Chainlink adoption update: What LINK holders should know before exiting

- The variety of every day addresses with a couple of LINK has been declining.

- On-chain efficiency appeared regarding for LINK and so did the symptoms.

Chainlink [LINK] adoption has been on the rise because the blockchain continues to broaden its integrations. LINK not too long ago introduced a number of new integrations throughout 4 chains- Avalanche, BNB, Ethereum, and Polygon.

⬡ Chainlink Adoption Replace ⬡

There have been 12 integrations of 5 #Chainlink companies throughout 4 completely different chains: #Avalanche, #BNBChain, #Ethereum, and #Polygon.

Chainlink is a key driver of #Web3 innovation. pic.twitter.com/x635fuhIlB

— Chainlink (@chainlink) February 12, 2023

Other than this, LINK additionally managed to stay within the whales’ portfolio. WhaleStats, a well-liked Twitter deal with that posts updates associated to whale exercise revealed that LINK was on the listing of the cryptos that the highest 100 Ethereum whales have been holding. This was a constructive replace because it mirrored the whales’ belief in LINK.

🐳 The highest 100 #ETH whales are hodling

$666,300,027 $SHIB

$146,436,746 $BEST

$139,060,980 $CHSB

$128,710,645 $MATIC

$96,545,419 $BIT

$81,023,390 $LOCUS

$61,037,825 $LINK

$60,189,488 $CHZWhale leaderboard 👇https://t.co/N5qqsCAH8j pic.twitter.com/4OIQYX3sdd

— WhaleStats (monitoring crypto whales) (@WhaleStats) February 12, 2023

Reasonable or not, right here’s LINK market cap in BTC’s phrases

Nevertheless, regardless of the whales’ confidence, the broader market’s curiosity in LINK appears to have declined over the previous few weeks.

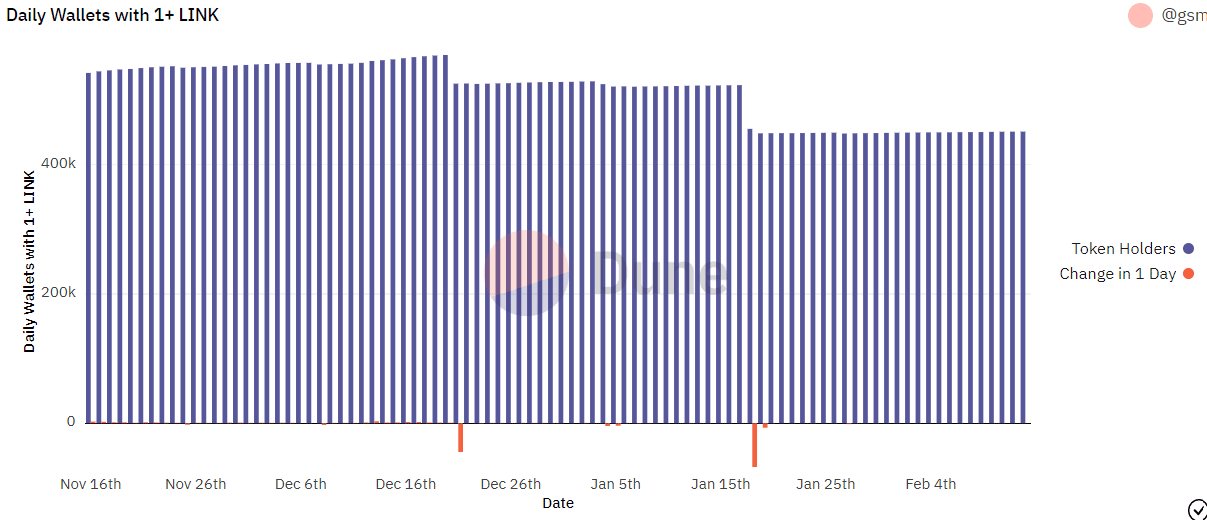

Dune’s knowledge revealed that the variety of every day addresses with a couple of LINK has been on a relentless decline. A take a look at LINK’s on-chain efficiency offered a greater understanding of this episode.

Supply: Dune

Causes to fret?

The decline within the variety of holders could be considerably attributed to LINK’s current efficiency on the value entrance, due to the bearish market situation.

As per CoinMarketCap, LINK registered a virtually 3% worth decline within the final 24 hours, and on the time of writing, it was buying and selling at $6.77 with a market capitalization of over $3.4 billion.

LINK’s efficiency on the metrics entrance additionally didn’t look promising, as a lot of the metrics supported the potential for an extra downtrend.

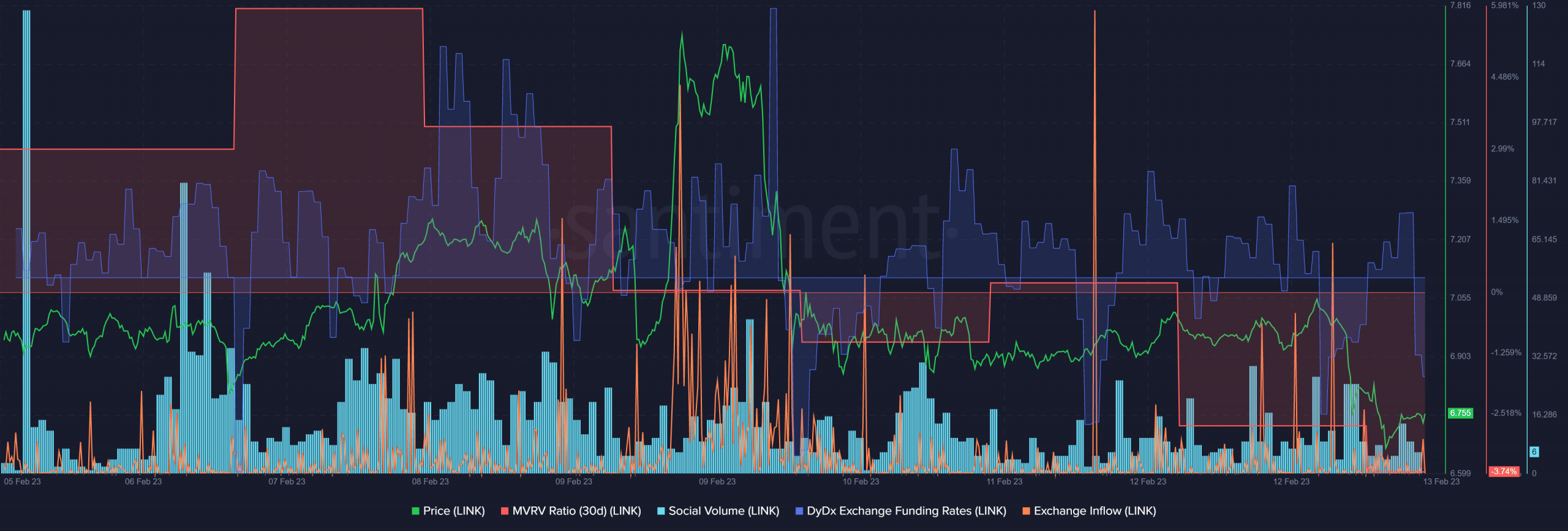

As an illustration, LINK’s demand within the derivatives market step by step declined as its DyDx funding charge went down. LINK’s trade influx spiked fairly a couple of instances over the last seven days, which was a bearish sign.

Moreover, its MVRV Ratio fell considerably, elevating the prospect of additional worth declines. The truth is, the community’s recognition additionally took a blow as its social quantity decreased.

Supply: Santiment

How a lot are 1,10,100 LINKs value at the moment?

Warning is suggested

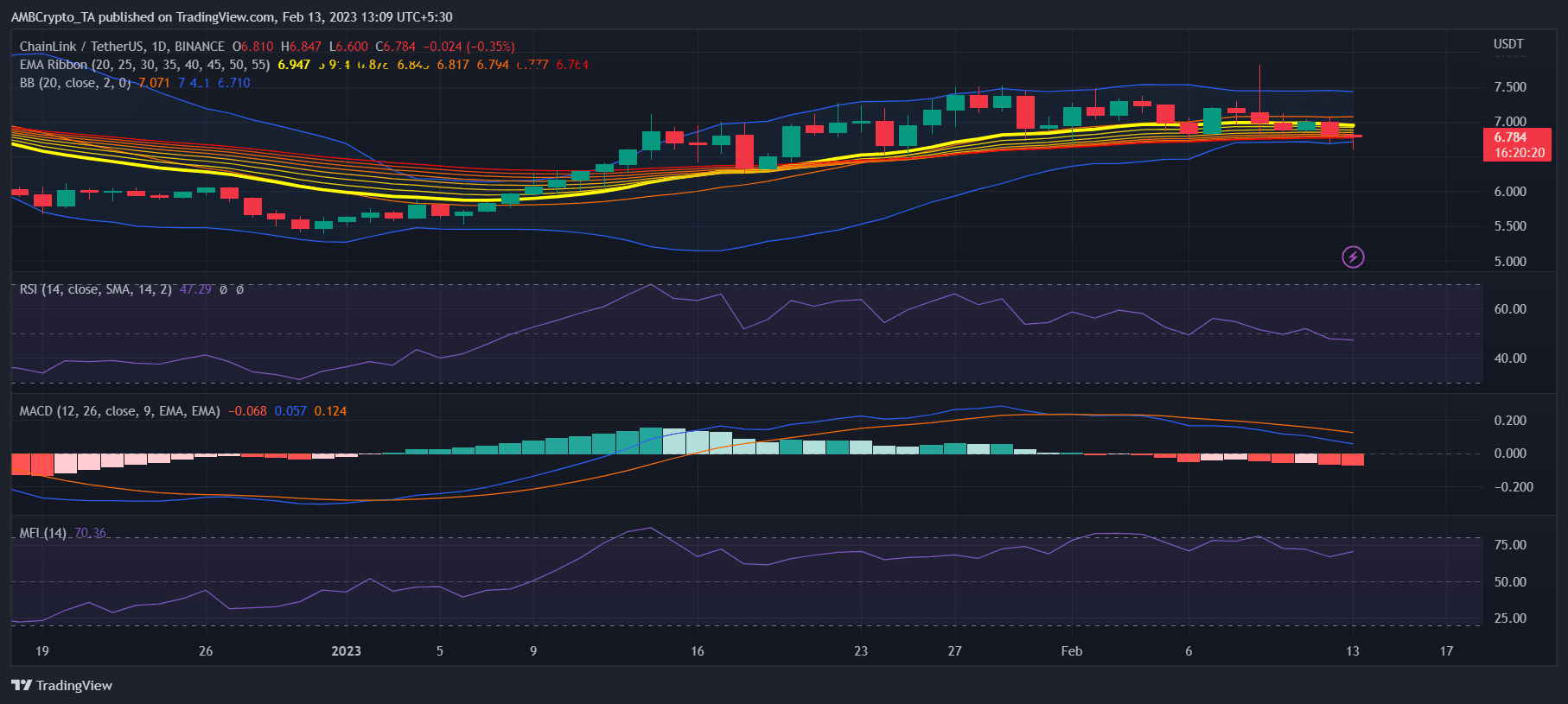

Like a lot of the metrics, LINK’s market indicators additionally painted a bearish image for the token. The Exponential Transferring Common (EMA) Ribbon revealed that the space between the 20-day EMA and the 55-day EMA was decreasing, rising the probabilities of a bearish crossover.

LINK’s MACD confirmed that the bears have been already main the market. The Relative Energy Index (RSI) went beneath the impartial mark, which too was bearish.

Furthermore, the Bollinger Bands revealed that LINK’s worth was in a much less unstable zone, reducing the probabilities of a sudden northward breakout. Nonetheless, the Cash Circulation Index (MFI) gave slight hope for an uptick because it went up marginally.

Supply: TradingView