Ethereum: A rally in whale holdings might not help ETH investors. Here is why…

- Ethereum whales are including extra ETH cash to their holdings

- The present market outlook could make it troublesome for whale accumulation to positively affect value

In the course of the intraday buying and selling session on 21 November, knowledge from on-chain analytics Santiment revealed a major surge in Ethereum [ETH] whale holdings. ETH whales that held between $10.9 million to $1.09 billion ETH added 947,940 ETH, which was value $1.03 billion on the present value.

🐳 #Ethereum‘s giant whales (holding $10.9M to $1.09B) have added 947,940 extra $ETH yesterday value ~$1.03B. That is the fifth largest single day add up to now yr. The previous 4 cases, $ETH‘s value vs. $BTC rose a mean of +3.2% the next 3 days. https://t.co/g4RdgE0Gzj pic.twitter.com/TVYkj4xVrU

— Santiment (@santimentfeed) November 21, 2022

Learn Ethereum’s [ETH] value prediction 2023-2024

Santiment famous that the addition represented the fifth “largest single-day add up to now yr.” Prior to now 4 cases, ETH’s value rallied within the three days that adopted.

At press time, ETH exchanged palms at $1,100.34. The main altcoin final traded at these ranges in July.

Does ETH look well-primed for a rally?

In line with knowledge from CoinMarketCap, ETH’s value was down by 2% up to now 24 hours. Throughout the identical interval, buying and selling quantity declined by 14%. This created a value/buying and selling quantity divergence that’s sometimes current in a bear market.

The divergence indicated patrons’ exhaustion and low conviction amongst ETH holders, who may be uncertain about any important optimistic value rally within the quick time period. For the projected rally to happen, conviction wants to extend as the identical would drive extra demand into the market, pushing up the alt’s value.

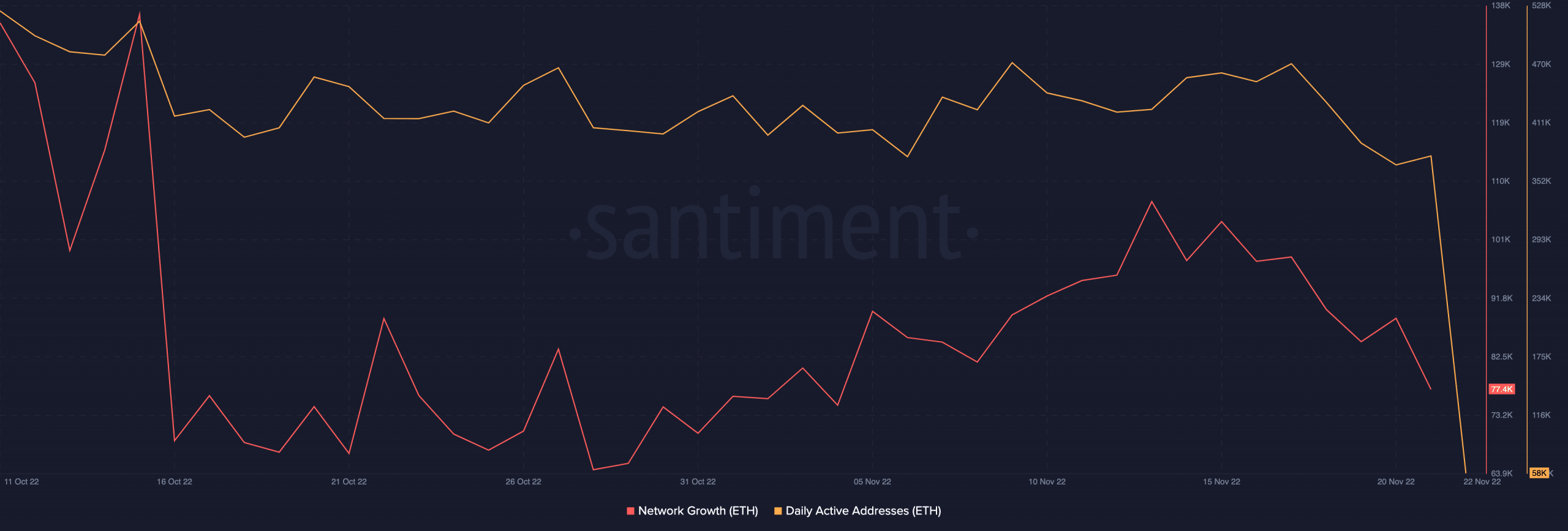

In addition to a value/buying and selling quantity divergence hindering the projected value rally, there was additionally a shortfall in new ETH demand. Per knowledge from Santiment, since 13 November, the rely of latest addresses created each day on the ETH community declined by 28% at press time. As of 21 November, 77,405 new addresses have been created on the ETH community.

Moreover, the rely of distinctive addresses that traded ETH each day has since declined by 41% within the final 4 days, knowledge from Santiment revealed. As of this writing, 58,039 addresses traded the main alt.

Supply: Santiment

Outlook seems bearish within the quick time period

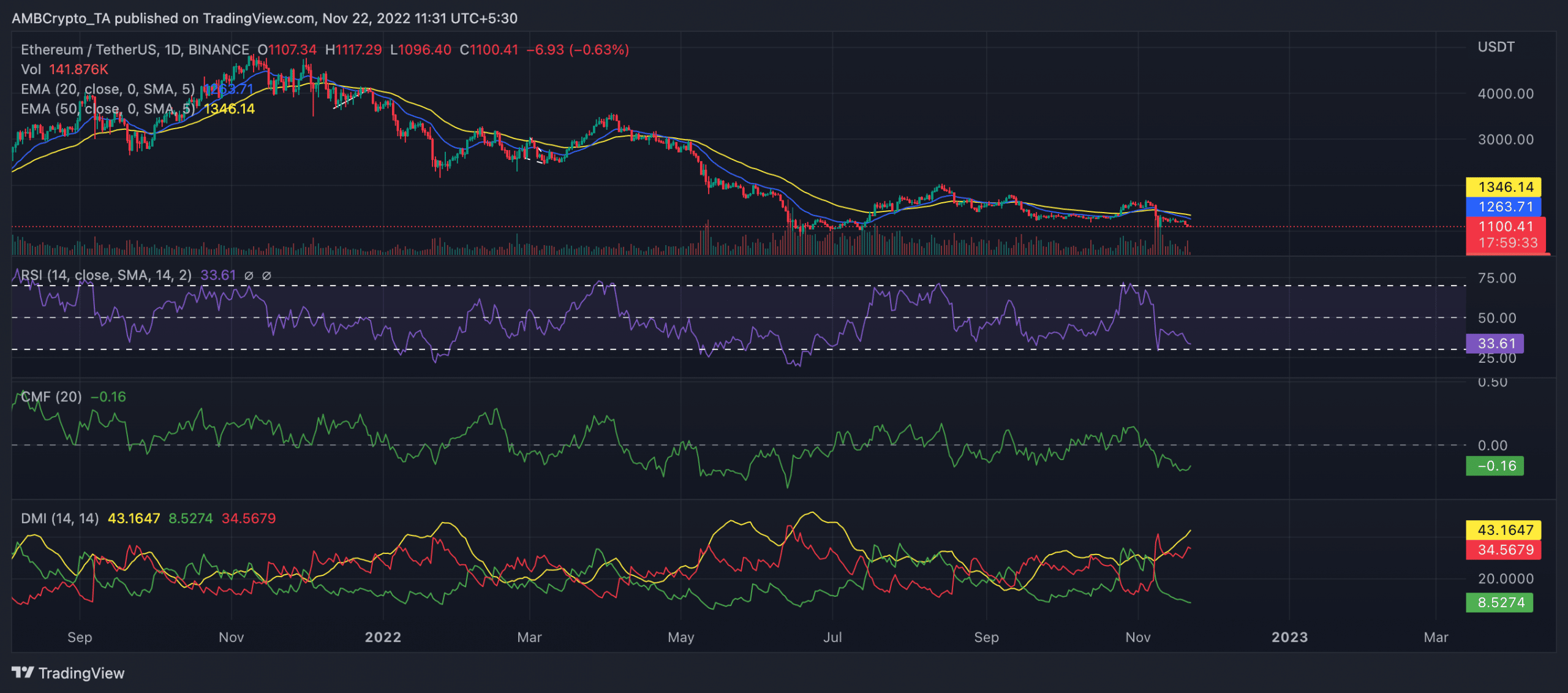

An evaluation of ETH’s value efficiency on a each day chart revealed that sellers had management of the market.

A take a look at its Exponential Shifting Common (EMA) place confirmed this. On the time of writing, the 20 EMA (blue) was under the 50 EMA (yellow) line. This depicted that ETH selloffs exceeded its accumulation.

This was additional confirmed by its Directional Motion Index (DMI). The sellers’ energy (pink) at 34.56 was solidly above the patrons’ (inexperienced) at 8.52.

The asset’s Relative Power Index (RSI) inched nearer to being oversold at press time. It was positioned in a downtrend at 33.61. The dynamic line (inexperienced) of the Chaikin Cash Move (CMF) additionally rested under the middle line to submit a detrimental worth of -0.17.

This confirmed that purchasing stress had dropped considerably at press time, and a optimistic flip in conviction is required for this to alter.

Supply: TradingView