ApeCoin: Here’s what short traders should watch out for before jumping in

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.

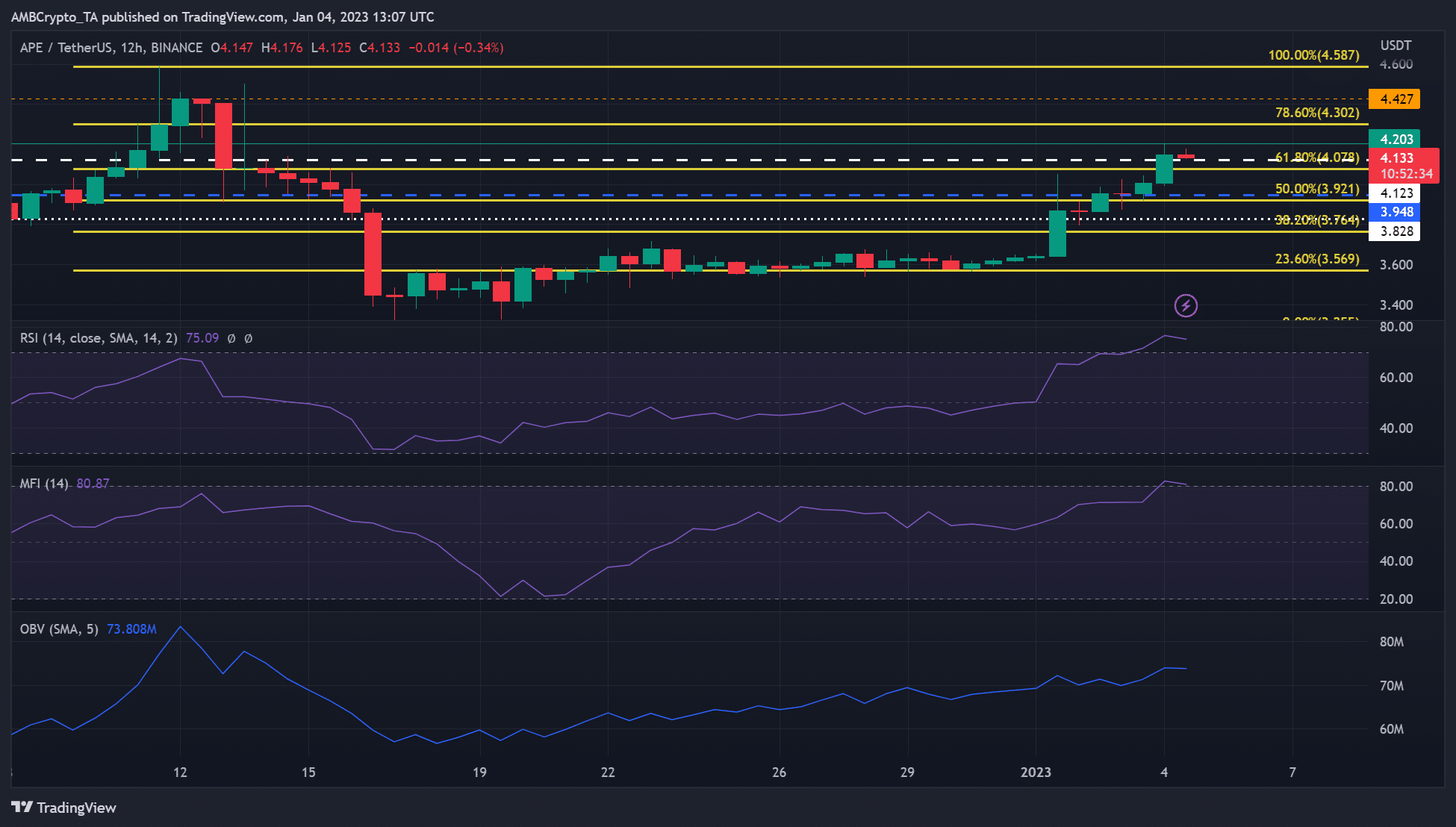

- A rejection of the worth at $4.03 would offer alternatives for brief sellers with targets at $3.948 and $3.828.

- A break above $4.302 would invalidate the worth reversal bias described above.

- APE noticed destructive sentiment, however short- and medium-term holders noticed income.

ApeCoin [APE] has rallied from a low of $3.254 in mid-December to a excessive of $4.200 on 4 January 2023. The rally gave traders a acquire of over 28% within the final three weeks.

Nonetheless, at press time, APE confronted a hurdle and situations that made a value reversal possible.

It was buying and selling at $4.133, up 4% within the final 24 hours.

Learn ApeCoin’s (APE) Worth Predictions 2023-24

The impediment at $4.203: Can bears exploit?

Supply: APE/USDT on TradingView

Though they don’t immediately point out a pattern reversal, the RSI and MFI actions have created some situations that might affect the worth reversal of APE.

The 12-hour chart confirmed that the Relative Energy Index (RSI) was deep in overbought territory and was trending down. It confirmed that purchasing stress had peaked and was regularly easing, giving the bears a possibility available in the market.

Equally, the bears’ leverage is bolstered by the Cash Circulate Index (MFI), a slight downtick, which confirmed distribution had begun, underlining the affect of the bears.

If the bears’ momentum intensifies, APE may very well be compelled right into a correction that might settle at $3.948, the 50% Fib retracement degree of $3.921 or $3.828. These ranges can function promoting targets for brief merchants.

How many APE are you able to get for $1

Nonetheless, if the bulls overcome the $4.203 impediment, particularly if BTC is bullish, then APE might break above the 78.6% Fib degree of $4.302, invalidating the above bearish bias

Medium and short-term holders of APE have made positive factors regardless of the decline in weighted sentiment

Supply: Santiment

Based on the Santiment knowledge, the MVRV ( Market Worth to Realized Worth ) ratio has shifted to the optimistic facet for the 30- and 60-day variables. This means that those that held APE within the final month or two made important positive factors. Lengthy-term holders, nevertheless, recorded losses.

Furthermore, the rising costs of APE coincided with a rise in every day energetic addresses. In brief, every day buying and selling quantity elevated and intensified shopping for stress, which drove APE costs up.

Nonetheless, there had been a slight decline in every day energetic addresses by press time. As well as, APE noticed elevated negatively weighted sentiment regardless of the rising costs.

The bearish outlook and slight decline in buying and selling quantity might have an effect on the additional uptrend and must be monitored. Traders also needs to monitor the actions of BTC earlier than taking quick positions.