Betting on AVAX’s short-term bullish MACD crossover? Read this first

- AVAX posted a short-term bullish MACD crossover

- It confronted key resistance on the 38.2% Fib degree ($13.506387) and will see a decline to $13.4181897

- A decline in optimistic sentiment and growth exercise might undermine the bulls’ upside momentum

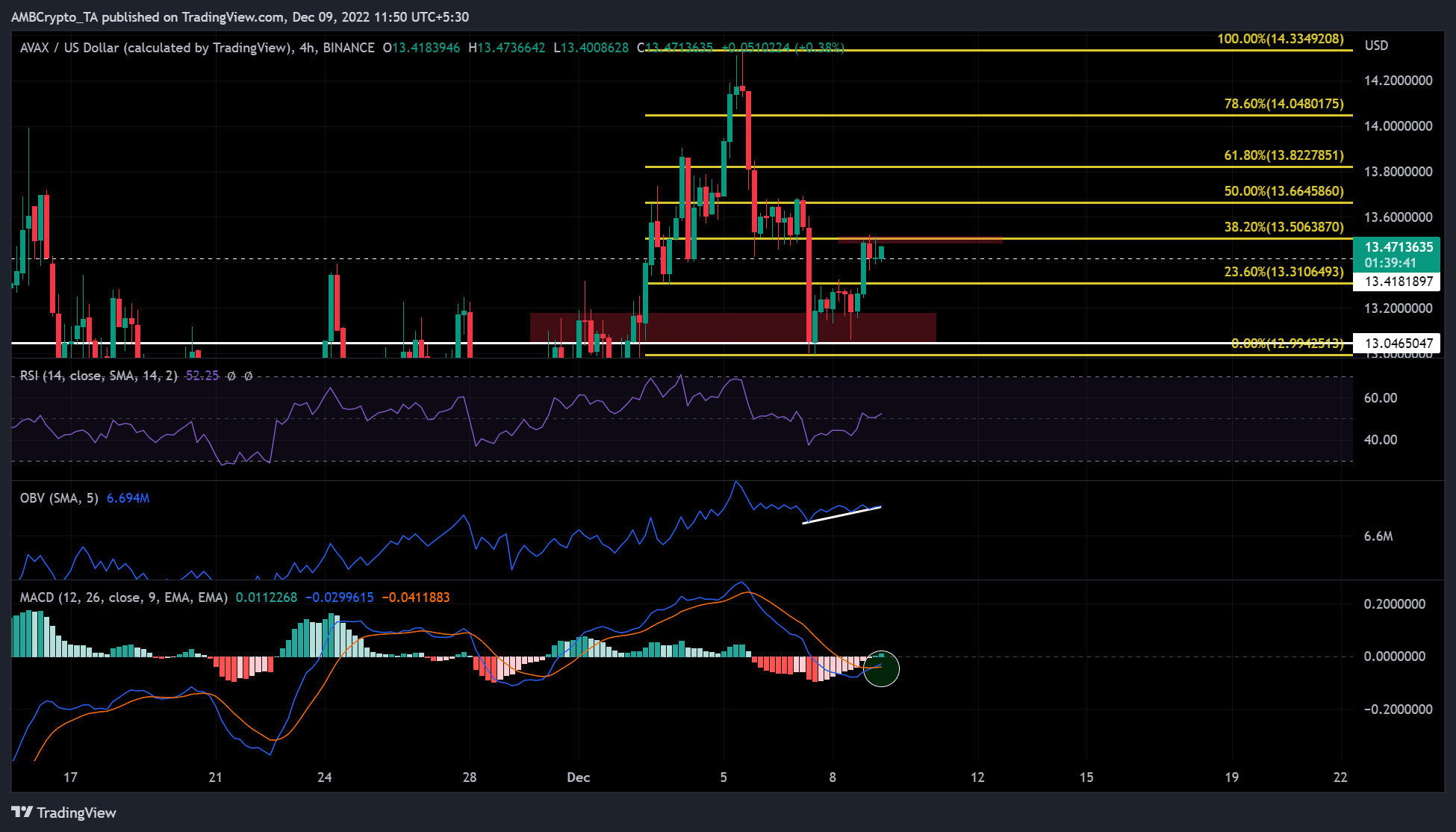

At press time, Avalanche [AVAX] was buying and selling at $13.4713635 and gave the impression to be on the verge of breaking the 38.2% Fib degree. Nevertheless, AVAX traders needs to be cautious, as the present resistance additionally acted as a bearish order blockade.

Though the present resistance has already been examined 3 times, the bearish outlook coming from the on-chain metrics, corresponding to adverse sentiment, might undermine the continuing upward stress. Subsequently, AVAX might see a value correction to $13.4181897 or under.

Will AVAX bulls break the bearish order block on the 38.2% Fib degree?

Supply: AVAXUSDT on TradingView

On the time of writing, AVAX’s bulls appeared buoyed by BTC’s recapture of the $17K degree. The bulls additionally recaptured the $13.26 degree and have been decided to interrupt the present resistance on the 38.2% Fib retracement degree.

Nevertheless, from the attitude of technical indicators, it’s not clear whether or not the bulls of AVAX can overcome the present resistance degree.

The on-balance quantity (OBV) has been steadily rising, displaying that buying and selling quantity and shopping for stress have elevated not too long ago. The bullish MACD crossover confirms the development noticed on the four-hour chart.

As well as, the Relative Power Index (RSI) has pulled again from the low vary and is hovering above the impartial level. This exhibits that purchasing stress has been steadily rising, giving consumers leverage.

Nevertheless, the RSI was at 52, solely two models above impartial. So, the consumers weren’t fairly in management and will simply face important resistance from the sellers. Subsequently, a convincing breakout above the 38.2% Fib degree space might be a significant problem.

Given the bearish outlook for AVAX primarily based on the on-chain metrics (see under), AVAX might fall again to present assist and the bullish order block at $13.4181897 or under.

Nevertheless, a break above the present resistance degree would invalidate the above bias. In such a case, AVAX might goal a brand new resistance degree on the 50% Fib degree ($13.6645860).

Avalanche witnessed a drop in growth exercise and weighted sentiment

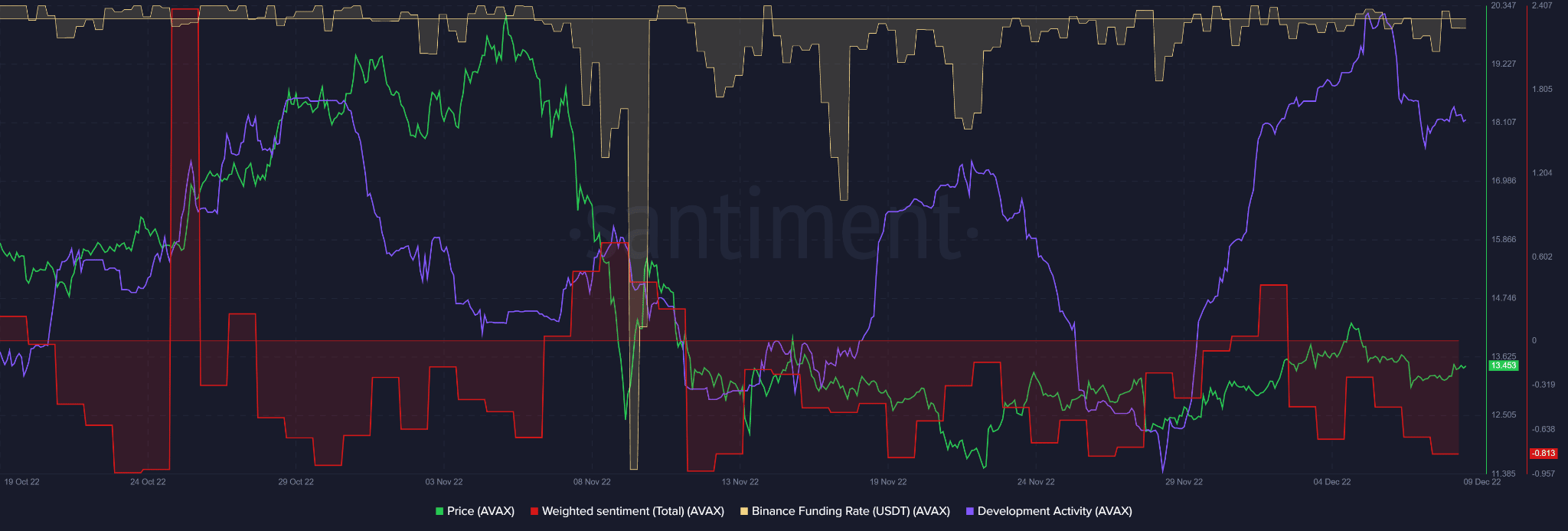

Supply: Santiment

In accordance with knowledge by Santiment, AVAX noticed a slight decline in growth exercise. As well as, the weighted sentiment for the asset additionally slipped deeper into adverse territory. This exhibits that the market outlook for AVAX within the spot market was bearish.

The identical outlook was echoed within the futures market. On the time of publication, the Binance Funding Price for the USDT/AVAX pair additionally made a turnaround from optimistic to adverse territory.

Subsequently, on the time of this text’s publication, AVAX’s rise might be short-lived, and a value correction might comply with. If the construction favors the bears, they may simply drop AVAX to $13.4181897 or under.

Nevertheless, if BTC maintains an uptrend above $17k, AVAX might break by means of present resistance and goal new resistance at a 50% Fib degree, which might invalidate the bearish forecast.