Assessing the risk Aave buyers will bear if they decide to buy the dip

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion

- Indicators confirmed momentum was firmly bearish for Aave

- The decrease timeframe vary highlighted buying and selling alternatives on the extremes

The volatility of Bitcoin [BTC] has been considerably low over the previous week. The onset of the festive season would possibly imply skinny order books and low liquidity and will take until after the New Yr to resolve.

Learn Aave’s [AAVE] Worth Prediction 2023-24

As issues stand, the $17.3k space posed stiff opposition to the bulls. Aave noticed sturdy promoting strain earlier in December and the retest of $63 as resistance meant additional draw back was seemingly.

The decrease timeframe vary highlighted an space the place consumers might step in

Supply: AAVE/USDT on TradingView

Aave has traded inside a spread that prolonged from $56.6 right down to $53.1. It was fashioned on 19 December. On the backside of this vary lay a pocket of liquidity, beneath a stage of short-term help at $53.7. Scalp lengthy positions might be tried on a go to to the vary lows, concentrating on $55 and $56 as take-profit ranges.

Nonetheless, the longer-term view of Aave remained bearish. It noticed an enormous drop from $97 to $55 within the wake of the panic surrounding FTX’s collapse in early November. A take a look at the On-Stability Quantity (OBV) revealed that the bulls have been lively in shopping for Aave tokens and defended the $50.6 help stage. The OBV recovered to ranges it had been at since July.

Nonetheless, this doesn’t rule out the potential of one other drop. The market construction remained bearish, and the psychological $50 stage might be examined as soon as once more. The Relative Energy Index (RSI) has been under impartial 50 since 7 December to point bearish momentum was dominant. The transferring averages additionally signaled downward strain.

The $56-$58 space can provide preferrred a great brief entry. Any transfer previous $58 would present the bias has flipped bullish once more.

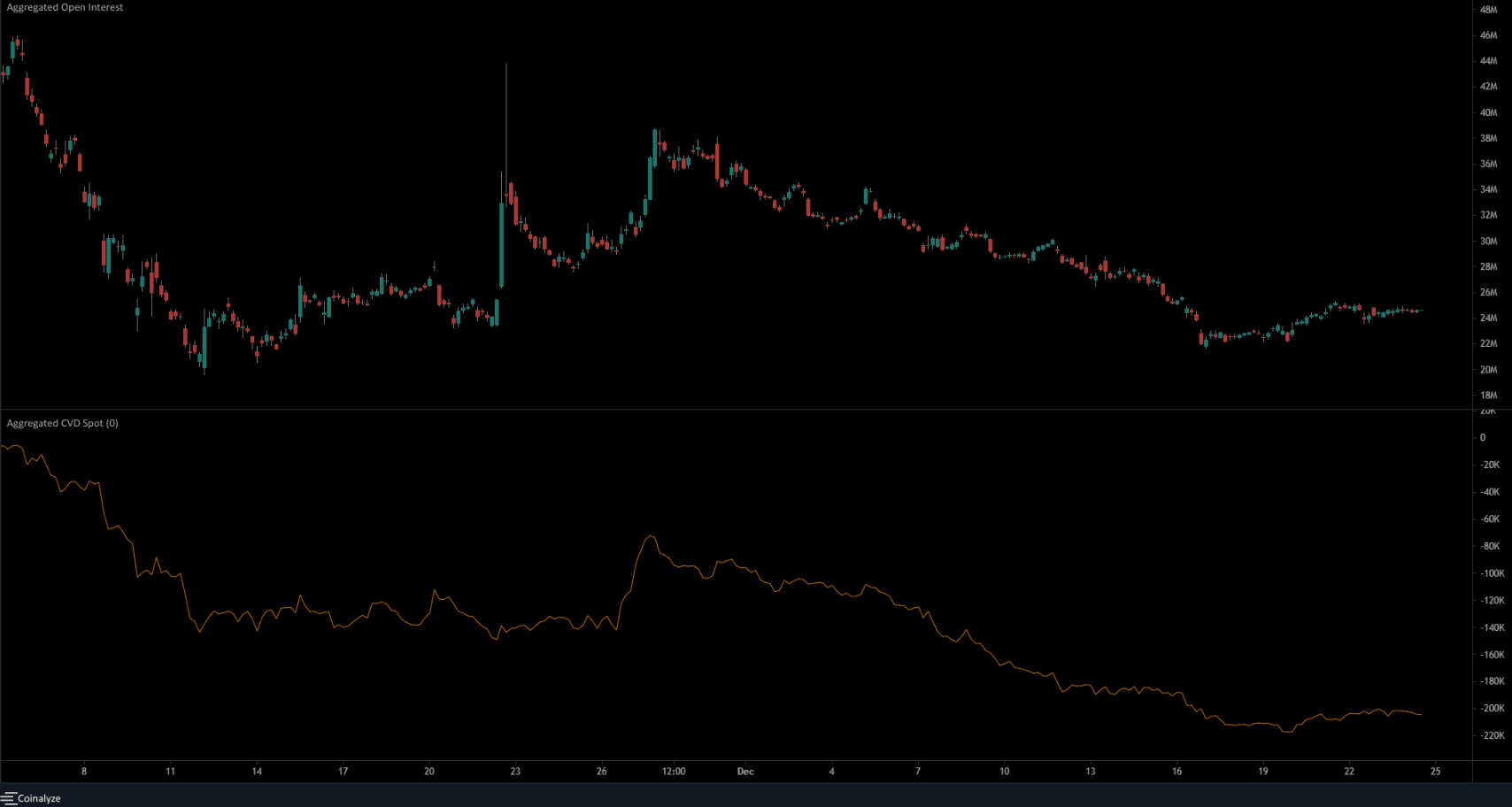

Open Curiosity declines however CVD famous some beneficial properties not too long ago

Supply: Coinalyze

The Open Curiosity and the spot CVD has picked up since 19 December. However the worth has traded inside a spread throughout this time. This steered that cash was getting into the market. Specifically, the rise in spot CVD meant consumers had been keen on AAVE at these costs.

Are your AAVE holdings flashing inexperienced? Verify the Revenue Calculator

Nonetheless, since late November each of those metrics have been in a powerful downtrend. Due to this fact, the client energy in latest days might get overwhelmed shortly if Bitcoin faces bother on the $16.6k mark.