What’s causing UNI’s declining price action despite increased whale interest?

- UNI remained one of many high decisions of the whales.

- A couple of of the metrics and market indicators advised an extra downtrend within the coming days.

On 31 January, Uniswap [UNI] launched particulars associated to its new Permit2 sensible contract, which is a token approval contract that may share and handle token approvals of various sensible contracts. In response to the most recent tweet, Permit2 sensible contract permits for seamless token approvals throughout web3 dApps, making issues simpler.

1/ Our new Permit2 sensible contract permits for seamless token approvals throughout web3 dApps, making issues simpler & safer 💁♀️

However that doesn’t imply each dApp that integrates Permit2 robotically has entry to your tokens.

Allow us to clarify 🧵

— Uniswap Labs 🦄 (@Uniswap) January 30, 2023

Learn Uniswap’s [UNI] Value Prediction 2023-24

With Permit2, customers now not should execute a number of transactions once they hook up with a brand new app. Furthermore, Permit2 additionally permits setting expiries on approvals, which means new protocols will solely have permission for a customizable length of time.

By the way, UNI as soon as once more turned in style among the many whales. In response to WhaleStats, a well-liked Twitter account that posts updates associated to whale exercise, UNI was one of many high 10 bought tokens among the many 100 largest Ethereum [ETH] whales, which mirrored whales’ belief within the token regardless of UNI’s latest worth motion.

JUST IN: $UNI @Uniswap now on high 10 bought tokens amongst 100 largest #ETH whales within the final 24hrs 🐳

Verify the highest 100 whales right here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see knowledge for the highest 5000!)#UNI #whalestats #babywhale #BBW pic.twitter.com/rYxp0QpA0T

— WhaleStats (monitoring crypto whales) (@WhaleStats) January 30, 2023

CoinMarketCap’s data revealed that UNI registered a virtually 2% decline within the final 24 hours, and on the time of writing, it was buying and selling at $6.48 with a market capitalization of greater than $4.9 billion.

Is the market responsible, or one thing else?

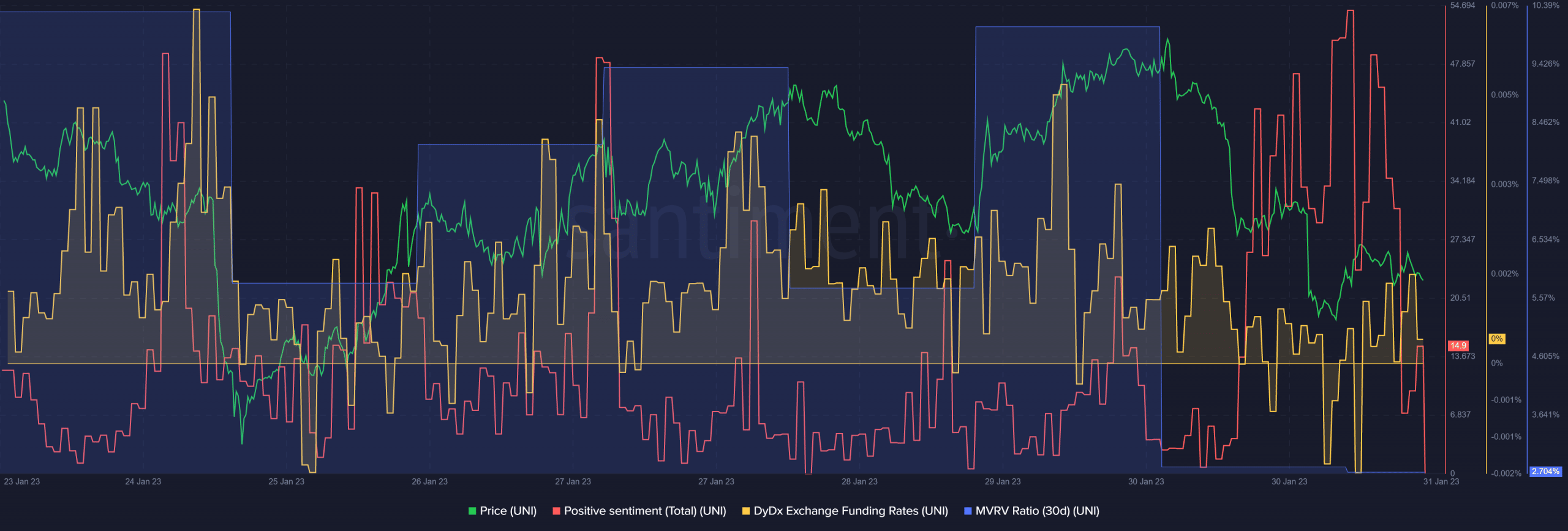

A more in-depth have a look at UNI’s on-chain metrics revealed whether or not this damaging worth motion was as a result of present bearish market or if one thing else was at work. UNI’s MVRV Ratio declined sharply on 30 January, which regarded bearish. Moreover, demand from the derivatives market additionally decreased as UNI’s DyDx funding fee registered a decline.

Although UNI failed to extend its worth, optimistic sentiments across the token surged. Not solely that, however CryptoQuant’s data revealed that UNI’s alternate reserve was lowering, reflecting much less promoting stress. Alternatively, lively addresses had been rising, reflecting extra customers within the community, which additionally regarded optimistic.

Supply: Santiment

How a lot are 1,10,100 UNIs price immediately?

UNI: Wanting ahead

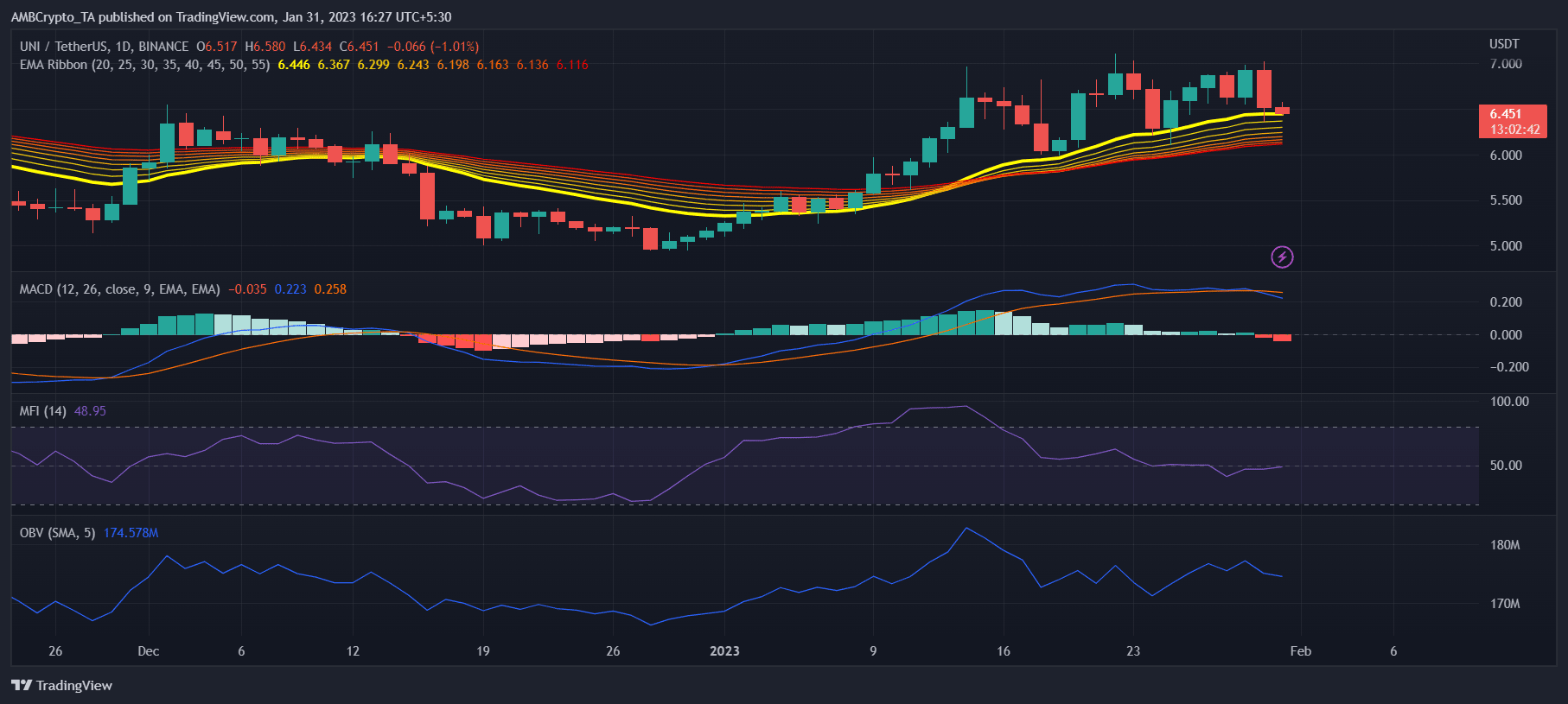

Just like the few on-chain metrics, UNI’s market indicators additionally supported the opportunity of an extra worth decline. The MACD was bearish, because it displayed a crossover within the sellers’ favor. UNI’s On Steadiness Quantity (OBV) registered a decline, which was once more a damaging sign. Moreover, the Cash Movement Index (MFI) was resting on the impartial mark.

Nonetheless, the Exponential Shifting Common (EMA) Ribbon remained on the bulls’ facet because the 20-day EMA was above the 55-day EMA.

Supply: TradingView