Binance’s CZ and Ethereum’s Vitalik agree on new idea as BNB remains stagnant

- Binance’s CEO shared an answer to assist keep away from exchanges utilizing buyer funds as offered by Vitalik Buterin

- BNB continues to prevail in static positions, in accordance with its on-chain info

The CEO of Binance, CZ, agreed with Vitalik Buterin that Centralized Exchanges (CEXes) wanted to provide public proof displaying consumer security. In fact, CZ had initially pushed the Proof-of-Reserves thought in response to the calamity that befell FTX customers, with a number of exchanges adopting the mannequin.

Nonetheless, Ethereum’s [ETH] co-founder proposed that the mannequin may very well be improved, with CZ confirming that the trade staff may implement the concept.

I do not perceive all of the equations in there both. Our staff says we’ll implement it and make it open-source, for the business.

— CZ 🔶 Binance (@cz_binance) November 19, 2022

Learn BNB’s worth prediction 2023-2024

Get able to show solvency

Vitalik, in his submit published through HackMD, famous that it was extra vital for exchanges to show solvency than sticking with reserves information alone. In line with the ETH founder, it was higher for the crypto sector to have its personal technique as an alternative of relying on fiat-backed methods.

Defending his place, he referred to the power of zk-SNARKs to assist with the design, because the cryptographic expertise may present robustness and privateness to the ecosystem. Vitalik additionally famous that the system may drive centralized exchanges into turning into non-custodial platforms. He stated,

“Sooner or later, we might also see cryptographically ‘constrained’ CEXes the place consumer funds are held in one thing like a validium sensible contract. We might also see half-custodial exchanges the place we belief them with fiat however not cryptocurrency.”

Stalemate in Binance Coin kingdom

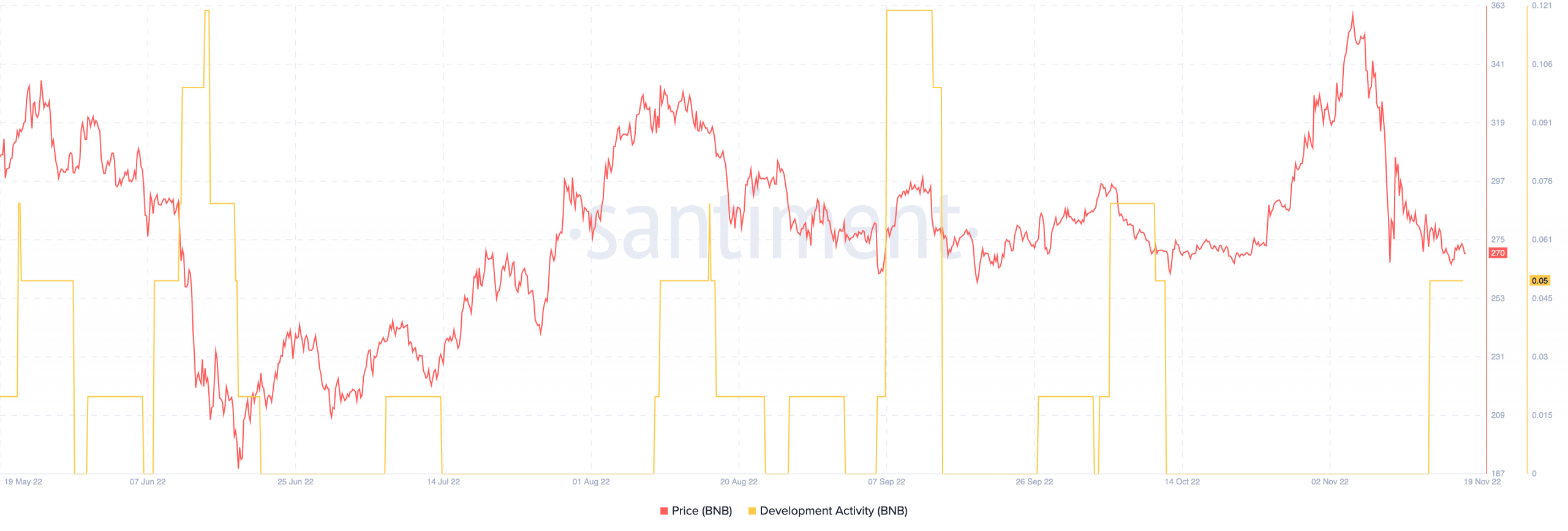

Whatever the growth, Binance Coin [BNB] most well-liked to stay at a standstill. At press time, the trade coin was buying and selling at $270, in accordance with information by Santiment. This worth represented a 0.40% decline within the final 24 hours.

Nonetheless, BNB’s growth exercise didn’t react to the replace instantly because it additionally hung around the identical spot since 14 November. At 0.05, the event exercise worth confirmed that the Binance chain had not seen main upgrades lately.

Supply: Santiment

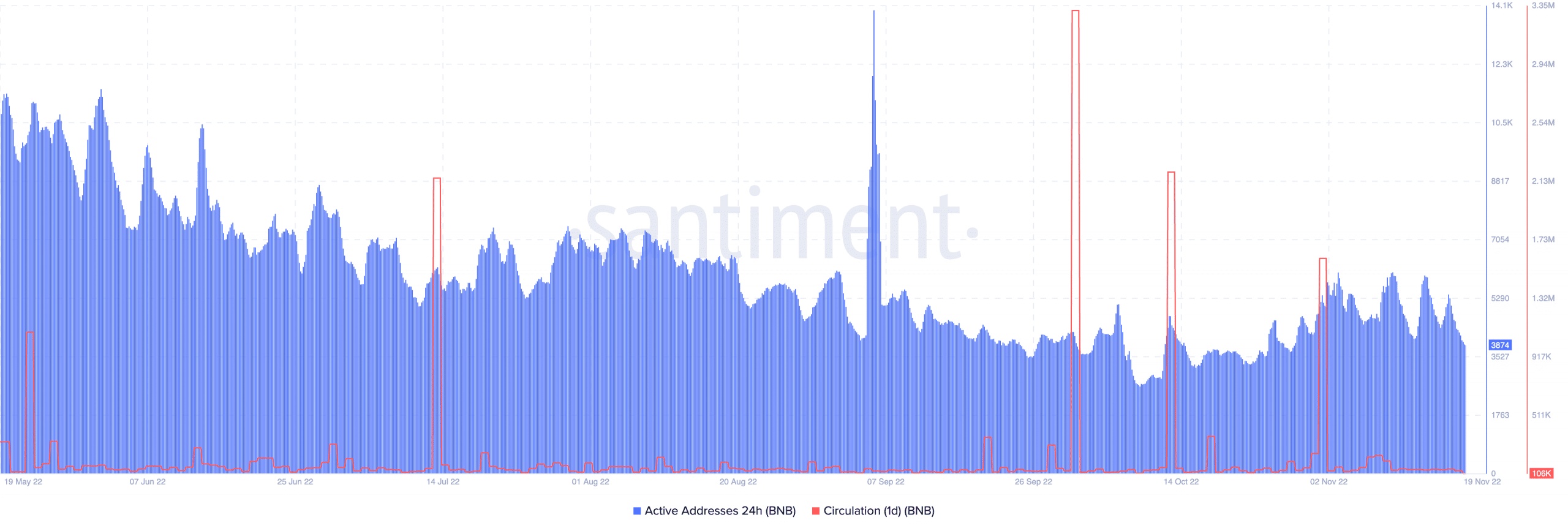

As well as, the 24-hour lively addresses appeared in unison with the abovementioned metrics. In line with Santiment, the on-chain status of BNB’s lively addresses was 3874. As of this writing, the rely was extraordinarily near the data of 18 November.

Though it was a decline, the standing implied that the distinctive deposit on the BNB chain had mildly decreased. With the one-day circulation in an identical place at 106,000, addresses on the chain additionally resorted to fewer transactions.

Supply: Santiment

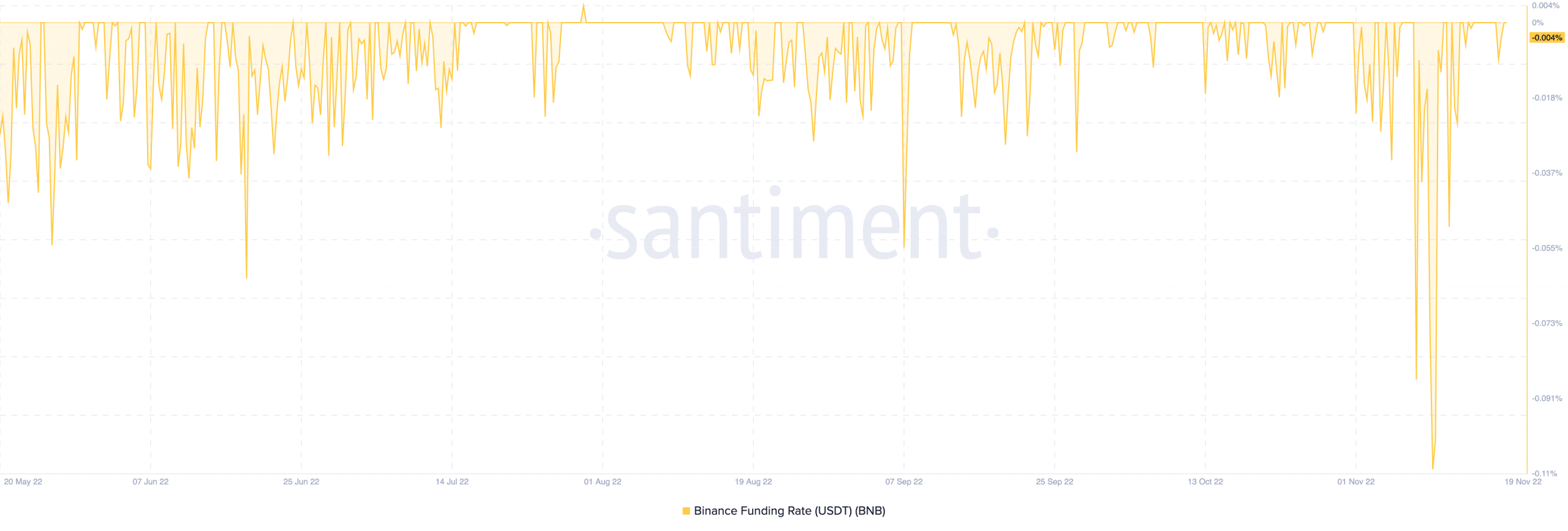

As for its situation within the derivatives market, BNB was not in a spectacular place. This was due to the Binance funding rate which had decreased to -0.004% at press time. This meant that futures and choices merchants had not reignited their curiosity within the coin. Therefore, it will additionally end in low volumes available in the market.

Regardless of the stagnant place of BNB, Vitalik reiterated the long-term goal was for CEXes to operate in a non-custodial method. CZ agreed in accordance.

Supply: Santiment