Binance Coin: How buyers can leverage BNB’s volatility to remain profitable

Disclaimer: The findings of the next evaluation are the only opinions of the author and shouldn’t be thought of funding recommendation.

- BNB witnessed a bullish risky break on its every day chart.

- Alternatively, the crypto’s social dominance and funding charges marked a decline.

Since dropping in direction of its multi-yearly lows in mid-June, Binance coin [BNB] regained bullish momentum to check its 11-month trendline help (earlier resistance) (white, dashed).

Right here’s AMBCrypto’s value prediction for Binance Coin [BNB] for 2023-24

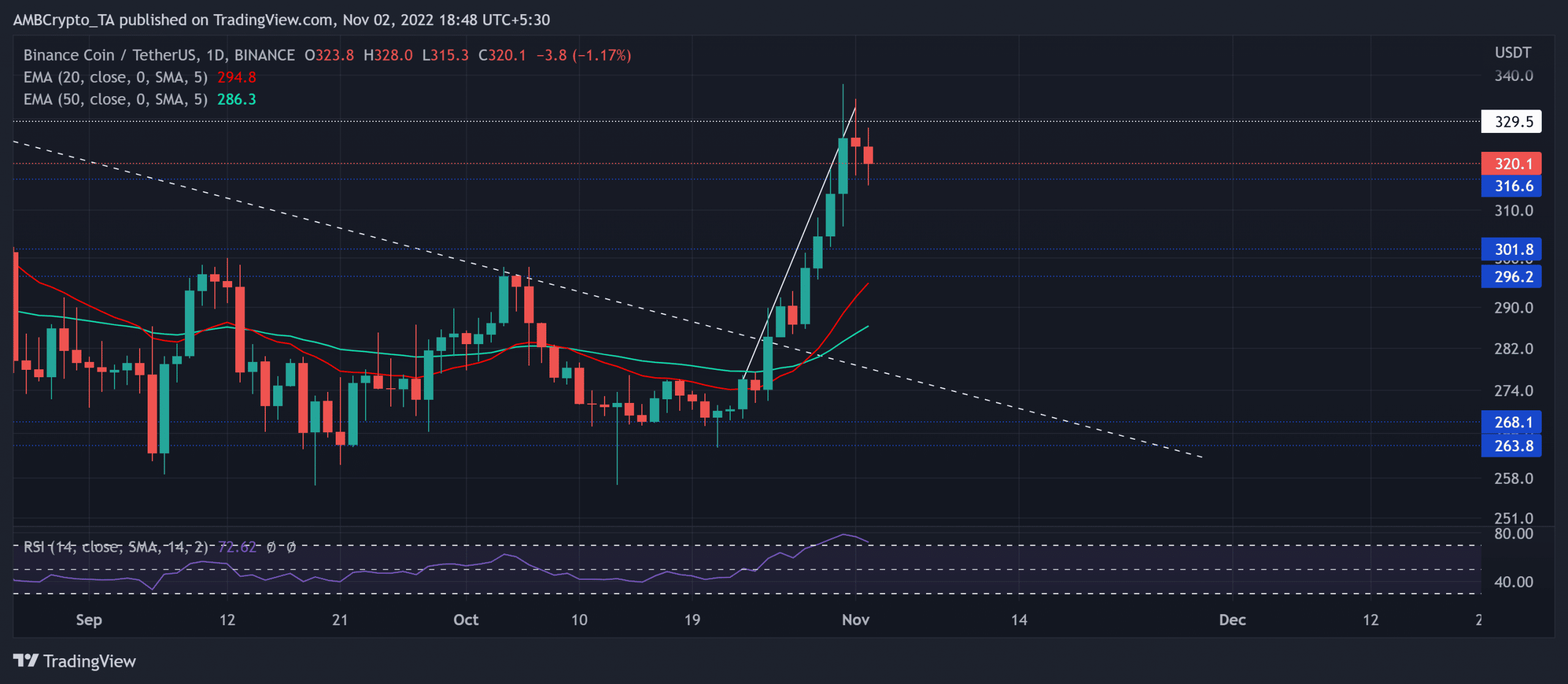

Following the footsteps of the king coin and most altcoins, BNB struggled to interrupt right into a excessive volatility section till not too long ago. With the patrons inducing a steep uptrend during the last two days above the 20/50/200 EMA, bulls would attempt to take care of their edge within the coming classes. At press time, BNB was buying and selling at $320.1.

BNB witnessed a bullish risky transfer

Supply: TradingView, BNB/USDT

Whereas the alt undertook a sideways observe for practically two months, the patrons lastly discovered a dependable break above the $296 zone. The bull run earlier than this break stemmed from a bullish hammer on the $268 baseline in late October.

The ensuing reversal led to an over 20% progress till the patrons confronted obstacles within the $329 zone.

Furthermore, in the course of the current positive factors, the 20 EMA (purple) jumped above the 50 EMA (cyan) to disclose an elevated bullish vigor. Ought to the rapid ceiling propel a agency reversal and the present candlestick shut as purple, BNB may witness a night star sample on its every day chart.

The ensuing final result would expose the alt to a possible check of the $316 mark. An in depth beneath this mark can induce additional losses.

Alternatively, a probable bounce-back from this help can set the stage for a reversal rally. Any potential rebound above the $329 ceiling may see its first main testing degree on the $355 area.

To enter a protracted place, the patrons should await a convincing rebound from its present decline. The Relative Power Index (RSI) entered the overbought area and hinted at a risk of a reversal within the coming classes.

Decreased Social Dominance & Funding charges

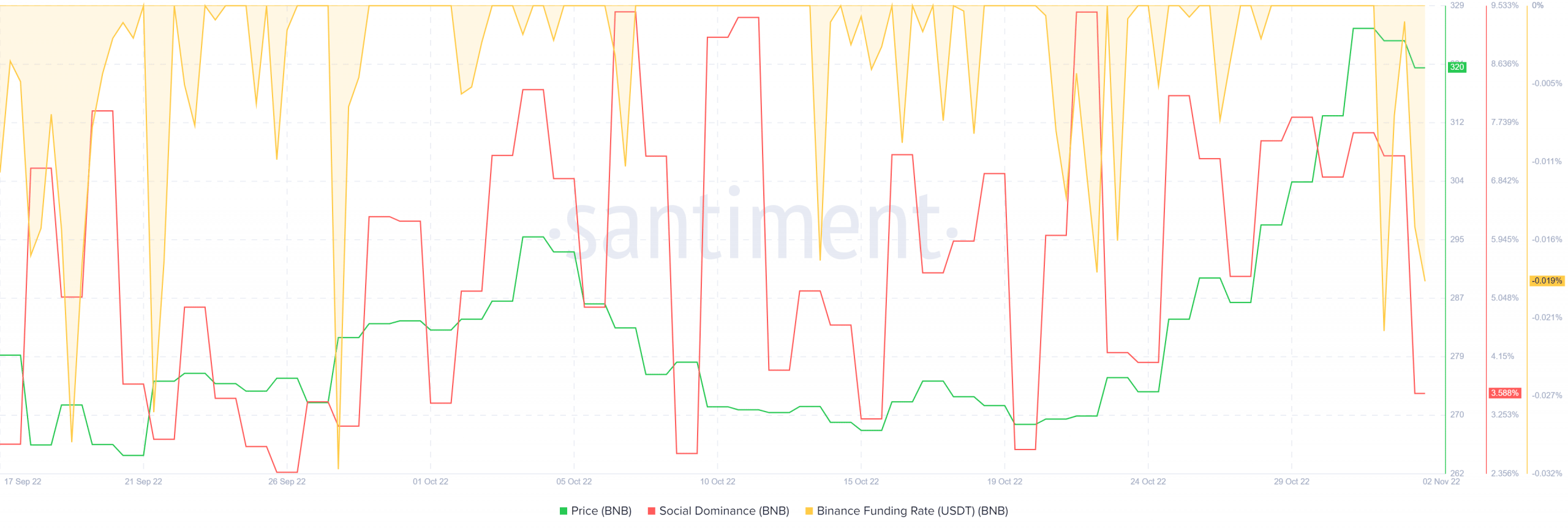

Supply: Santiment

Over the previous two days, BNB’s social dominance marked a pointy plunge. Empirically, the worth motion has been fairly delicate to this metric. Ought to the worth observe, BNB may see a pullback within the coming classes.

To high it up, an evaluation of the BNB Funding charges marked a sturdy plunge during the last two days. This studying advised a slight bearish inclination within the futures market.

Lastly, buyers/merchants should preserve an in depth eye on Bitcoin’s motion as BNB shares a comparatively excessive correlation with the king coin.