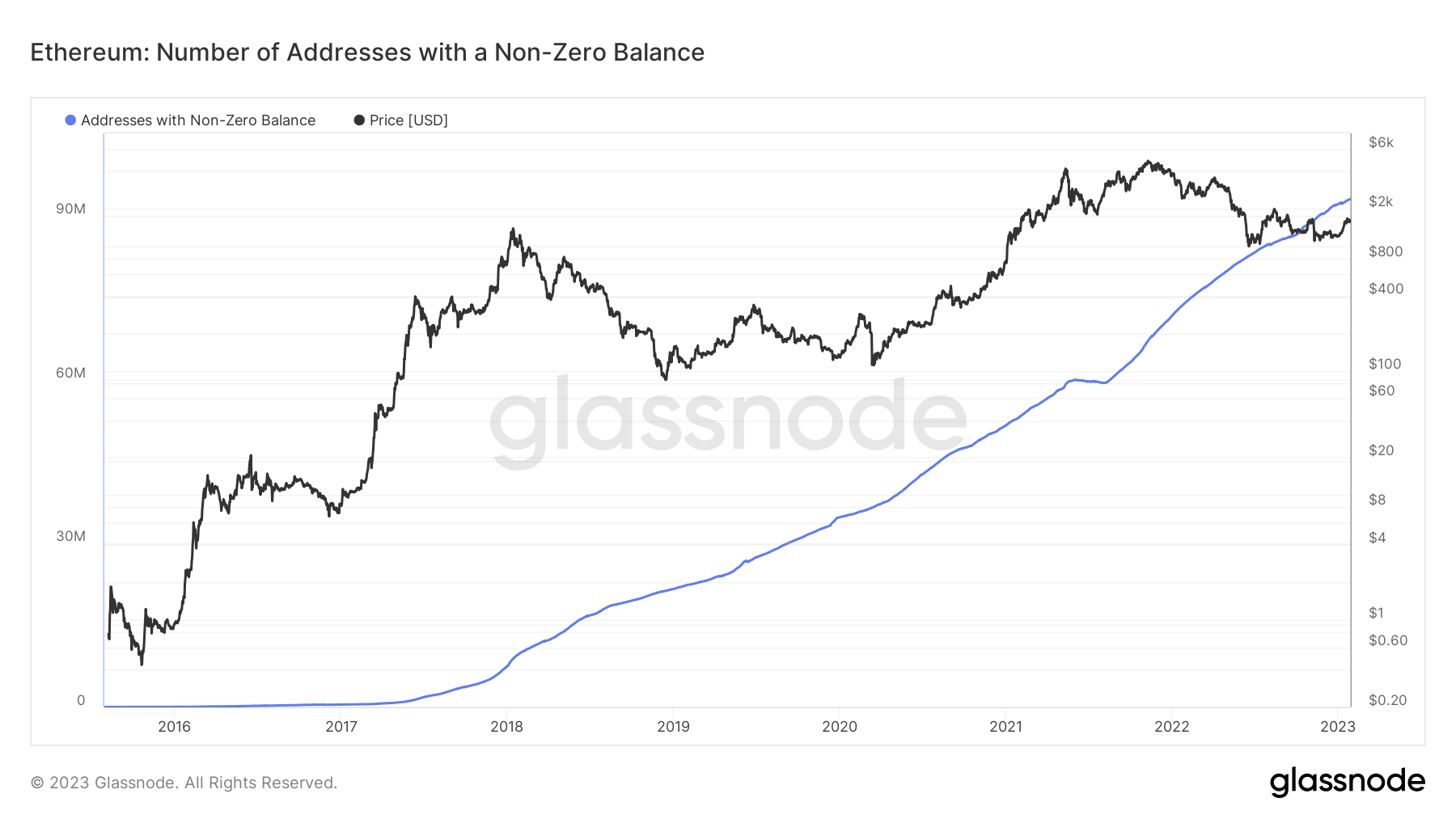

Through the years, there was a development in Ethereum [ETH] addresses, and the newest merging has additional stoked curiosity. Whereas the value of Ethereum declined for almost all of the earlier 12 months, one statistic was growing and simply reached an all-time excessive.

Is your portfolio inexperienced? Try the Ethereum Revenue Calculator

Constructive addresses surge in quantity

All through the years, the variety of Ethereum addresses has grown dramatically. Glassnode stories that the present variety of addresses exceeds 92 million, a brand new file. Extra considerably, although, is the rising pattern within the complete variety of addresses the place the steadiness is something apart from zero.

Supply: Glassnode

The “variety of addresses with a Non-Zero steadiness” measures the proportion of all addresses on the blockchain with a optimistic worth, indicating that they’ve not less than some Ether (ETH).

Buyers are starting to liquidate their holdings and exit the market when this statistic drops in worth. Following a steep decline in cryptocurrency costs, this sample might grow to be obvious.

Because the indicator rises, nonetheless, it means that new buyers are filling their wallets. The transfer is likely to be signaling the start of a bull market.

A number of variables could also be liable for the latest surge in tackle exercise, however two stand out as significantly believable explanations. For the better a part of the previous 12 months, the value of Ethereum (ETH) has been declining.

New and seasoned buyers might enhance their holdings or enter the market. As well as, ETH now had a brand new utility due to the Ethereum merge final 12 months. Following the merge, a brand new kind of investor was created, due to the staking function.

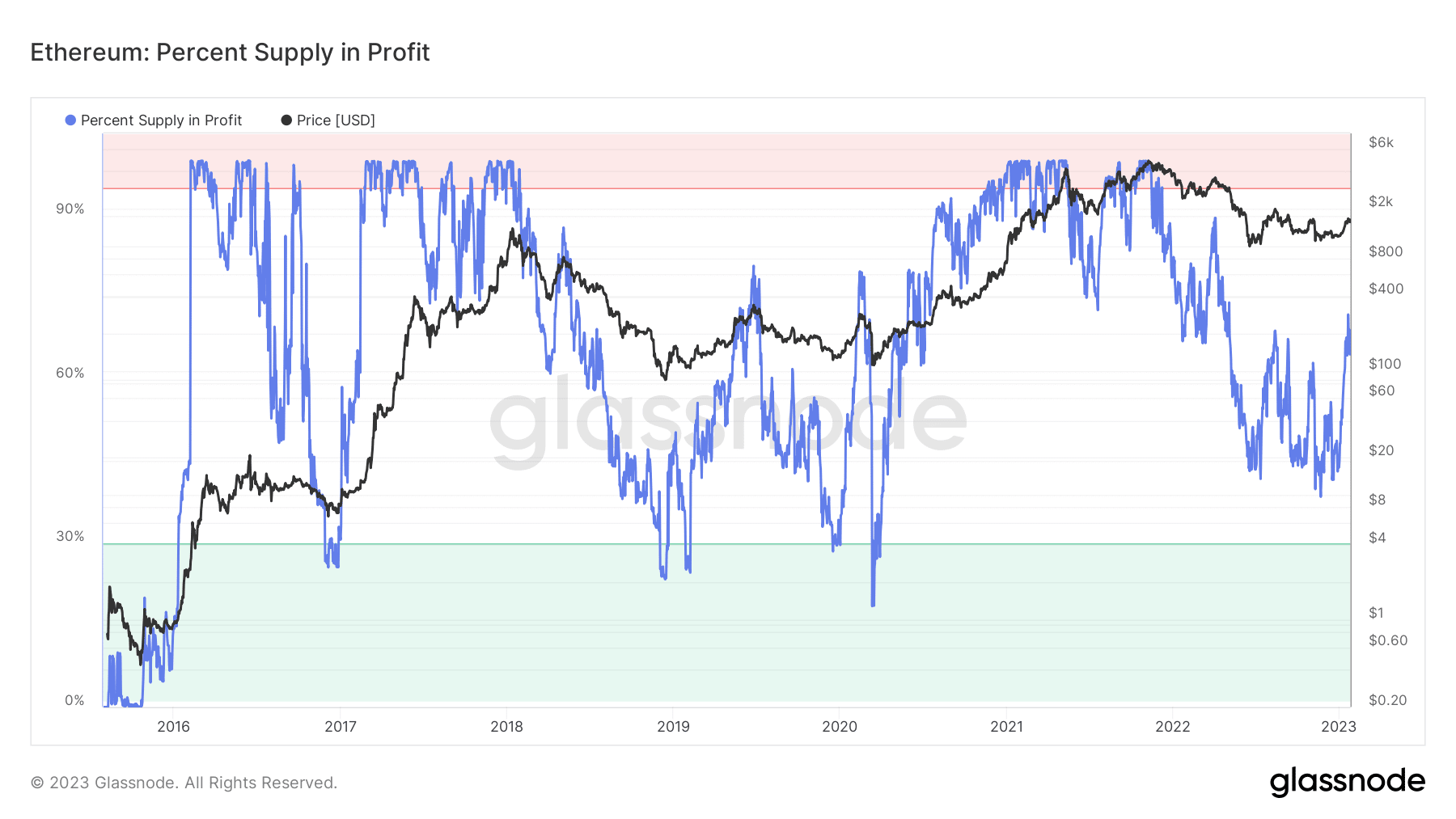

P.c provide in revenue will increase

Taking a look at one other essential indicator might present additional details about the state of Ethereum (ETH), given the metric’s accumulation pattern.

Based on CoinMarketCap, the circulating provide of Ethereum was over 122 million. Greater than 50% of the provision, as measured by the % provide in revenue, was worthwhile. The % provide in revenue was simply over 68% as of the time of writing.

Supply: Glassnode

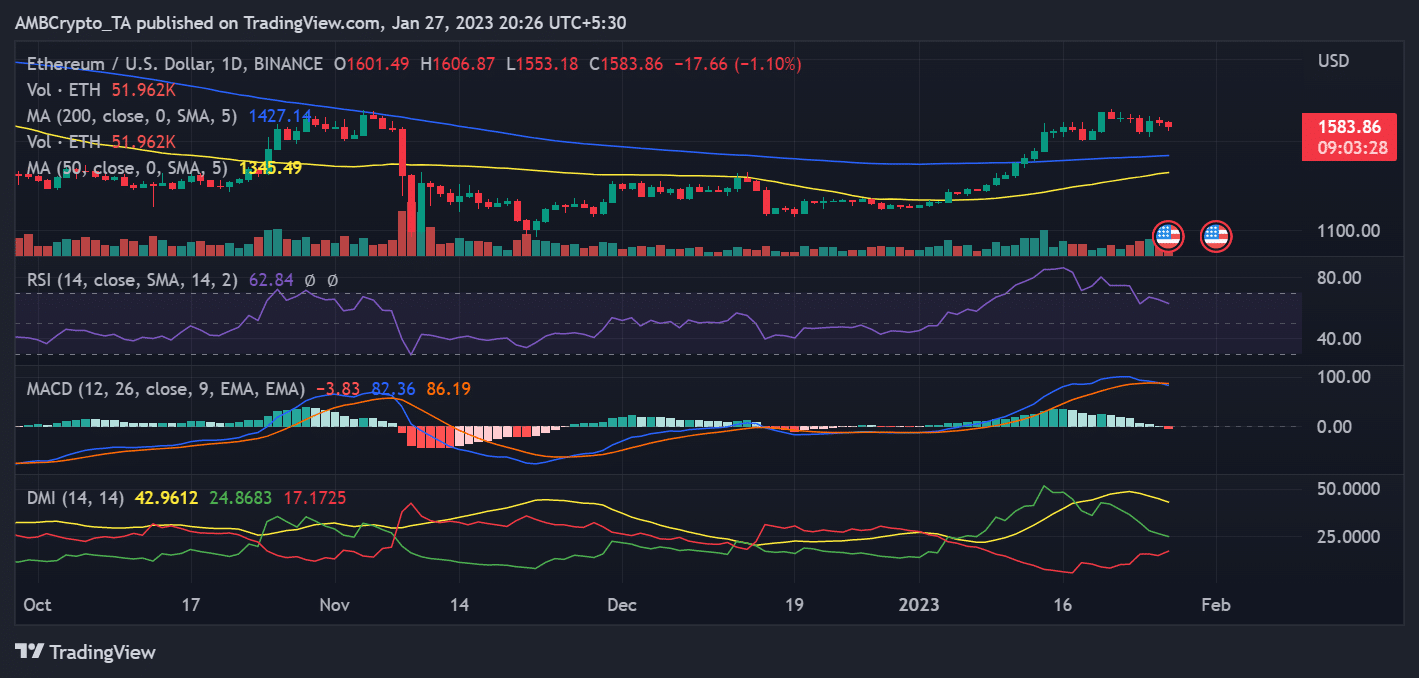

ETH worth is in decline, however…

As of this writing, the each day buying and selling worth of Ethereum was round $1567. A decline in worth was additionally seen inside the time-frame that was analyzed. Its worth had dropped by nearly 2%, bringing the whole drop within the earlier 48 hours to roughly 3%.

Supply: Buying and selling View

Lifelike or not, right here’s ETH market cap in BTC’s phrases

The identical-period evaluation of the Relative Energy Index revealed that the market was now in a downturn. With an extra worth decline, the RSI, which was at 60, may decline additional. However in response to the RSI line, it was nonetheless in a bull pattern regardless of the decline.