Loopring [LRC] sees increased distribution as new trading year commences

- Loopring suffered a decline in TVL in 2022.

- LRC continues to document elevated token sell-offs.

As the continuing crypto winter lingers within the new yr, LRC, the native token that powers main layer 2 zkRollup protocol Loopring, was among the many prime ten cryptocurrency belongings by buying and selling quantity among the many prime 500 Ethereum whales within the final 24 hours.

JUST IN: $LRC @loopringorg now on prime 10 by buying and selling quantity amongst 500 largest #ETH whales within the final 24hrs 🐳

Peep the highest 100 whales right here: https://t.co/tgYTpOm5ws

(and hodl $BBW to see information for the highest 500!)#LRC #whalestats #babywhale #BBW pic.twitter.com/yLpYRm8ctk

— WhaleStats (monitoring crypto whales) (@WhaleStats) January 1, 2023

Dubbed the primary zkRollup Layer 2 community, Loopring is a protocol for constructing non-custodial, orderbook-based decentralized exchanges (DEXs) on the Ethereum blockchain.

Are your LRC holdings flashing greens? Verify the Revenue Calculator

In 2022, extra folks began utilizing layer 2s on Ethereum as distinct communities and ecosystems fashioned round them. As well as, these layer 2s additionally provided considerably decrease transaction charges than the Ethereum predominant chain, which additional contributed to their adoption.

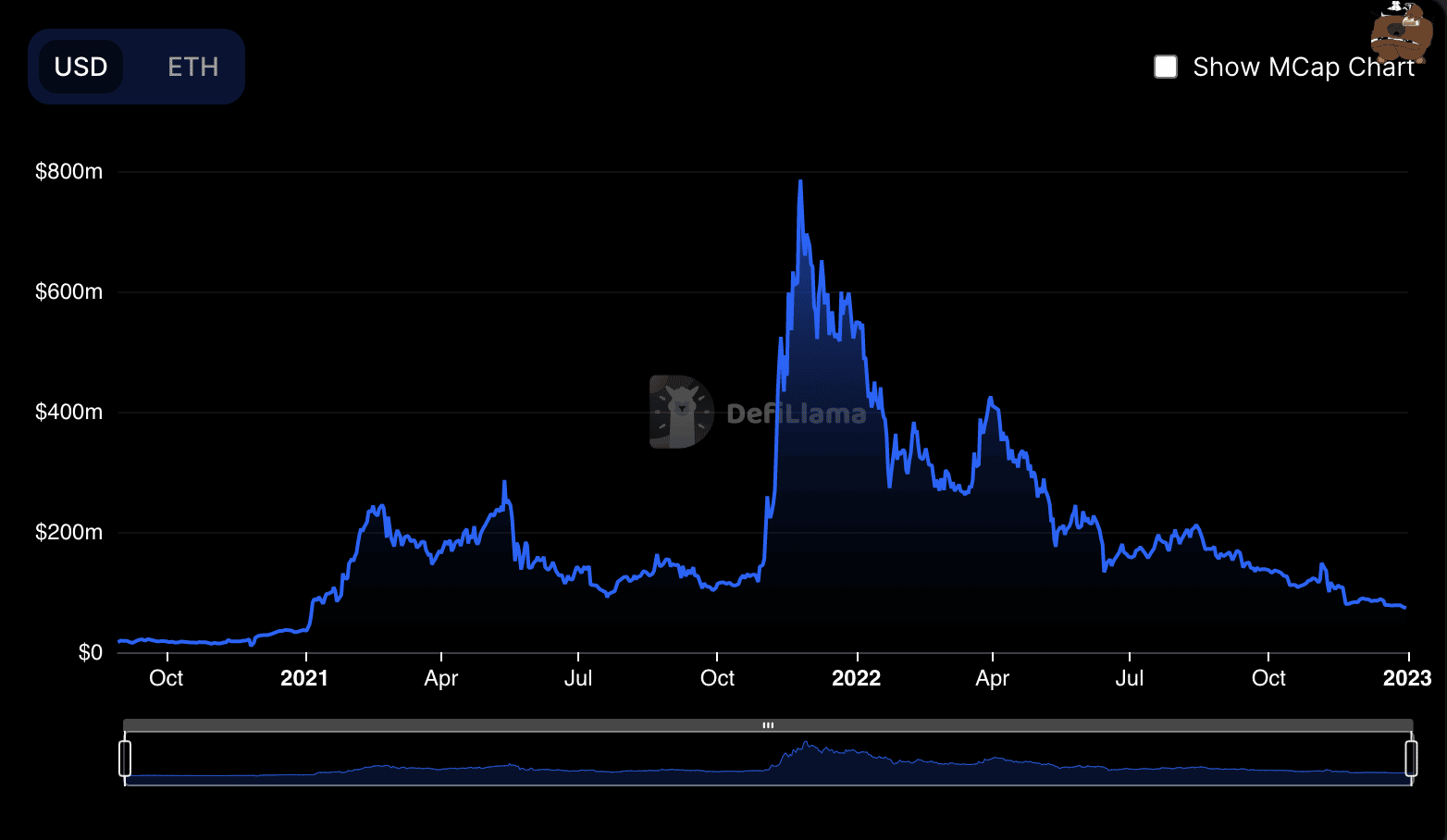

Elevated inflation and the surge in liquidity exit from decentralized finance (DeFi) protocols led to a decline in DeFi complete worth locked (TVL) in 2022. Primarily constructed to accommodate DEXes, Loopring didn’t escape the decline as its TVL fell by 86% throughout the yr, per information from DefiLlama.

Supply: DefiLlama

With a 1.89% market share of the L2 ecosystem, Looopring was noticed at quantity 5 on L2Beat’s checklist of L2 protocols, with the most important TVL.

Supply: L2Beat

Not a powerful begin

Regardless of being on the checklist of the highest ten cryptocurrency belongings by buying and selling quantity among the many prime 500 Ethereum whales within the final 24 hours, LRC’s efficiency was woeful inside the identical interval.

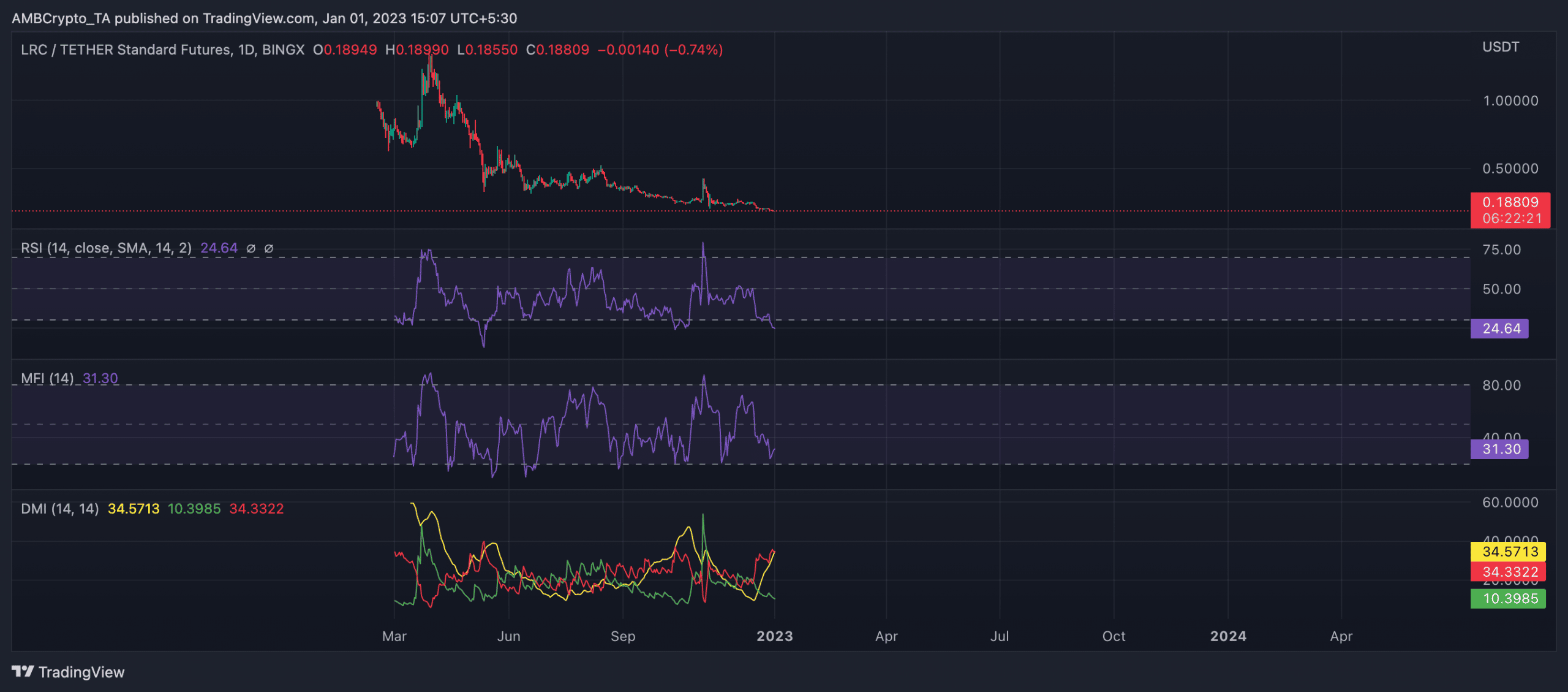

At press time, the altcoin exchanged arms at $0.1878, per information from CoinMarketCap. Nonetheless, indications from an evaluation of its efficiency on the every day chart confirmed that LRC was severely oversold at press time.

Struggling to wade off the bears, the consumers cowered, thereby leaving coin distributors in command of the LRC market.

Learn Loopring’s [LRC] Value Prediction 2022-2023

This was confirmed by the place of LRC’s Directional Motion Index (DMI). At press time, the sellers’ energy (pink) at 34.33 lay solidly above the consumers’ (inexperienced) at 10.39. Moreso, the Common Directional Index (yellow) was noticed in an uptrend indicating that the token distribution pattern intensified.

Depicting clearly the oversold nature of LRC at press time, key momentum indicators such because the Relative Power Index (RSI) and the Cash Circulation Index (MFI) have been positioned removed from their impartial spots. For instance, the RSI was noticed in a downtrend at 24.64. Likewise, the MFI was 31.30, at press time.

Supply: TradingView