Assessing the state of Avalanche’s [AVAX] metrics ahead of December 2022

- Avalanche’s TVL registers a rise, however the metrics favor the bears

- RSI and Bollinger Bands give bearish indicators whereas MFI and MACD recommend in any other case

Avalanche Day by day, a preferred Twitter deal with that posts updates concerning the Avalanche [AVAX] ecosystem, posted the weekly stats of the community on 27 November.

As per the info, the full stake quantity reached 260,644,512 AVAX, which appeared optimistic for the blockchain. Nonetheless, the full quantity of the Avalanche ecosystem modified little in comparison with final week, as its quantity stood at over 13 million, which translated to 2 million transactions per day.

Avalanche Subnet Weekly Stats

Complete Subnets: 39

Complete Blockchains: 30

Complete Validators: 1255

Complete Stake Quantity: 260,644,512 AVAXOverview🧵👇#AVAX #Avalanche $AVAX pic.twitter.com/zhadKQkUK0

— AVAX Day by day 🔺 (@AVAXDaily) November 27, 2022

Nonetheless, Avalanche’s whole energetic handle quantity confirmed indicators of a lower to a median of 30k per day. Other than these, a number of integrations occurred within the Avalanche ecosystem that had the potential to provoke a value pump. COMB Monetary, for instance, not too long ago introduced that Utopia went reside on Avalanche.

🚀 @Combfinancial is happy to tell that #Utopia is now formally deployed on @Avalancheavax

🚀 #COMB is devoted in direction of constructing monetary merchandise that each one customers can use and belief with their funds.

🔽INFOhttps://t.co/dL18tDDEKl pic.twitter.com/dSk0pwjvhk

— 🔺 𝗔𝘃𝗮𝗹𝗮𝗻𝗰𝗵𝗲 𝗦𝗽𝗮𝗰𝗲 🔺 (@Avalanche_Space) November 27, 2022

Apparently, AVAX’s efficiency on the chart has additionally been sluggish currently. The alt registered over a 5% decline in its value during the last 24 hours and was trading at $12.30, at press time.

On the identical notice, let’s take a look on the different notable developments and metrics to grasp what traders ought to anticipate from AVAX throughout the previous couple of weeks of this 12 months.

Learn Avalanche’s [AVAX] Value Prediction 2023-24

This seems regarding for Avalanche

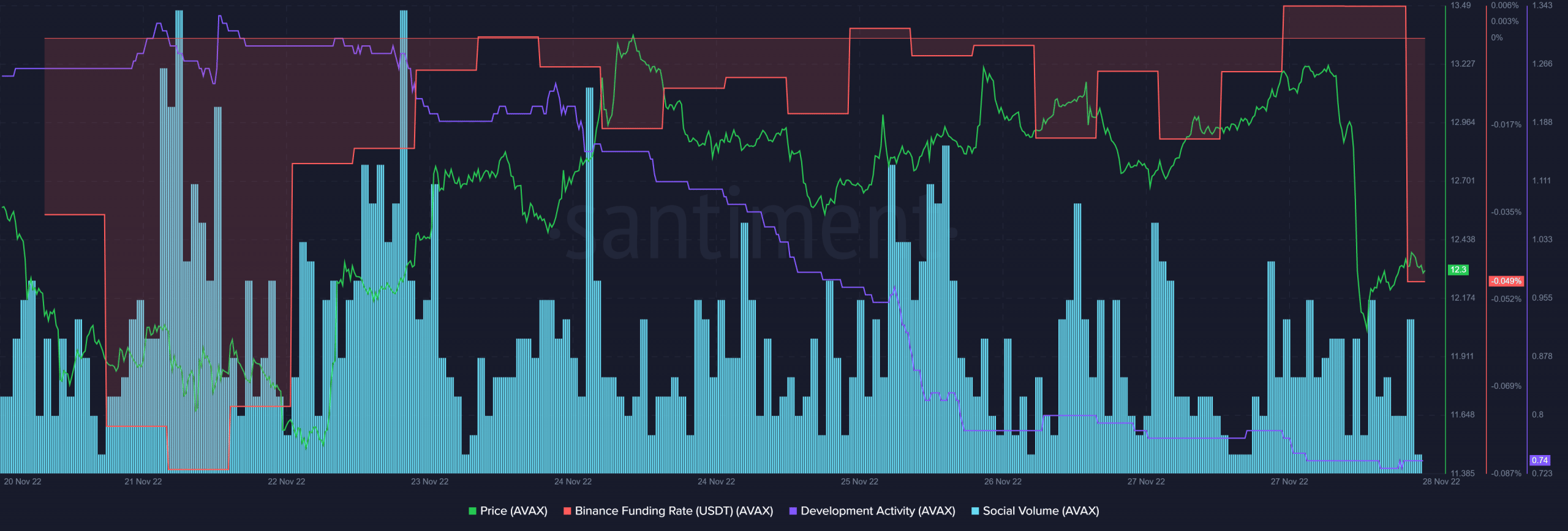

AVAX’s on-chain metrics revealed that the sellers have been main the market, as a number of metrics instructed an additional value decline in the course of the days to comply with. As an example, AVAX’s Binance funding fee registered a pointy lower, which is a bearish sign because it indicated that the token did not obtain curiosity from the derivatives market. AVAX’s recognition additionally appeared to lower, as its social quantity fell during the last week.

Moreover, AVAX’s improvement exercise shifted southward and decreased considerably, which is a unfavourable sign for a blockchain as a result of it represents decreased developer efforts to enhance the community.

Nonetheless, DeFiLlama’s data supplied some aid because it revealed a constructive replace. In response to the charts, AVAX’s whole worth locked (TVL) went up over the previous couple of days, which was a bit of optimistic information for the traders.

Supply: Santiment

Do the bulls have an opportunity?

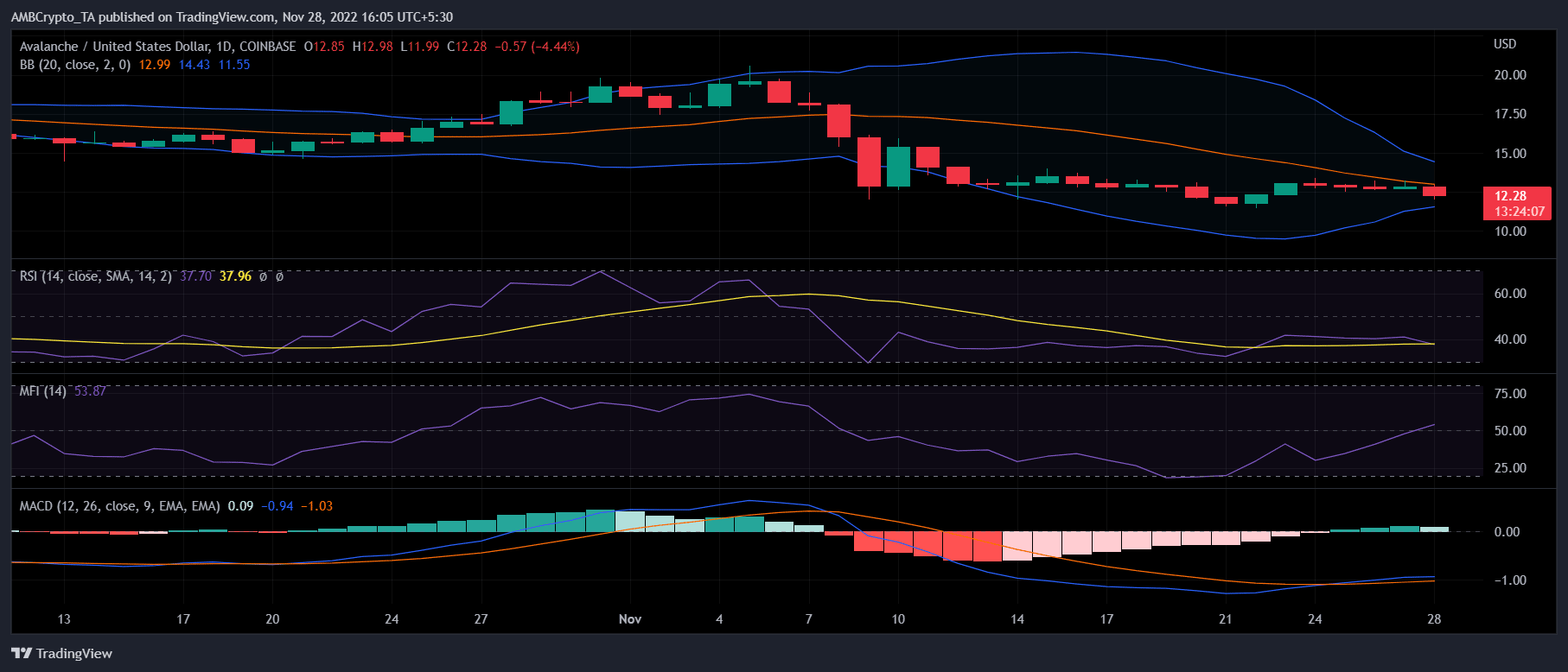

Although Avalanche’s every day chart additionally favored the bears, just a few of the indications instructed that the bulls is perhaps gearing up. The Bollinger Band indicated that AVAX’s value was about to enter a squeezed zone. Thus, lowering the probabilities of a northbound breakout quickly. The Relative Power Index (RSI) was resting beneath the impartial mark, which was yet one more bearish sign.

Nonetheless, AVAX’s Cash Circulate Index (MFI) registered an uptick, which gave traders hope. The MACD additionally displayed a bullish crossover, which could assist AVAX enhance its value within the coming days.

Supply: TradingView