Are stablecoins giving Ethereum a run for its money? This new report suggests…

- Ethereum’s market cap fell under stablecoins’ market cap

- The variety of transfers and charges declined

The FUD (concern, uncertainty, and doubt) surrounding the crypto market is the rationale why the neighborhood has been on the lookout for “stability” over the previous couple of days.

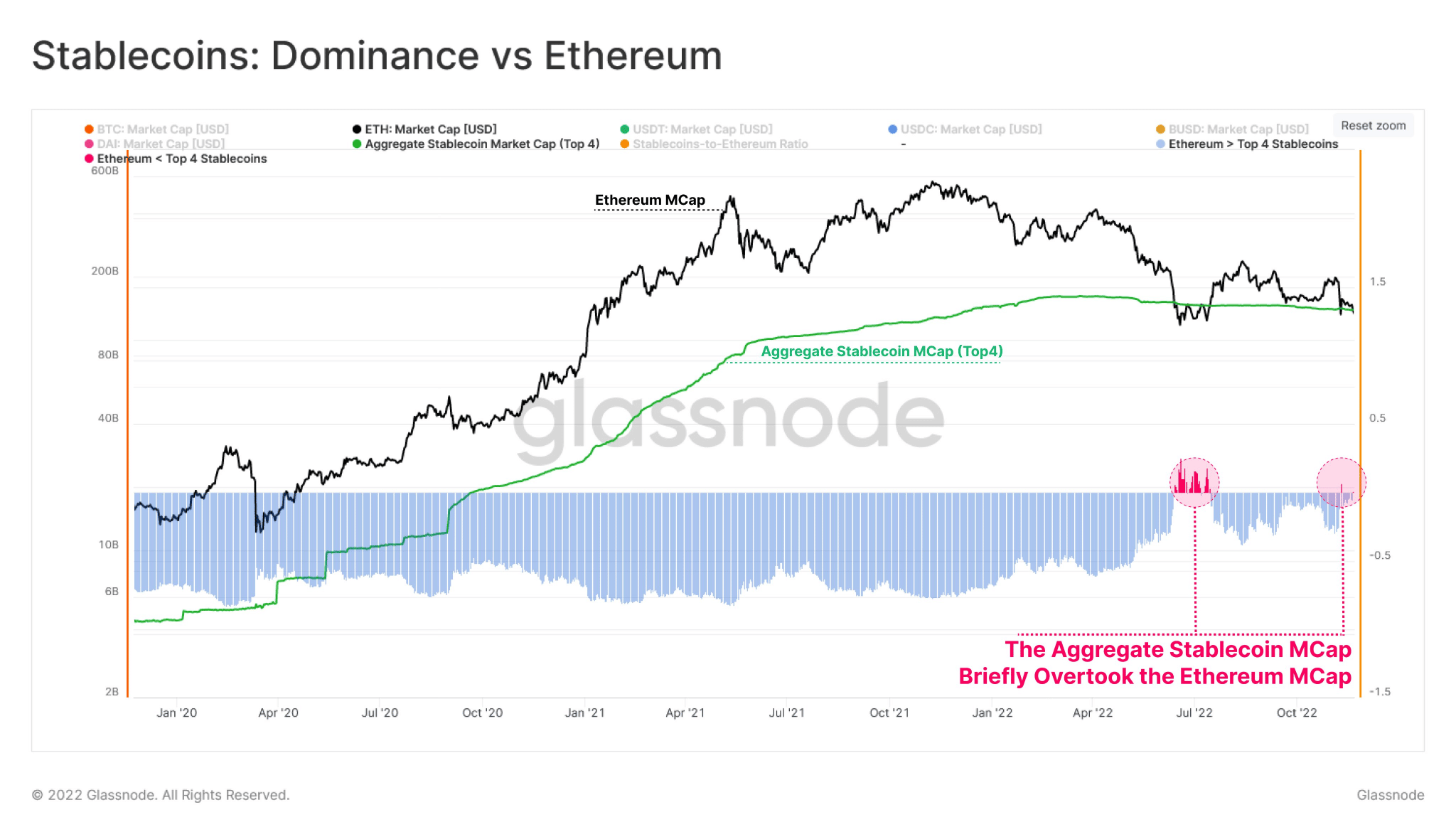

In a tweet posted by Glassnode, it was revealed that Ethereum’s market cap fell under the general stablecoin market cap in the previous couple of days.

Through the chaos of the previous couple of weeks, the #Ethereum market cap briefly fell under the combination stablecoin cap, as soon as once more.

The High 4 stablecoins USDT, USDC, BUSD and DAI make up over $138B in whole, with the $ETH market cap simply 2.8% greater at $142Bhttps://t.co/GJ9k17boJk pic.twitter.com/40JPvIquvv

— glassnode (@glassnode) November 24, 2022

Learn Ethereum’s Worth Prediction for 2022-2023

Wanting on the knowledge for Ethereum

In accordance with the picture under, the stablecoin market cap outperformed Ethereum’s market cap in the previous couple of days. This decline in market cap might be indicative of a bearish future for Ethereum.

Supply: Glassnode

Together with the declining market cap, there was a decline within the variety of transfers on the Ethereum community. From the picture under, it may be noticed that the variety of transfers reached a 23-month low of 17,493 on 25 November. Coupled with that, the variety of charges generated by Ethereum additionally declined.

In accordance with knowledge supplied by Glassnode, the full charges paid on the Ethereum community had declined and the variety of charges being paid to miners was $84k, which was a 1-month low, on the time of writing.

Supply: Glassnode

Will whales be the saving grace?

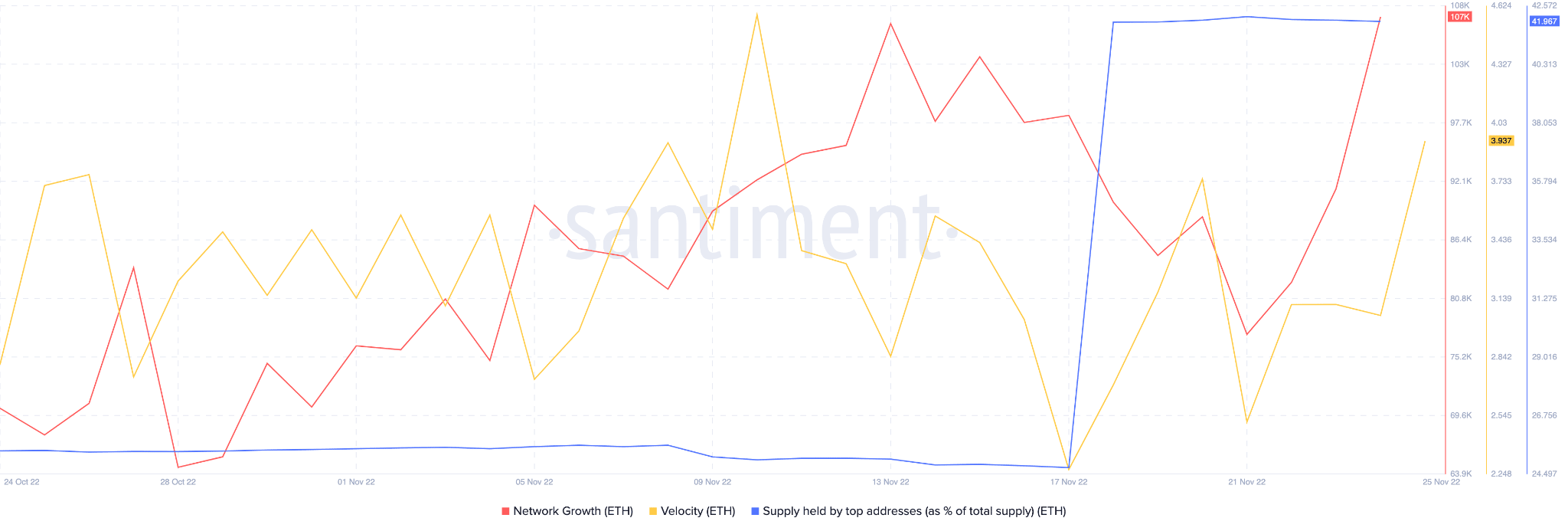

Nevertheless, regardless of all of the volatility, whales continued to point out curiosity in Ethereum. As evidenced by the picture under, there was a pointy improve within the provide held by the highest addresses.

Ethereum’s velocity grew in the identical interval, indicating that the typical variety of instances that ETH modified wallets every day had elevated.

In actual fact, king alt’s community progress additionally witnessed an uptick throughout the identical period. This implied that the variety of new addresses that transferred to Ethereum for the primary time had elevated.

Supply: Santiment

Regardless of exhibiting progress in these areas, Ethereum’s TVL continued to say no. On the time of writing, Ethereum’s TVL was at 23.53 billion and it had fallen by 1.51% within the final 24 hours, according to DefiLlama.

At press time, Ethereum was buying and selling at $1,183.10. Within the final seven days, its worth had depreciated by 3.03%. It stays to be seen whether or not ETH will bounce again.

Ethereum’s efforts to reduce fees on L2 might be one issue that might assist generate traders’ curiosity in ETH.