Decentraland [MANA] investors can profit from the obstacle at $0.3101, but …

- MANA was bullish on the 4-hour chart.

- The alt might sail to $0.3141 if it clears a key impediment.

- A break beneath the demand zone at $0.3019 will negate the forecast.

Decentraland [MANA] has been in a value pullback since 21 December. The bulls discovered regular help at $3019 and tried a rally. Nonetheless, bulls confronted a key impediment at $0.3101.

If MANA bulls clear the impediment, a easy sail to the availability zone round $0.3150 could possibly be possible. However might the bulls pull such a feat?

Learn Decentraland (MANA) value prediction 2023-24

The hurdle at $0.3101: Can the bulls smash it?

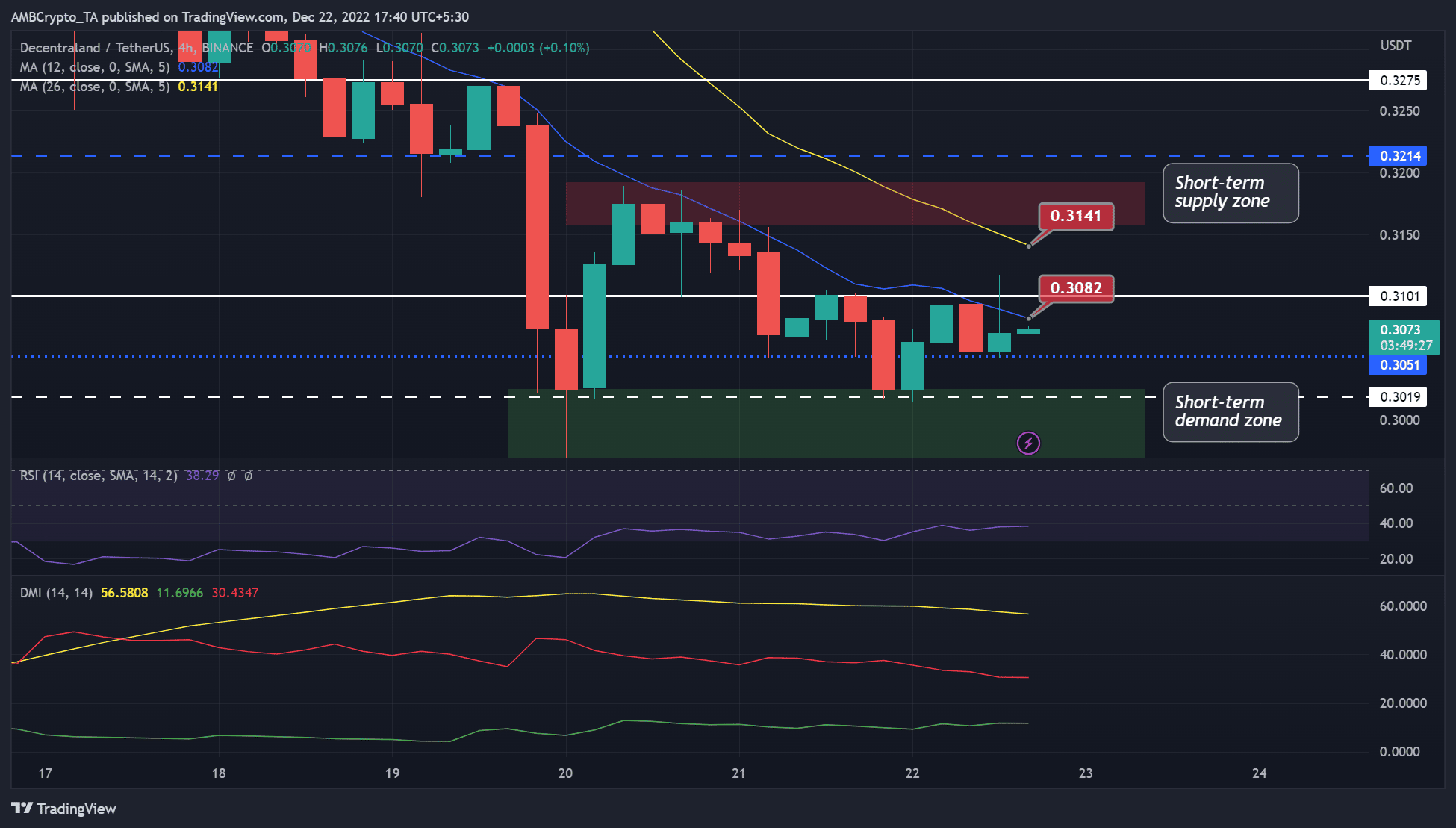

Supply: MANA/USDT on TradingView

MANA made a brand new increased low by press time, indicating bullish momentum. Particularly, the Relative Energy Index (RSI) climbed up from the oversold space quite gently and never sharply. This confirmed that purchasing stress elevated steadily, countering the affect of sellers.

Ought to the momentum persist, MANA might retest or break above the resistance at $0.3101. If the bulls clear the impediment, they will deal with the 26-period Shifting Common goal at $0.3141.

As well as, the Directional Motion Index’s (DMI) pink line (sellers) was on high however with a mild slope. It exhibits sellers had leverage available in the market, however patrons have been slowly gaining floor. If the development continues, bulls might push as much as the impediment.

Nonetheless, bears nonetheless had leverage. An aggressive transfer by bears might push MANA to the demand zone round $0.3019, invalidating the above bullish bias.

How many MANAs are you able to get for $1?

MANA recorded an improved sentiment however low demand within the derivatives market

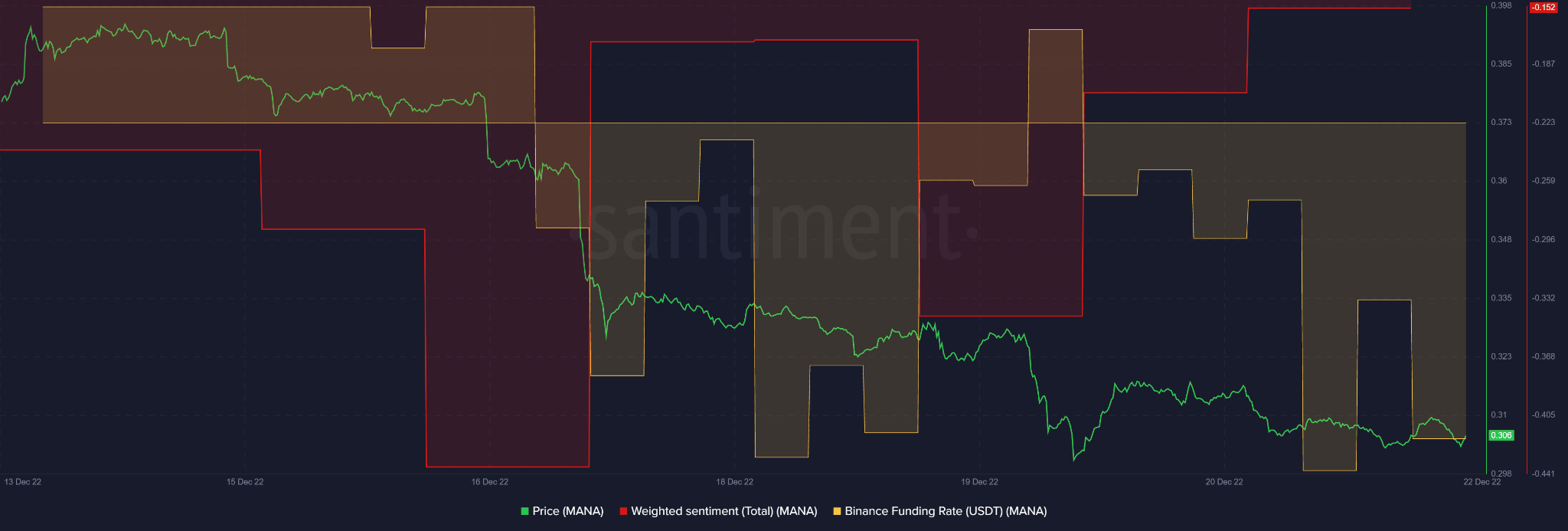

Supply: Santiment

In keeping with Santiment, MANA’s weighted sentiment metric moved increased towards the impartial stage, indicating an improved investor sentiment on the asset.

Nonetheless, there was little demand for MANA within the derivatives market because the Binance Funding Charge for MANA/USDT pair dropped.

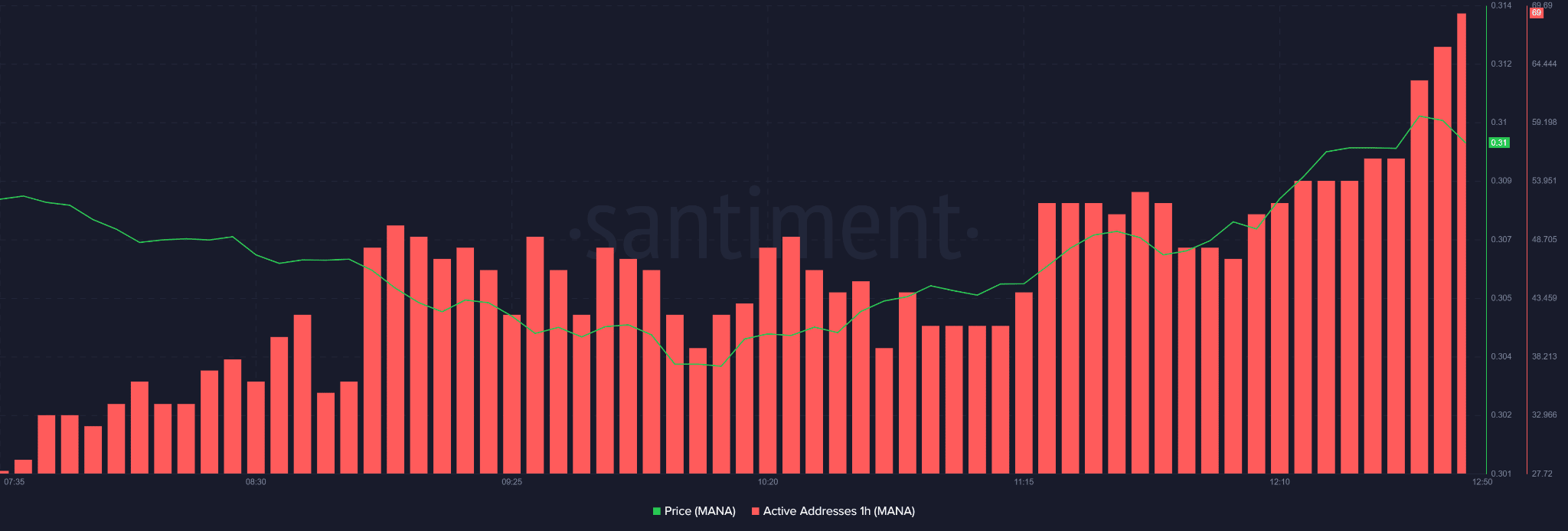

Nonetheless, the variety of lively addresses buying and selling MANA elevated steadily with the elevated costs. This boosted the buying and selling quantity and shopping for stress, thus, might maintain additional the uptrend if the momentum continued.

Supply: Santiment

However a bearish BTC might pull down MANA and undermine additional uptrend. Subsequently, traders ought to watch BTC’s efficiency too.