Could Ethereum [ETH] see more downside as withdrawals heighten

Ethereum [ETH] may threat an extra decline regardless of shedding over 23% of its worth to commerce at $1,261 within the final seven days. The rationale for this risk was the excessive deviation of on-chain withdrawals of the altcoin.

Onchain Edge, in a 11 November post on CryptoQuant, famous the state of those withdrawing transactions. As well as, he prompt that ETH traders may anticipate one other worth correction resulting from these actions.

Learn AMBCrypto’s Value Prediction for Ethereum 2023-2024

In accordance with the publication, the chance was on the upper aspect. Additional, a correction on the present stage was not a foul omen for Ethereum within the long-term. Whereas backing up his argument, he additionally identified that related circumstances occurred in Could and November 2021. The latest one happened in Could 2022.

Onwards, what transpires?

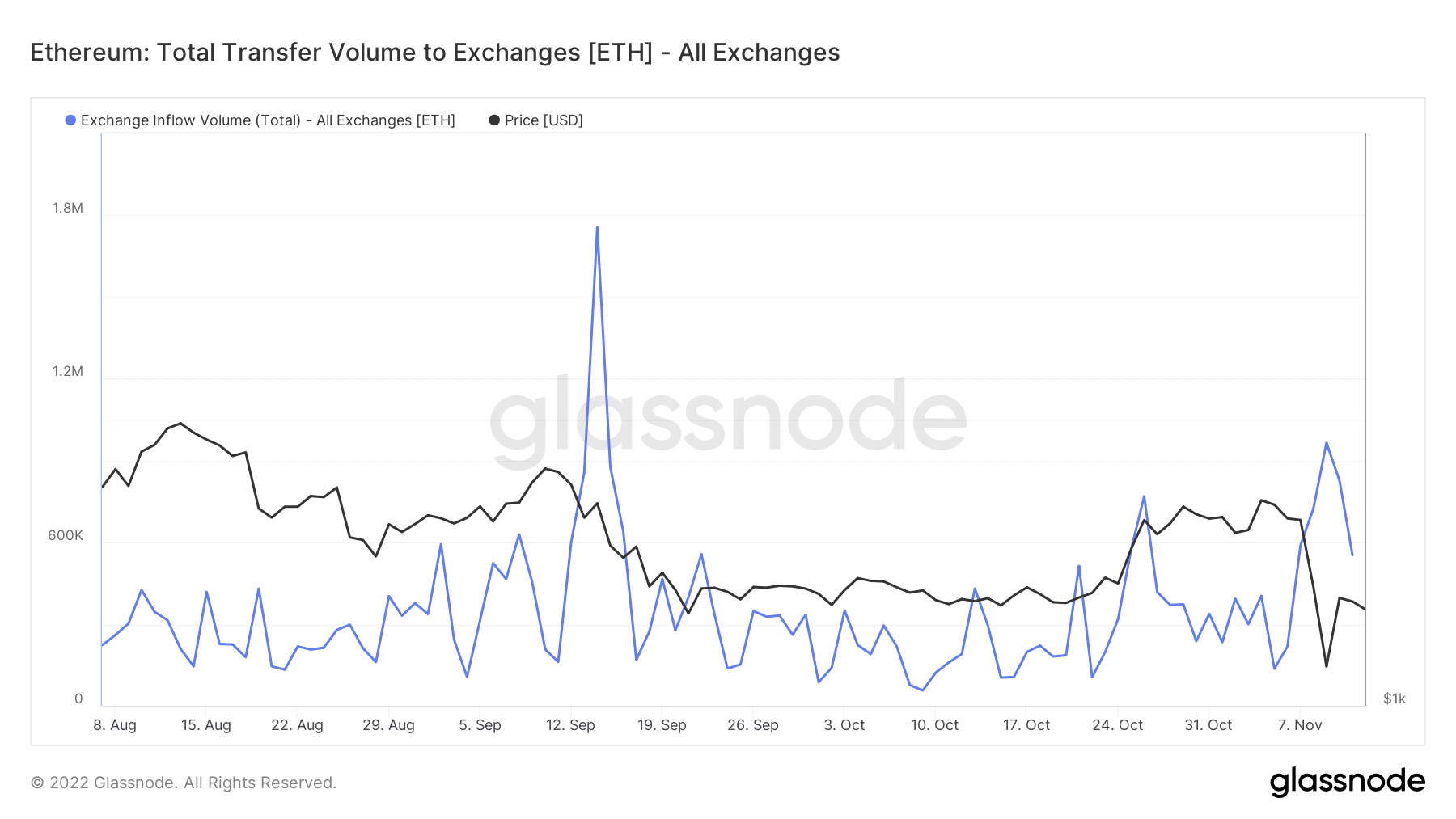

Per on-chain knowledge, Glassnode revealed that Ethereum’s whole influx quantity had considerably declined since 9 November. The lower was definitely not void of the mistrust that has rocked the ecosystem for the reason that FTX collapse. With these low change deposits, it implied that extra traders had been different choices to retailer their ETH. Whereas this knowledge may point out much less promoting strain, it was doubtless that a lot much less exercise was the explanation for this decline.

Supply: Glassnode

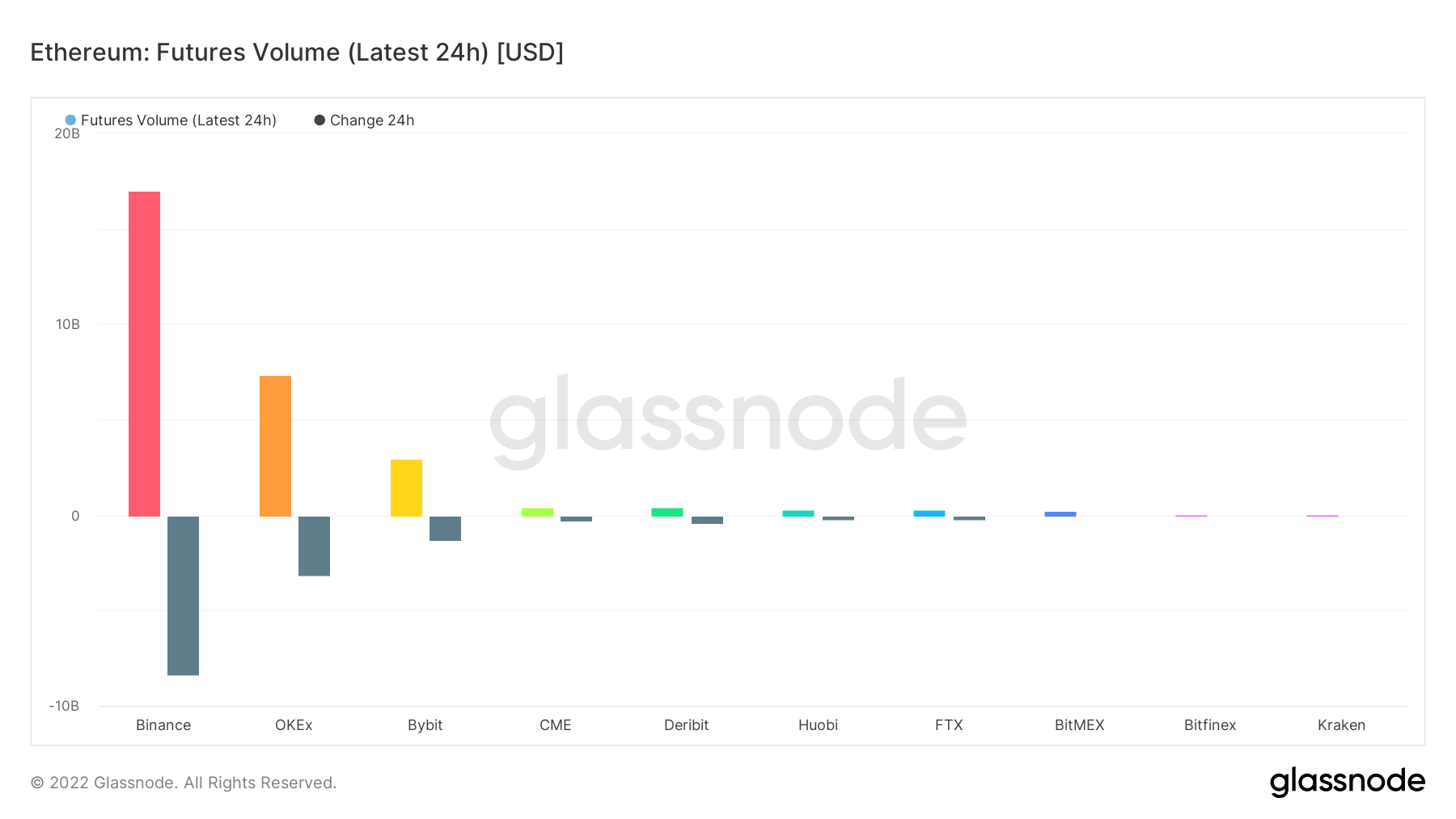

Along with this disinterest in buying and selling on exchanges, the derivatives market was not ignored. Additional Glassnode revelation confirmed that the futures quantity within the final 24 hours was a particularly detrimental worth throughout all exchanges. At press time, Binance futures quantity had shredded $8.31 billion inside the aforementioned interval.

This indicated one of many worst curiosity ranges since 2022 started. Therefore, this on-chain standing, if not improved within the coming days, may align with the premonition of an extra worth lower.

Supply: Glassnode

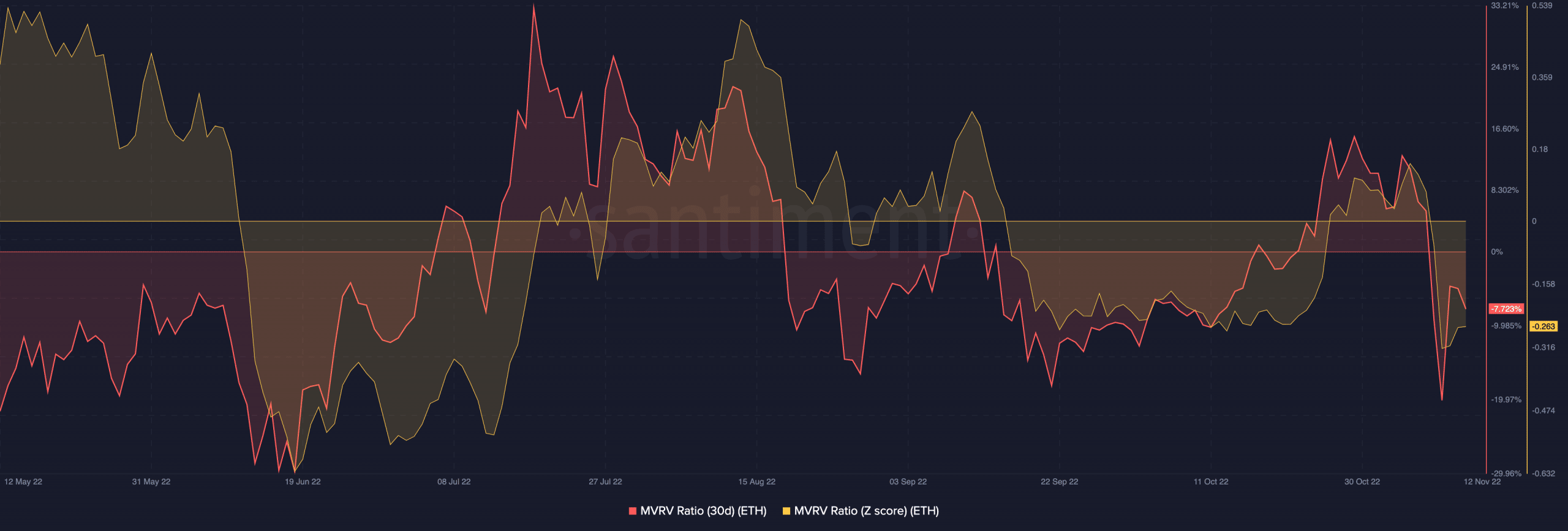

To a higher extent, Santiment confirmed that the chance was not out of the query. As of this writing, the on-chain knowledge evaluation platform revealed that the 30-day Market Worth to Realized (MVRV) ratio was -7.723%. At that worth, it implied that ETH traders had lately been in losses.

Moreover, income gathered earlier, particularly on exchanges, had been now in ruins. Equally, the MVRV Z-score was detrimental at -0.0263. Therefore, the realized cap worth had excessive potential to be price greater than the undiluted market capitalization.

Supply: Santiment

Prepare for extra rip ups

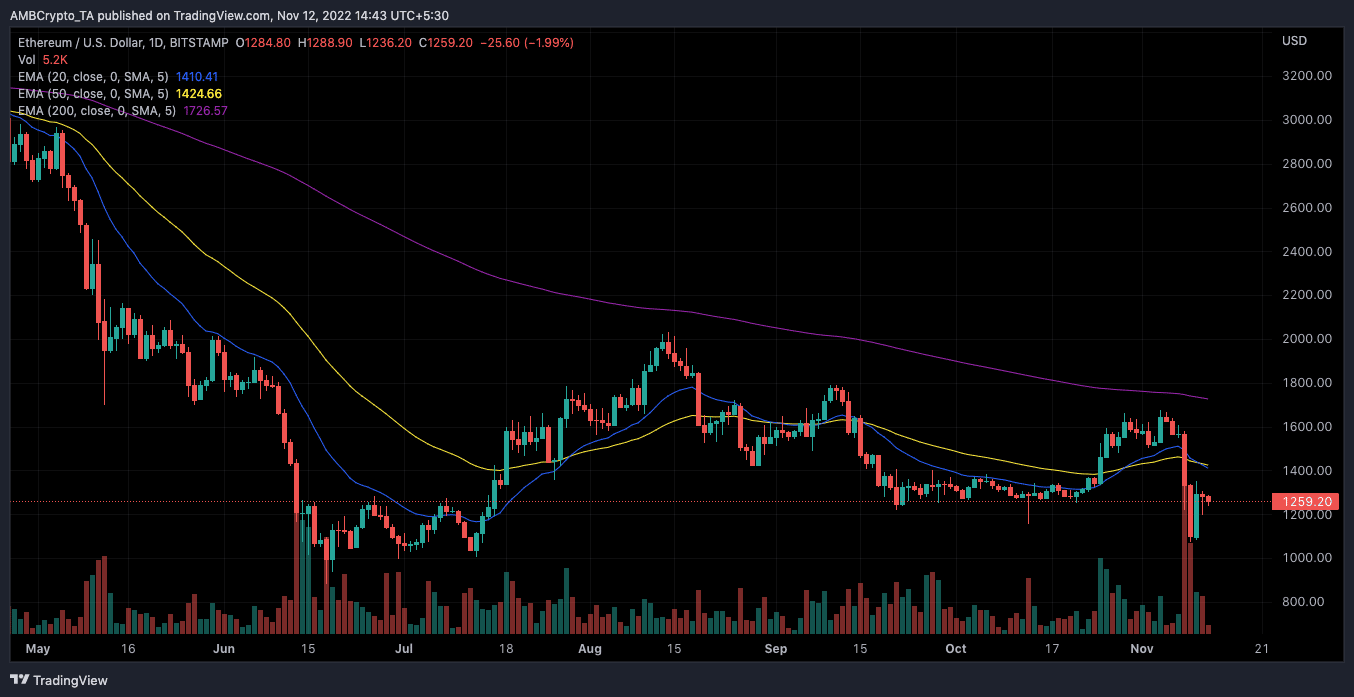

Nonetheless, indications from the Exponential Shifting Common (EMA) confirmed that it might be time for a correction. This was as a result of 50 EMA (yellow) already in pole place to go above the 20 EMA (blue).

On the event it lastly crosses, sellers may lastly take management of the market and the worth decreases decrease than the present $1,200 present area. Within the mid to long run, the 200 EMA (purple) indicated that the correction would finally result in a worth revival. However, it may be essential to train warning earlier than assuming the decline could be an inevitable occasion.

Supply: TradingView