Chainlink breaks through key level- Opportunities ahead for short sellers?

- LINK bulls dominate, pushing the worth past a short-term resistance degree.

- Indicators of a possible retracement emerge probably pointing to an upcoming alternative for short-sellers.

One other week of 2023 is within the rearview mirror and the bulls have emerged victorious as soon as once more. LINK holders are ecstatic after the rally that the coin has delivered since mid-February. Right here’s a have a look at how LINK has kicked off the second half of February.

Examine Chainlink [LINK] value prediction for 2023-2024

The primary half of February appeared like the beginning of a bearish retracement after the bullish efficiency that LINK delivered in January.

It did, actually, pulled again under the 200-day shifting common and briefly under the 50-day MA. The bulls simply made a powerful mid-month comeback that culminated in a 27.86% rally from its 4-week lows to its press time excessive of $8.25.

Supply: TradingView

LINK’s rally within the final two days was so sturdy that it managed to interrupt by the $7.79 resistance degree.

Additionally, the rally kicked off from the RSI mid-range, confirming that the relative energy was nonetheless in favor of the bulls. In different phrases, LINK, at press time, was nonetheless carrying on with the bullish momentum beforehand witnessed in January.

LINK could also be topic to a different selloff

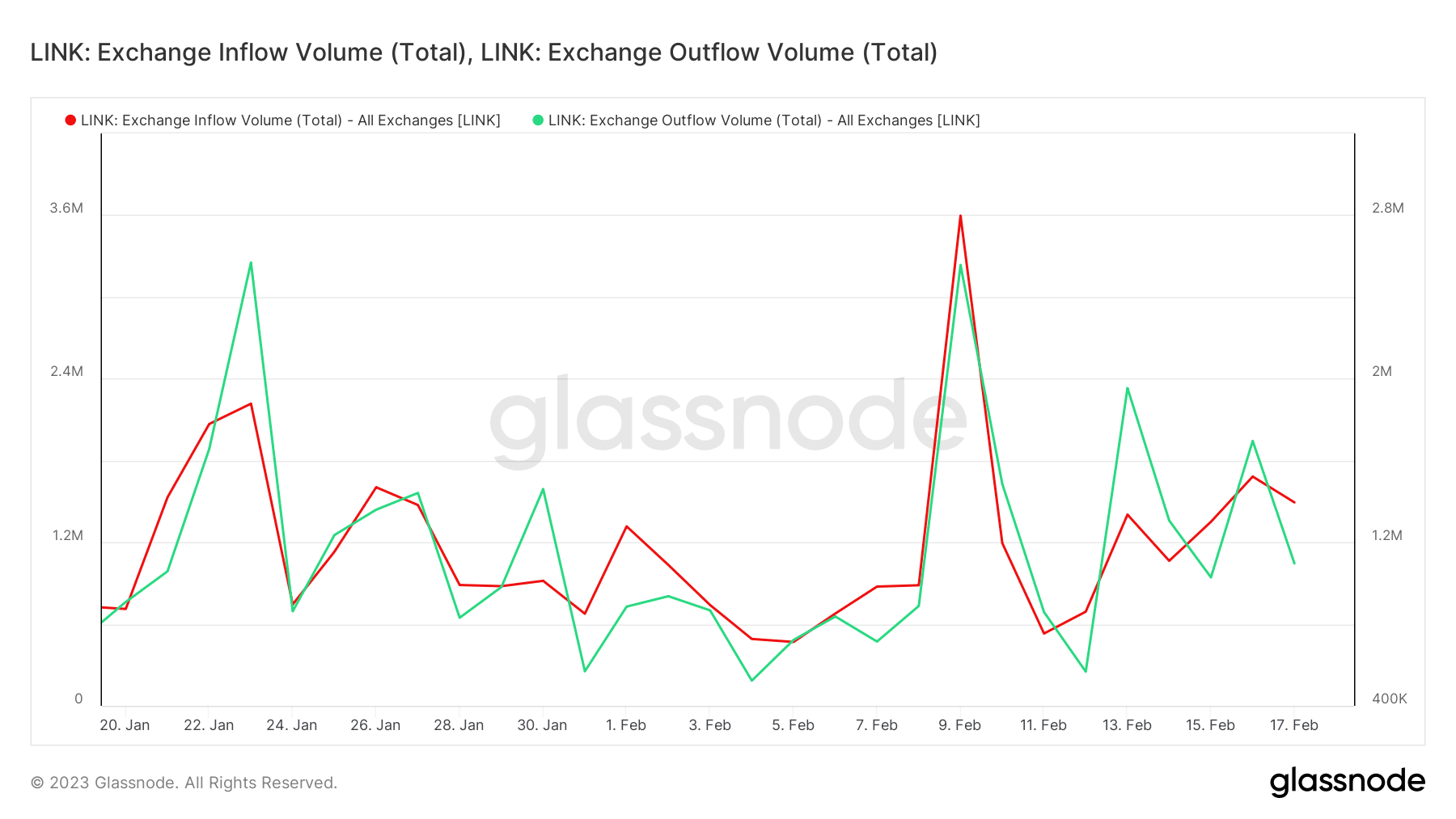

The bears may simply be across the nook regardless of this spectacular efficiency. The newest Glassnode information reveals that change outflows are slowing down. The final 24 hours demonstrated a return of upper change inflows, suggesting that promote stress was build up.

Supply: Glassnode

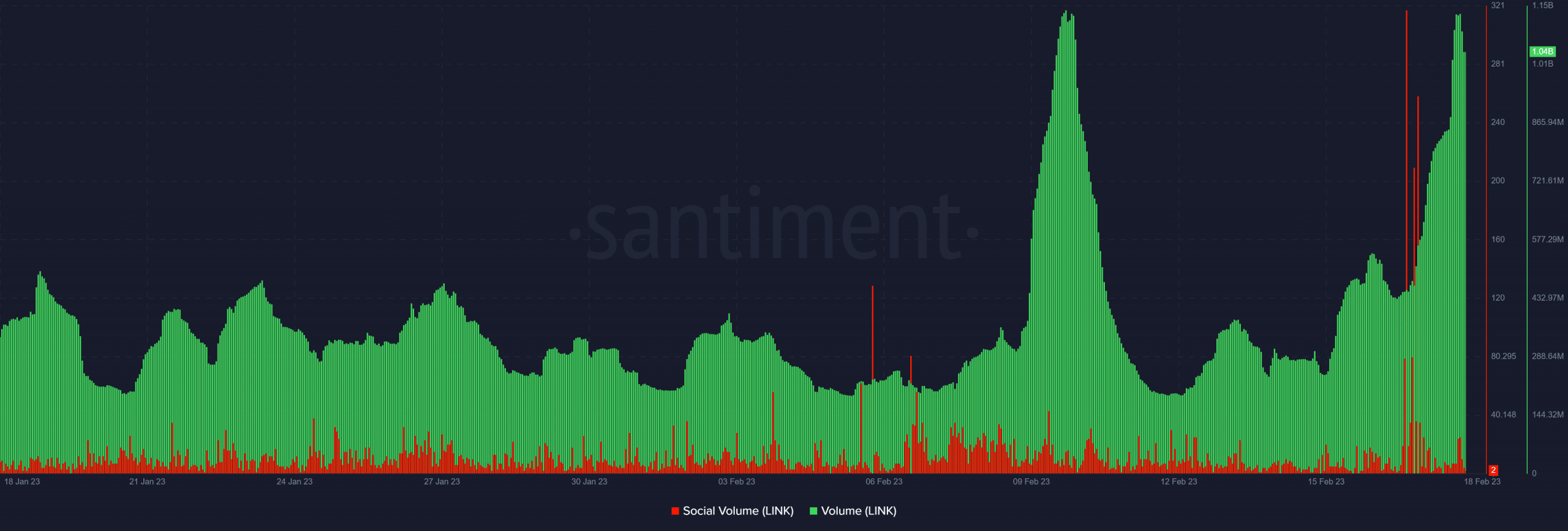

The slowdown in change volumes was preceded by a big spike in social quantity to the very best month-to-month ranges on 17 February.

This was adopted by a surge in on-chain quantity again to the earlier month-to-month excessive.

A bearish retracement ensued the final time that the quantity peaked on the identical degree. A retest of this identical degree carries the next chance of yielding comparable outcomes.

Supply: Santiment

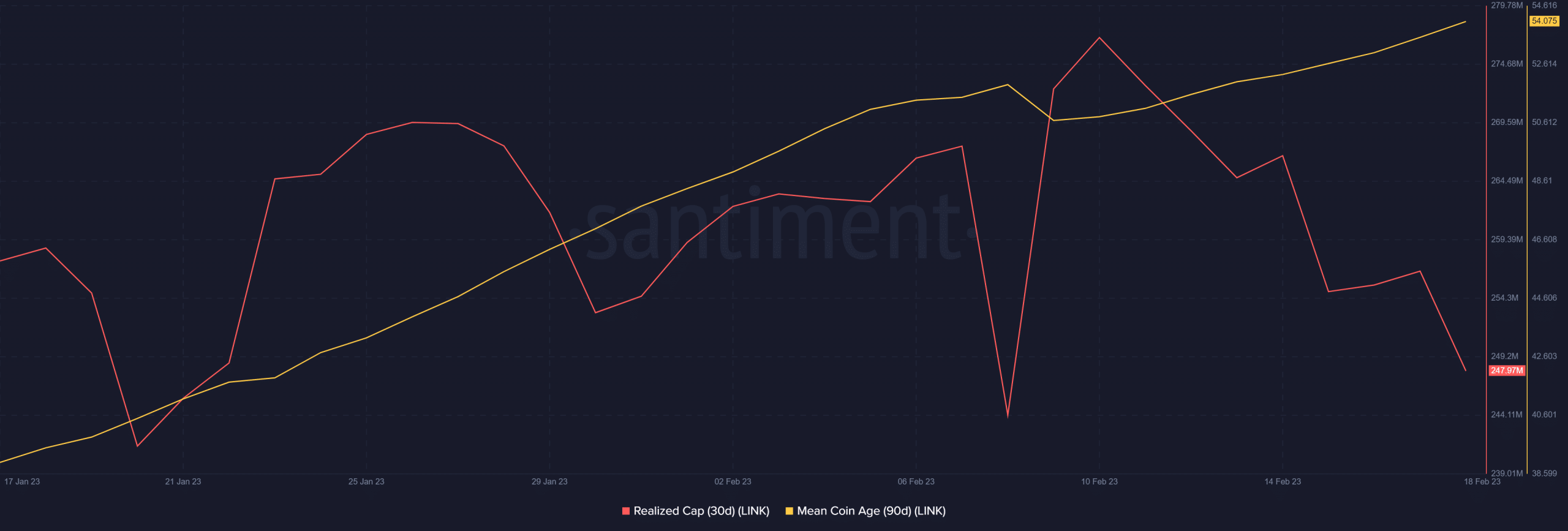

One other metric that presently highlights a possible retracement is the realized cap metric which was approaching the decrease 4-week vary, at press time.

A promote sign was noticed the final time that the metric dropped to the decrease vary, coupled with a powerful uptick in imply coin age.

Supply: Santiment

Is your portfolio inexperienced? Take a look at the Chainlink Revenue Calculator

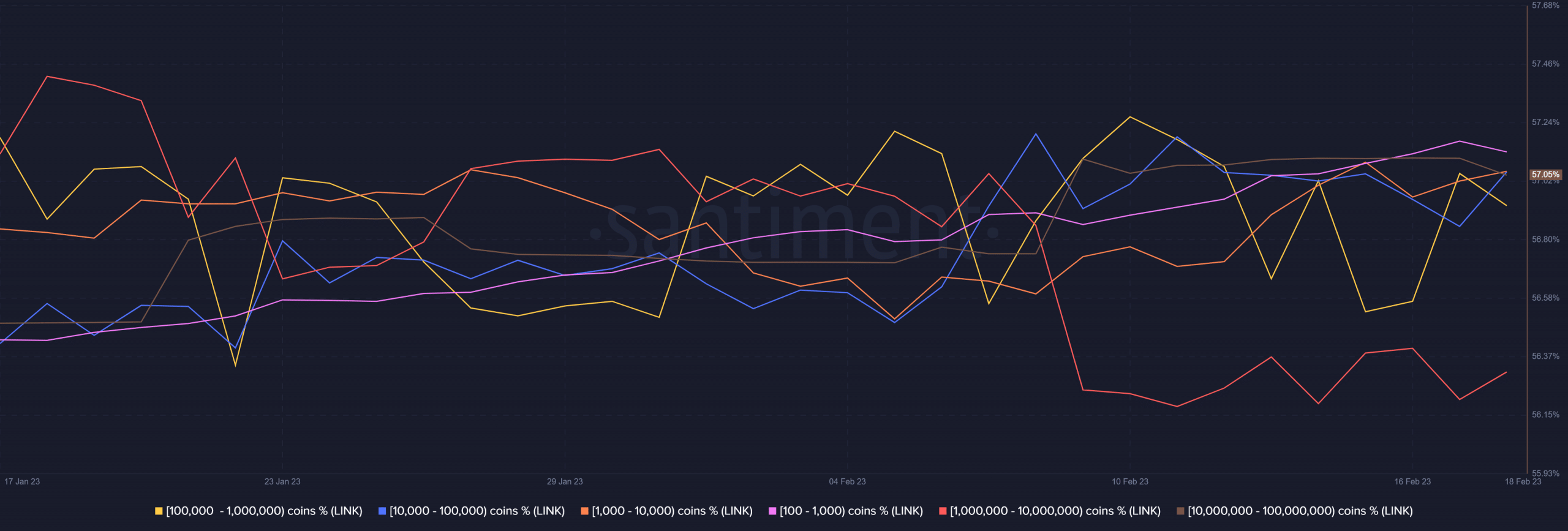

This time the imply coin age achieved a brand new month-to-month excessive. However the important thing determinant of promote stress was whales. The newest provide distribution information revealed that there was nonetheless some shopping for stress out there.

Nonetheless, the most important whales contributed to promoting stress within the final 24 hours, on the time of writing.

Supply: Santiment

The newest whale information reveals that addresses holding between 100,000 to 1 million LINK and people holding over 10 million LINK began promoting.

These two classes collectively management over 60% of the circulating provide. Therefore their actions are prone to have a serious affect available on the market. It means there is likely to be a stable alternative for brief sellers to learn primarily based on this evaluation.