Uniswap: If this is not checked, the year-end might bring trouble for UNI holders

- UNI was on the record of the highest 10 bought tokens among the many 5000 largest Ethereum whales.

- Its RSI was overbought, however a couple of metrics had been in favor.

Uniswap’s [UNI] efficiency, of late, has wholly aligned with the pursuits of buyers. UNI registered double-digit weekly beneficial properties, due to the curiosity of the whales. UNI was on the record of the highest 10 bought tokens among the many 5000 largest Ethereum whales within the final 24 hours.

JUST IN: $UNI @Uniswap now on high 10 bought tokens amongst 5000 greatest #ETH whales within the final 24hrs 🐳

Peep the highest 100 whales right here: https://t.co/kOhHps8XBB

(and hodl $BBW to see information for the highest 5000!)#UNI #whalestats #babywhale #BBW pic.twitter.com/jwAee5PJET

— WhaleStats (monitoring crypto whales) (@WhaleStats) December 6, 2022

Learn Uniswap’s [UNI] Value Prediction 2023-24

UNI additionally remained fairly standard within the crypto business because it was named the coin of the day when it comes to social exercise on 5 December. Moreover, as per LunarCrush’s information, the token’s Altrank was optimistic because it steered that the yr would possibly finish properly for its buyers.

⚡️Coin of the day by social exercise – @Uniswap $UNI

5 December 2022 pic.twitter.com/HYMAhtcOO4— 🇺🇦 CryptoDep #StandWithUkraine 🇺🇦 (@Crypto_Dep) December 5, 2022

Nevertheless, not every little thing was nearly as good because it regarded, CryptoQuant’s data revealed that buyers ought to stay cautious. The development reversal might need already began as UNI’s worth decreased by over 4% within the final 24 hours. At press time, Uniswap was trading at $6.13 with a market capitalization of round $4.68 billion.

Is a development reversal inevitable for Uniswap?

As per CryptoQuant, Uniswap’s Relative Power Index (RSI) was in an overbought place, at press time, which was a large bearish sign. Not solely that, however UNI’s web deposits on exchanges had been excessive in comparison with the seven-day common. This replace indicated increased promoting stress, thus rising the possibility of a worth lower quickly.

Nonetheless, a couple of metrics had been additionally working in favor of UNI. As an example, the token’s change reserve continued to fall, suggesting much less promoting stress.

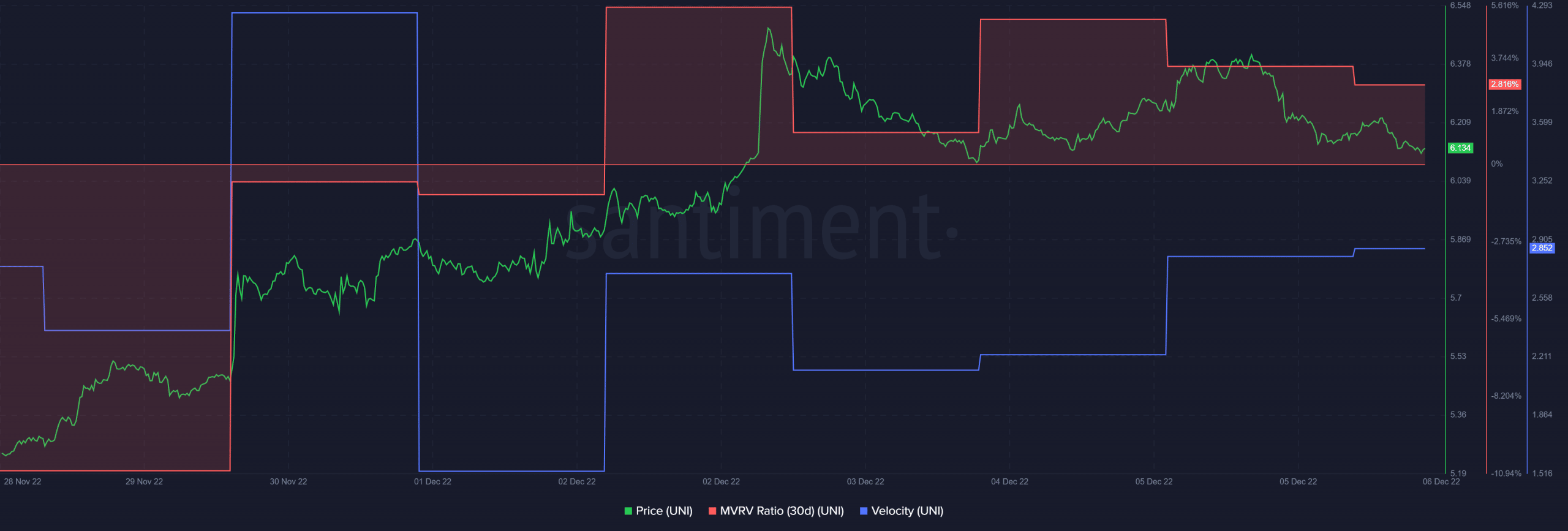

Furthermore, Uniswap’s MVRV ratio was additionally increased in comparison with final week, which is a constructive sign for the community. After declining, UNI’s velocity registered an uptick, which too regarded optimistic.

Supply: Santiment

Bears vs bulls

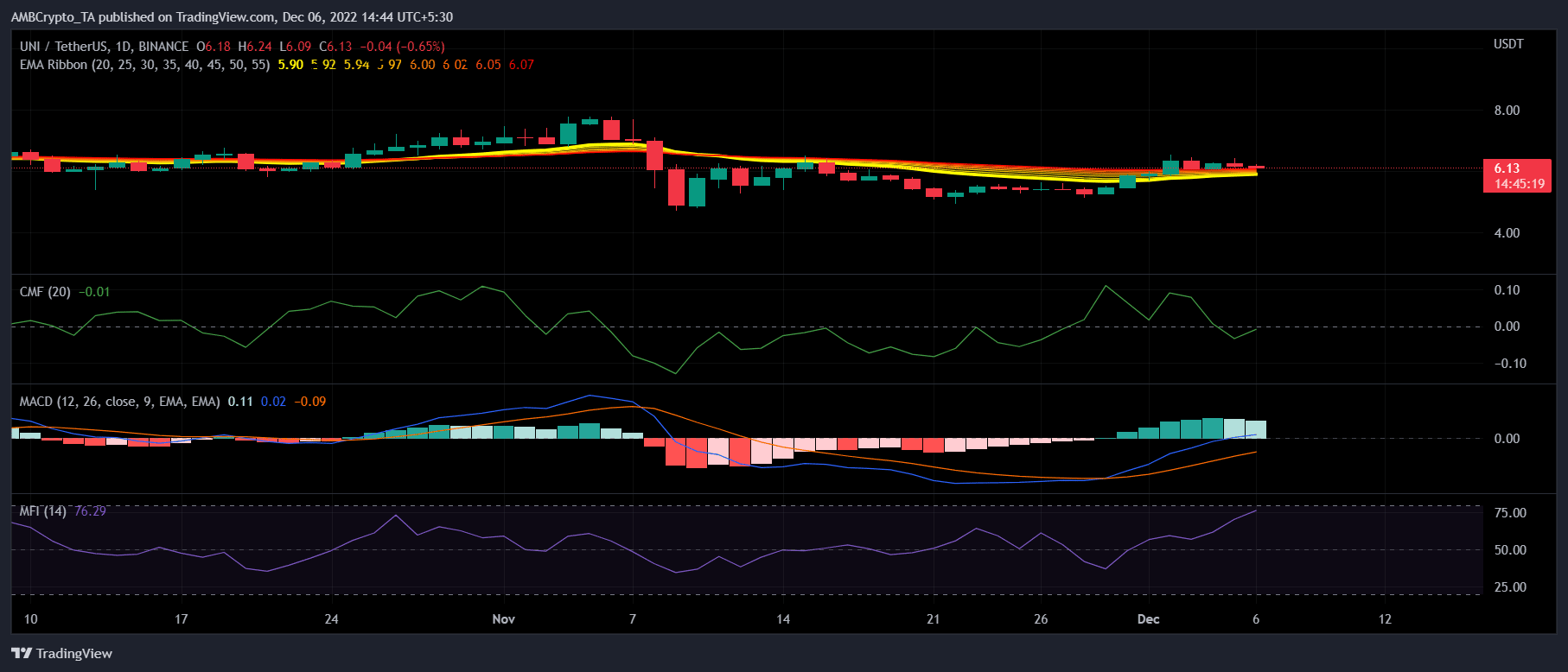

A have a look at UNI’s each day chart revealed that each the bulls and bears had been making an attempt to realize a bonus out there. In accordance with the Exponential Shifting Common (EMA) Ribbon, the 20-day EMA and the 55-day EMA had been struggling to flip one another. The Cash Circulation Index (MFI) was nearly to enter the overbought zone, which could spell hassle.

Nevertheless, the MACD indicated that the bulls had the higher hand available on the market. The Chaikin Cash Circulation’s studying additionally complimented the MACD, because it registered a slight uptick.

Supply: TradingView