Ethereum: After a dampened sentiment, ETH notices some shift in demand

The Ethereum [ETH] Merge expectations stay excessive particularly now that D-day is lower than two weeks away. The identical can’t be stated for ETH’s demand that has been closely affected by macro components particularly within the first week of September. Nonetheless, the demand for ETH achieved a swift restoration within the final three days because the tides shifted.

ETH, together with many of the prime cryptocurrencies, gave the impression to be headed downward earlier within the week as sentiments dampened. As a substitute, the market delivered a mid-week pivot that has triggered extra upside. ETH responded with a bullish push again above $1,700, albeit briefly at press time.

Assessing ETH’s present demand

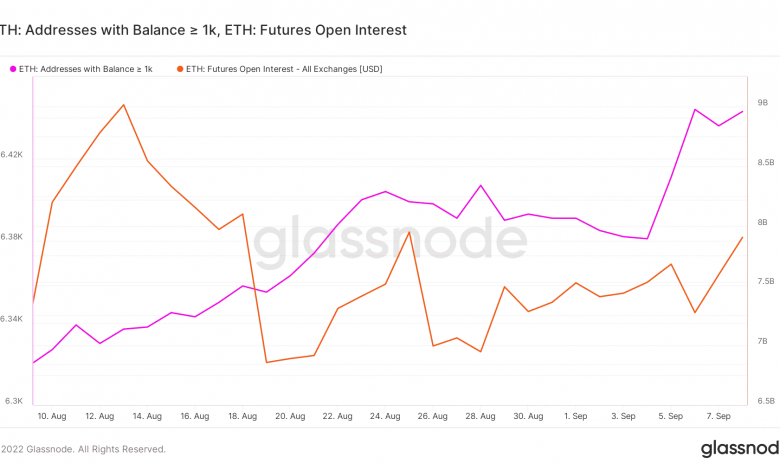

ETH whales have resumed accumulation, thus supporting the upside. That is evident by the rise within the variety of ETH addresses holding greater than 1,000 ETH. The identical addresses had beforehand decreased, earlier within the week, confirming outflows and supporting the slight worth drop.

Supply: Glassnode

The investor sentiment shift noticed within the addresses holding greater than 1,000 ETH additionally displays a shift in open curiosity. The futures open curiosity metric registered an uptick since 6 September, according to the mid-week bullish restoration. This confirms the demand shift in favor of the bulls.

ETH’s choices quantity put/name ratio signifies an analogous remark after a pivot within the final two days. The variety of name choices at present outweigh the put choices, putting weight on the bullish aspect.

Supply: Glassnode

ETH demand won’t be there but

ETH’s present efficiency is an underperformance in comparison with the expectations. Many buyers anticipated a significant rally, maybe above $2,000 by now. The extent of ETH demand at present out there has fallen wanting these expectations. Possible due to the dampened sentiment in keeping with the unfavorable macro-economic circumstances.

The demand ranges replicate in Ethereum’s taker purchase ratio which is at present at 0.51. The ratio assesses the futures market shorts vs. lengthy volumes and its present determine suggests that there’s nonetheless fairly a major quantity of quick volumes out there.

Supply: CryptoQuant

A taker purchase ratio above one confirms that futures purchase volumes are greater than the promote volumes. On this case, ETH isn’t there but, even because the merge attracts close to.

One of many potential implications is that the countdown to the merge has completed little to affect larger demand for ETH. The potential upside may nonetheless be restricted however there’s nonetheless sufficient time for that to vary particularly if market circumstances permit.