Crypto markets rocked as stablecoin reserves deplete, Curve 3pool concentrated by USDT, 60k BTC leaves Binance, Alameda shorts USDT

Following on from one of many craziest days in crypto historical past on Nov. 9, the 24/7 crypto markets maintain traders busy. Binance launched its proof-of-reserves, FTX’s stablecoin steadiness nears zero, the Curve 3pool grew to become concentrated with USDT, and 60,000 BTC left Binance. Rumors are brewing of an Alameda Analysis quick place on Tether USDT because it probably appears for a last-ditch lifeline.

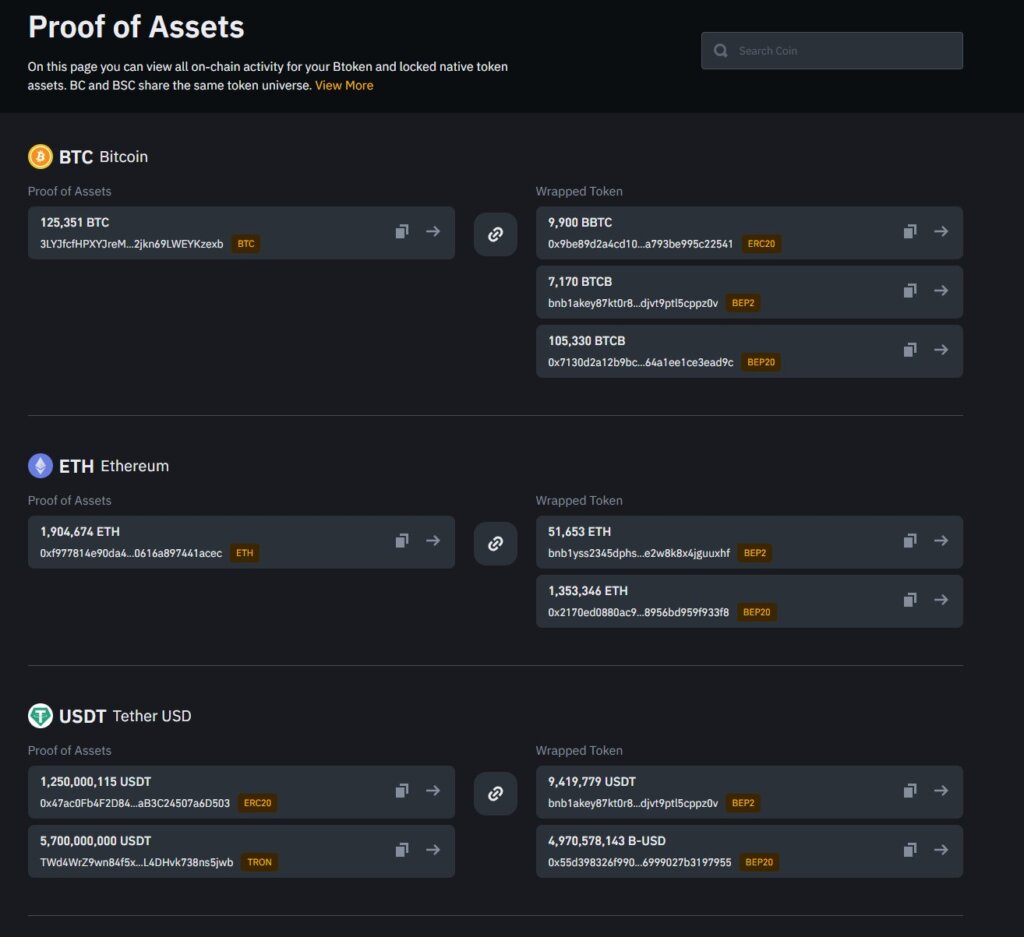

Binance proof-of-assets

Binance launched the proof-of-assets data that CZ had promised following the upcoming collapse of FTX. In a extra meant to buoy the markets and inject belief into the change after it was revealed that FTX had a gap in its steadiness sheet of $8 billion and no solution to course of consumer withdrawals, Binance revealed a brand new web page of its web site entitled “Proof of Assets.”

Binance outlined all of its asset holdings, and the change included all of the on-chain addresses for every token together with a hyperlink to indicate the correlation with bridged property on different chains. The power to open the blockchain explorer for every community and examine the info on-chain showcases the ability and talent of exchanges to be totally clear.

The extent of transparency proven by Binance is second to none and provides traders confidence that there is no such thing as a belief required. Following claims from change leaders at Celsius, Voyager, and now FTX that their property have been totally backed up till the purpose the place the businesses introduced insolvency, the trustless strategy to transparency by Binance is to be applauded.

Some notable holdings are listed under:

- 125,351 BTC

- 1,904,674 ETH

- 6,950,000 USDT

- 50,805,657 DOT

- 469,665,508 XRP

- 745,000 LTC

- 5,325,500,000 BUSD

- 987,571,153 ADA

- 878,999,999 USDC

- 100,000,000 DAI

The full worth of the above property is round $18.3 billion. Nevertheless, there are 385 tokens throughout all the change, so a full breakdown of all property could be required to offer an correct determine on the entire holdings.

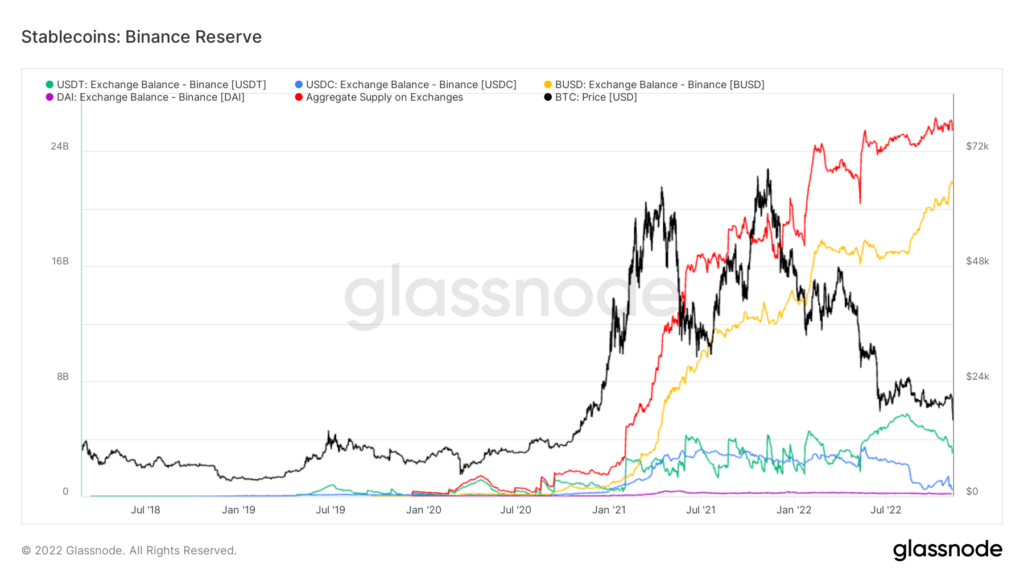

Stablecoin reserves deplete

One token that has seen elevated inflows to Binance over the previous few days is Binance USD (BUSD), which is the one stablecoin to see a rise in deposits. The mixture provide of all stablecoins on Binance nears $26 billion. The chart under exhibits the web influx of BUSD onto Binance in distinction with different stablecoins.

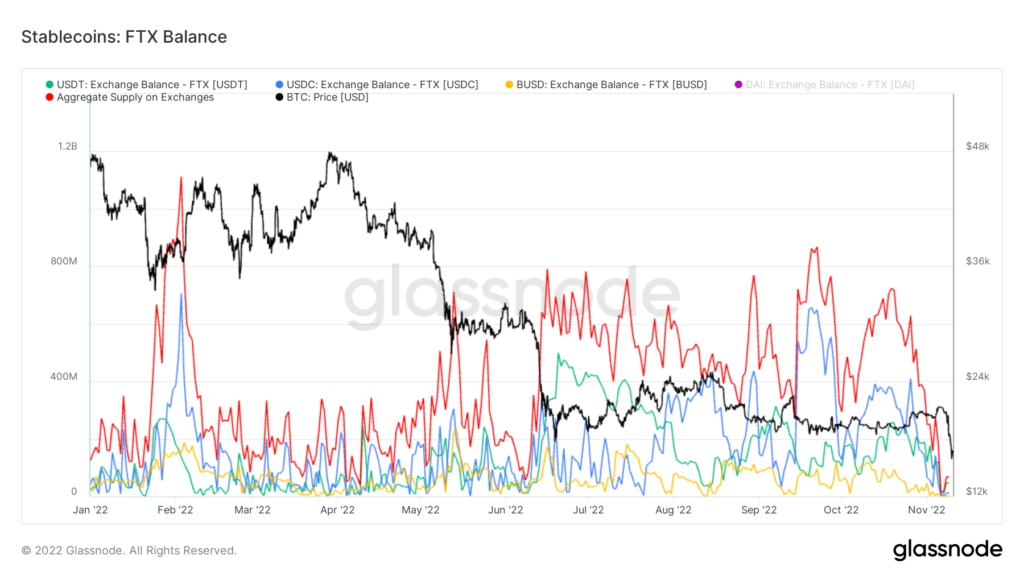

The bancrupt FTX has a really completely different story of its stablecoin balances as BUSD, USDC, USDT, and DAI are all close to zero as tokens have been withdrawn from the platform. Withdrawals are at present closed on the change, and new consumer accounts can’t be created.

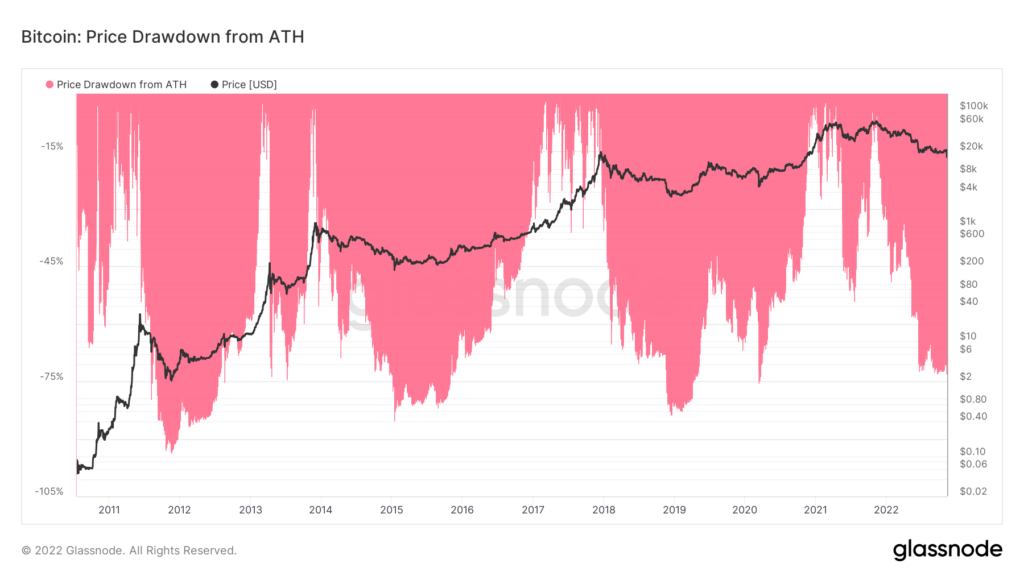

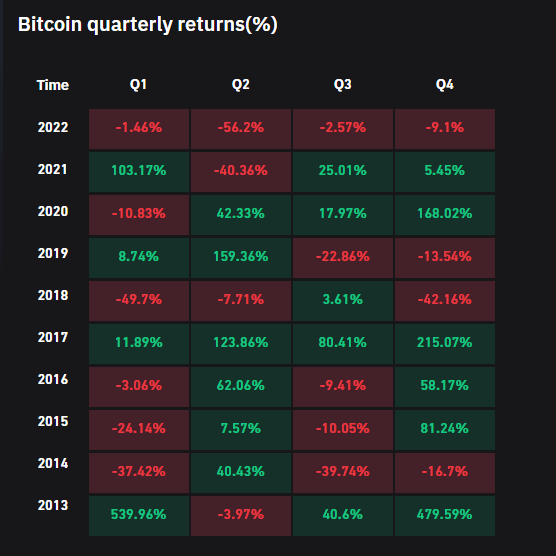

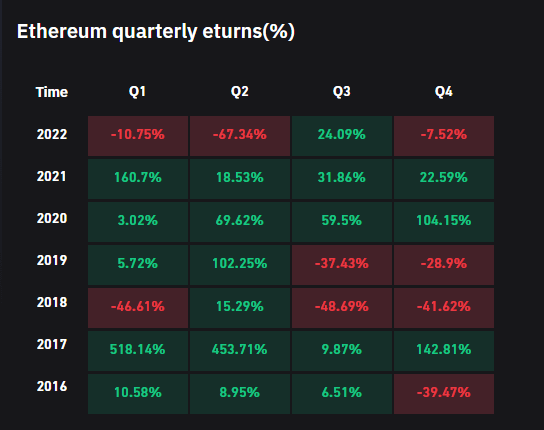

Bitcoin is down 77% from its ATH

The necessity for elevated transparency by Binance throughout this era of excessive volatility has additionally been mirrored within the worth of Bitcoin. The main cryptocurrency by market cap is down 77% from its all-time excessive in its fourth most vital drawdown of all time because it falls under ranges reached throughout the Terra Luna collapse of Could this yr.

Ethereum is now 77.3% down from its all-time excessive, which marks its fourth most vital drawdown ever.

The ensuing downward stress of the worth of Bitcoin places it on the right track for the primary time in its historical past to be down in all 4 quarters of the yr.

Ethereum had a stable third quarter as traders rallied into The Merge. Nevertheless, This fall is now seeking to be the third quarter this yr that Ethereum has closed down.

DeFi stablecoin imbalances

Whereas the fallout from FTX’s collapse has rocked main tokens, the DeFi trade is now displaying indicators of stress. For instance, the Curve 3pool has turn into 84% focused on USDT as DAI and USDC balances fell under 8% every. A big imbalance may result in liquidity points as customers try to withdraw funds in several denominations than these used to deposit.

This actually made me say “holy fucking shit” out loud 3 occasions in a row. https://t.co/HU9ySzcleb

— DIRTY BUBBLE MEDIA: FISH IN A BARREL (@MikeBurgersburg) November 10, 2022

Twitter consumer astromagic recognized a commerce for $250k made by Alameda to swap USDT to USDC. The commerce seems to be part of a bigger technique to quick USDT to the tune of a number of hundred thousand {Dollars}. Whereas the determine could appear inconsequential given the dimensions of the crypto trade, it begs the query of why Alameda is making such a commerce presently.

so alameda is attempting to quick $usdt?

>provide USDC on aave

>borrow USDT on aave

>swap USDT to USDC on curvedafuq man…https://t.co/F3tQvDMfF8

— astromagic (Trust_No_One) (@astro__magic) November 10, 2022

The stablecoins have been used as collateral to borrow extra USDT after which promote these borrowed funds again into USDC, making an on-chain web promote of round $550k USDT.

What you might be seeing under is an Alameda pockets deposit of $300k USDC into @AaveAave – Borrow $250k $USDT after which immediately promote it again to $USDC

That is technically an on-chain wanting USDT, nothing vital however wtf is occurring right here? pic.twitter.com/A9pLXLCE4h

— blocmates. Behind on DMs apologies (@blocmatesdotcom) November 10, 2022

Withdrawals improve throughout exchanges.

The concern, uncertainty, and doubt inside the crypto trade is rising as customers look to search out safer grounds and keep away from any potential contagion. For instance, following the collapse of Terra Luna earlier within the yr, Voyager, BlockFi, and Celsius all bumped into rapid liquidity points. As well as, FTX, Alameda Analysis, and FTX Ventures have extremely shut ties, and their investments considerably contribute to the crypto trade. In consequence, contagion inside different initiatives is very potential.

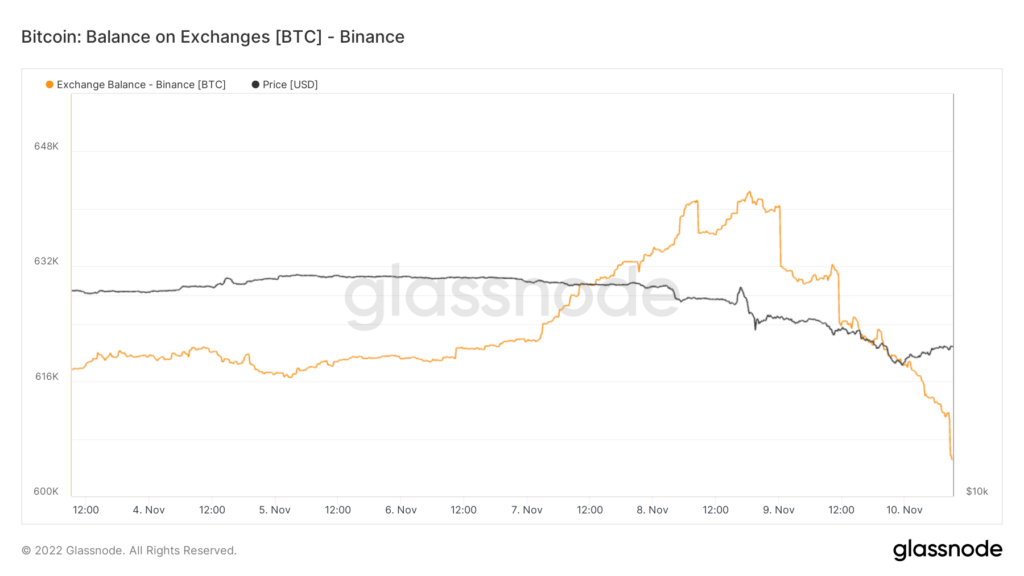

On Nov. 9, 60,000 BTC left exchanges, with the bulk coming from Binance as customers withdrew cash. The chart under exhibits the quantity of BTC that went to Binance over the previous seven days. Nevertheless, the info from Glassnode signifies that Binance nonetheless has over 600,000 BTC in its custody which is considerably greater than introduced in its proof of property report.

As of press time, the worth of Bitcoin has recovered to $17,526 from a low of $15,600 in a single day. Ethereum is again to $1,290 from a low of $1,069, whereas FTX’s FTT token is up 214% to $3.40 from a brand new all-time low of $1.08.

Bitcoin dominance has fallen to 40% from an area excessive of 42% on the finish of October. Nevertheless, apparently Bitcoin’s dominance has fallen all through the present turmoil available in the market, whereas throughout the Terra Luna collapse, it recorded an 11-month excessive of 48.5%.