FUD for thought: Can Coinbase’s clarification help Ethereum stakers?

- Coinbase clarifies stance on staking, ETH faces uncertainty.

- Validators stay constructive, nevertheless, merchants stay pessimistic in regards to the king altcoin.

Coinbase, of late, has been discovered on the coronary heart of the huge FUD surrounding the crypto market. The FUD was stirred resulting from SEC’s investigation into Coinbase’s rival agency, Kraken.

Now, after the Kraken incident panned out, questions round Coinbase began to come up.

Learn Ethereum’s Worth Prediction 2023-2024

Not too long ago, Coinbase got here out with a statement clarifying its stance on staking and securities, amidst SEC’s growing litigations.

In accordance with the alternate’s assertion, staking isn’t a safety underneath the U.S. Securities Act, nor underneath the Howey take a look at. The Howey Take a look at is a framework utilized by the SEC to find out whether or not an asset is a safety or not.

Coinbase said that superimposing these securities legal guidelines onto a course of like staking will probably be detrimental to customers. In accordance with Coinbase, these actions may drive U.S. customers to maneuver to offshore unregulated markets.

These statements will possible cut back the quantity of FUD across the matter.

Ethereum validators unaffected

Though these developments occurring earlier than the Shanghai Improve may show to hurt Ethereum, the validators on the community have remained undeterred.

In accordance with Staking Rewards, the variety of validators on the Ethereum community continued to rise. Over the past 30 days, it elevated by 3.54%.

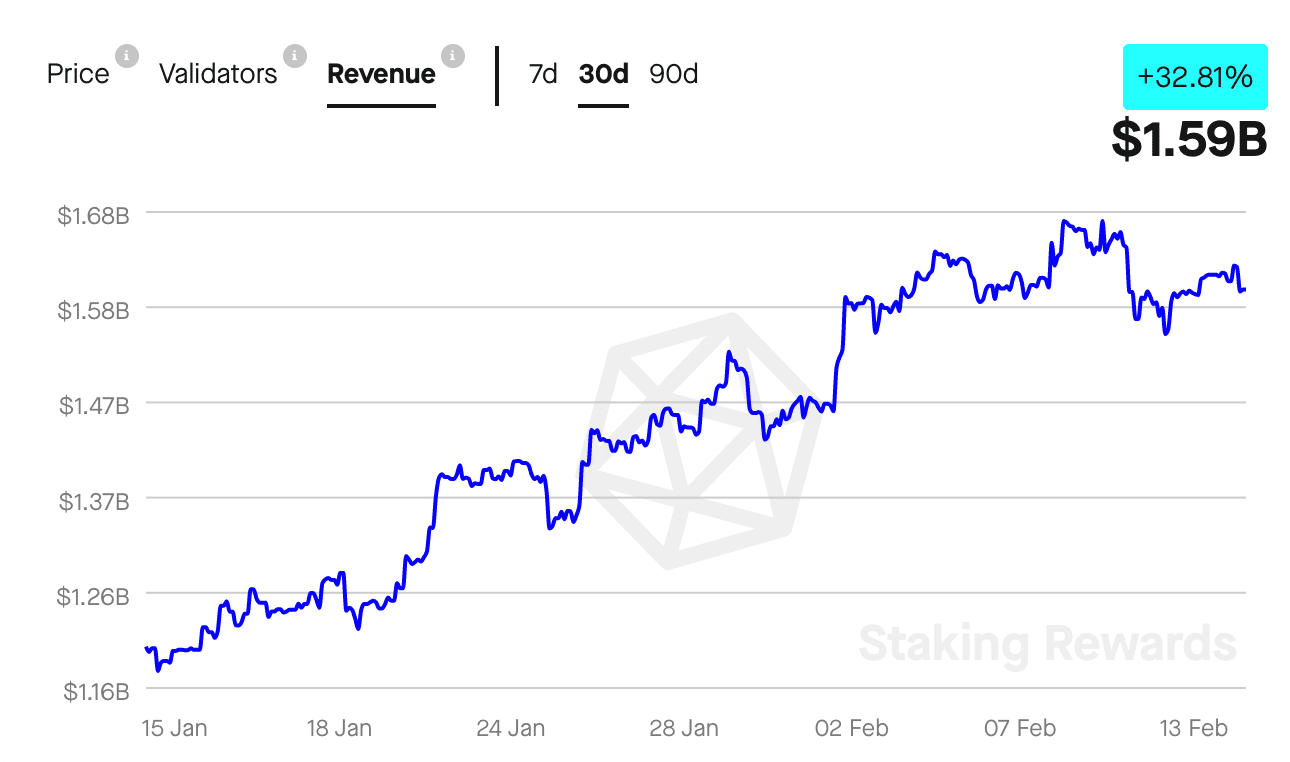

One of many causes for the curiosity from validators was the income generated by them. Contemplate this- Prior to now month alone, the income generated by the validators elevated by 32.81%.

Supply: Staking Rewards

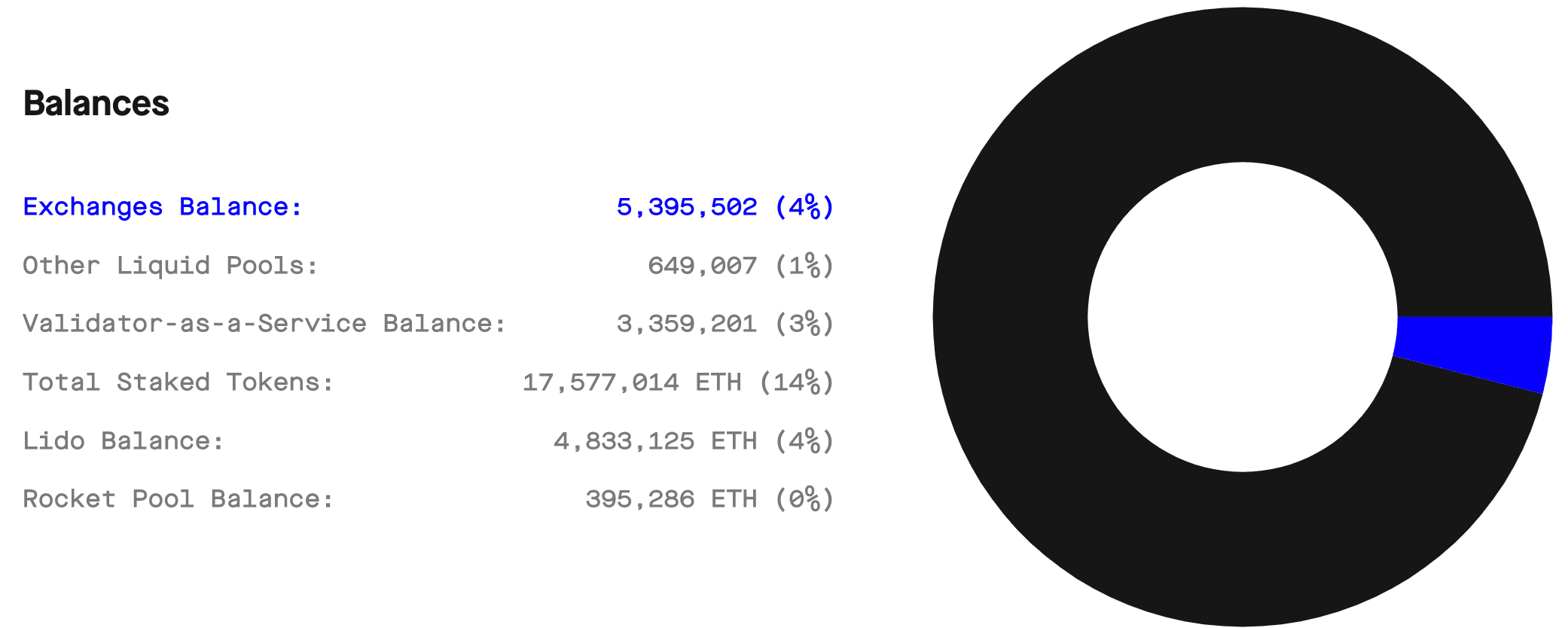

Subsequently, the general ETH staked additionally elevated. At press time, 14% of the general Ethereum provide was staked. After the Shanghai improve, this quantity may change. The vast majority of the staked ETH was staked via Lido or different centralized exchanges.

After the improve, extra retail curiosity in staking may improve, which might possible change the present distribution of staked Ethereum.

Supply: Staking Rewards

Though stakers had been constructive in regards to the state of Ethereum, merchants remained pessimistic. It appeared that the FUD was sufficient to sway merchants’ opinions.

At press time, the variety of quick positions taken in opposition to ETH elevated. In accordance with coinglass, 51.24% of merchants had taken quick positions in opposition to ETH.

How a lot are 1,10,100 ETH price right now?

Supply: coinglass