Bitcoin Investors Lock in Over $7,325,000,000 in Losses Amid Three Days of Deep Capitulation: Glassnode

Crypto analytics agency Glassnode finds that over half one million Bitcoin (BTC) had been offered at a loss as panic sweeps throughout the digital asset panorama.

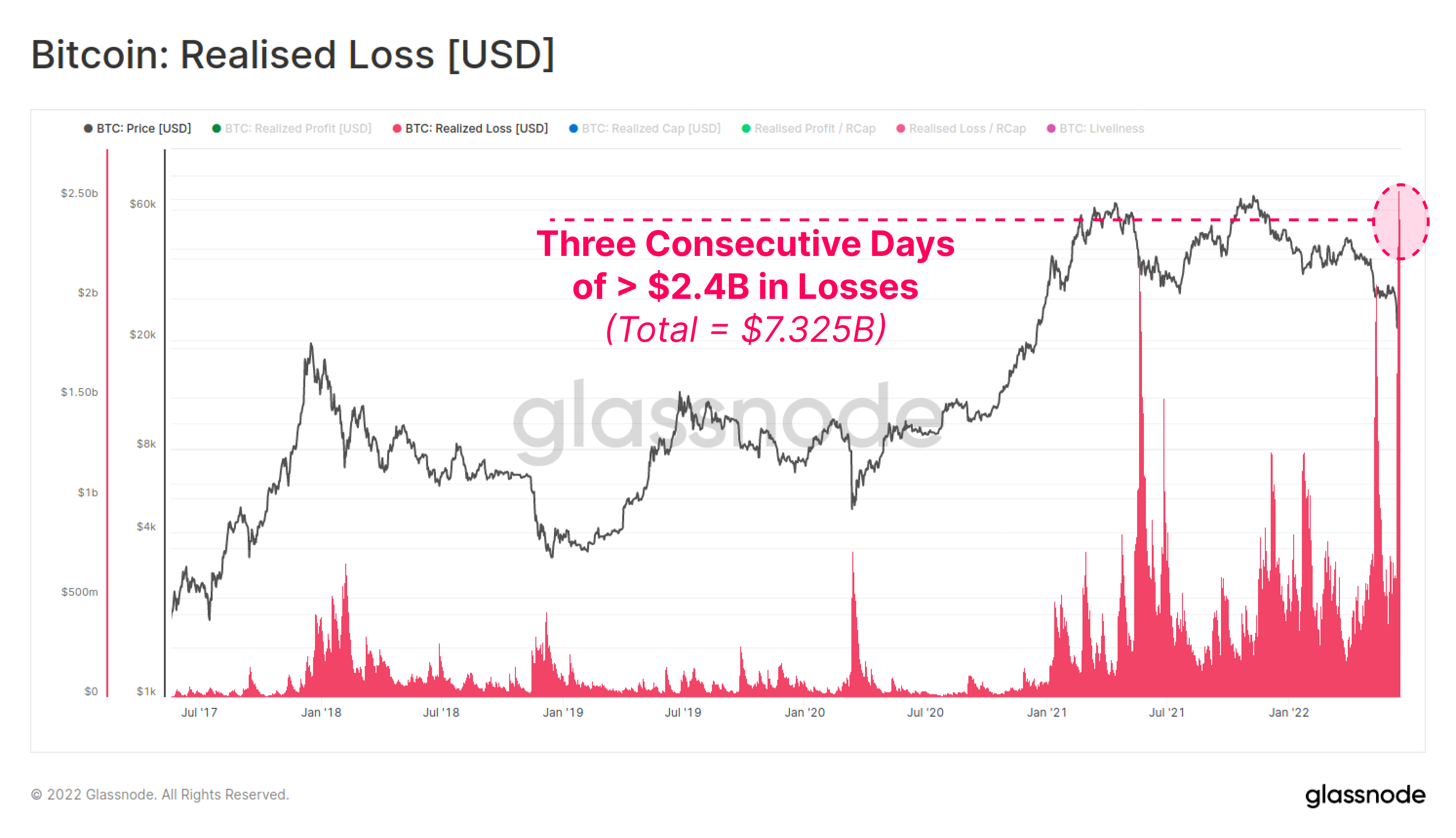

In a brand new detailed evaluation, Glassnode says that over a three-day interval, Bitcoin sellers racked up greater than $7.32 billion in losses as they scurried to the exits whereas unloading 555,000 BTC within the $18,000 to $23,000 value vary.

“The final three consecutive days have been the biggest USD [US dollar] denominated realized loss in Bitcoin historical past. Over $7.325 billion in BTC losses have been locked in by traders spending cash that had been accrued at greater costs.”

The agency goes on to note that many long-term holders (LTHs) additionally selected to unload BTC that had sat dormant for over a yr at a tempo of 20,000 to 36,000 Bitcoin per day final week.

Glassnode additionally highlights that some traders who purchased in at Bitcoin’s November 2021 all-time excessive (ATH) of $69,000 opted to promote at a staggering 75% loss.

“Investigating the revenue and loss by long-term holders sending cash to exchanges, we will see a deep capitulation befell.

A couple of Bitcoin LTHs even purchased the $69,000 high, and offered the $18,000 backside, locking in -75% losses. Whole LTH losses 0.0125% of market cap per day.”

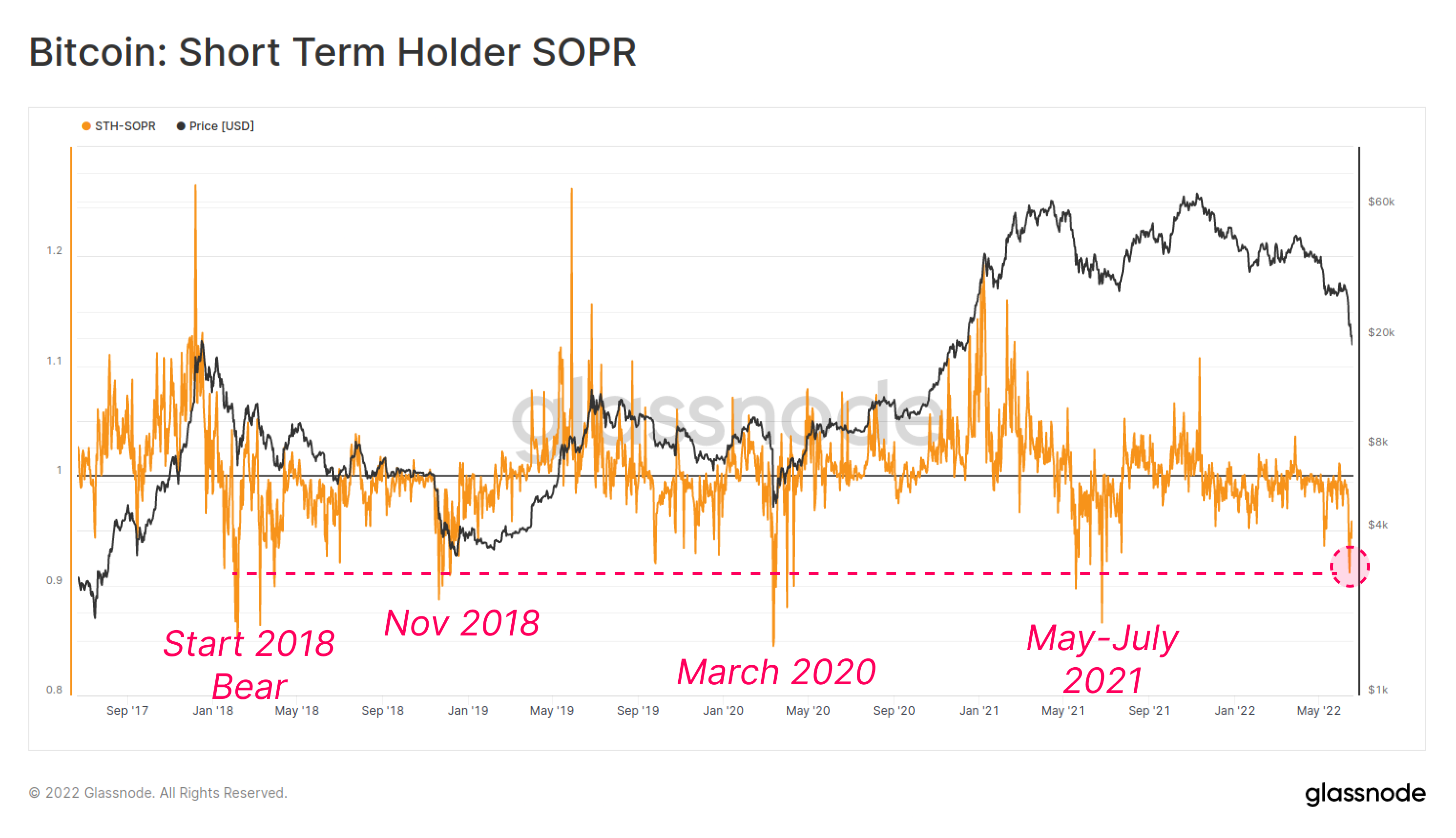

On the subject of the “ache” or losses felt by short-term holders (STH) capitulating, Glassnode reveals that solely three earlier cases had been worse: first firstly of the 2018 bear market, adopted by March 2020 and from Could to July of final yr.

The agency adds virtually all wallets in possession of Bitcoin additionally “maintain large unrealized losses,” with house owners of between 1 BTC and 100 BTC looking at an unrealized loss equal to 30% of Bitcoin’s market cap.

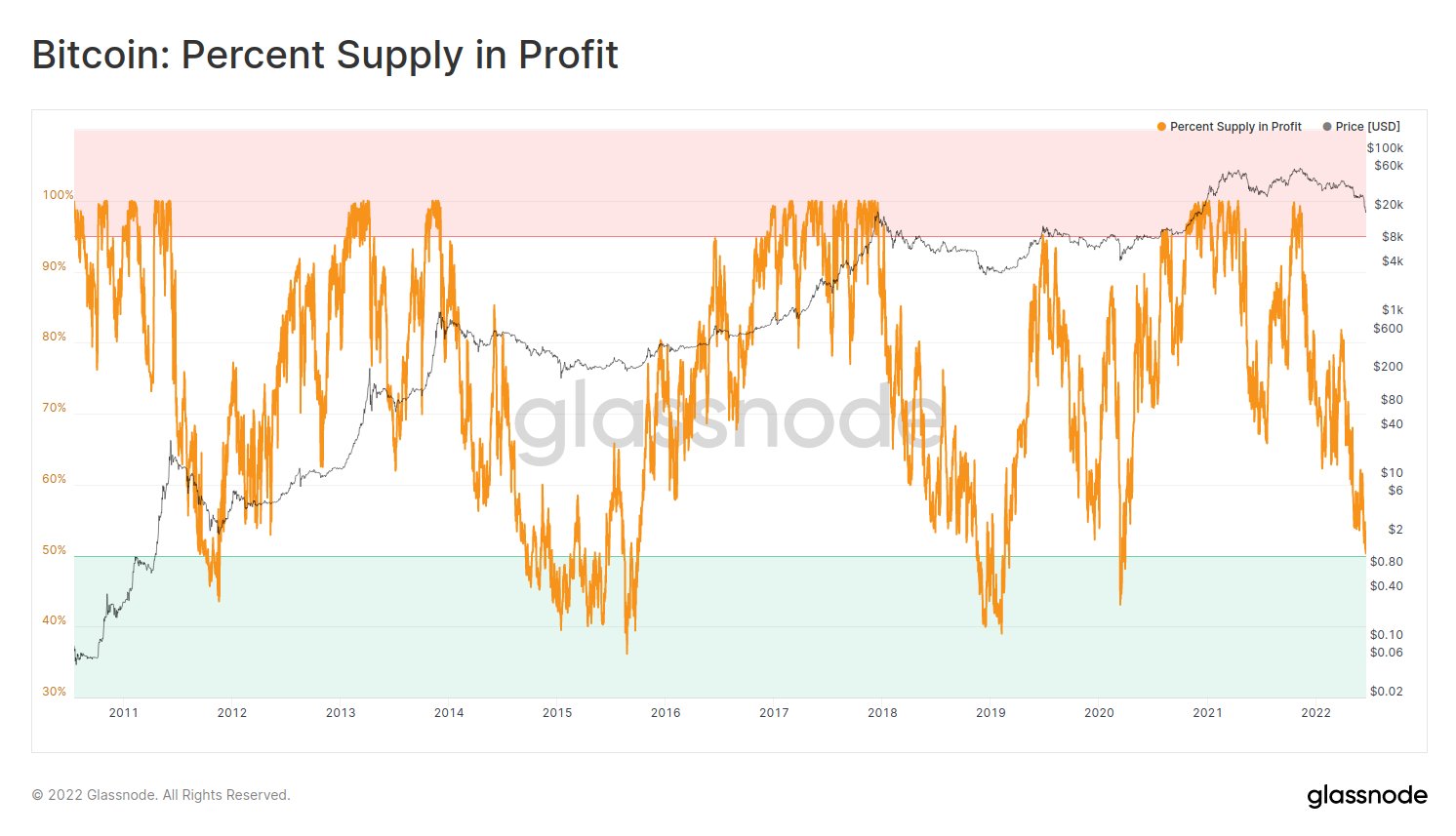

Glassnode concludes its BTC evaluation by declaring that lower than half of the Bitcoin provide was within the inexperienced, which traditionally coincides with cycle bottoms.

“We will see that as costs hit the $17,700 lows yesterday, simply 49% of the BTC provide was in revenue.

Historic bear markets have bottomed and consolidated with between 40% and 50% of provide in revenue.

Bitcoin investor conviction is significantly being put to the check.”

At time of writing, Bitcoin is up from its weekend lows and at the moment buying and selling sideways with a price ticket of $20,326.

Examine Worth Motion

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Sergej Razvodovskij/Nikelser Kate