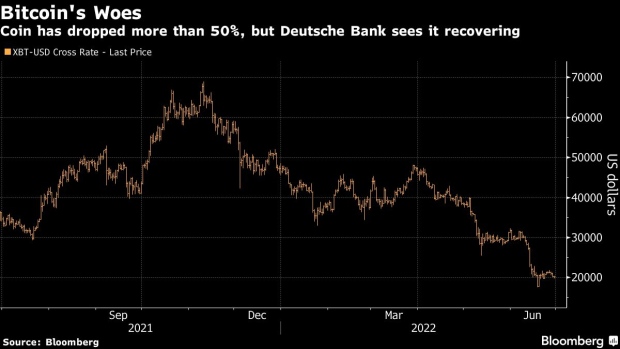

Bitcoin (BTC) Could Pop by the End of 2022, According to Deutsche Bank Analysts – Here’s Their Target

Researchers at Deutsche Financial institution say Bitcoin (BTC) may rise by as a lot as 40% to complete the yr regardless of its months-long shedding streak.

In accordance with a brand new BNN Bloomberg report, Deutsche analysts Marion Laboure and Galina Pozdnyakova notice that Bitcoin’s chart patterns are wanting much like conventional inventory markets.

Their prediction that the S&P 500 will recapture January ranges means BTC might climb again to $28,000.

The analysts add that cryptocurrencies are extra like diamonds than gold, noting the profitable branding carried out by the De Beers company.

“By advertising and marketing an concept somewhat than a product, they constructed a strong basis for the $72 billion-a-year diamond trade, which they’ve dominated for the final eighty years.

What’s true for diamonds, is true for a lot of items and companies, together with Bitcoin.”

Laboure and Pozdnyakova conclude by warning that it’s not assured BTC will rally because of the advanced and non-traditional nature of cryptocurrencies.

“Stabilizing token costs is difficult as a result of there are not any frequent valuation fashions like these throughout the public fairness system. As well as, the crypto market is very fragmented.

The crypto freefall might proceed due to the system’s complexity.”

At time of writing, Bitcoin is down 5.55% over the previous 24 hours, priced at $19,777.

BTC would wish to rally by 41.5% from present ranges to revisit $28,000, a value final seen on June twelfth.

Examine Worth Motion

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Featured Picture: Shutterstock/Phonlamai Picture/Sol Invictus