Bitcoin Futures Market Now Flashing Historically Bullish Signal, According to Crypto Analytics Firm IntoTheBlock

A number one analytics agency says that the Bitcoin (BTC) futures market is flashing a studying that has beforehand marked market bottoms.

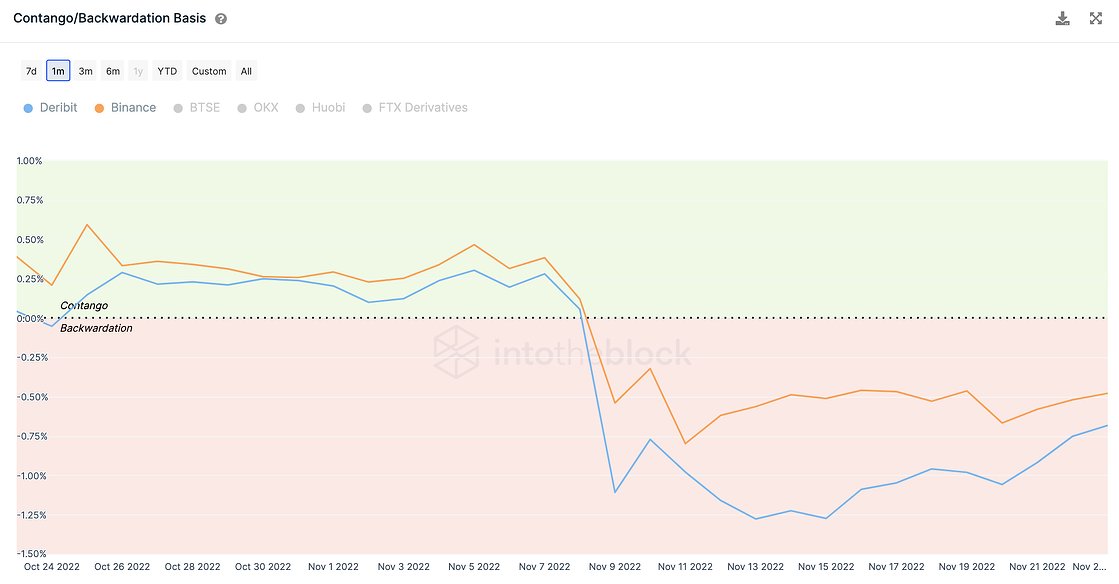

IntoTheBlock reveals that Bitcoin is witnessing steep backwardation, a situation the place BTC futures contracts are priced considerably decrease than the worth of the king crypto in spot markets.

In keeping with the analytics agency, backwardation signifies excessive promoting strain for Bitcoin within the final two weeks.

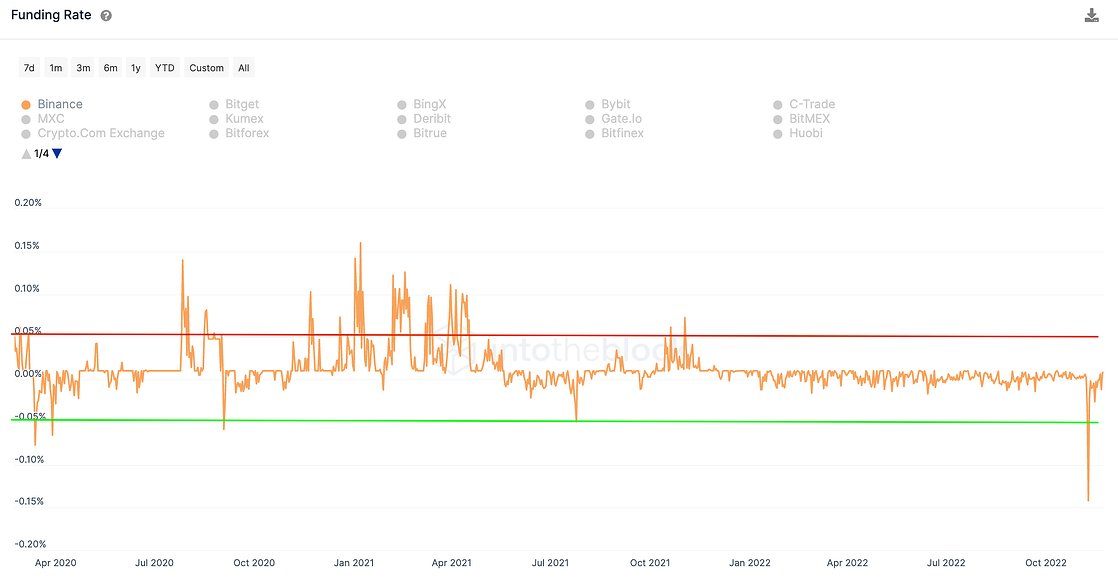

IntoTheBlock provides that whereas the futures markets are in backwardation, funding charges for Bitcoin are at the moment in extremely damaging territory, indicating that merchants are closely shorting BTC, or betting that the king crypto’s worth will proceed to go down.

Merchants are inclined to be aware of extraordinarily damaging funding charges because it primes the marketplace for a brief squeeze.

A brief squeeze takes place when market contributors who borrow items of an asset at a sure worth in hopes of promoting them for a lower cost to pocket the distinction are compelled to purchase property again because the commerce strikes towards their bias.

Explains the analytics agency,

“Instances the place futures contracts are in backwardation are inclined to align with market bottoms, as occurred in March 2020 and Might 2021. An analogous development could be noticed with extremely damaging funding charges. Is Bitcoin bottoming?”

At time of writing, Bitcoin is altering fingers for $16,610, up almost 7% from its 2022 low of $15,546.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Alexander56891/Sensvector