Bitcoin Plunges Below $27,000, Which Holder Groups Are Selling?

Bitcoin has plunged beneath the $27,000 mark throughout the previous day. Listed below are the market segments which are presumably collaborating on this selloff.

These Bitcoin Traders Have Been Spending Their Cash Lately

In a brand new tweet, the on-chain analytics agency Glassnode has damaged down the costs at which the common cash bought at present had been purchased. Usually, the BTC market is split into two fundamental segments: the long-term holders (LTHs) and the short-term holders (STHs).

The STHs comprise a cohort together with all buyers who acquired their Bitcoin throughout the final 155 days. The LTHs, however, are buyers who’ve been holding for greater than this threshold quantity.

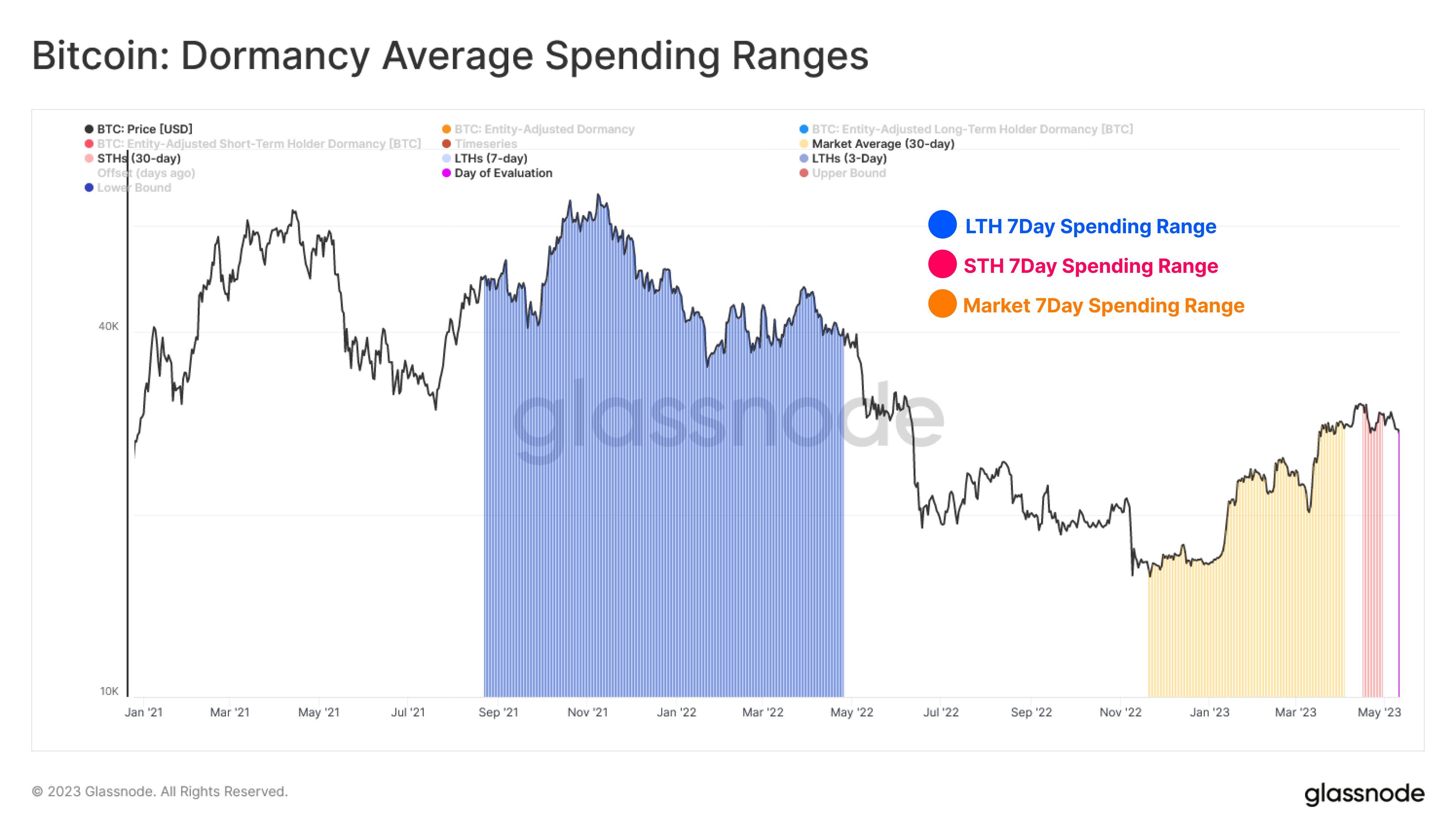

Within the context of the present dialogue, the related indicator is the “dormancy common spending ranges,” which finds out the intervals through which the common cash being spent/transferred by these two teams had been first acquired.

For instance, if the metric exhibits the 7-day spending vary for the LTHs as $20,000 to $30,000, it implies that the cash these buyers bought previously week had been initially purchased at costs on this vary.

Here’s a chart displaying the info for the present 7-day dormancy common spending ranges for the STHs and LTHs, as properly for the mixed market.

The totally different common spending ranges of the principle segments of the sector | Supply: Glassnode on Twitter

The graph exhibits that the 7-day common spending vary for the STHs is kind of near the present costs at $30,400 to $27,300. A few of these sellers purchased at larger costs than these noticed previously week, so that they will need to have been promoting at a loss (though not a very deep one).

The indicator places the LTHs’ acquisition vary at $67,600 to $35,000. As highlighted within the chart, the timeframe of those purchases included the lead-up to the November 2021 value all-time excessive, the highest itself, and the interval when the decline in direction of the bear market first began.

It could seem that these holders who purchased on the excessive bull market costs have budged due to the strain the cryptocurrency has been underneath these days and have lastly determined to take their losses and transfer on.

Usually, the longer an investor holds onto their cash, the much less possible they turn out to be to promote at any level. This is able to maybe clarify why the acquisition timeframe of the present STHs is so latest; the fickle ones are those that have solely been holding a short time.

For the BTC LTHs, nonetheless, the possible motive why the acquisition interval of the common vendor from this group is up to now again, quite than nearer to 155 days in the past (the cutoff of the youngest LTHs), is that a whole lot of the youthful LTHs could be in earnings at present as they purchased throughout the decrease, bear-market costs.

As such, the Bitcoin buyers extra more likely to waver of their conviction proper now could be these holding essentially the most extreme losses, the 2021 bull run prime consumers.

The chart additionally contains the 7-day common spending vary for the mixed BTC sector, and as one could anticipate, this vary lies in the course of the 2 cohorts ($15,800 to $28,500), however the timeframe is nearer to the STHs, as a whole lot of the sellers are certain to be latest consumers.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,300, down 10% within the final week.

Seems to be like BTC has taken a plunge throughout the previous day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com