Can Ethereum [ETH] bear the loss of desperation in the wake of…

- A Crest or trough development per the change inflows might decide if ETH would succumb to a worth lower

- ETH approached the overbought area as directional motion was not agency

Ethereum [ETH], the second largest cryptocurrency by market capitalization gained 8.74% within the final seven days. Nevertheless, this improve could possibly be quick lived as per a CryptoQuant analyst.

Joawedson, the analyst, referred to the way during which the change flows have an effect on ETH as the idea for his forecast.

Learn Ethereum’s [ETH] worth prediction 2023-2024

Unfazed by ETH’s impression

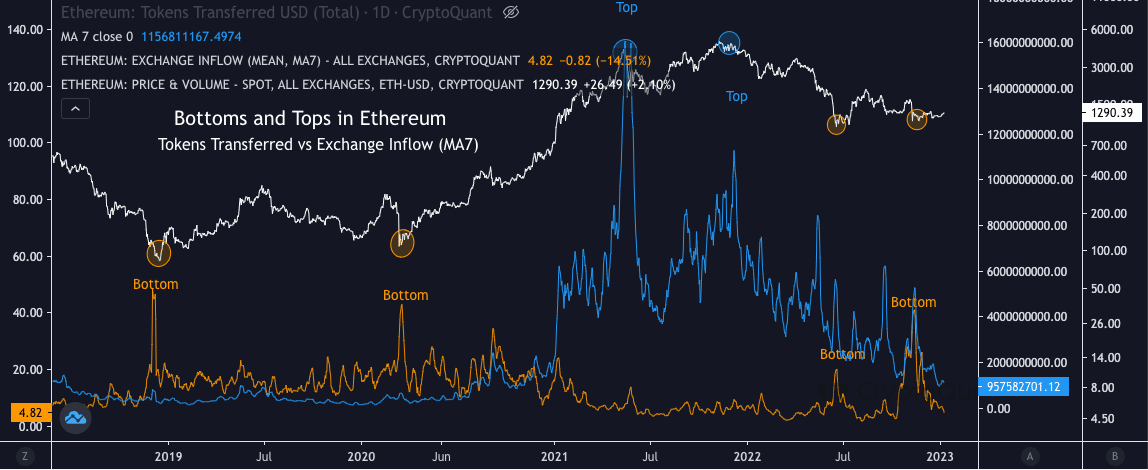

Moreover, the development displayed by the change flows act as a yardstick for evaluating potential tops and bottoms. In keeping with CryptoQuant data, the change influx final hit notable peak values round November 2022.

The seven-day Shifting Common (MA) additionally appeared to comply with an analogous development. Nevertheless, not too long ago each metrics indicated a lower from the crest. This implied that buyers who’ve held ETH for lengthy could be distressed from its lengthy decline interval. Therefore, buyers might contemplate promoting their holdings.

Supply: CryptoQuant

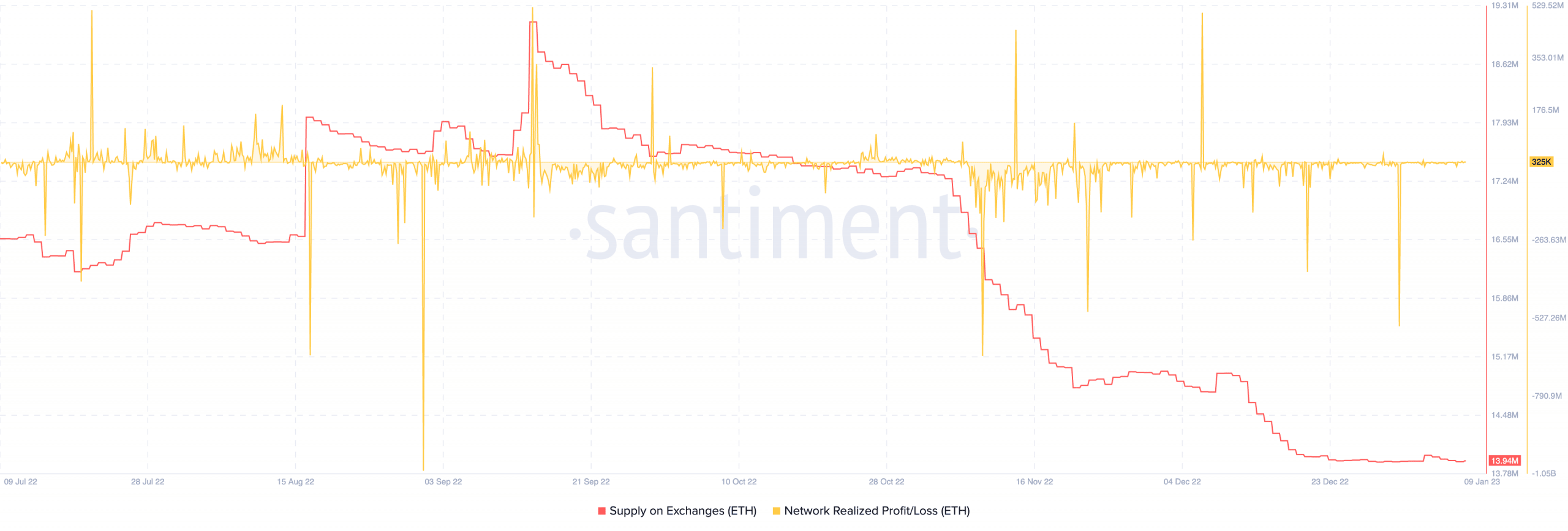

In the interim, Santiment confirmed that ETH provide on exchanges has been reducing since 9 December 2022. Since there was no spike on this regard, it meant short-term promote strain was not extraordinarily excessive.

This differed from the what was displayed by the change influx MA. So, ETH had an opportunity to flee capitulation within the quick time period.

In different components, the community realized revenue and loss was at 325,000. This worth depicted an upturn from the sharp lower on 1 January. Observe that the metric is used to calculate the revenue or loss gathered by holders over a time period.

As the worth was not unfavorable, it advised elevated capital inflows. However since there was no signal of a rising peak, it couldn’t be ascertained if there was a excessive demand being established.

Supply: Santiment

Are your holdings flashing inexperienced? Test the ETH Revenue Calculator

A fall could possibly be imminent as a result of…

In the meantime, ETH’s spectacular efficiency might truly be truncated, in response to the indications from the each day chart. At press time, altcoins witnessed important demand. This helped escalate the Relative Power Index (RSI) which went as excessive as 65.40.

This area indicated that ETH was quickly approaching the overbought stage. Historically, if the RSI hits the overbought zone, ETH would most definitely reverse its development. Moreover, its Directional Motion Index (DMI), confirmed the shopping for energy was not as stable as buyers may need anticipated.

Though the constructive DMI (inexperienced) was larger, the development of the Common Directional Index (ADX) didn’t buttress the directional energy. At 21.78, the ADX (yellow) confirmed that ETH’s bullish path was barely void of vigor.

Supply: TradingView