Analyzing Cardano’s potential for price correction amid Djed stablecoin launch

- Cardano’s stablecoin can be launched subsequent week.

- ADA will probably shed the positive factors it has recorded to date this yr.

Cardano’s [ADA] native over-collateralized stablecoin, Djed can be launched “subsequent week,” as per a 24 January blog post revealed by COTI, the layer-1 scalable enterprise community powering the coin.

We’re happy to share one other replace about Djed’s progress and to tell you that the launch is scheduled for subsequent week!

Learn extra: https://t.co/7kPjfGMNmk$DJED $COTI @InputOutputHK @Cardano pic.twitter.com/mHA5KVblay

— COTI (@COTInetwork) January 24, 2023

Practical or not, right here’s ADA’s market cap in BTC’s phrases

In accordance with the publication, following its launch within the coming days, the over-collateralized stablecoin and its reserve coin, SHEN, can be listed on the Singaporean cryptocurrency trade, Bitrue.

🔔$DJED $SHEN unique twin itemizing coming to #Bitrue Spot Buying and selling!

🚀#Bitrue would be the first trade to checklist $DJED and $SHEN @COTInetwork

✅Buying and selling begins quickly

✅Keep tuned for unique occasions!👉Particulars: https://t.co/BvmhnVw1QA #DJED #SHEN pic.twitter.com/G1kcvYNOIJ

— Bitrue (@BitrueOfficial) January 24, 2023

Because of its nature as an over-collateralized stablecoin, Djed can be backed by Cardano’s native coin ADA and reserve coin SHEN.

Over-collateralized stablecoins are backed by belongings which have a better worth than the stablecoin itself. That is in distinction to different varieties of stablecoins, similar to these backed by a fiat forex or people who use algorithmic mechanisms to take care of their worth. Thus, there are considerations about their long-term stability.

There have been a number of cases of over-collateralized stablecoins which have failed prior to now. One instance is Foundation Money [BAC] owned by disgraced founder Do Kwon. It was a stablecoin undertaking that raised $133 million in funding from enterprise capital companies. Nevertheless, the undertaking shut down in December 2018 after dealing with regulatory challenges over its backing.

One other instance was Carbon [CUSD], an algorithmic stablecoin that was over-collateralized with Ethereum [ETH]. Nevertheless, the undertaking additionally shut down as a consequence of regulatory challenges.

ADA sees a pullback

Exchanging fingers at $0.3564 per coin at press time, ADA’s value declined by 6% within the final 24 hours. After closing 2022 on a tumultuous notice, ADA’s value rose by 40% for the reason that yr started, information from CoinMarketCap revealed.

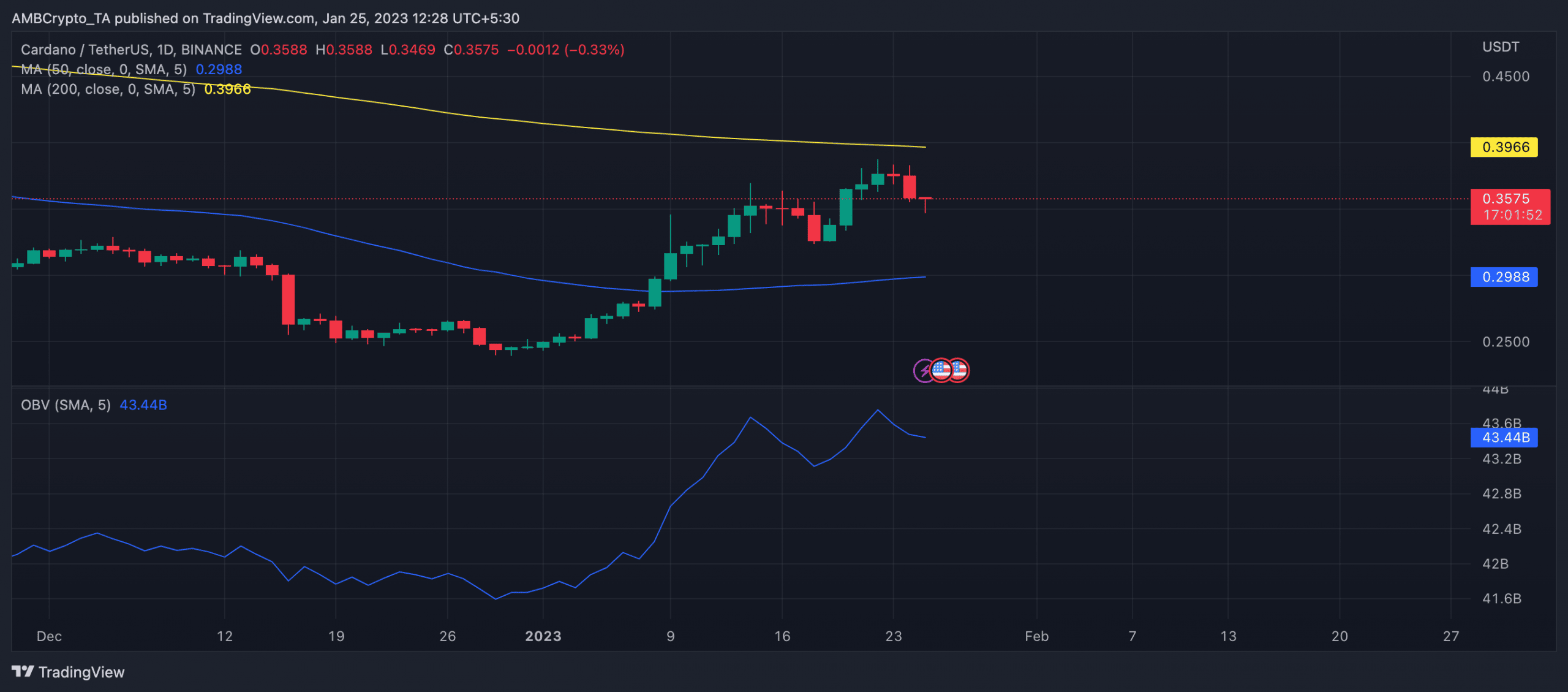

With waning shopping for strain and elevated profit-taking in the previous few days, ADA’s on-balance quantity (OBV) was noticed in a downtrend on a day by day chart. As of this writing, the alt’s value was 43.44 billion, having dropped by 1% since 22 January.

Is your portfolio inexperienced? Take a look at the Cardano Revenue Calculator

A gradual fall in a crypto asset’s OBV is usually taken as a bearish sign. It sometimes signifies that there’s extra promoting strain than shopping for strain, culminating in a fall in an asset’s value. Since 22 January, ADA’s value has fallen by 5%.

An evaluation of ADA’s Easy Shifting Common (SMA) revealed a resurgence of a bearish development available in the market. At press time, the 50-day shifting common was positioned under the 200-day shifting common. That is typically an indication of a downward development.

Supply: ADA/USDT on TradingView