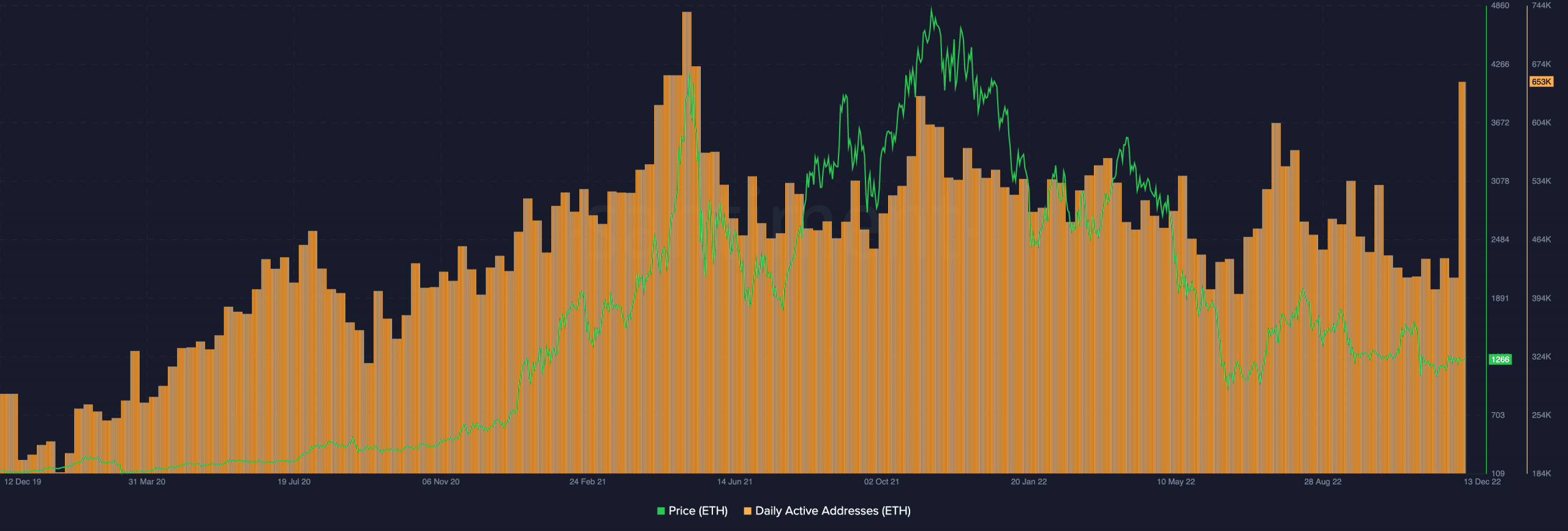

ETH’s spike in address activity didn’t coincide with ‘profit-taking opportunity’

- ETH offered at a five-week excessive of $1,335 on 13 November.

- Each day lively addresses rallied to a year-high of 653,000.

- There was a decline in ETH’s community development.

Having traded momentarily on the $1,335 worth mark, the main altcoin Ethereum [ETH] hit a five-week excessive in the course of the intraday buying and selling session on 13 November.

Learn Ethereum’s [ETH] Value Prediction 2023-2024

Per knowledge from Santiment, the worth leap was because of the rally within the rely of distinctive addresses that traded the alt. At 653,000 day by day lively addresses buying and selling ETH at press time, this represented the most important day by day excessive since Could 2021.

Supply: Santiment

With the present state of the final market and the fixation of many buyers on seeing positive aspects of their investments, a leap in an asset’s worth is often adopted by a surge in profit-taking.

However, curiously, the expansion in ETH’s worth and day by day lively addresses didn’t coincide with “a traditional revenue take alternative,” Santiment famous.

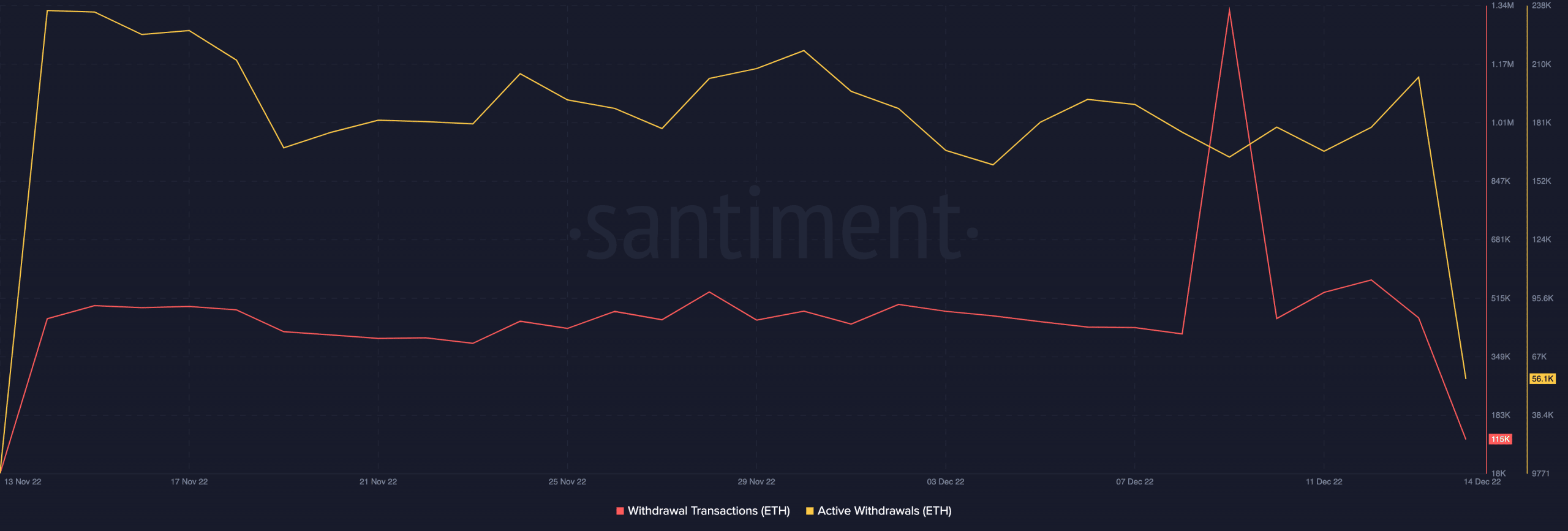

In truth, within the final 24 hours, lively ETH withdrawals fell by 72%. As well as, the ETH withdrawal transactions rely additionally dropped by 75% throughout the similar interval. This was a sign that the worth rally didn’t result in any inordinate rally in profit-taking by ETH holders.

Supply: Santiment

A take a look at ETH’s trade exercise within the final 24 hours additional corroborated this place. Whereas its trade inflows declined by 80%, ETH’s trade outflows rallied by 73% within the final 24 hours. This confirmed that ETH accumulation exceeded its sell-offs.

Supply: Santiment

Patrons are forging forward

Whereas ETH’s worth rebounded from the five-week excessive, it traded at $1,322.10 at press time. Its time was up by 5% within the final 24 hours. With ETH’s transaction price $8 billion accomplished throughout the similar interval, buying and selling quantity was up by 80%.

Assessed on a day by day chart, ETH continued to see elevated accumulation placing the patrons in command of the market. The place of ETH’s Directional Motion Index (DMI) confirmed this. At press time, the patrons’ energy (inexperienced) at 21.32 rested above the sellers’ (crimson) at 18.40.

Additional, key indicators such because the Relative Power Index (RSI) and Cash Circulation Index (MFI) revealed the depth of ETH accumulation at press time. For instance, the RSI was noticed in an uptrend at 57.08, whereas the MFI was at 63.74

Each indicators positioned above their respective impartial areas confirmed that ETH accumulation quantity exceeded the distribution fee.

Supply: TradingView

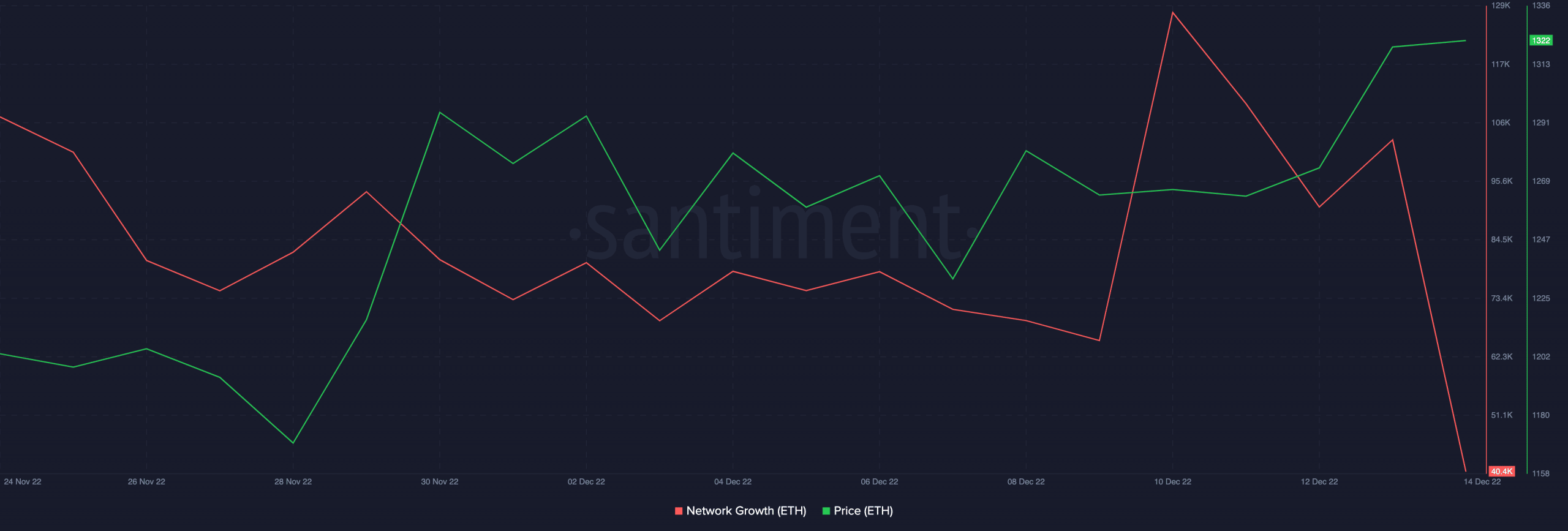

Whereas the variety of distinctive day by day addresses that traded ETH was pegged at its highest stage since Could 2021, on-chain knowledge revealed a discount in new calls for on the community. Based on on-chain knowledge from Santiment, ETH’s community development declined by 61% within the final 24 hours.

It’s trite to notice that when patrons’ exhaustion units into the market, and new demand for ETH fails to return in, a worth decline may observe.

Supply: Santiment