ETH staking service providers’ dominance is concerning, here’s why

- 70% of Ethereum staked is managed by staking providers, which has raised issues about decentralization.

- Income generated by Ethereum has elevated regardless of a decline in buying and selling exercise.

In keeping with knowledge supplied by glassnode, it was noticed that 70.86% of all Ethereum staked on the beacon chain was being staked by staking providers reminiscent of Lido, Coinbase, Kraken, and Binance.

This focus of staking providers on the beacon chain has the potential to impression the general decentralization of the Ethereum community. At press time, Lido made up 29.3% of the general staked ETH, adopted by Coinbase (12.8%), Kraken (7.6%), and Binance (6.3%).

This means {that a} comparatively small variety of entities maintain a good portion of the staked ETH and that the community is much less decentralized than it might be.

Life like or not, right here’s ETH’s market cap in BTC’s phrases

Regardless of this, the variety of validators on the Ethereum community continued to develop.

Ethereum will get validation

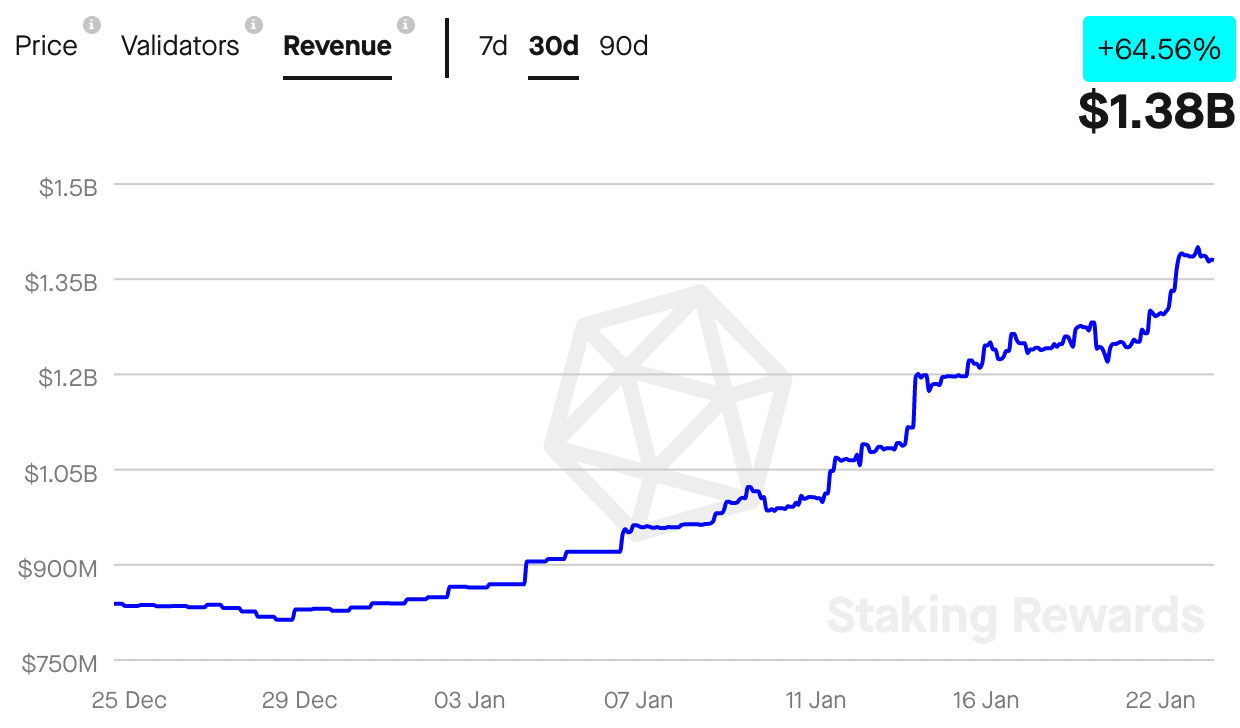

Primarily based on knowledge supplied by Staking Rewards, the variety of validators on the Ethereum community grew by 2.53% over the past month. Together with that, the income generated by the stakers grew as properly.

This implied that an rising variety of persons are turning into fascinated by staking their ETH and incomes rewards for validating transactions on the community.

Supply: Staking Rewards

Massive ETH addresses flee

Though validators confirmed curiosity in ETH, it was noticed that giant addresses shied away from holding Ethereum, regardless of rising costs. In keeping with glassnode’s knowledge, the variety of addresses holding 10k+ cash reached a 1-month low of 1,199 at press time. This prompt that giant holders of ETH weren’t as assured within the long-term prospects of the token as they as soon as had been.

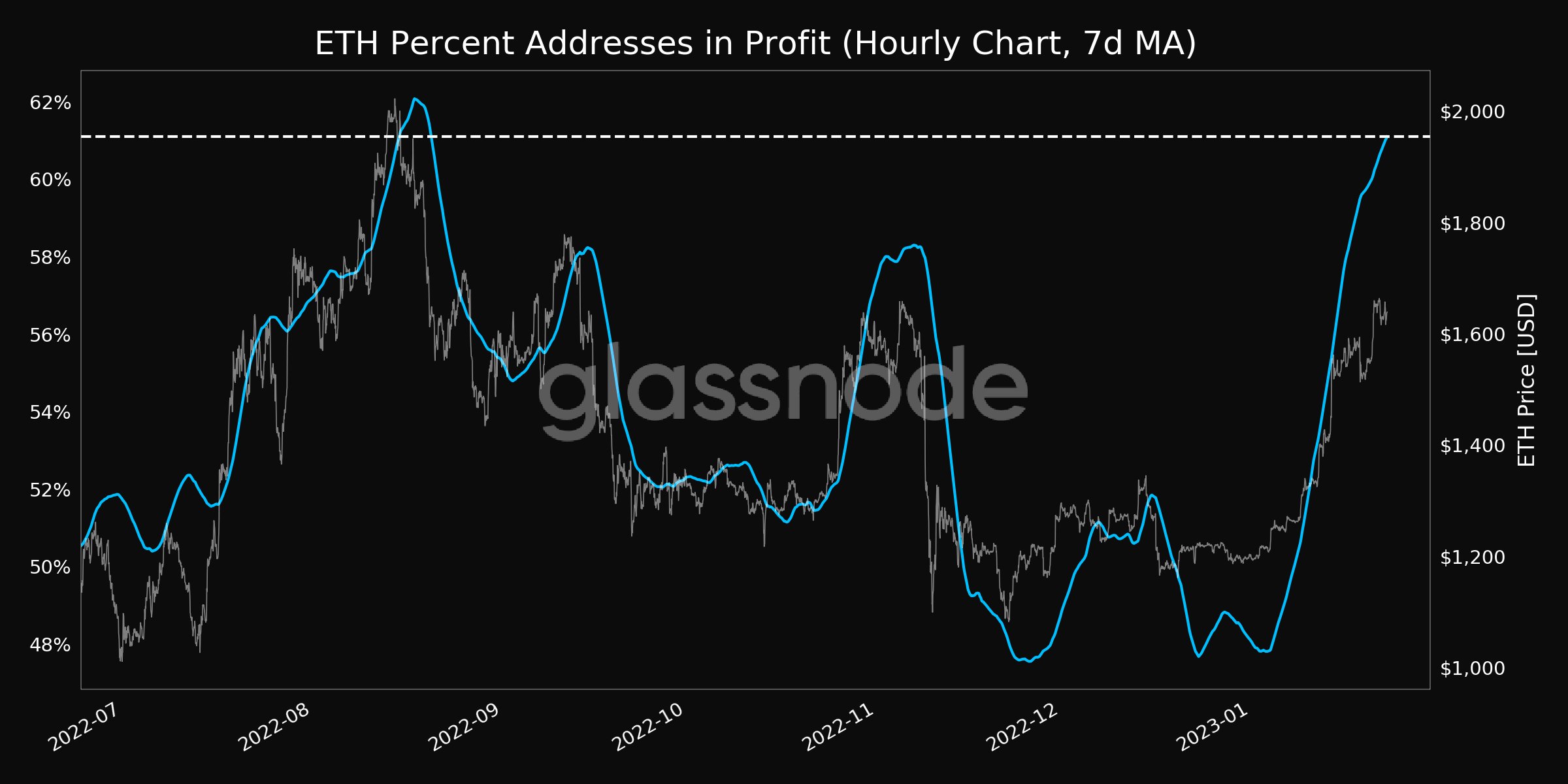

One of many causes for a similar might be the rising variety of Ethereum addresses in revenue. On the time of writing, greater than 60% of addresses holding Ethereum had been in revenue.

If this quantity continues to develop, it may incentivize addresses to promote their holdings for a revenue which may impression ETH’s value negatively.

Supply: glassnode

One other reason for concern for Ethereum could be the decline within the variety of Ethereum trades. Primarily based on Santiment’s knowledge, the variety of trades on the Ethereum community declined materially.

What number of are 1,10,100 ETH value at the moment

This additionally impacted the general fuel spent on the community, which decreased sharply over the previous few days.

Supply: Santiment

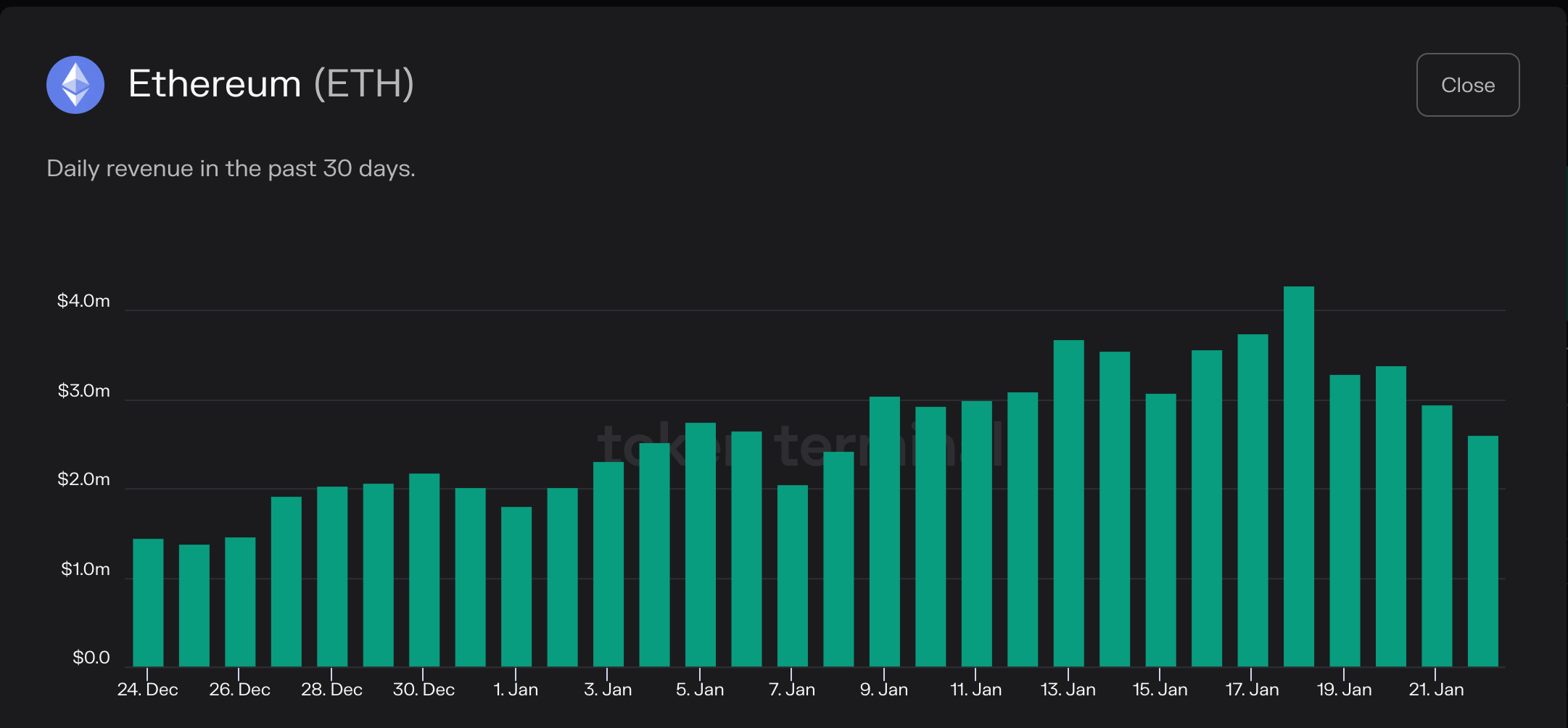

Moreover, in line with token terminals knowledge, the income generated by Ethereum elevated by 39.6% over the past month. Throughout press time the cumulative income accrued by Ethereum was $79.3 million.

Supply: token terminal

Nevertheless, it’s but to be decided how all these elements may come collectively and impression Ethereum’s value.