Avalanche boosts growth prospects: Will it influence AVAX’s price action

- Avalanche ushers in its first institutional subnet, doubtlessly paving the way in which for extra liquidity.

- AVAX exhibits indicators of weak spot because the market waits for one more directional value shock.

Institutional adoption is little question one of the crucial essential catalysts within the crypto and blockchain section. This was evident in 2021 by the sturdy adoption that poured in, albeit short-lived. Avalanche [AVAX] is reviving the hope of mass adoption after onboarding Intain.

Learn Avalanche’s [AVAX] Worth Prediction 2023-24

Avalanche not too long ago introduced that it’s going to host Intain as the primary institutional subnet. It is a vital growth for Avalanche, because it marks an essential milestone for the community by way of institutional demand. This will encourage extra establishments to embrace Avalanche.

The primary institutional Subnet is right here!

.@IntainFT, a structured finance platform that facilitates administration of $5.5B in belongings, is launching IntainMARKETS, an on-chain market for tokenized asset-backed securities.

Let’s check out why Intain #ChoseAvalanche /🧵 pic.twitter.com/yFGqLIasD1

— Avalanche 🔺 (@avalancheavax) January 31, 2023

The opposite main cause why the brand new institutional subnet is essential is due to Intain’s potential. It’s a structured finance platform that primarily offers with debt capital markets. This implies it has the potential to facilitate the circulate of enormous quantities of liquidity inside the Avalanche ecosystem.

A scarcity of short-term reactions

Extra blockchain networks, particularly layer 1s, had been prioritizing crypto tasks that may ship immense worth. However what does this imply for Avalanche’s future? Maybe it’d contribute to sturdy natural development and doubtlessly affect AVAX’s demand.

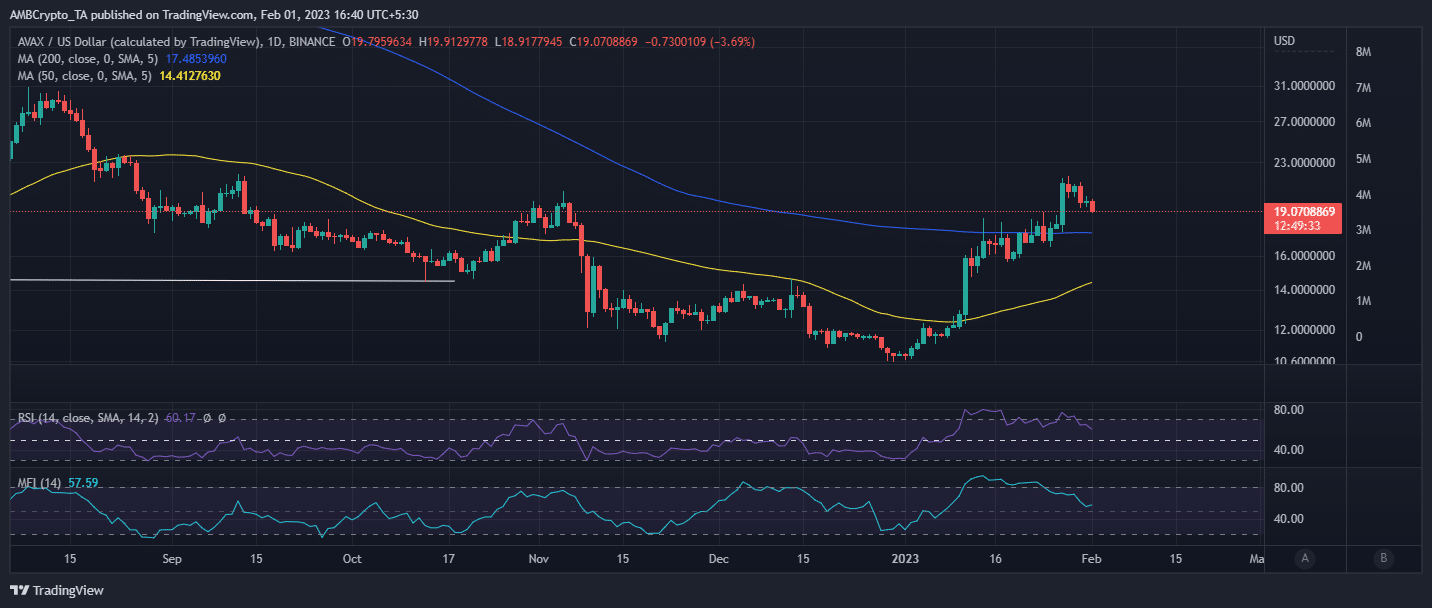

AVAX’s value at press time already represented a 12% drop from its present four-week excessive. There was no signal of sturdy incoming shopping for stress within the final 24 hours, therefore the announcement in regards to the institutional subnet didn’t set off a sentiment shift.

Supply: TradingView

AVAX’s metrics counsel…

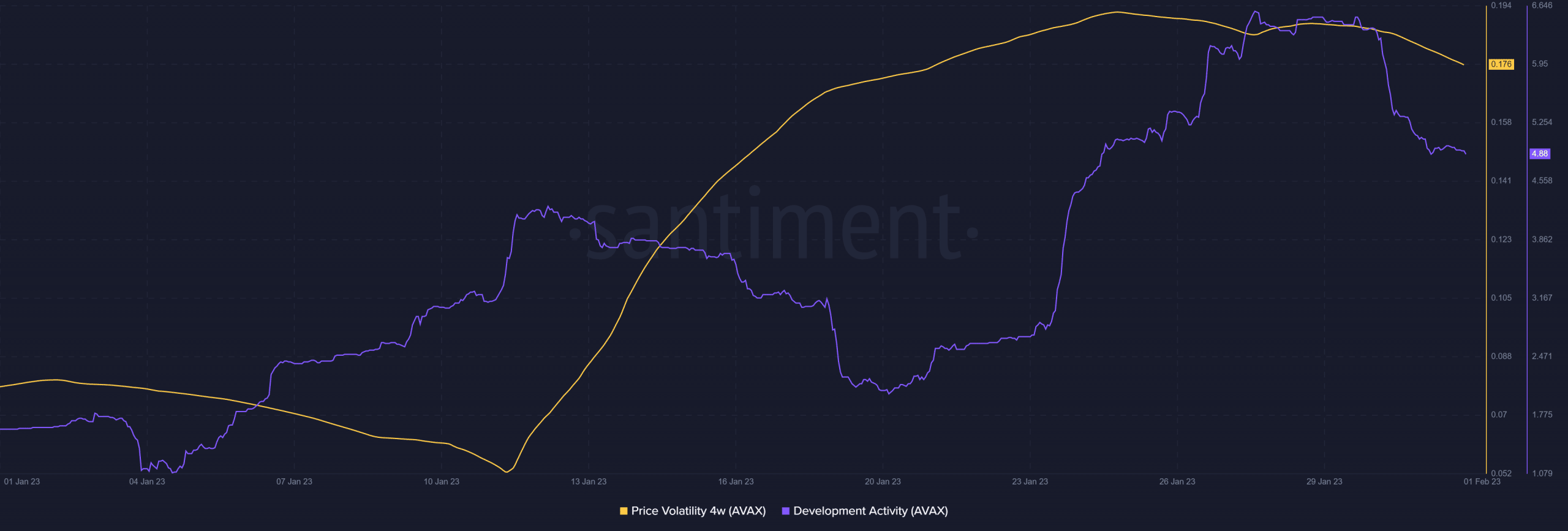

AVAX’s bearish value final result mirrored the uncertainty across the FOMC assembly. It additionally mirrored the tip of the bullish wave in January, particularly within the first two weeks. The worth volatility metric confirms this, indicating a slowdown volatility as extra merchants watch on the sidelines, ready for clear instructions.

Supply: Santiment

Additionally, growth exercise slowed down in the previous couple of days in direction of the tip of January. This added to the record of things that had been influencing market sentiment. Furthermore, the weighted sentiment metric tanked between 27 – 29 January.

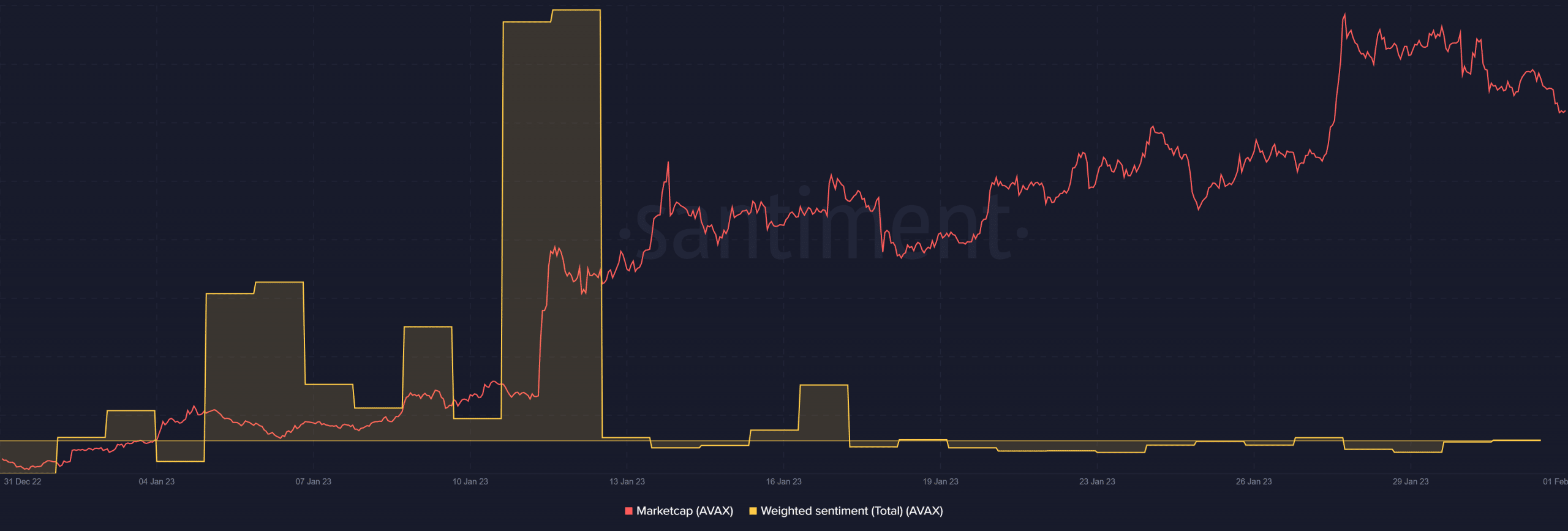

Supply: Santiment

Practical or not, right here’s Avalanche market cap in BTC’s phrases

The drop in weighed sentiment was accompanied by a drop in market cap by barely over $547 million. Nonetheless, the weighted sentiment has improved barely, suggesting that the general investor sentiment is likely to be headed for a bullish shift.

The market final result will largely be decided by the FOMC. A good price revision might set off one other bullish transfer, however the reverse may additionally be true. One other selloff may push AVAX in direction of the $17 value stage. Whereas one other rally might push the value to a brand new 2023 excessive within the subsequent few days.