Over $124,700,000,000 in Bitcoin (BTC) Is Now Ancient, According to Analytics Firm Glassnode

Practically $125 billion value of Bitcoin (BTC) are actually thought-about “historical,” or untouched for a minimum of seven years, in keeping with high blockchain analytics agency Glassnode.

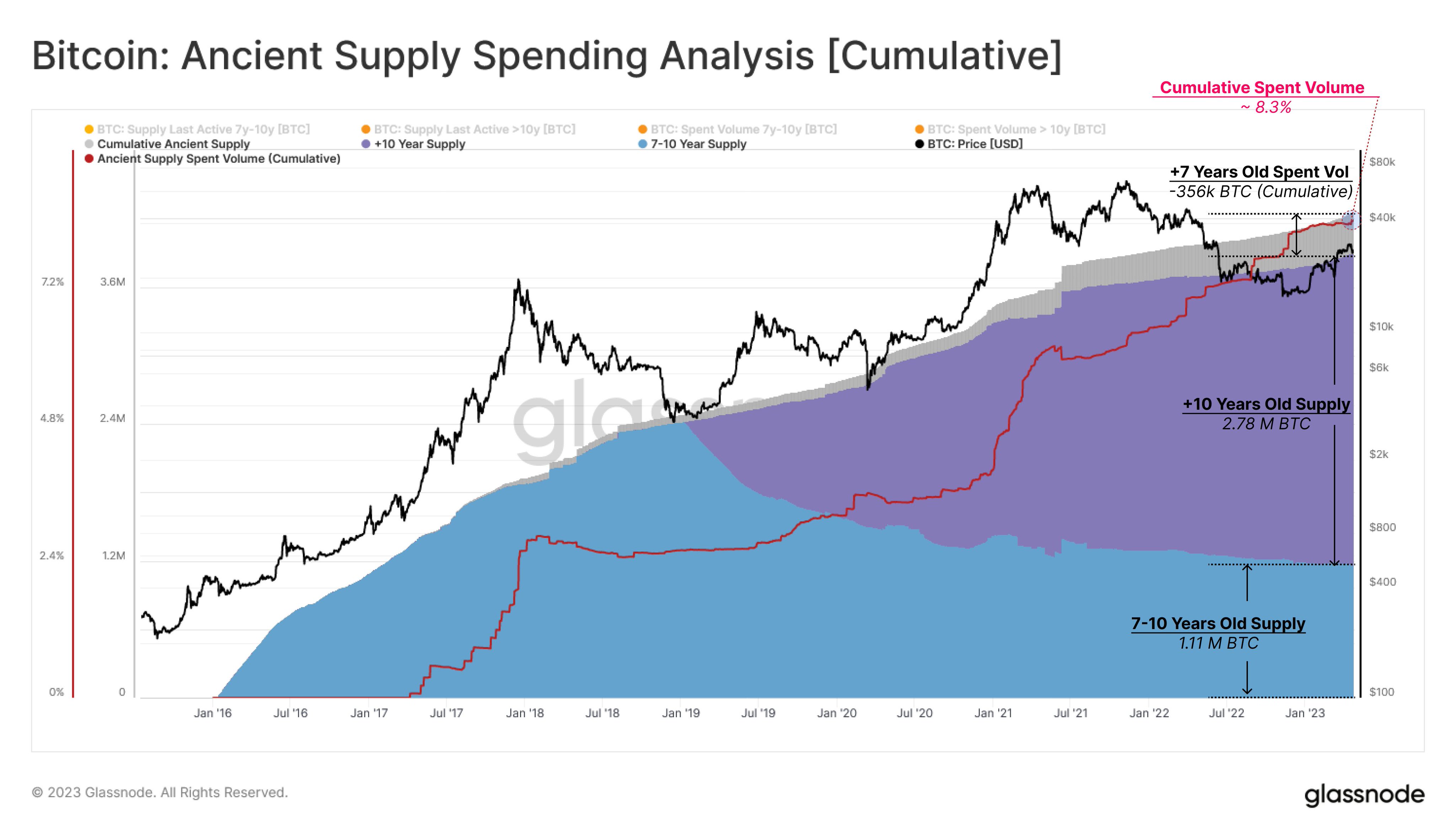

Glassnode says that in all of Bitcoin’s historical past, solely 8.3% of all cash that change into historical have ever been spent.

Of the BTC that stay historical, Glassnode says they may very well be both dormant or misplaced utterly.

“Because the inception of Bitcoin, solely 4.25 million cash have reached the standing of Historic Provide (7+ Years).

Remarkably, solely 356,000 historical cash have been spent, equal to eight.3% of the all-time historical provide complete, while 3.9 million (91.7%) cash presently stay dormant or misplaced.”

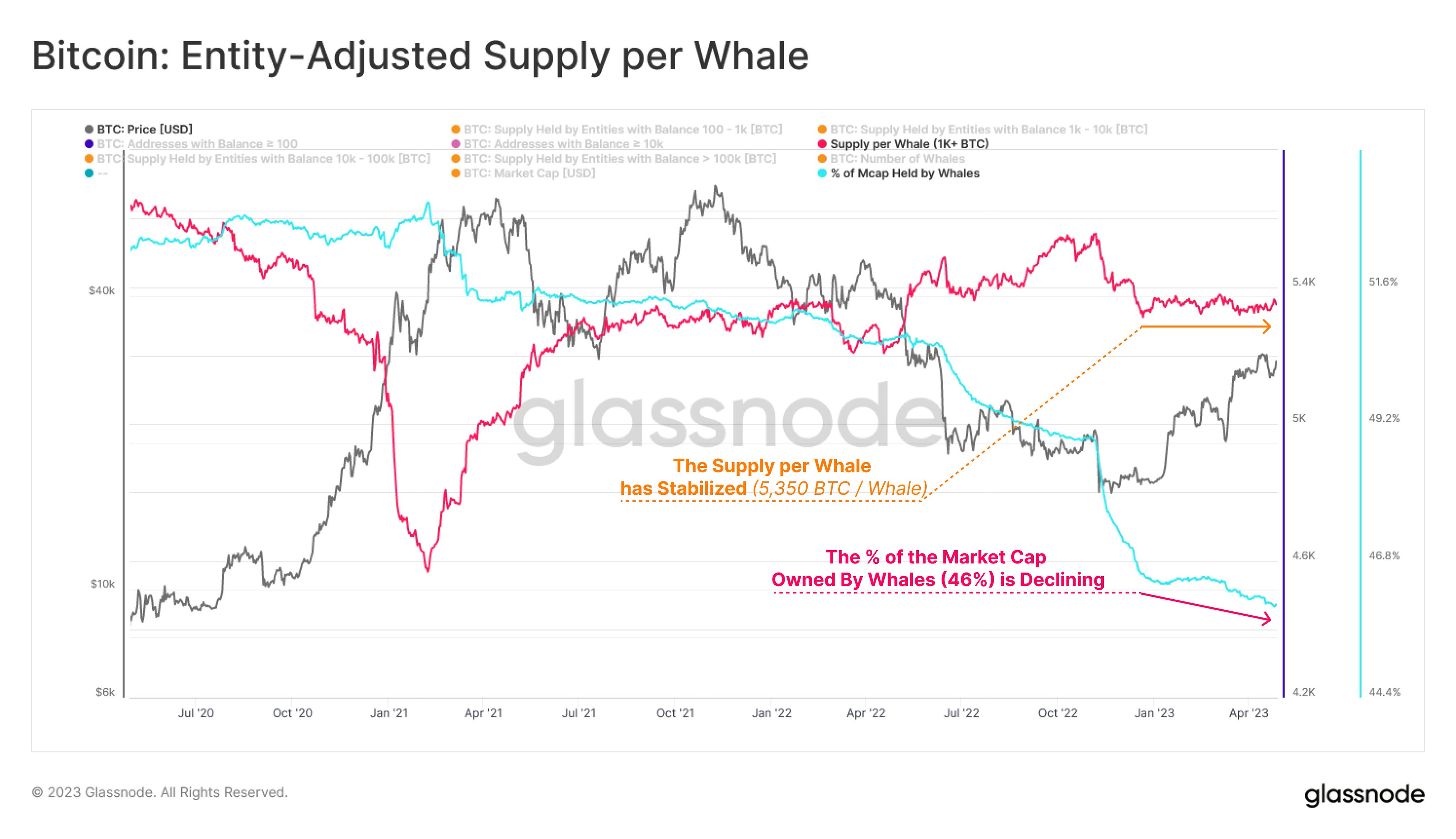

The analytics agency additionally takes a take a look at its supply-per-whale metric, which appears to be like on the common quantity of BTC held by whales. It finds that the typical BTC owned by whales has remained comparatively static for a number of months now, however that every whale is proudly owning a smaller and smaller share of the Bitcoin market cap on common.

“Following the current surge in value motion, the Bitcoin provide per whale has reached an equilibrium, remaining secure round a price of ~5,350 BTC/whale.

Nevertheless, regardless of stability in provide held, the proportion of the market cap owned by the whale cohort (46%) is declining.”

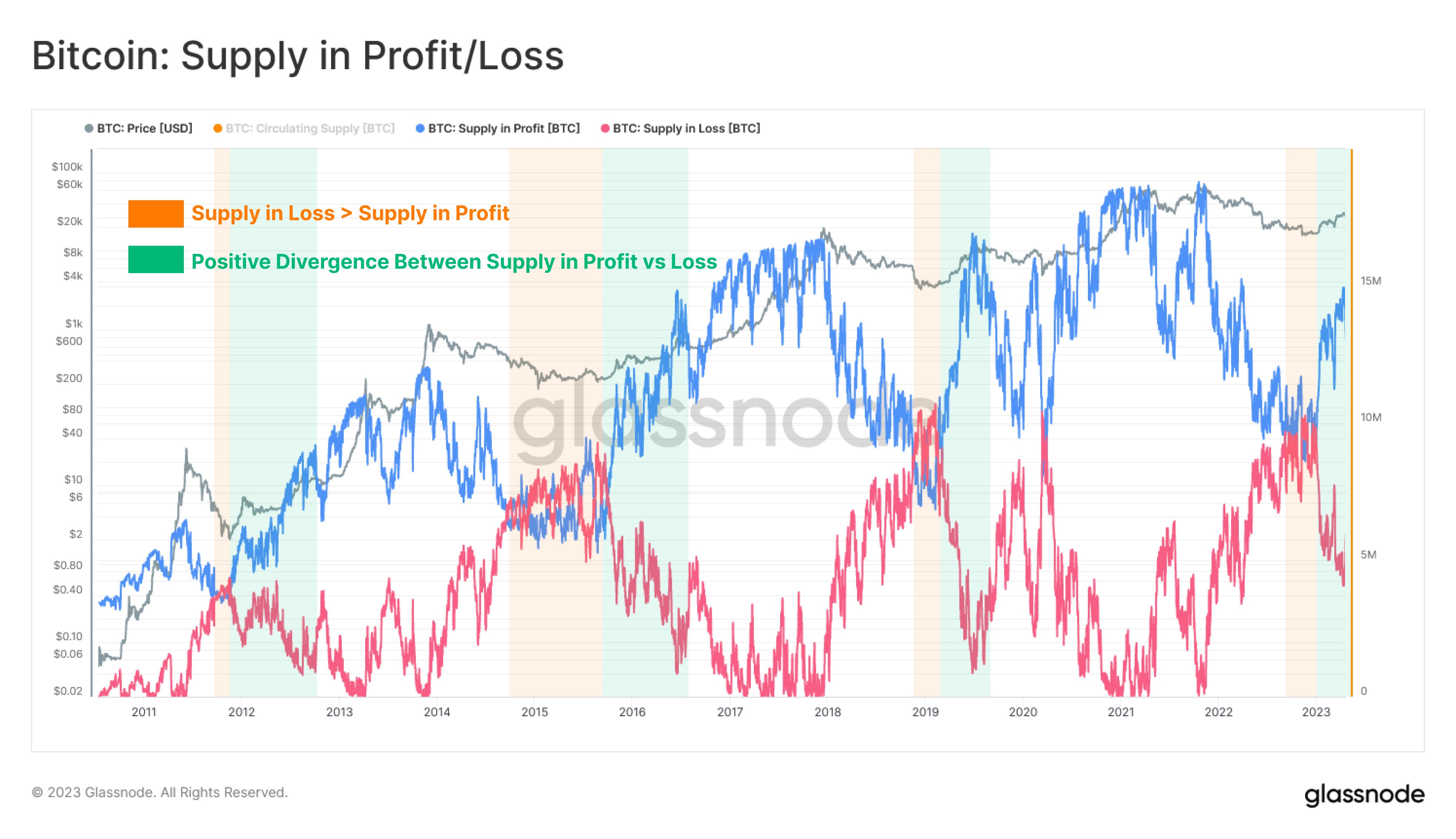

Glassnode additionally takes observe of its provide in revenue/loss metric, which retains monitor of the quantity of cash which can be sitting at a loss and at a revenue. In keeping with the agency, the metric is displaying that market contributors’ positions are increasingly within the inexperienced as time goes on, indicating {that a} sell-off occasion is perhaps on the desk.

“With the robust opening to 2023, the mixture market has confidently transitioned out of a regime of unrealized loss, in direction of certainly one of unrealized revenue, proven by the sharp divergence between provide held in revenue vs. loss. As this takes place, the inducement to take earnings grows.”

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Liu zishan/Vladimir Sazonov