Chainlink investors looking beyond LINK’s price could find some respite here

- Chainlink clinched an all-time excessive within the depend of its every day social contributors.

- Its worth continues to say no, and its outlook within the quick time period stays bearish

Current knowledge from cryptocurrency social analytics platform LunarCrush revealed that LINK, Chainlink’s native token, clinched an all-time excessive of 35,540 in its variety of every day social contributors.

Learn Chainlink’s [LINK] worth prediction 2023-2024

The rally in social exercise got here after the main oracle community announced the primary 10 members within the maiden version of its Chainlink BUILD program.

Give a welcome to the primary 10 #Chainlink BUILD initiatives:@SpaceandTimeDB@truflation@bitsCrunch@KryptonProtocol@InterestDeFi@Galaxisxyz@mycelium_xyz@Dolomite_io@caskprotocol@chainml_

Constructing the way forward for Web3? Take your dApp to the following stage: https://t.co/uIUNQltMbO pic.twitter.com/29oCUSQFVP

— Chainlink (@chainlink) November 18, 2022

First introduced in September, the Chainlink BUILD program shaped a part of its Chainlink Economics 2.0. By means of this program, early-stage and established initiatives inside Chainlink are supplied with “enhanced entry to Chainlink providers and technical assist in trade for commitments of community charges and different incentives to Chainlink service suppliers, reminiscent of stakers.”

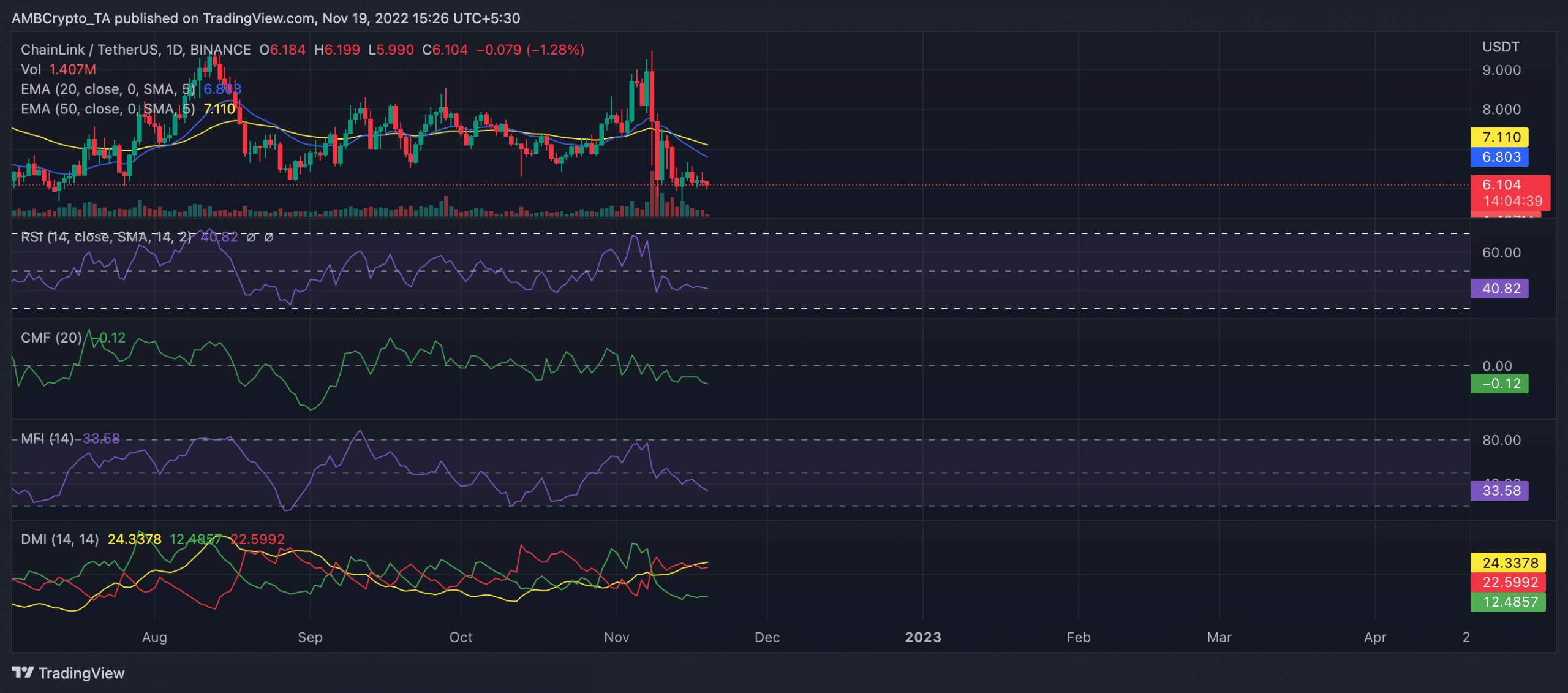

LINK on a every day chart

Ranked because the #21 largest cryptocurrency with a market capitalization of $6.08 billion, LINK exchanged arms at $6.10 as of 19 November. Moreover, as per knowledge from CoinMarketCap, the asset’s worth had declined by 2% between 18 and 19 November. Inside the similar interval, buying and selling quantity was additionally down by 27%. As of 20 November, LINK stood at a worth of $6.21 and traded 1.7% increased within the final 24 hours.

On the every day chart of 19 November, LINK sellers overpowered the patrons out there. On the time of writing, the 20 Exponential Shifting Common (EMA) was positioned under the 50 EMA (yellow) line.

Moreover, lending credence to this place was LINK’s Directional Motion Index (DMI). As of this writing, LINK’s sellers’ energy (crimson) at 22.59 rested above the patrons’ (inexperienced) at 12.48.

The Common Directional Index (ADX) confirmed that patrons would possibly discover it troublesome to revoke the sellers’ energy within the quick time period.

Additional, key indicators such because the Relative Power Index (RSI) and Cash Circulation Index (MFI) have been positioned in downtrends. Headed in the direction of the oversold place at press time, LINK had seen important distribution within the final week. At press time, the RSI was 40.82, whereas the MFI was 33.58.

Additionally signifying the decline in LINK shopping for momentum was its Chaikin Cash Circulation (CMF). On the time of writing, the dynamic line (inexperienced) of the CMF was positioned under the middle line in a downtrend at -0.12.

Supply: TradingView

Right here comes the respite

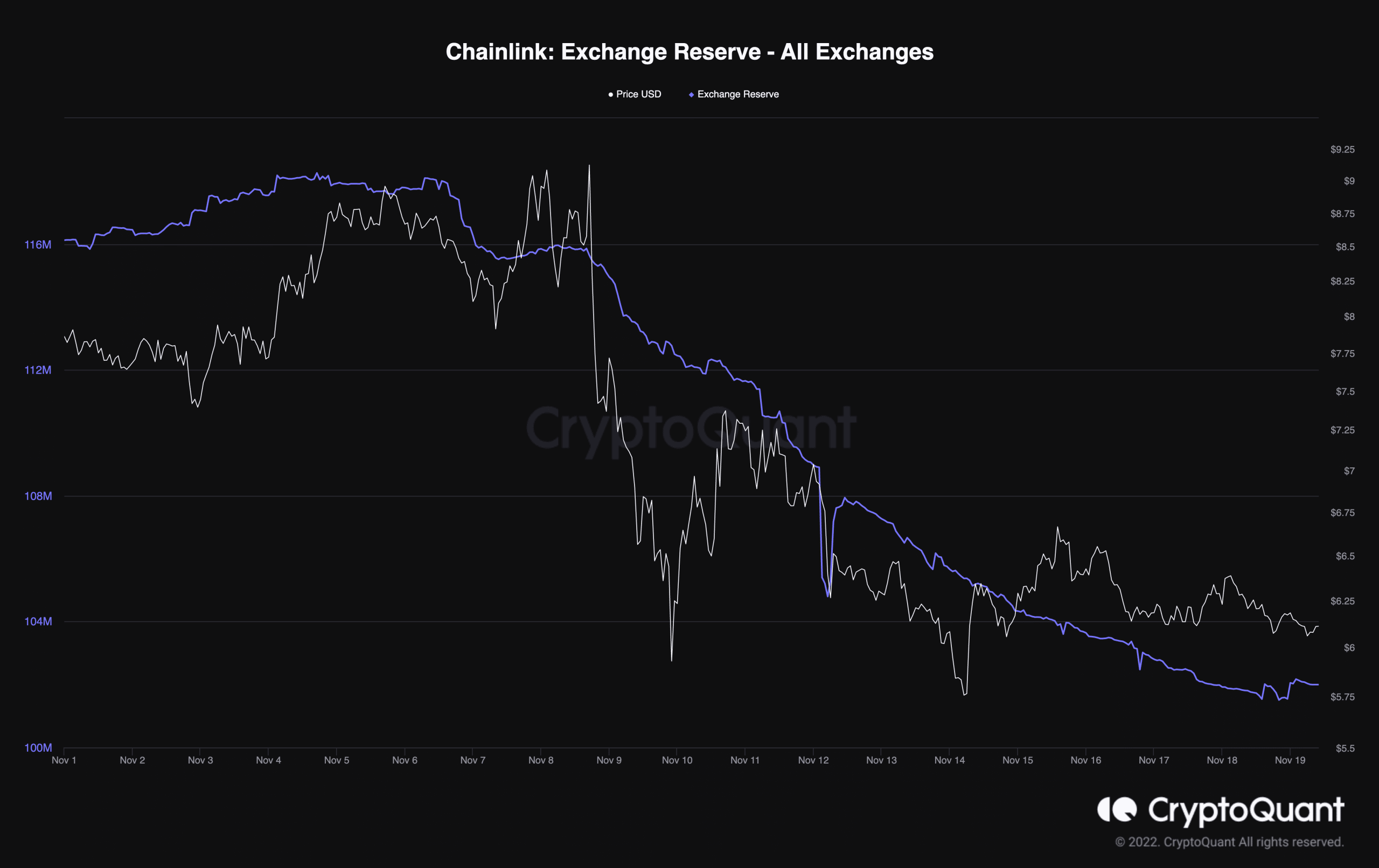

Apparently, because the alt’s worth fell, on-chain knowledge revealed that its trade reserve had declined because the starting of the month. With 101.99 million LINK tokens current on exchanges as of 19 November, knowledge from CryptoQuant confirmed that its trade reserve dropped by 13% within the final 19 days.

Supply: CryptoQuant

Additional, on the similar time, its provide exterior of exchanges rose by 1.2%, knowledge from Santiment confirmed.

Supply: Santiment

This indicated that whereas LINK’s worth may be down, there have been fewer sellers than patrons out there.