AVAX: Here’s why bulls could target or bypass the $14 supply zone

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- AVAX witnessed a 20% surge in worth within the final 10 days

- AVAX’s demand within the derivatives market remained constructive

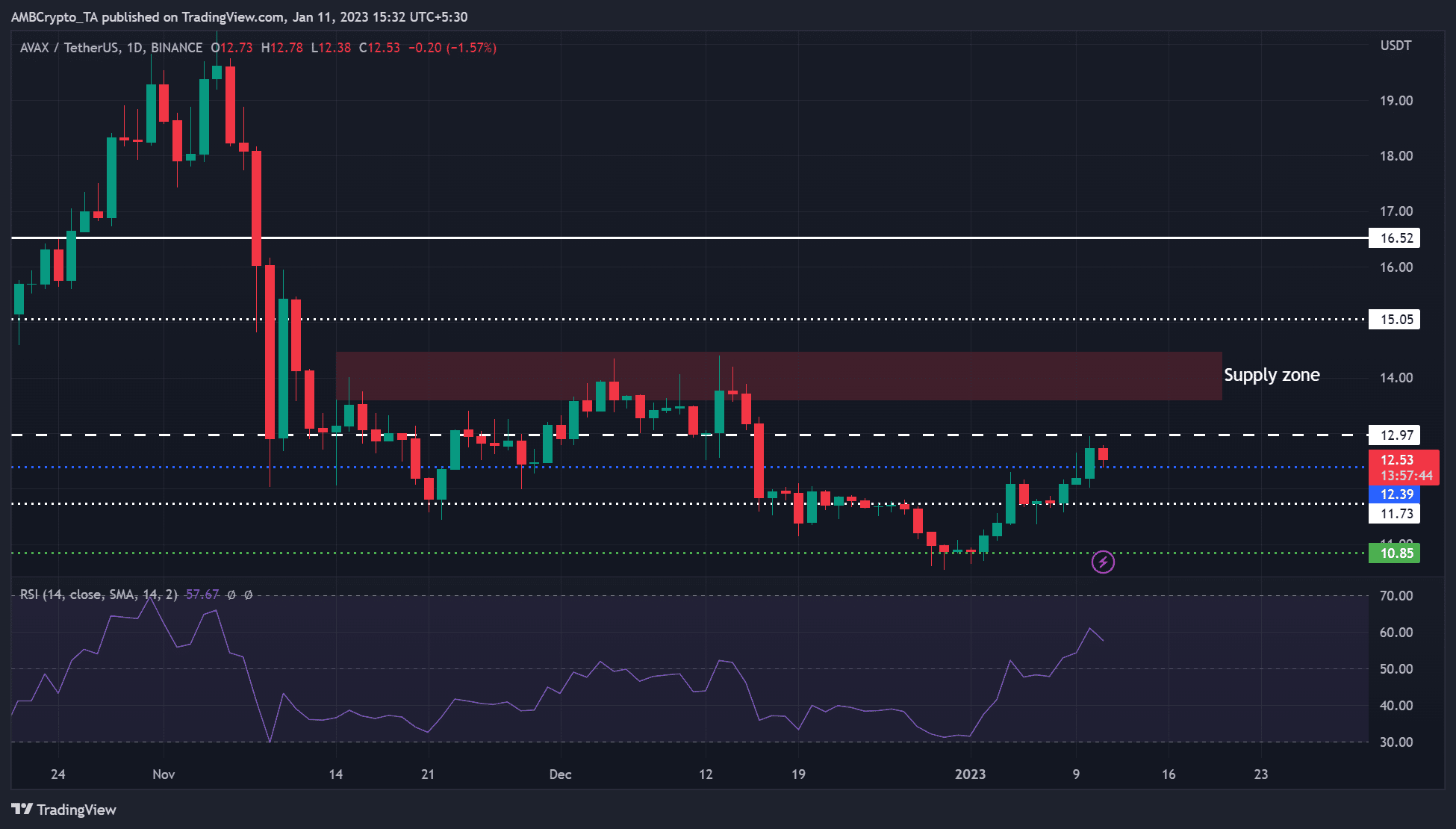

Avalanche [AVAX] surged by 20%, rising from $10.85 to $12.97 prior to now 10 days. Primarily based on the every day charts, AVAX bulls may goal an important provide zone.

At press time, AVAX flickered purple and was buying and selling at $12.53. It had simply confronted a short-term worth rejection at $12.97. Equally, BTC confronted rejection at $17.50K however might be bolstered if the US Shopper Worth Index (CPI) announcement on January 12 favors conventional inventory markets.

Such a BTC rally may increase AVAX bulls to beat the $12.97 hurdle and goal this provide zone.

Learn Avalanche [AVAX] Worth Prediction 2023-24

The $14.0 provide zone: Can the bulls attain it?

AVAX/USDT on TradingView

The Relative Energy Index (RSI) on the every day chart was at 57, a substantial degree above the 50-midpoint. It had risen from the oversold zone for the reason that starting of the yr. This confirmed that purchasing stress had elevated steadily prior to now 10 days; as such, bulls had the higher hand.

Subsequently AVAX bulls may try and push above the $12.97 degree and goal the $14.0 provide zone, particularly if BTC breaks above the $17.50K mark. Nonetheless, AVAX bulls may face intense opposition from sellers if it hits the availability zone.

So traders with diamond arms may wait and unload at this zone. Nonetheless, a powerful bullish BTC may attempt to push AVAX even above the availability zone, however bulls should overcome some further obstacles if it involves that.

Are your holdings flashing inexperienced or purple? Test with AVAX Revenue Calculator

Alternatively, bears may acquire extra affect earlier than AVAX hits the availability zone and push the costs decrease. Such a downward transfer would invalidate the above bullish bias. The downtrend might be checked by the $11.73 or $10.85 assist ranges.

AVAX noticed constructive sentiment and demand within the derivatives market.

Supply: Santiment

In accordance with Santiment, weighted sentiment and Binance Funding Charge for AVAX/USDT pair remained on the constructive aspect since 5 January. This confirmed that traders remained bullish on AVAX, and the demand within the derivatives market didn’t change regardless of a slight drop in worth on the time of writing.

Nonetheless, a decline in buying and selling volumes may undermine bulls’ uptrend momentum. Any uptick in buying and selling quantity alongside a bullish BTC may sign a serious rally towards the availability zone. Subsequently, traders ought to observe BTC actions.