Binance’s Bitcoin, Ethereum, Stablecoins Netflow Reveals Stability Despite US CFTC Suit

The world’s largest crypto trade Binance and CEO “CZ” was accused of violating crypto buying and selling and derivatives guidelines in a lawsuit filed by the U.S. Commodity Futures Buying and selling Fee (CFTC). This raised the degrees of FUD concerning Binance amid heightened scrutiny and crypto regulatory crackdowns following the collapse of FTX.

On-chain knowledge agency CryptoQuant in a report shared an evaluation of Binance’s well being after the U.S. CFTC lawsuit. A comparative evaluation of Bitcoin, Ethereum, and stablecoin netflows and reserves throughout regulatory FUD after FTX collapse, BUSD crackdown, and the CFTC lawsuit was assessed.

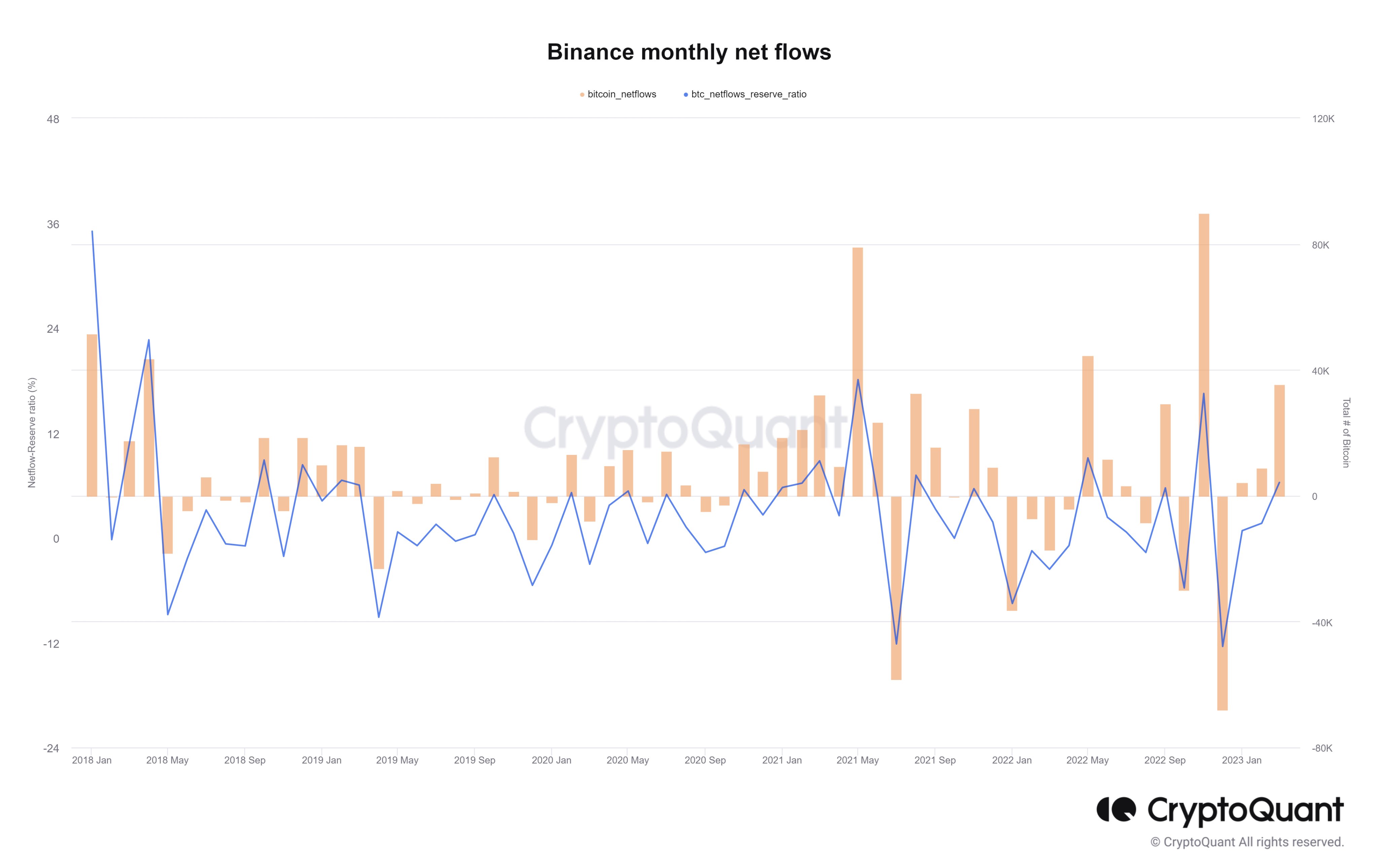

Through the regulatory FUD after the FTX disaster in December, Binance recorded the best web outflows of 40,353 BTC on December 12. Additionally, the trade recorded a complete web outflow of 78,744 BTC between December 10-16.

In the meantime, Binance witnessed the most important each day web outflow of 5,027 BTC on February 12 throughout the BUSD FUD and a each day web outflow of 4,505 BTC after the CFTC lawsuit. Thus, the latest Bitcoin outflow is comparatively low as in comparison with the sooner occasions.

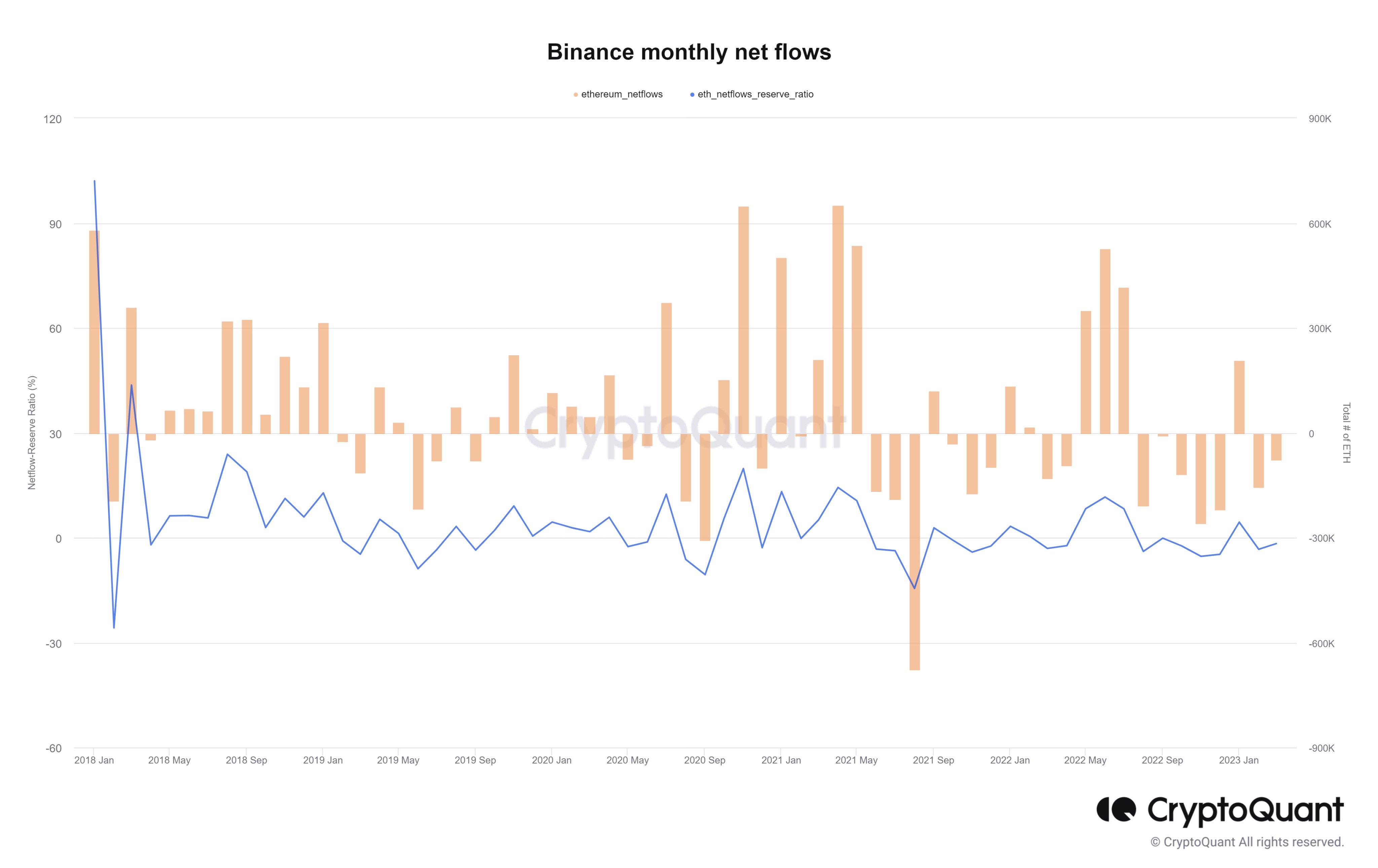

Ethereum web outflows knowledge is much like Bitcoin outflows, with the full web outflows persevering with to say no. Through the regulatory FUD, Binance recorded the best each day web outflow of 278k ETH on December 12. The each day web outflow of 79,706 ETH and 76,146 ETH occurred after BUSD FUD and the CFTC lawsuit, respectively. CryptoQuant famous Internet Movement-Reserve Ratio metric signifies web flows have remained inside historic ranges.

Within the case of stablecoins, on-chain knowledge reveals web outflows of $871 million, a daily-high outflow of $671 million in February. Nevertheless, Binance recorded whole web outflows of $1 billion for the reason that CFTC lawsuit.

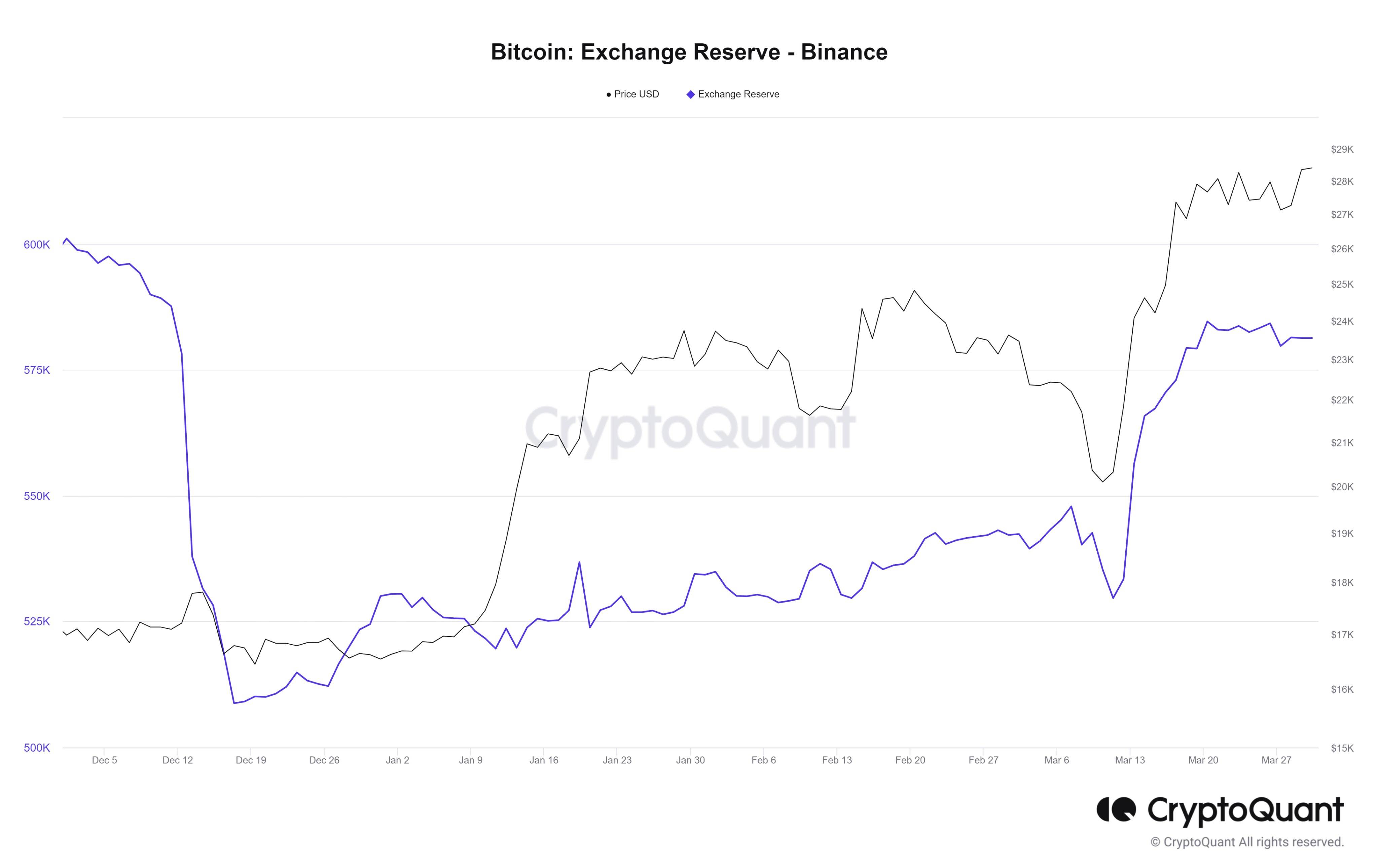

Binance’s Bitcoin (BTC) and Ethereum (ETH) reserves remained at “wholesome” ranges, with reserves rising from December ranges. BTC reserves elevated from 509k in December 2022 to 581k at present. ETH reserves elevated to 4.487 million from 4.420 million in December. Furthermore, Alternate to Alternate Flows knowledge reveals buyers nonetheless take into account Binance as a reliable and fascinating trade.

Additionally Learn: Montenegro Court docket Rejects Do Kwon’s Attraction; Terra’s Daniel Shin Arrest Reviewed

Bitcoin Worth Rises Above $29K Amid CFTC Go well with In opposition to Binance

Bitcoin value in the present day jumped over $29K briefly to hit a excessive of $29,159. Presently, the BTC value trades at $28,570 amid optimistic sentiment available in the market. Traders consider Bitcoin will rise above $30K to maneuver swiftly to $35,000 quickly.

Ethereum value can be buying and selling above $1800 after the broader crypto market restoration on Wednesday.

Additionally Learn: Bitcoin Worth Jumps 4% Defying Consolidation, Key Help and Resistance Ranges