Chainlink announces new partnership as fight for EVM compatibility rages on

- StarkWare has partnered with Chainlink for the combination of Chainlink Worth Feeds onto the Starknet testnet.

- LINK has commenced a brand new bear cycle.

On 6 February, StarkWare, a know-how agency specializing within the creation of scalable options for blockchain and decentralized functions, announced a collaboration with Chainlink Labs.

The partnership will see the combination of Chainlink Worth Feeds onto the Starknet testnet, with the potential for it to be rolled out onto the Starknet mainnet quickly.

Learn Chainlink’s [LINK] Worth Prediction 2023-24

StarkWare presents a set of zero-knowledge (ZK) proof know-how and blockchain infrastructure merchandise, together with StarkNet. StarkNet is a permissionless, decentralized Validity-Rollup protocol that features as a layer-2 scaling answer on the Ethereum mainnet.

EVM-compatible ZK rollups are growing

Ethereum’s scalability and excessive transaction prices have lengthy been a priority for customers of the blockchain community. To deal with these points, Optimistic rollups, similar to Arbitrum and Optimism, have been launched as potential options.

Nevertheless, these rollups have been solely short-term fixes, and the emergence of zkEVMs might quickly render them out of date.

Aside from StarkNet, different platforms that present zk rollups which are suitable with the Ethereum Digital Machine (EVM) embrace Polygon zkEVM, zkSync zkEVM, Scroll zkEVM, and AppliedZKP zkEVM.

Whereas Polygon zkEVM continues to be in its improvement part, it has seen elevated utilization because it was made out there for testing by way of a public testnet on 11 October.

Extra development, & extra excellent news for the Polygon zkEVM testnet.

Transactions surpassed 284k final week 📈

Check out all of the metrics, and experiment with the way forward for scaling your self.👇🏼 pic.twitter.com/1ounXhZEyO

— Polygon ZK (@0xPolygonZK) February 6, 2023

LINK worth stalls, no additional uptrend in sight

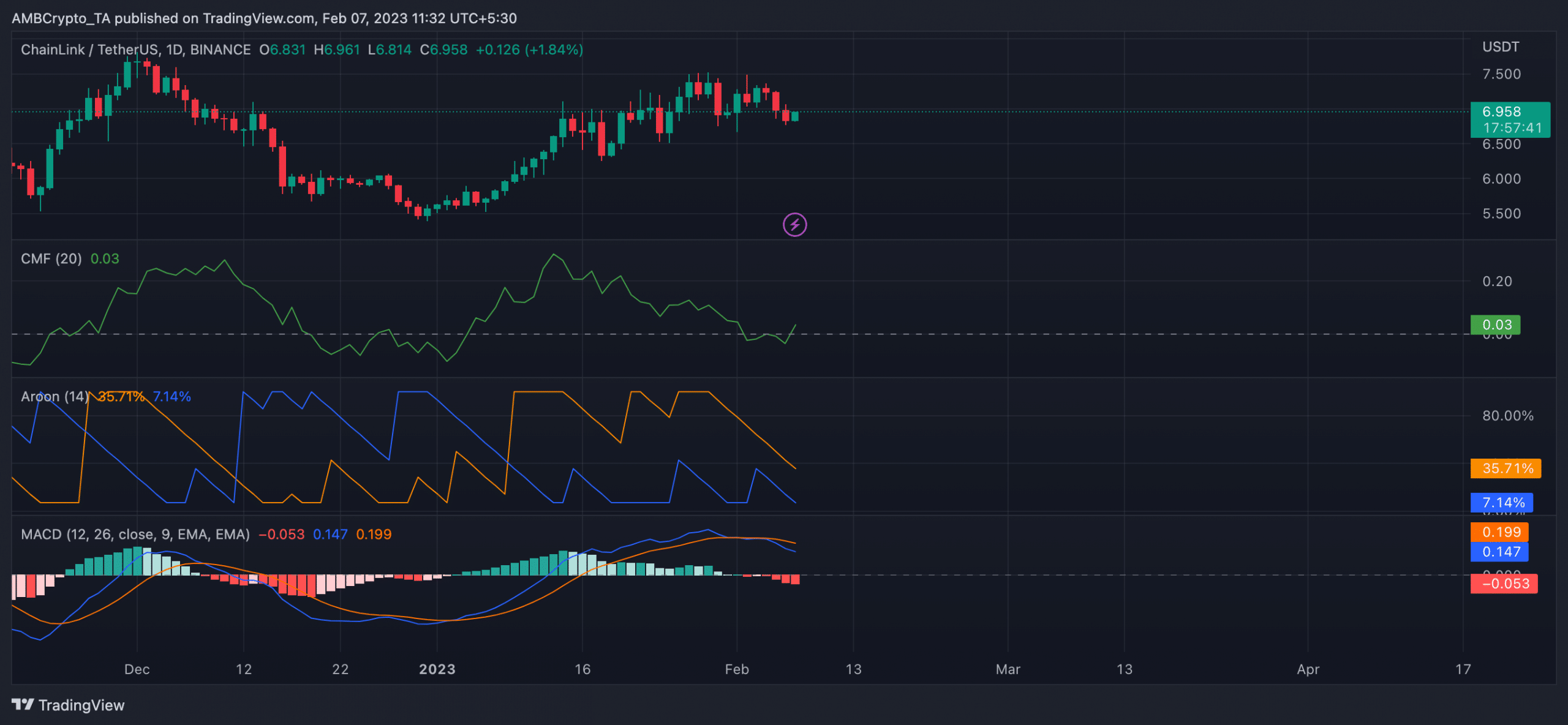

At press time, LINK exchanged palms at $6.94, per knowledge from CoinMarketCap. Within the final week, the alt traded inside a decent vary as its worth oscillated between $6.5 and $7.5.

Having rallied by 25% on a year-to-date foundation, worth actions on the each day chart revealed that LINK shopping for momentum has waned considerably since February started.

Actually, the brand new month ushered within the graduation of a brand new bear cycle because the alt’s transferring common convergence/divergence (MACD) line (blue) intersected with the development line (orange) in a downtrend and has been so positioned since 1 February. Since then, LINK’s worth has dropped by 7%.

Is your portfolio inexperienced? Try the Solana Revenue Calculator

As of this writing, LINK’s Chaikin Cash Circulation (CMF) rested barely above the middle line at 0.03. In a downtrend, the LINK market noticed much less demand that might assist drive up its worth.

Lastly, a have a look at the Aroon indicator confirmed the weak nature of the bullish development within the LINK market. At press time, the Aroon Up Line (blue) was positioned in a downtrend at 7.14%.

If the Aroon Up line is close to 100, it means that the uptrend is strong and the newest peak was achieved lately. Then again, if the Aroon Up line is near 0, the uptrend is weak, and the newest excessive was attained a very long time in the past. That is typically a precursor to a worth drop, so warning is suggested.

Supply: ETH/USDT on TradingView