ApeCoin [APE] $4.849 support holds as bears struggle: Is a price reversal imminent?

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- APE might discover secure help and bounce again into restoration.

- APE’s rising open rate of interest might sign a pending pattern reversal.

ApeCoin [APE] has been in a value correction up to now three days. It dropped from $5.532 and was hovering round a right away help on the time of writing.

At press time, APE was buying and selling at $4.871, and bears might wrestle to push past this help degree.

Learn Apecoin’s [APE] Value Prediction 2023-24

Can the $4.849 help maintain?

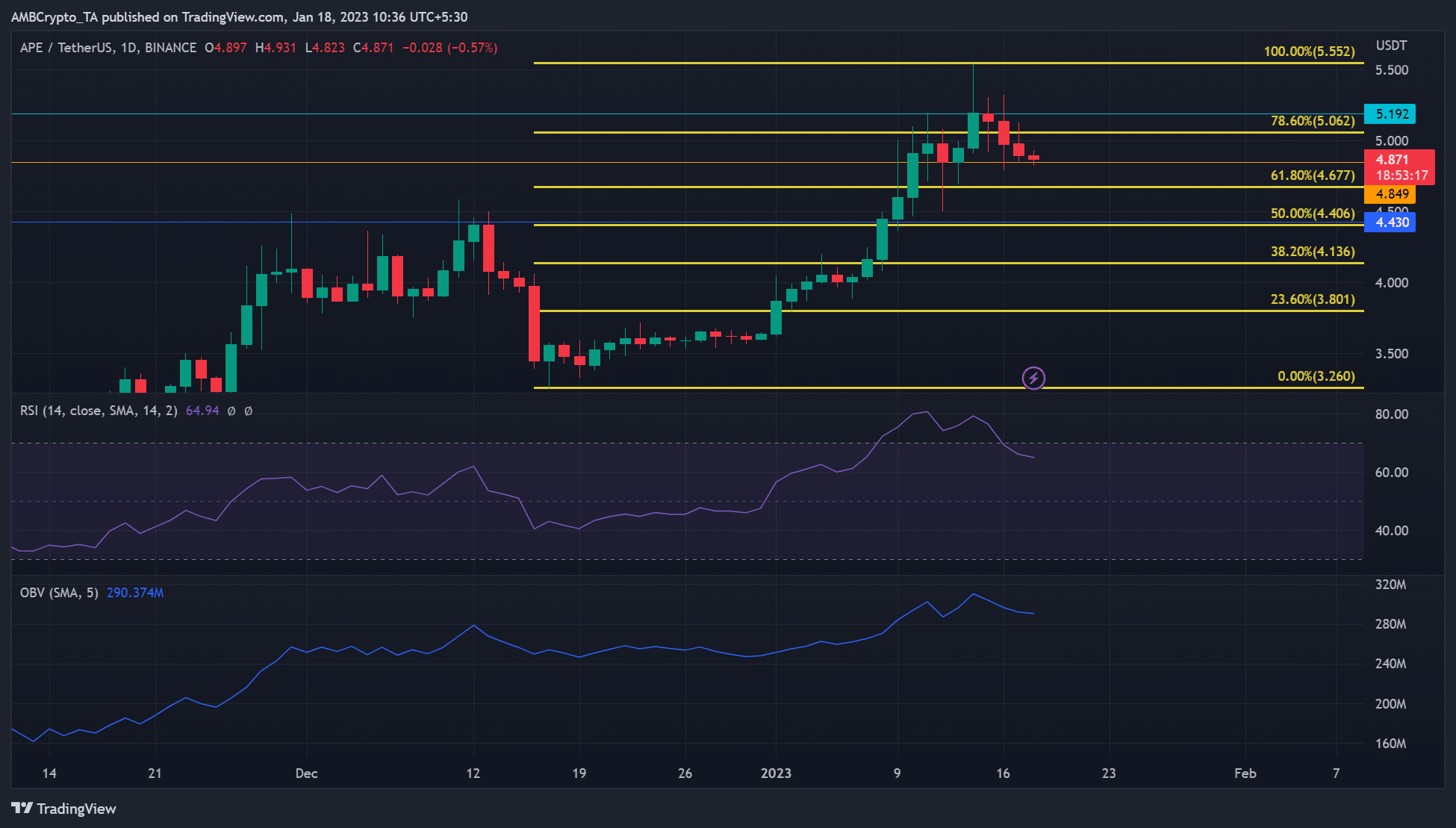

Supply: APE/USDT on TradingView

APE rallied from 17 December, 2022, and peaked on 14 January, 2022. APE bulls pulled it from its December low of $3.260 to a excessive of $5.552 on January 14, posting 70% positive factors.

The rally cooled off afterward, setting APE right into a value correction. APE had dropped by 12% on the time of writing, however bulls might are available in at $4.849 help.

APE’s day by day chart confirmed the Relative Energy Index (RSI) retreated from the overbought zone however was nonetheless above 60 models. This indicated shopping for strain declined, however APE was nonetheless in a bullish market construction.

Subsequently, bulls might try a value restoration after retesting the $4.849 help. They may goal the bearish order block at $5.192 or the overhead resistance of $5.552 within the subsequent few days.

Nevertheless, a breach beneath $4.849 would invalidate the above bullish bias. Such a downtrend might set APE to retest the 61.8% Fib degree of $4.677, providing additional short-selling alternatives for brief merchants.

Is your portfolio inexperienced? Take a look at the APE Revenue Calculator

APE’s day by day energetic addresses and weighted sentiment declined, however OI elevated

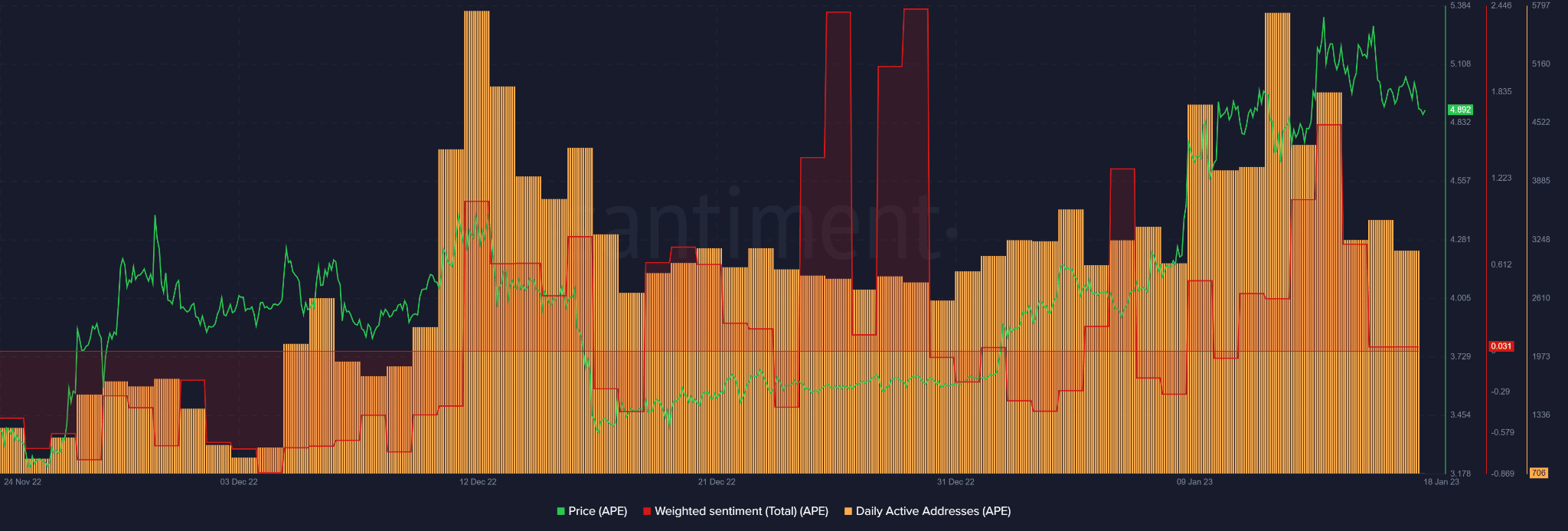

Supply: Santiment

Santiment’s knowledge confirmed that APE’s day by day energetic addresses fell. In consequence, fewer accounts traded the asset, undermining buying and selling volumes and any uptrend momentum.

In the identical interval, APE’s weighted sentiment retreated from its constructive elevation and virtually rested on the impartial line on the time of publication. It exhibits buyers’ confidence fell, however remained constructive.

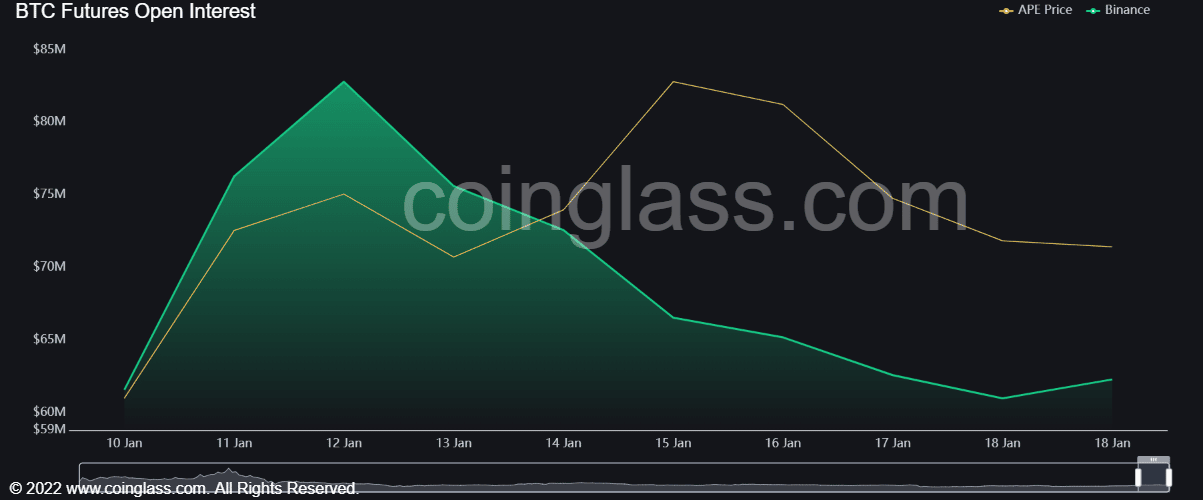

Supply: Coinglass

APE’s open curiosity (OI) declined from 12 January however progressively elevated on 18 January, as per Coinglass. The OI/value divergence from 13-15 January led to a value reversal on 16 January. The present OI/value divergence might set APE for one more value reversal and affect an uptrend momentum.

Such a value reversal might set APE to safe the $4.849 help and goal the overhead resistance at $5.552. Nevertheless, a bearish BTC might lengthen APE’s value correction and invalidate the above bullish forecast.