Voyager creditors subpoena more executives from FTX and Alameda

- Voyager collectors have summoned prime executives from FTX and Alameda Analysis to a deposition on 23 February.

- A decline in shopping for stress for VGX will lead to an additional value decline.

In a brand new court filing, the unsecured collectors’ committee of Voyager Digital has issued subpoenas to prime executives from FTX and Alameda Analysis.

This comes two weeks after the chapter directors issued comparable summons to founder and former CEO Sam Bankman-Fried, former Alameda chief Caroline Ellison, FTX co-founder Gary Wang and the change’s head of product, Ramnik Arora.

Learn Voyager [VGX] value prediction 2023-2024

Within the newest courtroom submitting, the summoned executives are anticipated to seem for depositions on 23 February. The newly issued sequence of subpoenas type a part of efforts by Voyager’s collectors towards investigating FTX’s efforts to bail out the crypto lender when it went bankrupt in July 2022.

VGX holders proceed to experience ache

At press time, VGX exchanged palms at $0.5164. Regardless of experiencing a 71% enhance in worth year-to-date because of the general market rally, the token’s value has plummeted by greater than 50% following Voyager’s chapter announcement in July 2022.

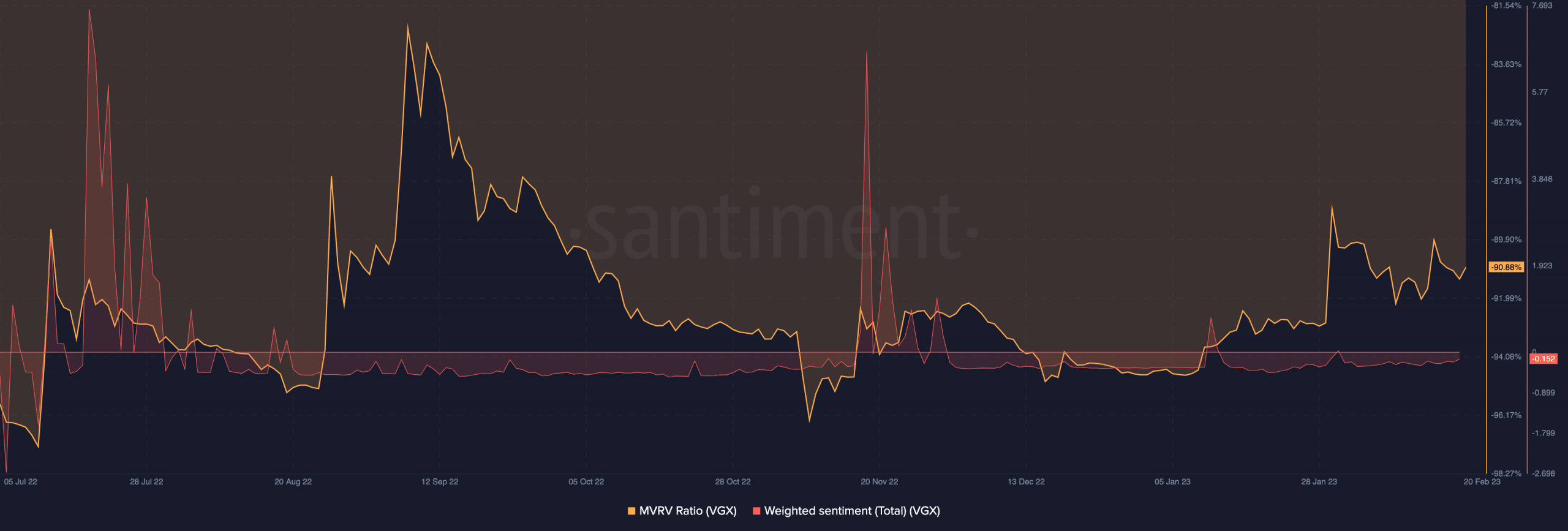

With lingering uncertainty in regards to the precise date when traders and customers of the bankrupt crypto lender will likely be made complete, VGX has been trailed by detrimental sentiments since 1 December 2022.

Knowledge from on-chain knowledge supplier Santiment confirmed the token’s weighted sentiment to be pegged at -0.152 at press time.

Furthermore, holders proceed to log losses regardless of the latest rally within the alt’s value within the final month. Per knowledge from Santiment, since Voyager declared chapter seven months in the past, VGX’s MVRV ratio has been detrimental.

The newest value progress didn’t change that. At press time, VGX’s MVRV ratio was -90.88%.

When a crypto asset’s MVRV is lower than zero, it implies that the typical investor who holds that specific cryptocurrency is making a loss on their funding.

Which means that the present market value of the cryptocurrency is beneath the typical value at which traders acquired the cash. In different phrases, the market is bearish, and the promoting stress is excessive.

Supply: Santiment

Within the quick time period, anticipate this

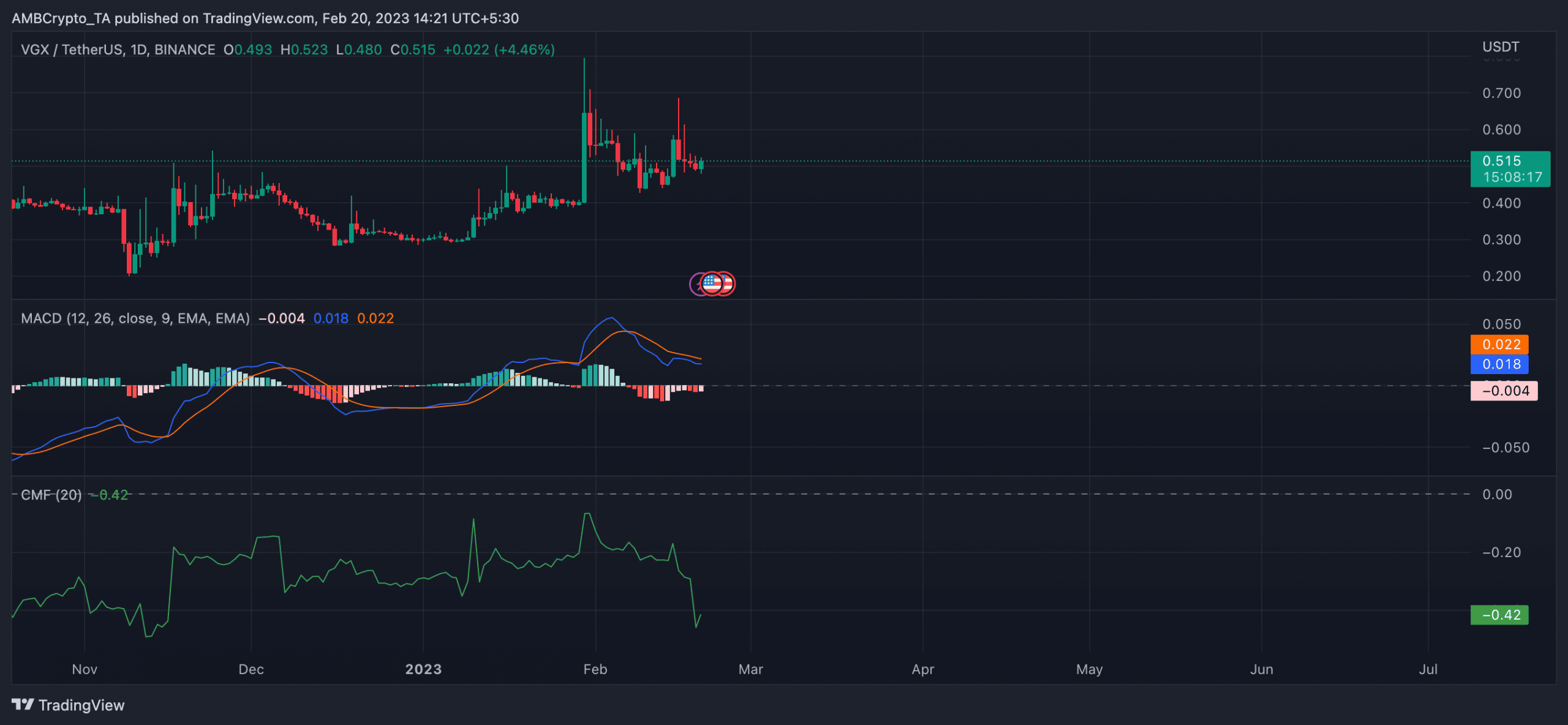

Sharing a statistically vital constructive correlation with Bitcoin [BTC], an evaluation of VGX’s efficiency on the every day chart revealed that the alt’s value was impacted by the downside within the king coin’s value.

A take a look at the token’s Shifting common convergence/divergence (MACD) revealed the graduation of a brand new bear cycle on 6 February. Since then, VGX’s value has fallen by 4%, in line with CoinMarketCap.

Is your portfolio inexperienced? Try the VGX Revenue Calculator

A value decline is commonly precipitated by an preliminary fall in shopping for stress, which was what occurred in VGX’s case. The token’s Chaikin Cash Circulation (CMF) breached the middle line in a downtrend to be noticed at -0.42 at press time.

When an asset’s CMF is detrimental, it means that the promoting stress on the asset is excessive, as the cash flowing out of the asset is larger than the cash flowing into it.

A continued decline in shopping for stress mixed with detrimental traders’ sentiment will lead to an additional fall in VGX’s value within the meantime.

Supply: VGX/USDT on TradingView