Bitcoin Fundamentals Wanes Ahead Of FOMC; Wall Street Estimates

Bitcoin worth holds above $28,000 as merchants speculate whether or not extra upside momentum nonetheless exists. Traders are awaiting the essential price hike determination by the U.S. Federal Reserve after the FOMC assembly on Wednesday amid the banking disaster within the U.S.

The CME FedWatch Tool signifies there’s an 18.1% likelihood of no price hike by the Fed and an 81.9% likelihood for a 25 bps price hike. Furthermore, the Crypto Fear & Greed Index has hit a 16-month excessive of 68, with the market sentiment at the moment within the ‘Greed‘ zone.

Bitcoin Fundamentals Shifting Forward of FOMC

Huge Bitcoin rally within the final two weeks pushed BTC worth to hit over $28,000 after 9 months. Nevertheless, the basics are altering forward of the FOMC price hike determination.

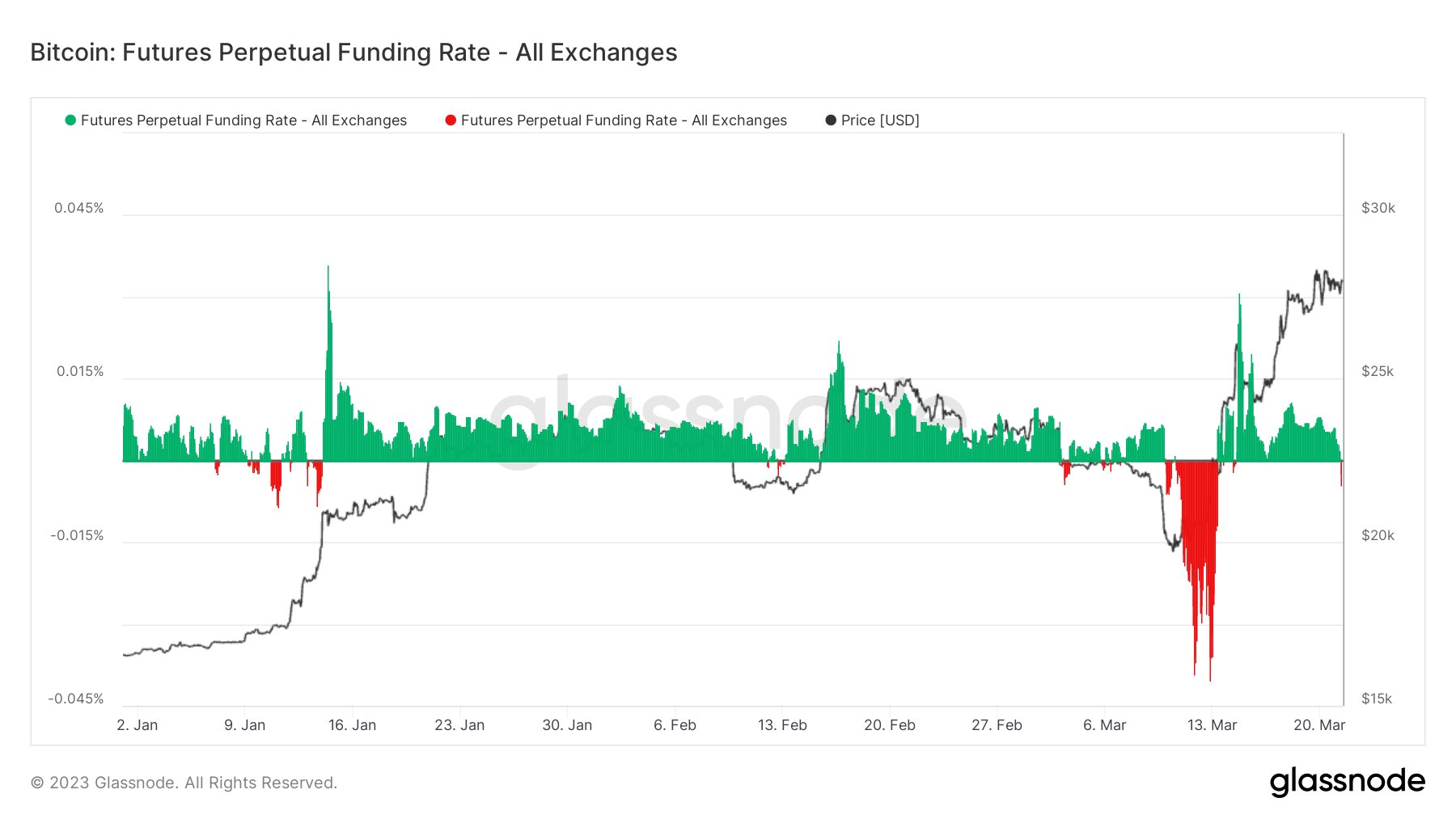

Bitcoin futures perpetual funding price simply turned adverse for the primary time in per week as merchants speculate whether or not a correction is coming subsequent. Bearish sentiment forward of the essential FOMC price hike will probably trigger Bitcoin worth to fall under $27,000 once more.

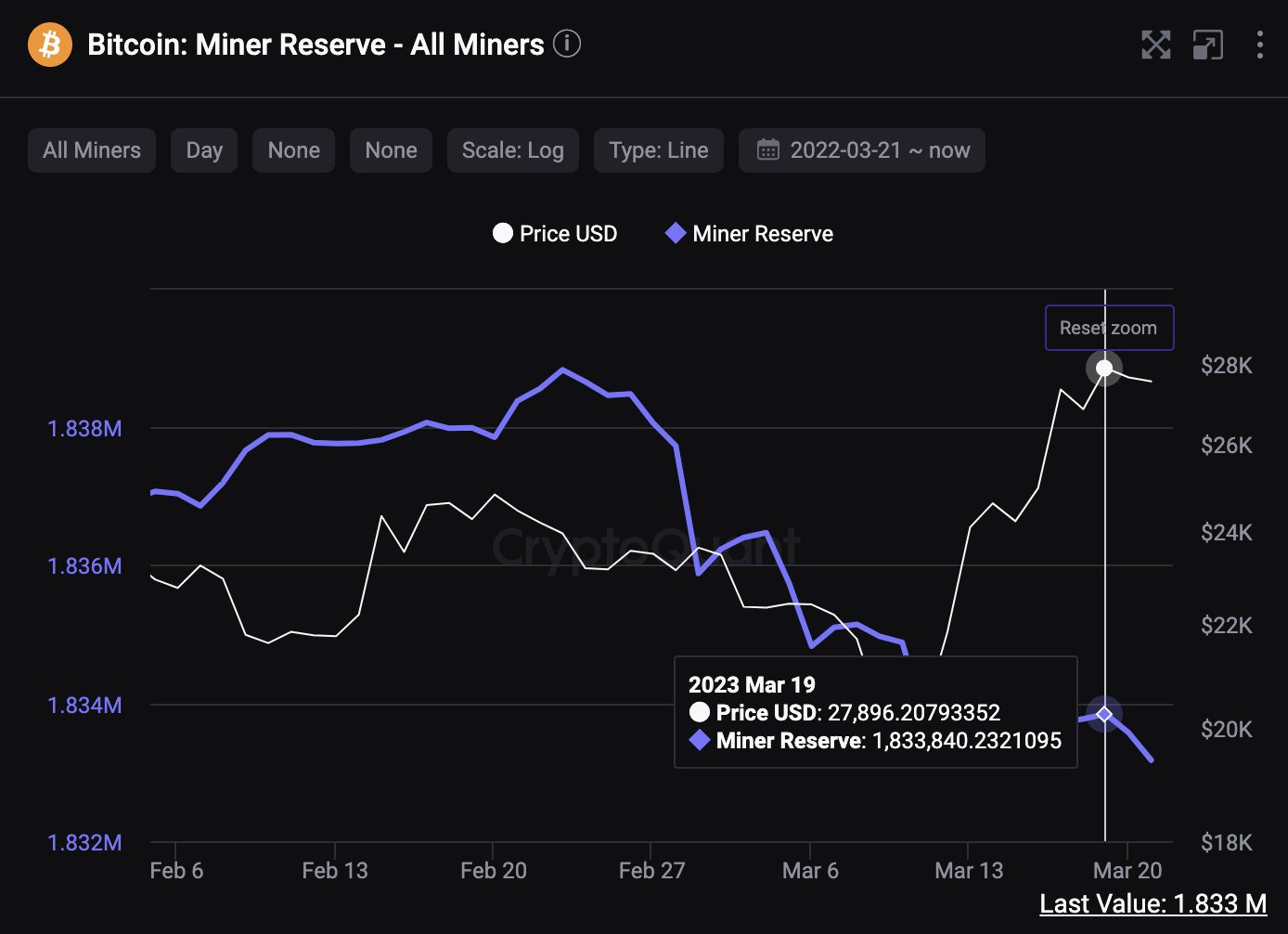

In the meantime, the dump on BTC dominance is making a spike in altcoins, with Ethereum and XRP leaping 3% and 5% in simply an hour, respectively. Furthermore, miner reserves dropped by 668 BTC within the final 48 hours, which means that miners have bought round $18,370,000 price of BTC.

Wall Avenue Estimates On Fed Price Hike

Tesla CEO Elon Musk, economist Peter Schiff, and billionaire Invoice Ackman have warned the U.S. Fed and FDIC of worsening banking disaster and market circumstances if the central financial institution decides to proceed price hikes. Invoice Ackman believes the Fed ought to pause, whereas Elon Musk replied “Fed must drop the speed by no less than 50bps on Wednesday.”

For the primary time in a few years, Wall Avenue giants have given combined estimates on the Fed price hike. Barclays, Credit score Suisse, and Goldman Sachs now not count on the Fed to hike charges in March. In the meantime, Bloomberg, JP Morgan, Morgan Stanley, BMO, and Citi estimate a 25 bps price hike.

Additionally Learn: LUNC Information: Developer Edward Kim Hints At Terra Luna Traditional Turning into AI Chain